|

市場調查報告書

商品編碼

1683437

超高分子量聚乙烯:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Ultra-high Molecular Weight Polyethylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

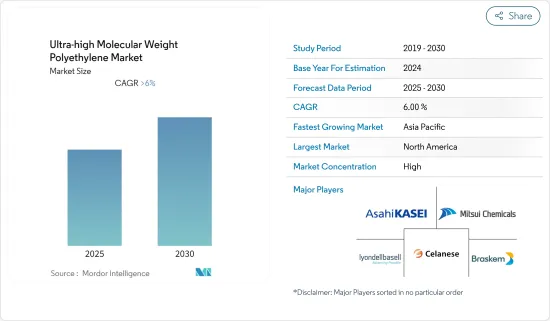

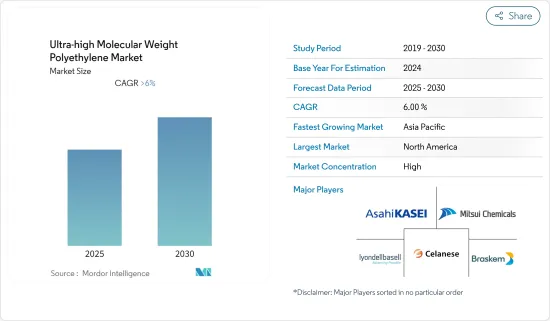

預測期內,超高分子量聚乙烯市場預計將以超過 6% 的複合年成長率成長。

超高分子量聚乙烯主要用於製造汽車、航太和國防工業的零件。新冠肺炎疫情正在對汽車產業造成嚴重影響。根據國際汽車工業組織(OICA)的數據,2020年第三季全球汽車產量約5,000萬輛,較2019年第三季的約6,500萬輛產量大幅下降。然而,COVID-19疫情的爆發導致全球患者人數不斷增加,從而增加了醫療救助的需求,從而刺激了超高分子量聚乙烯市場。根據《2019 年世界人口展望》(聯合國,2019 年),到 2050 年,全球每六人中就有一人年齡在 65 歲或以上,高於 2019 年的每十一人中就有一人。 2019 年全球整體65 歲或以上人口為 7.03 億,預估 2020 年預期壽命為 72.63 歲。到 2050 年,65 歲或以上人口數量可能會超過 15 億。這種情況也促進了醫療保健產業的發展,從而增加了對超高分子量聚乙烯的需求。

主要亮點

- 從中期來看,高性能聚合物的應用範圍不斷擴大以及醫療領域的需求不斷成長正在推動市場成長。

- 另一方面,超高分子量聚乙烯的熔點低、UHMWPE不適合某些重型應用以及COVID-19的影響預計會阻礙市場成長。

- 北美佔據了主要佔有率,而預計亞太地區在預測期內將以健康的速度擴張。

超高分子量聚乙烯的市場趨勢

汽車和國防領域的需求不斷成長

- 超高分子量聚乙烯(UHMWPE)是一種具有極高分子密度的高性能熱塑性聚合物。主要用於汽車、防彈、醫療及各種機械零件的製造。

- 由於超高分子量聚乙烯 (UHMWPE) 的特性,汽車產業的需求日益成長。 UHMWPE 用於汽車零件,如閥門、活塞、齒輪、軸承和耐磨條。

- 然而,受新冠疫情影響,汽車業也面臨產銷減少,導致對超高分子量聚乙烯的需求下降。根據OICA的數據,2020年第三季全球汽車產量約5,000萬輛,較2019年第三季的約6,500萬輛大幅下降。

- UHMWPE的性能包括耐磨性、高抗衝擊性、優異的耐化學性、能量吸收性、隔音性以及優異的介電和絕緣性能。

- 由於這些優異的性能,UHMWPE也用於製造國防零件。隨著各國國防力量的不斷壯大與升級,超高分子量聚乙烯的需求也日益增加。

- 由於近期各地區都爆發了新冠肺炎疫情,預計製造業和其他終端用戶產業對超高分子量聚乙烯的需求短期內將會下降。

- 高性能聚合物在汽車中的廣泛應用和軍事領域的技術進步將在未來幾年推動對超高分子量聚乙烯的需求。

亞太地區佔市場主導地位

- 由於中國、韓國、日本和印度的汽車產業高度發達,加上多年來對醫療保健產業的持續投資,亞太地區有望主導全球市場。

- 近年來,UHMWPE因其特性主要用於整形外科應用。亞太地區醫療領域的擴張是推動超高分子量聚乙烯(UHMWPE)需求增加的原因之一。

- UHMWPE也用於機械設備。中國是機械零件製造工廠的所在地,亞太地區的快速工業化預計將在未來幾年增加對超高分子量聚乙烯的需求。

- 根據國際汽車製造商組織(OICA)的統計,亞太地區引領全球汽車生產。中國是最大的汽車生產國,光是2019年就生產了25,720,665輛汽車。

- 此外,中國航空業多年來也取得了顯著的成長。據波音公司預計,未來20年中國將需要約7,600架新民航機,總價值約1.2兆美元。

- 中國是世界上最大的電子設備製造基地。智慧型手機、 有機發光二極體電視、平板設備、電線、電纜、耳機等電子產品在電子領域成長最快。該國不僅滿足國內電子產品需求,還將電子產品出口到其他國家。

- 根據中國國家統計局數據,2020年12月,中國電力及家用電子電器零售額約達1,000億元。

- 由於受到全球COVID-19的影響,各項製造活動已停擺。這導致所有生產設施短暫停頓。因此,預計在此期間汽車產業對超高分子量聚乙烯的需求有所下降。

- 此外,亞太地區造紙、食品飲料和化學工業的成長正在推動各種應用對超高分子量聚乙烯的需求。

- 預計未來幾年醫療領域的持續成長、汽車和航太領域以及其他終端用戶產業的需求不斷成長將推動超高分子量聚乙烯市場的發展。

超高分子量聚乙烯產業概況

超高分子量聚乙烯市場部分整合,少數幾家大公司控制相當一部分市場。主要公司包括旭化成工業、Brasken、三井化學、RondellBasell Industries Holdings BV 和塞拉尼斯公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大高性能聚合物的應用

- 醫療產業需求不斷成長

- 限制因素

- 熔點低,不適合重載應用

- COVID-19 疫情爆發對市場的影響

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 最終用戶產業

- 汽車

- 航太和國防

- 醫療

- 化學

- 電子產品

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Asahi Kasei Advance Corporation

- Braskem

- Celanese Corporation

- DSM

- Rochling

- Korea Petrochemical Ind Co. Ltd

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- Teijin Aramid BV

- TOYOBO CO. LTD

第7章 市場機會與未來趨勢

The Ultra-high Molecular Weight Polyethylene Market is expected to register a CAGR of greater than 6% during the forecast period.

Ultra-high molecular weight polyethylene is used mainly to manufacture components of the automobile, aerospace, and defense industries. COVID-19 has badly impacted the automobile industry. According to the OICA (International Organization of Motor Vehicle Manufacturers), the global production of vehicles in the third quarter of 2020 is around 50 million, a significant decrease compared to the production in the third quarter of 2019, which was around 65 million. However, the outbreak of the COVID-19 pandemic has been increasing the need for medical assistance due to the increasing number of patients globally, thereby stimulating the UHMWPE market. According to the World Population Prospects 2019 (United Nations, 2019), by 2050, one in six people in the world will be over the age of 65, up from one in 11 in 2019. Globally, there were 703 million older persons aged 65 or over in 2019, and the life expectancy is also estimated to be 72.63 years by 2020, which may bring the number of people aged 65 years and more to over 1.5 billion by 2050. This scenario is another factor, which has been boosting the medical sector, thus increasing the demand for UHMWPE.

Key Highlights

- Over the medium term, increasing applications for high-performance polymers and growing demand from the medical sector are driving the market growth.

- On the flip side, ultra-high molecular weight polyethylene has a low melting point, UHMWPE is not suitable for certain heavy load applications, and the impact of COVID-19, which, in turn, is expected to hinder the market growth.

- North America dominated the market with a significant share, and Asia-Pacific is estimated to expand at a healthy rate during the forecast period.

Ultra-High Molecular Weight Polyethylene Market Trends

Growing Demand from the Automobile and Defense Sectors

- Ultra-high molecular weight polyethylene (UHMWPE) is a high-performance thermoplastic polymer that has a very high molecular density. It has been majorly used for automobiles, ballistic protection, medical, and production of various machined parts.

- The demand for the UHMWPE from the automobile industry has been growing because of its properties. UHMWPE is being used in automobile parts such as valves, pistons, gears, bearings, and wear strips.

- However, due to the COVID-19 impact, the automotive industry has also faced a decline in production and sales and thus decreased the demand for UHMWPE. According to the OICA, the global production of vehicles in the third quarter of 2020 was around 50 million, a significant decrease compared to the production in the third quarter of 2019, which was around 65 million.

- The properties of UHMWPE include sliding abrasion resistance, high impact resistance, good chemical resistance, energy absorption, and sound-dampening, and excellent dielectric and insulating properties.

- Due to these outstanding properties, UHMWPE is also being used for manufacturing defense components. The demand for UHMWPE has been increasing because of the growing and upgrading defense units in all the countries.

- Recently, the outbreak of COVID-19 in all regions is expected to decrease the demand for UHMWPE from the manufacturing and other end-user industries in the short term.

- Increasing applications for high-performance polymers in automobiles and technological advancements in the military sector are driving the demand for ultra-high molecular weight polyethylene through the years to come.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market owing to the highly developed automobile sector in China, Korea, Japan, and India, coupled with the continuous investments done in the region to advance the medical sector through the years.

- Recently, UHMWPE is majorly being used in orthopedic applications because of its properties. The expanding medical sector in Asia-Pacific is one of the reasons leading to an increase in the demand for ultra-high molecular weight polyethylene (UHMWPE).

- UHMWPE is also being used in mechanical equipment. China has mechanical component manufacturing plants, and also rapid industrialization in Asia-Pacific is expected to increase the demand for the UHMWPE in the coming years.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), Asia-Pacific leads global automobile production. China is the largest producer of automobiles, and China alone produced 2,57,20,665 vehicles in 2019.

- Furthermore, the Chinese aircraft industry depicted significant growth over the years. According to Boeing, China is estimated to require around 7,600 new commercial aircraft, valued at USD 1.2 trillion, over the next two decades.

- China has the world's largest electronics production base. Electronic products, such as smartphones, OLED TVs, tablets, wires, cables, and earphones, recorded the highest growth in the electronics segment. The country serves not only domestic demand for electronics but also exports electronic output to other countries.

- According to the National Bureau of Statistics of China, in December 2020, retail sales of household appliances and consumer electronics in China had amounted to about CNY 100 billion.

- The impact of COVID-19 across the world resulted in the lockdown of various manufacturing activities. Due to this, all production units have been stopped for a brief period. Hence, the demand for UHMWPE in the automotive sector is estimated to have decreased during this period.

- Also, the growing paper, food and beverage, and chemical industries in Asia-Pacific are the reasons to increase the demand for UHMWPE in various applications.

- The continuous growth in the medical sector, increasing demand from automobile and aerospace sectors, and other end-user industries are expected to drive the market for ultra-high molecular weight polyethylene through the years to come.

Ultra-High Molecular Weight Polyethylene Industry Overview

The ultra-high molecular weight polyethylene market is partially consolidated in nature, with a few major players occupying a significant portion of the market. Some of the major companies are Asahi Kasei Advance Corporation, Braskem, Mitsui Chemicals Inc., LyondellBasell Industries Holdings BV, and Celanese Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications of High-performance Polymers

- 4.1.2 Growing Demand from the Medical Sector

- 4.2 Restraints

- 4.2.1 Low Melting Point and Unsuitable for High Load Applications

- 4.2.2 Impact of the COVID-19 Outbreak on the Market

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 End-user Industry

- 5.1.1 Automotive

- 5.1.2 Aerospace and Defense

- 5.1.3 Medical

- 5.1.4 Chemical

- 5.1.5 Electronics

- 5.1.6 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahi Kasei Advance Corporation

- 6.4.2 Braskem

- 6.4.3 Celanese Corporation

- 6.4.4 DSM

- 6.4.5 Rochling

- 6.4.6 Korea Petrochemical Ind Co. Ltd

- 6.4.7 LyondellBasell Industries Holdings BV

- 6.4.8 Mitsui Chemicals Inc.

- 6.4.9 Teijin Aramid BV

- 6.4.10 TOYOBO CO. LTD