|

市場調查報告書

商品編碼

1683408

海上鑽井市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Offshore Drilling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

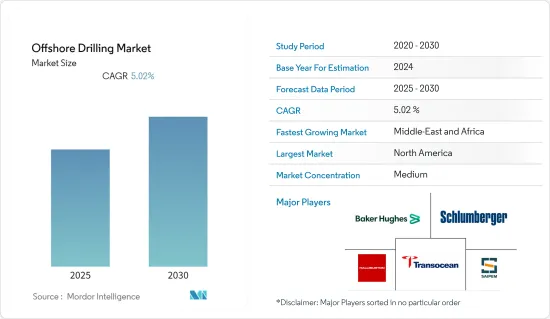

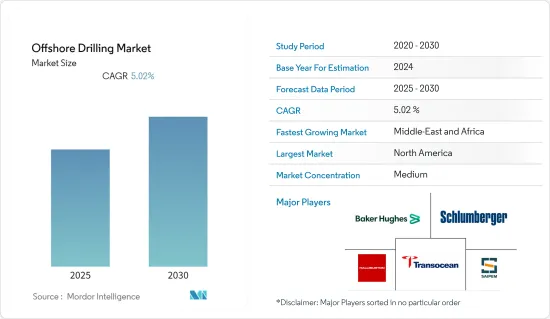

預測期內,海上鑽井市場預計將實現 5.02% 的複合年成長率

關鍵亮點

- 由於技術創新不斷增加以及鑽井作業可行性不斷提高,深水和超深水鑽井領域預計將在長期內實現顯著成長。

- 另一方面,預計未來幾年原油價格波動將抑制海上鑽井市場的成長。

- 海上鑽井技術和設備的進步正在擴大海上鑽井的能力,從而在預測期內推動市場發展。

- 中東和非洲是海上鑽井的潛在市場之一,預計大部分需求來自奈及利亞、安哥拉和埃及。

海上鑽井市場趨勢

深水和超深水鑽井領域佔據市場主導地位

- 在海上盆地進行深水和超深水鑽探可以獲得尚未開發的石油和天然氣蘊藏量。這些蘊藏物通常遠離海岸線,而且深度遠遠超出了淺水鑽探的能力,無法到達。深水、超深水儲存由於碳氫化合物含量高,具有極高的探勘開發吸引力。

- 過去幾年,天然氣全球產量和消費量大幅增加。由於各國設定的碳排放目標,預計這種情況將持續下去。因此,隨著對天然氣的需求增加,對碳氫化合物生產的需求也預計將增加,從而導致深水和超深水活動活性化。

- 深水和超深水油田有可能為滿足全球能源需求做出貢獻,這不僅是因為其生產潛力高,還因為油藏的規模和品質使其能夠生產大量的石油和天然氣。深水田和超深水田的流速通常比淺水田更高,這使得它們對石油和天然氣公司來說更具經濟可行性和吸引力。

- 例如,2023年3月,印度石油天然氣公司(ONGC)與道達爾能源公司簽署了一份合作備忘錄,以探勘印度深水區塊。作為協議的一部分,道達爾能源將向印度石油天然氣公司提供技術援助,以探勘印度東海岸、特別是馬哈納迪島和安達曼群島的深水區塊。

- 此外,2022 年 8 月,印度石油天然氣公司與埃克森美孚簽署了一項協議,在印度東海岸和西海岸進行深水石油和天然氣探勘。兩家公司的探勘活動主要集中在東部近海地區的克里希納戈達瓦里 (Krishna Godavari) 和卡弗里 (Cauvery) 盆地以及西部近海地區的庫奇-孟買 (Kutch-Mumbai) 地區。

- 此外,最近一波成本削減和重大技術創新使得許多石油和天然氣開發商能夠擴大其永續深水開發投資組合。此外,全球多家銀行正在為海上活動提供融資,這也促進了海上鑽井市場的發展。

- 因此,預測期內,深水活動的增加和技術突破可能會推動深水領域的成長。

中東和非洲經濟快速成長

- 中東和非洲是世界上已探明石油、天然氣田蘊藏量的主要地區之一。該地區的離岸帳戶仍未充分開發,包括科威特、沙烏地阿拉伯、伊朗、卡達、奈及利亞、喀麥隆和阿拉伯聯合大公國。

- 截至2021年,中東和非洲地區的石油總產量達到3,544.2萬桶/日,其中海上石油產量佔很大佔有率。中東地區除了持有全球約一半的原油蘊藏量(截至2021年約佔世界石油蘊藏量的64.1%)外,還擁有豐富的天然氣蘊藏量。截至2021年,佔全球已探明天然氣蘊藏量99.419兆標準立方公尺的48.3%。科威特、奈及利亞和喀麥隆沿海也擁有大量石油和天然氣蘊藏量。

- 此外,隨著全球能源需求快速成長,海上石油生產已成為一種有吸引力的能源來源。因此,本區強國均將目光集中到海上天然氣田的探勘。

- 預計未來幾年該地區的海上石油和天然氣探勘支出將大幅增加。豐富的資源以及從深水和超深水區域採收石油和天然氣的可能性不斷增加,預計將為海上鑽井市場提供巨大的機會。

- 中東和非洲許多國家都擁有豐富的海上石油和天然氣蘊藏量。全球最大的天然氣田、波斯灣的南帕斯天然氣綜合體以及地中海東部油氣蘊藏量的發現都有望推動市場成長。

- 例如,2022年2月,阿布達比國家石油公司(ADNOC)啟動了巨型下札庫姆海上油田進一步開發的工程、採購、施工和安裝合約的競標程序。此外,2021 年至 2025 年間,中東和非洲將核准77 多個新的上游計劃和 27 個新項目。預計這些發展將在預測期內推動海上鑽井市場的發展。

- 未來幾年,中東地區海上位置的投資和新計畫合約可能會增加。此外,巨大的資源潛力、全球對石油的高需求以及其他國家對從中東獲得能源供應的興趣日益濃厚,可能會刺激該地區探勘和生產計劃的啟動。因此,預計它將影響中東和非洲海上鑽井市場的成長。

- 因此,即將到來的海上探勘與生產活動(特別是在西非地區)等因素預計將在未來幾年內推動該地區的海上開採數量。

海上鑽井產業概況

海上鑽井市場已部分細分化。市場的主要企業(不分先後順序)包括貝克休斯公司、哈利伯頓公司、斯倫貝謝有限公司、Transocean Limited 和 Saipem SpA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:美元)

- 截至 2022 年的海上鑽油平臺歷史與需求預測(以金額為準)

- 2028 年各地區海上資本支出預測(單位:美元)

- 主要計劃資訊

- 現有計劃

- 計劃中和即將開展的計劃

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 天然氣需求不斷成長以及天然氣基礎設施的發展

- 海上石油和天然氣探勘活動增加

- 限制因素

- 採用更清潔的替代燃料

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 頂升

- 半潛式

- 鑽井船

- 其他

- 深度

- 淺水

- 深海/超深海

- 市場分析:依地區分類,市場規模及需求預測至 2028 年(按地區分類)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 挪威

- 英國

- 亞太地區

- 中國

- 印度

- 南美洲

- 巴西

- 智利

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Baker Hughes Company

- China National Offshore Oil Corporation

- China Oilfield Services Ltd

- Exxon Mobil Corporation

- Halliburton Company

- Maersk Drilling AS

- Saipem SpA

- Schlumberger Limited

- Transocean Limited

- Weatherford International PLC

第7章 市場機會與未來趨勢

- 已開發市場和新興市場中尚未開發的石油和天然氣潛力

- 海上鑽井技術的進步。

簡介目錄

Product Code: 68223

The Offshore Drilling Market is expected to register a CAGR of 5.02% during the forecast period.

Key Highlights

- Over the long term, the deepwater and ultra-deepwater segment is expected to develop significantly due to the increasing technological innovation and the rising viability of such operations.

- On the other hand, the volatility in crude oil is expected to restrain the growth of the offshore drilling market in the coming years.

- Nevertheless, advances in offshore drilling technologies and equipment have expanded the capabilities of offshore drilling, aiding the market in the forecast period.

- Middle-East and Africa are expected to be one of the potential markets for offshore drilling, with most of the demand coming from Nigeria, Angola, and Egypt.

Offshore Drilling Market Trends

Deepwater and Ultra-deepwater Segment to Dominate the Market

- Deepwater and ultra-deepwater drilling in offshore basins provide access to significant untapped oil and gas reserves. In many cases, these deposits are located far from the coastline and cannot be reached by drilling at depths far beyond the capability of shallow-water drilling. The exploration and production of deepwater and ultra-deepwater reservoirs are attractive because they contain large hydrocarbons.

- For the past several years, natural gas has witnessed considerable growth in its global production and consumption as countries are shifting from coal to natural gas as a primary energy source for cleaner energy. This scenario is expected to continue owing to the carbon emission targets set by various countries. Hence, with increasing natural gas demand, the demand for hydrocarbon production is expected to grow, thus leading to an increase in deepwater and ultra-deepwater activities.

- In addition to their high production potential, deepwater and ultra-deepwater fields may contribute to meeting global energy demands because they yield significant quantities of oil and gas due to the size and quality of their reservoirs. It is common for deepwater and ultra-deepwater wells to have higher flow rates than shallow-water wells, making them economically viable and attractive to oil and gas companies.

- For instance, in March 2023, the Oil and Natural Gas Corp. (ONGC) and TotalEnergiesentered a memorandum of understanding (MoU) to explore deepwater blocks in India. As part of the agreement, the French firm would provide technical assistance to ONGC in exploring deepwater blocks off India's east coast, particularly Mahanadi and Andaman.

- Furthermore, in August 2022, ONGC and ExxonMobil signed heads of agreement (HoA) to explore oil and gas deepwater on the Indian east and west coasts. Both firms would conduct exploration work focusing on the Krishna Godavari and Cauvery basins in the eastern offshore area and the Kutch-Mumbai region in the western offshore area.

- Moreover, the recent waves of cost reductions and critical technological breakthroughs have enabled many oil and gas exploration and production companies to expand their portfolio of sustainable deepwater developments. Also, several banks across the globe are financing offshore activities boosting the market for offshore drilling.

- Therefore, with the increase in deepwater activities and the technology breakthrough, the deepwater segment may grow during the forecast period.

Middle-East and Africa to Witness a Significant Growth

- The Middle East & Africa is one of the significant regions of proven oil and gas field reserves worldwide. The region's offshore accounts remain underdeveloped in Kuwait, Saudi Arabia, Iran, Qatar, Nigeria, Cameroon, and the United Arab Emirates.

- As of 2021, the total oil production in the Middle East & Africa reached 35,442 thousand barrels daily, of which offshore oil production accounted for a significant share. Besides holding nearly half of the world's crude oil reserves (about 64.1% of global oil reserves as of 2021), the Middle East has many natural gas reserves. The region accounted for 48.3% of the world's total proven natural gas reserves of 99,419 billion standard cubic meters as of 2021. Also, critical oil and gas reserves exist in offshore regions, such as Kuwait, Nigeria, Cameroon, etc.

- Moreover, with the rapidly increasing global energy needs, offshore oil production has become an attractive energy source. Therefore, countries with significant regional players focus on exploring offshore oil and gas fields.

- The region's offshore oil and gas exploration spending is set to grow significantly over the next few years. The availability of abundant resources, coupled with the increased potential to recover oil and gas from deep water and ultra-deepwater areas, is expected to provide an excellent opportunity for the offshore drilling market.

- Many countries in the Middle East and Africa have large-scale offshore oil and gas reserves. The world's largest gas field, the South Pars Gas Complex in the Persian Gulf, and the discoveries of oil and gas reserves in the eastern Mediterranean Sea are all expected to aid the market's growth.

- For instance, in February 2022, Abu Dhabi National Oil Company (ADNOC) kicked off a bid process for an engineering, procurement, construction, and installation contract for further development at its huge Lower Zakumoffshore oilfield. Furthermore, there are more than 77 and 27 approved upstream projects in the Middle East & Africa for 2021-2025. Such developments are anticipated to drive the offshore drilling market during the forecast period.

- Nevertheless, investment in offshore locations and new project agreements in the Middle East would likely increase in the coming years. Also, the vast resource potential, high global oil demand, and increased attention of other countries to secure energy supplies from the Middle Eastern region would initiate exploration & production projects in the area. Hence, it is expected to impact the growth of the offshore drilling market in the Middle-east and African region.

- Therefore, factors, such as upcoming offshore E&P activities, especially in the West African region, are expected to boost the number of offshore drilling in the area in the coming years.

Offshore Drilling Industry Overview

The offshore drilling market is partially fragmented. Some of the key players in the market (not in any particular order) include Baker Hughes Company, Haliburton Company, Schlumberger Limited, Transocean Limited, and Saipem SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, until 2028

- 4.3 Historic and Demand Forecast of Offshore Drilling Rigs in Numbers, until 2022

- 4.4 Historic and Demand Forecast of Offshore CAPEX in USD, by Region, till 2028

- 4.5 Key Projects Information

- 4.5.1 Existing Projects

- 4.5.2 Planned and Upcoming Projects

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Growing demand for natural gas and developing gas infrastructure

- 4.8.1.2 Increasing offshore oil and Gas Exploration Activities

- 4.8.2 Restraints

- 4.8.2.1 Adoption of Cleaner Alternatives

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Jackups

- 5.1.2 Semisubmersible

- 5.1.3 Drill Ships

- 5.1.4 Other Types

- 5.2 Depth

- 5.2.1 Shallow Water

- 5.2.2 Deepwater and Ultra-deepwater

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Norway

- 5.3.2.3 United Kingdom

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Chile

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 China National Offshore Oil Corporation

- 6.3.3 China Oilfield Services Ltd

- 6.3.4 Exxon Mobil Corporation

- 6.3.5 Halliburton Company

- 6.3.6 Maersk Drilling AS

- 6.3.7 Saipem SpA

- 6.3.8 Schlumberger Limited

- 6.3.9 Transocean Limited

- 6.3.10 Weatherford International PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Oil and Gas potential in developed and Emerging Markets

- 7.2 Technological Advancements in Offshore Drilling

02-2729-4219

+886-2-2729-4219