|

市場調查報告書

商品編碼

1683439

綠色和生物基塑膠添加劑:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global Green & Bio-based Plastic Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

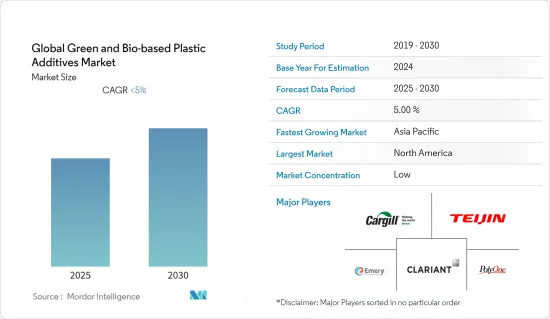

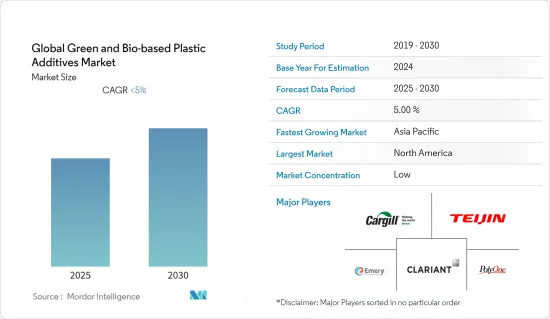

預計預測期內全球綠色和生物基塑膠添加劑市場複合年成長率將低於 5%。

包裝應用對生物基塑膠的需求不斷增加,推動了市場成長。

預計 COVID-19 的影響和原因將阻礙市場成長。

綠色和生物基塑膠添加劑市場趨勢

包裝應用需求不斷成長

- 綠色生物基塑膠添加劑是添加到塑膠中的生物物質,以積極、環保的方式改善塑膠的最終機械性能、使用性能和其他品質。

- 已開發地區和開發中地區對生物基塑膠添加劑的需求都在增加。包裝被認為是全球生物基塑膠添加劑的主要應用之一。

- 塑化劑是最常見的生物基功能添加劑之一,可提高塑膠的柔韌性。需要這些添加劑的塑膠的最終用途包括包裝、電子和汽車。

- 北美和歐洲是監管嚴格的地區,尤其是用於食品包裝、瓶子和食品儲存的塑膠。因此,企業對生產生物基塑膠產品持開放態度,並正在投資生物基塑膠。

- 北美是生物基塑膠添加劑消費量的最大市場,其次是歐洲。

- 由於近期各地區爆發新冠疫情,預計未來兩年綠色和生物基塑膠添加劑市場的成長速度將放緩。

- 預計未來幾年環保塑膠應用的開發和發展中地區對塑膠的認知不斷提高將推動對綠色和生物基塑膠添加劑的需求。

未來幾年亞太地區將佔據市場主導地位

- 由於中國、韓國、日本和印度的汽車產業高度發達,以及多年來對發展食品加工廠和電子產品的持續投資,亞太地區有望主導全球市場。

- 近年來,亞太地區的醫療保健產業也快速成長。綠色和生物基塑膠添加劑正在用於醫療設備,因為它們為塑膠產品提供了更高的安全性和靈活性。

- 中國和日本是亞太地區消費品、玩具、電子產品和其他產品的主要生產國。隨著企業擴大使用生物基塑膠產品,這些領域對綠色和生物基塑膠添加劑的需求近年來逐漸成長。

- 中國從事食品加工行業歷史悠久,已崛起為世界主要食品加工國家之一。食品業也是中國收益最高的行業之一,如今遠高於其他國家。

- 此外,汽車和建設產業對生質塑膠產品的使用不斷增加以及政府對塑膠的監管日益加強,也有望支持亞太地區綠色和生物基塑膠添加劑市場的成長。

綠色及生物基塑膠添加劑產業概況

全球綠色和生物基塑膠添加劑市場是一個分散的市場,許多公司都在競爭。主要參與者包括 Emery Oleochemicals、嘉吉公司、普立萬公司、帝人有限公司和科萊恩公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 包裝應用對生物基塑膠的需求不斷成長

- 其他促進因素

- 限制因素

- COVID-19 的影響

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 功能類型

- 塑化劑

- 抗菌劑

- 抗靜電劑

- 阻燃劑

- 穩定器

- 增強劑

- 其他類型

- 最終用戶產業

- 包裝

- 電子產品

- 醫療設備

- 紡織品

- 消費品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- Clariant AG

- Cargill

- Cathay Industrial Biotech

- FKuR Kunststoff

- Emery Oleochemicals

- PolyOne Corporation

- Kompuestos

- Teijin Limited

- Arkema SA

- Zhejiang Hisun Biomaterials

第7章 市場機會與未來趨勢

- 其他機會

The Global Green & Bio-based Plastic Additives Market is expected to register a CAGR of less than 5% during the forecast period.

Growing demand for bio-based plastics for packaging applications and other reasons are driving the market growth.

The impact of COVID-19 and reasons are expected to hinder the market growth.

Green and Bio-Based Plastic Additives Market Trends

Growing Demand for Packaging Applications

- Green and bio-based plastic additives are bio substances that are added to plastics to increase the final and mechanical properties, performance, and other qualities in a positive and environmental friendly way.

- The demand for bio-based plastics additives has been growing in developed as well as in developing regions because of environmental rules that are being implemented by the respective governments. Packaging is considered as one of the major applications for biobased plastic additives globally.

- Plasticizers are one of the most common functional bio-based additives that can improve the flexibility of plastics. Some of the end-use applications of plastics that require these additives are packaging, electronics, automotive, etc.

- North America and Europe are the regions that have high regulations on plastics, especially which are being used for food packaging, bottles, food storage purposes, and others. So, companies are looking forward to making bio-based plastic products and invest in bio-based plastics.

- North America is the largest market in the consumption of bio-based plastic additives followed by Europe as these regions have more demand from food processing units and other end-user industries, compared to other regions.

- Recently, the outbreak of COVID-19 in all regions is expected to decrease the growth rate of green and bio-based plastic additives market for the next two years as many production units have been closed due to lockdown and the outputs are not expected to witness any significant growth in near future.

- Increasing applications for environmentally friendly plastics, growing awareness in developing regions on plastics are expected to grow the demand for green & bio-based plastic additives through the years to come.

Asia-Pacific Region to Dominate the Market in the coming years

- Asia-Pacific is expected to dominate the global market owing to the highly developed automobile sector in China, Korea, Japan, and India, coupled with the continuous investments done in the region to advance the food processing plants and electronics through the years.

- The medical sector in the Asia-Pacific is also growing rapidly in recent years. Green and bio-based plastic additives are being used for medical devices, as these offer more safety and flexibility to the plastic products.

- China and Japan are leading countries in the production of consumer goods, toys, electronics, and other products in Asia-Pacific. As companies have been inclining to use more biobased plastic products, the demand for green & bio-based plastic additives for these segments is growing gradually in recent times.

- China entered the food processing industry long back and has been emerging as one of the leading food processing countries in the world. Also, the food sector is one of the highest revenue generators in China, much higher than any other country in recent times.

- Also, increasing usage of bio-plastic products in automobiles and construction industries, and rising government regulations on plastics, are expected to support the growth of the green and bio-based plastic additives market in the Asia-Pacific region.

Green and Bio-Based Plastic Additives Industry Overview

The global green & bio-based plastic additives market is fragmented in nature with many players competing in the market. Some of the major companies are Emery Oleochemicals, Cargill Inc, PolyOne Corporation, Teijin Limited, and Clariant AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Bio-based Plastics for Packaging Applications

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Impact of COVID-19

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Functionality Type

- 5.1.1 Plasticizers

- 5.1.2 Antimicrobial Agents

- 5.1.3 Antistatic Agents

- 5.1.4 Flame-Retardants

- 5.1.5 Stabilizers

- 5.1.6 Reinforcing Agents

- 5.1.7 Other Types

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Electronics

- 5.2.3 Medical Devices

- 5.2.4 Textiles

- 5.2.5 Consumer Goods

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Clariant AG

- 6.4.2 Cargill

- 6.4.3 Cathay Industrial Biotech

- 6.4.4 FKuR Kunststoff

- 6.4.5 Emery Oleochemicals

- 6.4.6 PolyOne Corporation

- 6.4.7 Kompuestos

- 6.4.8 Teijin Limited

- 6.4.9 Arkema S.A.

- 6.4.10 Zhejiang Hisun Biomaterials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Other Opportunities