|

市場調查報告書

商品編碼

1683427

濕度感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Humidity Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

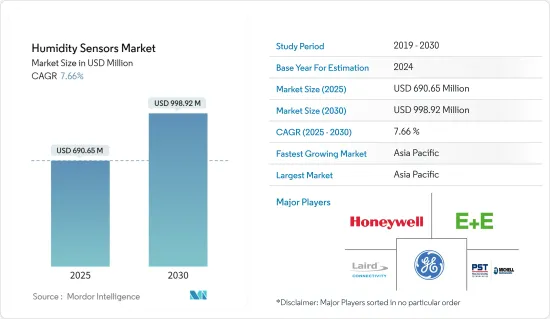

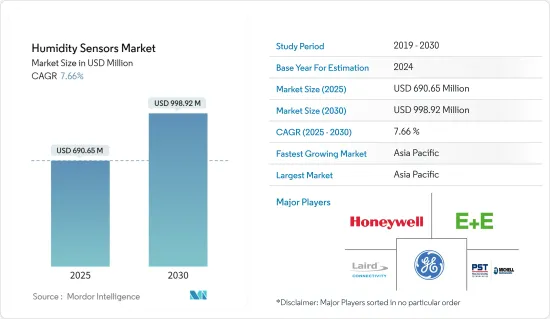

濕度感測器市場規模預計在 2025 年為 6.9065 億美元,預計到 2030 年將達到 9.9892 億美元,預測期內(2025-2030 年)的複合年成長率為 7.66%。

濕度感測器是一種測量環境中濕度並將結果轉換為相應電訊號的電子設備。它們有各種尺寸和功能;有些整合到手持設備中,而有些則是更大的嵌入式系統的一部分(例如空氣品質監測系統)。濕度感測器廣泛應用於氣象、醫療、汽車、暖通空調、工業製造等領域。電容式感測器具有功耗低、線性度好、RH檢測範圍寬等優點,但製造流程複雜是主要缺點。

主要亮點

- 濕度感測器的性能主要由其納微結構(孔徑、層厚度、表面結構元素尺寸分佈、表面形貌均勻性、電極距離等)決定。要實現濕度感測器,它必須滿足各種特性,例如重複性、靈敏度、再現性、線性度、低滯後、快速響應恢復速度、穩定性、低成本以及易於連接到控制單元。感測器應根據這些規範進行設計。

- 濕度感測器可以提高各種應用的性能、降低能耗並增強安全性。越來越多的OEM在其引擎、電子設備和其他產品中設計相對濕度和溫度感測器,以提供更好的控制和輸出。

- 過去幾年,汽車產業取得了長足發展,得益於安全、娛樂或純粹創新等新技術的出現,汽車數量不斷增加。世界各地的政府機構都在實施要求安裝感測器的安全和排放標準。因此,汽車公司必須遵守當局製定的安全和排放法規。預計這一趨勢將在預測期內增加對汽車溫度感測器的需求。

- 然而,無線感測器容易受到竊聽、干擾和欺騙等各種攻擊。它也容易受到其他無線設備和訊號的干擾,從而降低資料傳輸的品質。因此,確保網路和收集資料的安全是所研究市場面臨的關鍵挑戰。此外,無線設備通常較小,處理和儲存能力有限。這使得執行複雜任務或儲存大量資料變得困難。

- COVID-19 疫情嚴重擾亂了全球供應鏈和多種產品的需求,預計到 2020年終,無線濕度感測器的採用將受到影響。然而,由於對家用電子電器和醫療應用的需求不斷增加,市場成長顯著增加。各個參與者都在進行投資和合作以滿足需求。

濕度感測器市場趨勢

汽車產業將經歷顯著成長

- 汽車產業涵蓋從事汽車創造、改進、生產、推廣、銷售、維護和客製化的各種公司和營業單位。就收益而言,汽車產業是世界上最大的產業之一,許多公司都在持續投資汽車產業的發展。該行業還為用於管理車內濕度水平、減少車窗霧氣並提高舒適度的濕度感測器提供了機會。

- 2022 年汽車市場成長至約 6,720 萬輛,而 2021 年為 6,670 萬輛。由於全球經濟衰退,2020 年和 2021 年銷量有所下降。新冠疫情和俄烏戰爭導致2022年汽車半導體短缺,並引發了供應鏈問題。不過,預計 2023 年將恢復成長,達到 7,080 萬台。預計類似的成長趨勢將影響未來的汽車需求,從而進一步擴大濕度感測器市場。

- 在汽車領域,濕度感測器用於監測和控制車輛內部氣候。這些感測器在調節汽車的氣候控制和通風系統方面發揮關鍵作用,確保車窗除霜以提高安全性。

- 此外,只有當濕度超過一定閾值時,通風過程才會啟動,從而最大限度地減少電力使用並提高汽車的整體效率。因此,汽車產業對濕度感測器的需求不斷擴大,推動了市場成長。汽車銷售的成長和汽車產量增加的投資預計將提升市場潛力。

亞太地區可望主導市場

- 預計預測期內亞太地區的濕度感測器市場將經歷顯著成長。感測器主要在亞太地區製造,最尖端科技依靠感測器發揮作用,感測器技術在世界各地廣泛應用。

- 基礎設施建設、技術進步、旅遊活動的增加、可支配收入的增加以及政府提高能源效率的舉措推動了暖通空調產業的發展。隨著各行各業擁抱自動化、物聯網和人工智慧整合,對更高效能和更節能系統的需求正在增加。預計該地區將佔據石油和天然氣需求成長的主導地位。石油和天然氣產業通常在極端天氣條件下,在陸上和海上的惡劣環境中運作。 HVAC 系統透過維持空氣品質、溫度和濕度來確保室內工作空間保持居住,從而推動市場成長。

- 第 22 屆 ACREX India 展會是南亞最大的空調、暖氣、通風和智慧建築展覽會,將於 2023 年 3 月在孟買展覽中心舉行。該展會由印度暖氣、冷凍與空調工程師學會 (ISHRAE) 與 Informa Markets 合作舉辦,旨在展示印度蓬勃發展的暖通空調行業,並為總理的 Atmanirbhar 願景做出貢獻。關注 HVAC 領域的技術進步,這對於更美好的未來至關重要。

- 在這個市場營運的公司正致力於將新產品創新作為業務擴展的一部分。例如,2023年7月,Weathernews公司與Omron Corporation共同開發了新型天氣物聯網感測器,並以「Soratena Pro」為名發布。 Soratena Pro 是一款高性能物聯網天氣感測器,可監測溫度、濕度、氣壓、降雨量、風向和風速等元素。該技術由專注於感測器開發的OMRON與Weathernews公司共同開發,充分利用兩家公司的優勢,實現最高水準的天氣預報準確率。

- 該地區的食品和飲料行業也經歷了成長,各種國內外餐飲企業都在此開展業務。食品工業中技術的使用範圍也不斷擴大,從食品製備到消費。食品和飲料產業也是濕度感測器的重要用戶,濕度感測器可以監測溫度和濕度以防止食物變質。

- 根據OICA預測,2022年中國商用車產量將達3,184.53輛,位居世界第一。日本以1,269.16台位列第二、第三位,泰國以1,289.46台位列第三。此外,汽車的電氣化和混合動力化、汽車製造商之間的聯盟以及可支配收入的增加正在刺激汽車產業對汽車感測器的需求。中國等國家對全球汽車感測器產業的擴張做出了重大貢獻。此外,該地區是全球一些主要汽車製造商的所在地,預計將在預測期內推動汽車感測器(包括濕度感測器市場)的發展。

濕度感測器產業概況

濕度感測器市場比較分散。鑑於工業物聯網(IIOT)和自動化等技術的重大進步,預計將出現對更多特定技術感測器的需求,這可能會導致更全面的競爭。公司包括通用電氣公司、萊爾德連接公司、E+E Elektronik GmbH、霍尼韋爾國際公司和英國米歇爾儀器公司。

2023 年 11 月,E+E Elektronik 推出了新一代精確可靠的房間感測器:CDS201、HTS201 和 TES201。我們為每個設施自動化應用提供用於測量二氧化碳、濕度和溫度的 CDS201 三合一設備、HTS201 濕度和溫度感測器以及 TES201 溫度感測器。每款產品都配有類比輸出或數位介面以及大型現代化顯示器。功能性卡扣式外殼可最大程度降低安裝成本並防止干擾空氣污染。

2023 年 9 月,Process Sensing Technologies 宣布收購 Sensore Electronic GmbH。 Sensore 將增強公司現有的感測器產品組合。 Sensore 的產品特別適合要求最嚴格的產業中的關鍵應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠疫情及其他宏觀經濟因素對市場的影響

- 主要技術類型:紅外線、雙金屬、冷卻鏡、氧化鋁電容式等。

- 主要技術類型 – 紅外線

- 主要技術類型-雙金屬

- 主要技術類型 – 冷卻鏡

- 主要技術類型 – 氧化鋁電容式

第5章 市場動態

- 市場促進因素

- 製程工業的安全需求日益增加

- 汽車產業的新應用

- 市場限制

- 非接觸式科技的使用限制

第6章 市場細分

- 按最終用戶產業

- 化工和石化

- 建築自動化 (HVAC)

- 車

- 石油、天然氣和天然氣

- 藥品

- 半導體

- 發電

- 飲食

- 紙和紙漿

- 用水和污水、焚燒爐

- 家電

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第 7 章 通路分析

第8章 競爭格局

- 公司簡介

- General Electric Company

- Laird Connectivity

- E+E Elektronik GmbH

- Honeywell International Inc.

- Mischell Instrument UK

- TE Connectivity Ltd

- Sensirion AG

- Bosch Sensortec GmbH

- Texas Instruments Incorporated

- Amphenol Advanced Sensors

- STMicroelectronics International NV

第9章投資分析

第10章 市場機會與未來趨勢

The Humidity Sensors Market size is estimated at USD 690.65 million in 2025, and is expected to reach USD 998.92 million by 2030, at a CAGR of 7.66% during the forecast period (2025-2030).

A humidity sensor is an electronic device that measures the humidity in its environment and converts its findings into a corresponding electrical signal. It comes in various sizes and functions; some are built into handheld devices, while others are part of larger embedded systems (such as air quality monitoring systems). Humidity sensors have wide use in meteorology, medicine, automobiles, HVAC, and industrial production. Some advantages to capacitive sensors include low power consumption, good linearity, and wide-range RH detection, but a complicated fabrication process is a major drawback.

Key Highlights

- A humidity sensor's performance is primarily determined by its nano- and microscopic structure, which includes pore size, layer thickness, size distribution of the surface structural element, surface morphology uniformity, and electrode distance. For implementation, humidity sensors must meet a variety of characteristics, including repeatability, sensitivity, reproducibility, linearity, low hysteresis, fast response-recovery speed, stability, low cost, and ease of connection to control units. Sensors should be designed according to these specifications.

- Humidity sensors can improve performance, reduce energy consumption, and increase safety in a variety of applications. Increasingly, OEMs are designing relative humidity/temperature sensors into engines, electronics, and other products to improve control and output.

- The automotive industry has grown significantly in the past few years, aided by the growth in unit volumes with the emergence of new technologies, whether it be for safety, entertainment, or pure innovation. Government organizations in many countries are implementing safety and emission control standards mandating the installation of sensors. Automotive companies are, thereby, required to comply with the safety and emission control regulations set by these authorities. This trend is expected to increase the demand for automotive temperature sensors over the forecast period.

- However, wireless sensors are vulnerable to various attacks, such as eavesdropping, jamming, and spoofing. They can be susceptible to interference from other wireless devices or radio signals, which can degrade the quality of data transmission. Thus, ensuring the security of the network and the data it collects poses a significant challenge to the market studied. In addition to this, they are typically small and have limited processing and storage capabilities. This makes it challenging to perform complex tasks or store large amounts of data.

- Due to the outbreak of COVID-19, the global supply chain and demand for multiple products have majorly been disrupted, and wireless humidity sensor adoption is anticipated to be influenced until the end of 2020. However, the growing demand for consumer electronics and medical applications significantly increased market growth. Various players were investing and collaborating to cater to the requirements.

Humidity Sensors Market Trends

Automotive Sector to Witness Major Growth

- The automotive sector encompasses a diverse array of companies and entities engaged in creating, advancing, producing, promoting, selling, maintaining, and customizing automobiles. It stands as one of the largest industries globally in terms of revenue, with numerous companies consistently investing in its growth. This industry also presents opportunities for the utilization of humidity sensors used to reduce misting-up of the windows and enhance comfort by managing the humidity levels inside the car.

- The car market grew to approximately 67.2 million vehicles in 2022, compared to 66.7 million in 2021. The industry saw a decline in sales in 2020 and 2021 due to a weakening global economy. The COVID-19 pandemic and Russia's war on Ukraine caused a shortage in automotive semiconductors and supply chain issues in 2022. However, it was expected to resume growth in 2023 and reach 70.8 million units. Similar growth trends are expected to shape the demand for automotive in the future, which further translates to an increase in the market for humidity sensors.

- The automotive sector employs humidity sensors to oversee and manage the climate within vehicles. These sensors play a crucial role in regulating the air conditioning and ventilation system of cars, ensuring that the windows defrost adequately for enhanced safety.

- Moreover, they activate the ventilation process solely when the humidity level surpasses a specific threshold, thereby minimizing power usage and enhancing the overall efficiency of vehicles. As a result, the demand for humidity sensors in the automotive industry continues to expand, fostering market growth. The growing sales of the vehicles and investments in boosting vehicle production are expected to drive the market's potential.

Asia-Pacific is Expected to Dominate the Market

- The humidity sensors market in Asia-Pacific is expected to witness significant growth over the forecast period. Sensors are largely manufactured in the Asia-Pacific region, and sensor technology is widely being used worldwide as cutting-edge technologies rely on the functioning of the sensors.

- The HVAC industry is fueled by infrastructure development, technological advancements, growing tourism activities, advancing disposable income, and government initiatives promoting energy efficiency. The industry is adopting automation, IoT, and AI integration, and the demand for higher-performing and energy-efficient systems is increasing. The region is expected to account for the growth of oil and gas demand. The oil and gas industry often operates in severe onshore and offshore environments under extreme weather conditions. HVAC systems ensure that indoor workspaces remain habitable by maintaining air quality, temperature, and humidity, driving the market growth.

- The 22nd edition of ACREX India, one of the largest exhibitions for air conditioning, heating, ventilation, and intelligent buildings in South Asia, was held in March 2023 at the Bombay Exhibition Centre in Mumbai. The event, organized by the Indian Society of Heating, Refrigerating and Air Conditioning Engineers (ISHRAE) in partnership with Informa Markets, showcased India's thriving HVAC industry, seeking to contribute to the Prime Minister's Atmanirbhar vision. The focus would be on technological advancements in the HVAC sector, which are essential for a better future.

- Companies operating in the market focus on innovating new products as part of their business expansion. For instance, in July 2023, Weathernews Inc. and Omron Corporation collaborated and developed a new weather IoT sensor, which was released as Soratena Pro. Soratena Pro is a high-performance weather IoT sensor that monitors elements, including air temperature, humidity, atmospheric pressure, rainfall, wind direction, and wind velocity. Soratena Pro was jointly developed by OMRON, which specializes in sensor development, and Weathernews boasts technology for the highest weather forecast accuracy, leveraging the strengths of both companies.

- The region is also witnessing growth in the food and beverage sectors, with various domestic and international food service outlets entering the region. The use of technology in the food industry is also growing from preparing to consuming food. The food and beverage industry is also a significant user of humidity sensors that monitor the temperature and humidity of food products to prevent any spoilage.

- According to OICA, China took the top position in the production of commercial vehicles in 2022 with 3,184.53 vehicles. Japan and Thailand took second and third positions with 1,269.16 and 1,289.46 production of commercial vehicles, respectively. Moreover, vehicle electrification and hybridization, alliances among automotive players, and rising disposable income stimulate the demand for automotive sensors in the automotive sector. Countries such as China contribute substantially to expanding the global automotive sensors industry. The region is also home to a few large automakers worldwide and is expected to advance its automotive sensors, including the humidity sensors market, over the forecast period.

Humidity Sensors Industry Overview

The humidity sensors market is fragmented. Considering significant advancements in technology, like IIOT and automation, the need for more specific sensors for technology is expected to emerge, which may result in more completive rivalry, and some of the players include General Electric Company, Laird Connectivity, E+E Elektronik GmbH, Honeywell International Inc., and Michell Instrument UK.

In November 2023, E+E Elektronik launched a new generation of accurate and reliable room sensors, CDS201, HTS201, and TES201. Tailored to the respective facility automation application, the company offers a CDS201 3-in-1 device for CO2, humidity, and temperature, the HTS201 humidity and temperature sensor, and the TES201 temperature sensor. Each variant has analog outputs or a digital interface and a large, state-of-the-art display. The functional snap-on enclosure minimizes installation costs and avoids the intake of false air.

In September 2023, Process Sensing Technologies announced the acquisition of Sensore Electronic GmbH. Sensore would be an addition to the existing sensor portfolio. Sensore's products are particularly well-suited for critical applications in the most demanding industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

- 4.4 Major Technology Types Infrared, Bimetallic, Cooled Mirror, and Aluminums Oxide Capacitive, among others

- 4.4.1 Major Technology Types - Infrared

- 4.4.2 Major Technology Types - Bimetallic

- 4.4.3 Major Technology Types - Cooled Mirror

- 4.4.4 Major Technology Types - Aluminum Oxide Capacitive

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Safety in the Process Industries

- 5.1.2 Emerging Applications in the Automotive Industry

- 5.2 Market Restraints

- 5.2.1 Limitations in the Use of Non-contact Technologies

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Chemical and Petrochemical

- 6.1.2 Building Automation (HVAC)

- 6.1.3 Automotive

- 6.1.4 Oil and Gas and Natural Gas

- 6.1.5 Pharmaceutical

- 6.1.6 Semiconductor

- 6.1.7 Power Generation

- 6.1.8 Food and Beverage

- 6.1.9 Paper and Pulp

- 6.1.10 Water, Wastewater, and Incineration

- 6.1.11 Consumer Electronics

- 6.1.12 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 DISTRIBUTION CHANNEL ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 General Electric Company

- 8.1.2 Laird Connectivity

- 8.1.3 E+E Elektronik GmbH

- 8.1.4 Honeywell International Inc.

- 8.1.5 Mischell Instrument UK

- 8.1.6 TE Connectivity Ltd

- 8.1.7 Sensirion AG

- 8.1.8 Bosch Sensortec GmbH

- 8.1.9 Texas Instruments Incorporated

- 8.1.10 Amphenol Advanced Sensors

- 8.1.11 STMicroelectronics International NV