|

市場調查報告書

商品編碼

1683489

數位紡織印花:市場佔有率分析、產業趨勢與統計、2025-2030 年成長預測Digital Textile Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

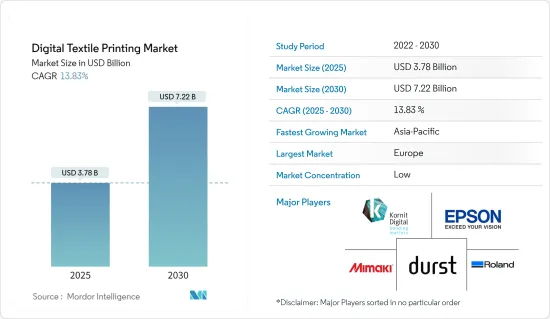

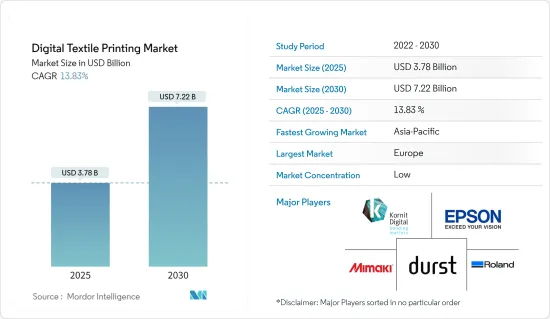

預計 2025 年數位紡織品印花市場規模為 37.8 億美元,到 2030 年將達到 72.2 億美元,預測期內(2025-2030 年)的複合年成長率為 13.83%。

主要亮點

- 使用噴墨技術的數位紡織品印花可以為材料裝飾上鮮豔的圖案。在紡織品設計軟體的支援下,該方法滿足了客自訂T 卹印花日益成長的需求並提供了設計可能性。除了服裝領域之外,數位紡織印花在商業和家居裝飾市場也得到廣泛的應用。

- 與膠印和固體油墨印刷等傳統方法相比,數位印刷使用較溫和的化學品和溶劑。在印染印花市場,環保方法和成本效益生產的雙重關注正在推動對數位解決方案的需求激增。

- 此外,紫外線凝膠技術等進步正在推動產業創新。例如,2024 年 5 月,主要企業Canon美國公司透過韌體更新擴展了其 M 系列 UV 凝膠印表機的功能,以鞏固其去年推出的科羅拉多 M 系列印表機的成功。此舉旨在拓寬應用範圍並開拓新的細分市場。

- 印花織物在車輛包裝和室內裝飾中的使用正日益成為市場成長的動力。數位印表機還存在墨水成本和維護成本高等挑戰。這些因素,加上油墨和列印頭等原料價格的波動,可能會阻礙市場擴張。然而,紡織品積層製造等有前景的技術支撐了市場的成長。

- 儘管前景光明,但障礙依然存在。油墨成本高、高速單一途徑機器上需要多個印刷頭以及昂貴的維護和更換費用使其難以在紡織市場上與輪轉印花競爭。

數位紡織印花市場趨勢

服飾和服飾領域預計將佔據市場主要佔有率

- 服裝和服飾印花技術自誕生以來已經取得了長足的進步。服裝和配件的最新印花方法是數位紡織品印花。數位紡織品印花使用電腦控制的印表機將以數位格式儲存的圖案和圖像傳輸到織物上。技術進步使得設計師和製造商能夠快速、輕鬆地創造出複雜的圖案。

- 印染市場傳統上高度重視永續性和紡織廢棄物。據聯合國稱,時尚產業嚴重依賴數位技術,造成全球溫室氣體排放的 10% 左右。

- 透過將紡織品設計流程轉移到國內,數位紡織品印花提高了生產速度並降低了運輸成本。

- 此外,隨著尖端的數位紡織印花技術,中國大多數位紡織印花企業已開始建造先進的數位紡織印花設施,以滿足對無限色彩組合和色彩精度的需求。

- 此外,預計預測期內,消費行為的改變、都市化的加快、快速適應性、時裝設計生命週期的縮短以及可支配收入的增加將增加服飾和服飾領域對數位紡織品印花解決方案的需求。

亞太地區預計將出現最高成長

- 亞太地區擁有眾多紡織中心,可望引領全球成長。中國和印度是該地區的主要市場推動者,而越南和孟加拉正在成為紡織市場的主要企業。

- 中國和印度以其具有競爭力的人事費用而聞名,其紡織業正在快速擴張,從而推動了該地區的市場成長。中國數十年來一直是紡織強國,目前正致力於增強自身能力,投資無梭織機等先進技術來提高織物品質。

- 聚酯纖維因其抗皺、耐磨和經濟高效等特性,已成為熱昇華墨水的首選布料,尤其是在時尚領域。絲綢仍然是服裝和家居裝飾中備受青睞的材料,但其在該地區的應用受到高價格的限制,日本和海灣國家對絲綢紡織品的需求領先。

- 數位紡織印花和染料昇華技術徹底改變了紡織品生產的格局,開啟了新的利潤豐厚的市場領域。這一發展使大尺寸印染印表機和印刷服務提供者受益,為建築物、零售指示牌和其他商業環境的軟標誌鋪平了道路。這些進步加上不斷擴張的時尚產業預計將推動該地區的市場成長。

數位紡織印花產業細分

隨著印花紡織品的需求不斷成長,數位紡織品印花市場競爭也日益激烈。隨著對永續產品的偏好日益成長,主要企業正將重點轉向產品創新和策略合作夥伴關係。知名的市場參與者包括 Kornit Digital、Seiko Epson、Mimaki Engineering、Durst Group 和 Roland DG Corporation。

- 2024 年 8 月,領先的數位紡織品印花公司 Orange O Tec Pvt Ltd 在 Gartex 新德里展覽會上推出了其革命性的「印度製造」數位紡織品印花機 Fabpro 1i。此舉標誌著 Orange O Tec 的重大轉變,該公司已進口數位紡織印刷機 15 年。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 紡織品印花概述

- 技術開發

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 時尚產業服飾個性化的成長

- 服裝直接印刷

- 使用數位印表機降低列印成本

- 市場挑戰

- 初期投資高

- 墨水和基板相容性

- 微觀經濟因素如何影響市場

第6章 市場細分

- 按印刷方式

- 卷對卷列印

- 服裝直接印刷

- 按類型

- 昇華

- 顏料

- 反應性

- 其他類型(酸等)

- 按應用

- 服飾和服飾

- 適合家庭使用

- 展示和招牌

- 按基材分類

- 棉布

- 絲綢

- 聚酯纖維

- 其他基材

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Kornit Digital

- Seiko Epson Corporation

- Mimaki Engineering

- Durst Group

- Electronics For Imaging Inc.

- D.Gen Inc.

- Aeoon Technologies GmbH

- Roland DG Corporation

- Ricoh Company Ltd

- ColorJet

- ATP Color

- SPG Prints

第8章投資分析

第9章:市場的未來

The Digital Textile Printing Market size is estimated at USD 3.78 billion in 2025, and is expected to reach USD 7.22 billion by 2030, at a CAGR of 13.83% during the forecast period (2025-2030).

Key Highlights

- Digital textile printing, powered by inkjet technology, embellishes materials with vibrant patterns. This method, bolstered by Textile Design Software, caters to the surging demand for custom t-shirt printing, offering an array of design possibilities. Beyond the apparel sector, digital textile printing has found extensive applications in commercial and home decor markets.

- Compared to conventional methods like offset and solid ink printing, digital printing employs gentler chemicals and solvents. The textile printing market is witnessing a surge in demand for digital solutions, driven by a dual focus on eco-friendly practices and cost-effective production.

- Furthermore, advancements such as UV gel technology are driving industry innovation. For example, in May 2024, Canon USA Inc., a prominent player in digital imaging, expanded its M-series UVgel Printer's capabilities through a firmware update, building on the success of its Colorado M-series launched the previous year. This move aims to broaden application horizons, potentially tapping into new market segments.

- The use of printed fabrics gains traction in vehicle wrapping and interior decoration as the market is poised for growth. Challenges, such as the high ink costs and maintenance expenses associated with digital printers, also exist. These factors, coupled with the volatility in raw material prices, notably ink and print heads, could impede the market's expansion. However, the market's growth is buoyed by promising technologies like textile additive manufacturing.

- Despite the promising landscape, hurdles remain. High ink costs and the need for multiple printing heads in high-speed single-pass machines, coupled with their pricey maintenance and replacement, render them less competitive against rotary printing in the textile market.

Digital Textile Printing Market Trends

The Garment and Apparel Segment is Expected to Hold Significant Share in the Market

- Since its inception, garment and clothing printing techniques have advanced significantly. The most recent printing method for apparel and accessories is digital textile printing. Digital fabric printing transfers designs or images kept in a digital format into the fabric using computer-controlled printers. Designers and makers may produce complex patterns quickly and simply due to technology.

- The market for textile printing has traditionally placed a high priority on sustainability and textile waste. According to the United Nations, the fashion industry is heavily reliant on digital technology, which contributes approximately 10% of global greenhouse gas emissions.

- Due to shifting the textile design process domestically, digital textile printing has increased the speed of production and lowered shipping expenses, which enables designers to make smaller fabric test runs and waste less while finalizing the fabric, which also reduces excessive waste in the design process.

- Moreover, with cutting-edge digital textile printing technology, most digital textile printing businesses in China have begun to build advanced digital textile printing equipment in response to the demand for limitless color combinations and color accuracy.

- Furthermore, demand for digital textile printing solutions in the garment and apparel segment is expected to be anticipated to increase due to changing consumer behavior, increased urbanization, faster adaptability, shorter life cycles of fashion designs, and higher disposable income during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth

- Asia-Pacific, driven by its numerous textile hubs, is poised to lead global growth. China and India stand out as the region's primary market drivers, with Vietnam and Bangladesh emerging as key players in the textile landscape.

- China and India, known for their competitive labor costs, have witnessed a surge in textile industry expansion, propelling the market's growth in the region. China, a textile powerhouse for decades, is now focusing on enhancing its capabilities, investing in advanced technologies like shuttle-less looms to elevate fabric quality.

- Polyester has emerged as the go-to fabric for sublimation ink, especially in the fashion realm, owing to its attributes such as wrinkle and abrasion resistance and cost-effectiveness. While silk remains a coveted choice for apparel and home decor, premium pricing limits its widespread adoption in the region, with Japan and Gulf nations leading in demand for silk textiles.

- Digital textile printing and dye-sublimation technologies have revolutionized the textile production landscape, carving out new, lucrative market niches. This evolution has benefitted large format textile printers and print service providers, opening up avenues in soft signage for buildings, retail displays, and other commercial settings. The expanding fashion industry, coupled with these advancements, is set to fuel the market's growth in the region.

Digital Textile Printing Industry Segmentation

The digital textile printing market is witnessing heightened competition as the demand for printed textiles surges, drawing new vendors enticed by the sector's stable profitability. With a mounting preference for sustainable goods, major players are pivoting toward product innovation and strategic collaborations. Notable market players encompass Kornit Digital, Seiko Epson Corporation, Mimaki Engineering, Durst Group, and Roland DG Corporation.

- August 2024: Orange O Tec Pvt Ltd, a leading player in digital textile printing, unveiled its revolutionary "Made in Bharat" digital textile printing machine, the Fabpro 1i, at the Gartex New Delhi exhibition. This launch signifies a significant shift for Orange O Tec, which, after 15 years of importing digital textile printing machines, emerges as a prominent manufacturer in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Overview of Textile Printing

- 4.2 Technology Developments

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Personalization of Clothing Items in the Fashion Industry

- 5.1.2 Direct to Garment Printing

- 5.1.3 Reduction in Per Unit Cost of Printing with Digital Printers

- 5.2 Market Challenges

- 5.2.1 High Initial Investments

- 5.2.2 Ink and Substrate Compatibility

- 5.3 Impact of Microeconomic Factors on the Market

6 MARKET SEGMENTATION

- 6.1 By Printing Method

- 6.1.1 Roll-to-Roll printing

- 6.1.2 Direct-to-Garment Printing

- 6.2 By Type

- 6.2.1 Sublimation

- 6.2.2 Pigment

- 6.2.3 Reactive

- 6.2.4 Other Types (Acid, etc.)

- 6.3 By Application

- 6.3.1 Garment and Apparel

- 6.3.2 Household

- 6.3.3 Display and Signage

- 6.4 By Substrate

- 6.4.1 Cotton

- 6.4.2 Silk

- 6.4.3 Polyester

- 6.4.4 Other Substrates

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kornit Digital

- 7.1.2 Seiko Epson Corporation

- 7.1.3 Mimaki Engineering

- 7.1.4 Durst Group

- 7.1.5 Electronics For Imaging Inc.

- 7.1.6 D.Gen Inc.

- 7.1.7 Aeoon Technologies GmbH

- 7.1.8 Roland DG Corporation

- 7.1.9 Ricoh Company Ltd

- 7.1.10 ColorJet

- 7.1.11 ATP Color

- 7.1.12 SPG Prints