|

市場調查報告書

商品編碼

1683231

電感器磁芯和磁珠市場:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Inductors, Cores and Beads - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

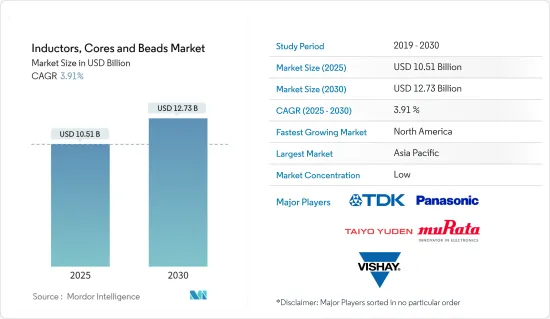

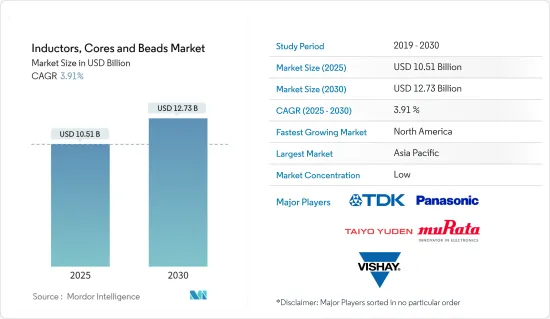

電感磁珠市場規模預計在 2025 年為 105.1 億美元,預計到 2030 年將達到 127.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.91%。

新型SMD產品開發愈加活躍,重點關注智慧型手機、模組和物聯網設備的小型晶片以及汽車應用的高可靠性晶片。

關鍵亮點

- 提高功率密度和效率對大多數電感器設計人員來說都是一個挑戰。人們持續需要緊湊、高效能的電源解決方案來滿足日益嚴苛的應用要求。

- 在全球範圍內,智慧型手機、平板電腦、掌上遊戲機、筆記型電腦和機上盒等家用電子電器的需求不斷成長,是推動各種電感器、磁芯和磁珠需求的主要因素。

- 此外,工業、航太和國防以及醫療領域等對高可靠性要求的應用的需求也不斷增加。

電感磁珠市場趨勢

家用電子電器佔據很大市場佔有率

- 約15%的智慧型手機由陶瓷和玻璃製成,其電路基板使用電感器、保險絲和電阻器等被動核心進行溫度控管。

- 物聯網和5G網路可望提高設備與網路、物聯網、自動駕駛、M2M之間資訊通訊的整體速度和效率。

- 大部分消費性電子產品都是高功率設備,功率從幾百瓦到幾千瓦不等。所使用的磁性元件的數量取決於充電樁的功率。一個充電樁平均需要20個磁性元件,其中電感器佔大多數。

- 挑戰依然是晶片面積的大小。例如,英特爾表示,其多核心處理器中用於電源管理的 DC-DC 轉換器中的晶片電感器佔用了可用晶片總面積的約四分之一,因此成本很高。

北美佔據主要市場佔有率

- 在美國,電感器在汽車電子設備的應用正在擴大,智慧電網技術的採用也正在增加。由於電感器用途廣泛,已成為許多電子系統中的關鍵元件。由於應用範圍廣泛,電感器在北美多個行業中得到了越來越廣泛的應用。

- 2016 年,美國公用事業公司在發電、輸電和配電基礎設施方面投資約 1,440 億美元。據國際能源總署稱,2018年美國智慧電網基礎設施投資達126億美元。

- 電感磁珠因其低功耗和多功能適應性,在最新的自我調整LED 大燈中得到應用,這些大燈正在取代傳統的滷素和 HID 大燈、ADAS、汽車點火系統等。

- 2018年,美國汽車產量為113.1億輛,加拿大汽車產量為202萬輛。

- 美國提高價值2000億美元的中國產品進口關稅,電子元件產業受到進一步影響。

電感磁珠產業概況

電感磁珠市場機會帶來了激烈的競爭。有許多製造商在爭奪更大的市場佔有率。市場正在見證以小型化和改變磁芯形態來實現更高電感的形式出現的技術創新。

- 2019 年 9 月 - TDK 推出專為惡劣汽車環境設計的金屬芯功率電感器。

- 2019 年 6 月 - TDK 推出專為行動裝置設計而客製化的薄膜功率電感器,與傳統產品相比,支援高 4% 的電流和低 12% 的電阻。

- 2019 年 6 月 - Kemet 公司推出了一系列新型 SMD 金屬複合功率電感器,適用於筆記型電腦、平板電腦、伺服器和高清電視等各種商業和消費應用中的 DC-DC 轉換器中的現代電源應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 引入市場促進因素與限制因素

- 市場促進因素

- 市場限制

第5章 市場區隔

- 按電感器類型

- 功率電感

- 疊層片式電感

- 射頻電感器

- 其他電感類型

- 按核心材料

- 空氣芯

- 鐵氧體磁芯

- 陶瓷芯

- 其他核心類型

- 透過晶片磁珠

- 多層珠

- 鐵氧體磁珠

- EMI 磁珠

- 按最終用戶產業

- 車

- 計算

- 通訊設備

- 消費性電子產品

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- TDK Corporation

- Vishay International Inc.

- Panasonic Corporation

- Murata Manufacturing Co. Ltd.

- Taiyo Yuden Co. Ltd.

- Kemet Corporation

- AVX Corporation

- Texas Instruments

- TT Electronics Plc

- Hefei MyCoil Technology Co., Ltd.

第7章 投資機會

第8章 市場機會與未來趨勢

The Inductors, Cores and Beads Market size is estimated at USD 10.51 billion in 2025, and is expected to reach USD 12.73 billion by 2030, at a CAGR of 3.91% during the forecast period (2025-2030).

New product development of SMDs are gaining momentum, centering on small chips for smartphones, modules, and IoT terminals, and high-reliability chips for automotive application.

Key Highlights

- The increasing power supply density and efficiency is a challenge for most of the inductor designers. There is a continuous need for reduced size and high-performance power solutions to meet increasingly stringent application requirements.

- Globally, the growing demand for consumer electronics, such as smartphones, tablets, portable gaming consoles, laptops, set-top boxes, among others, is the major factor driving the demand for various inductors, core and beads.

- The market is also witnessing a boost in demand from applications, which require high reliability, in the industrial, aerospace and defense, and medical sectors.

Inductors Cores & Beads Market Trends

Consumer Electronic to Witness a Significant Market Share

- Around 15 percent of a smartphone is made from ceramics and glass that is from electronic applications with circuit boards for thermal management employs cores of passive components like inductors, fuses or resistors.

- The Internet of Things and 5G network is expected to boost the overall speed and efficiency of communicating information between devices and networks, IoT, autonomous driving and M2M performances.

- Most of consumer electronic products are high-power devices, and the power ranges from hundred to several kilowatts.The amount of magnetic components employed depends on the power of the charging pile. On an average, 20 magnetic components are required in a charging pile, of which the inductor is used in a larger amount.

- The challenge remains the large chip area utilisation. For instance, Intel stated that the on-chip inductors used in their DC-DC converters for power management in multi-core processors occupy approximately a quarter of the total available chip area, which made them costly.

North America to Hold a Significant Market Share

- The United States witnesses a growing use of inductors in automotive electronics and increasing adoption of smart grid technologies. Due to their various applications, inductors are one of the primary components of many electronic systems. Because of the extensive usage, more inductors are being applied in several industries across North America.

- U.S. utilities invested approximately USD 144 billion in electricity generation, transmission, and distribution infrastructure in 2016. According to IEA, U.S. investments in smart grids infrastructure stood at USD 12.6 billion in 2018.

- The application of inductors, core and beads find their applications in modern adaptive LED headlights because of their low power consumption and multifunctional adaptability, these are replacing conventional halogen and HID headlights, ADAS, automotive ignition systems, among others.

- The Unites States automotive production in 2018 stands at 11.31 billion cars and commercial vehicles and Canada's automotive production at 2.02 miliion cars and commericial vehicles, as per OICA.

- The region expects a gradual ease in China-US trade spats after May of 2019, when the United States raised import tariffs on USD 200 billion of Chinese goods, which further affected the electronic component industry.

Inductors Cores & Beads Industry Overview

The inductor, cores and beadsmarket's opportunities have resulted in intense competition. There are a significant number of manufacturers vying for the increasing market share. The market witnesses increased innovation in the form of reduced size and varying the form of cores to achieve higher inductance.

- September 2019 - TDK introduced metal-core power inductors tomeet the tough conditions forharsh automotive environments, these conductors have a wide operating temperature range from -55 °C up to +155 °C.

- June 2019 -TDK launched a Thin-Film Power Inductor specifically for Mobile Device Design tohandle 4% higher currents and 12% lower resistance than conventional products.

- June 2019 - Kemet Corporation launched new range of SMD metal composite power inductors to suit modern power applications inDC-DC converters that are utilized in a variety of commercial and consumer applications including notebook computers, tablets, servers and HDTVs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.5 Market Restraints

5 MARKET SEGMENTATION

- 5.1 By Inductor Type

- 5.1.1 Power Inductors

- 5.1.2 MultiLayer Chip Inductors

- 5.1.3 RF Inductors

- 5.1.4 Other Inductor Types

- 5.2 By Core Material

- 5.2.1 Air Core

- 5.2.2 Ferrite Core

- 5.2.3 Ceramic Core

- 5.2.4 Other Core Types

- 5.3 By Chip Beads

- 5.3.1 MultiLayered Beads

- 5.3.2 Ferrite Beads

- 5.3.3 EMI Beads

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Computing

- 5.4.3 Communications

- 5.4.4 Consumer Electronics

- 5.4.5 Other End-User Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 TDK Corporation

- 6.1.2 Vishay International Inc.

- 6.1.3 Panasonic Corporation

- 6.1.4 Murata Manufacturing Co. Ltd.

- 6.1.5 Taiyo Yuden Co. Ltd.

- 6.1.6 Kemet Corporation

- 6.1.7 AVX Corporation

- 6.1.8 Texas Instruments

- 6.1.9 TT Electronics Plc

- 6.1.10 Hefei MyCoil Technology Co., Ltd.