|

市場調查報告書

商品編碼

1683491

電動自行車馬達:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)E-bike Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

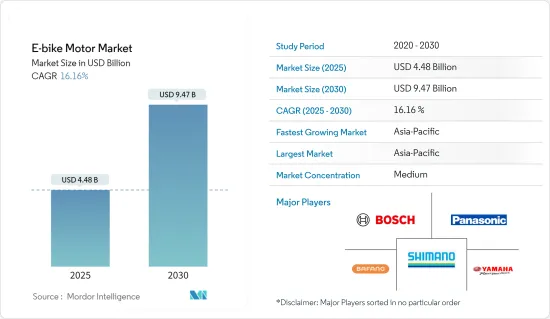

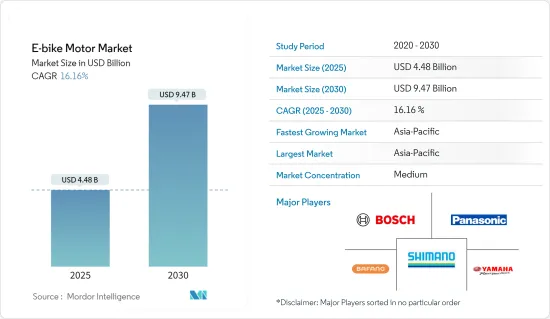

預計 2025 年電動自行車馬達市場規模為 44.8 億美元,到 2030 年將達到 94.7 億美元,預測期內(2025-2030 年)的複合年成長率為 16.16%。

推動環保交通途徑和不斷增強的健康意識等多種因素推動了電動自行車馬達市場的快速成長。世界各大城市都受到污染的困擾,其主要原因是機動車排放和噪音的增加。這一背景推動了全球對清潔能源和高功率汽車的需求,從而增強了電動自行車市場。展望未來,隨著消費者對冒險和休閒的興趣越來越大,以及電動自行車在租賃和物流等領域找到新的應用,對電動自行車馬達的需求預計將激增。

過去十年來燃料成本的上升導致許多人選擇使用電動自行車作為日常通勤。此次燃油價格上漲,主要是受石油輸出國組織影響,原油價格上漲。隨著世界各地城市逐步解除封鎖,電動自行車因其營運成本效益和便利性而需求激增。

隨著排放增加,人們對環境和健康的擔憂日益加劇,促使各國政府和全球組織加強排放法規,以抑制二氧化碳排放。此外,高性能電動自行車的出現預計將在未來幾年大幅推動對電動自行車馬達的需求。

電動自行車馬達市場趨勢

250W 以下容量領域主導市場成長

250W 電動自行車驅動裝置佔據電動自行車驅動裝置市場主導地位,因為它們適合平坦的地形和都市區通勤。這些電動自行車在亞太和歐洲地區尤其受歡迎,因為這些地區的城市基礎設施和短程通勤距離是常態。選擇這些低功率電動自行車是因為它們在城市環境中表現良好並且符合當地法規。

歐洲法規將電動自行車的功率輸出限制在 250 瓦,並確保騎乘者的速度不超過 25 公里/小時。根據該法規,超過該功率輸出的電動自行車將被重新歸類為摩托車,需要額外的類型核准和認證。因此,製造商專注於生產符合 250W 限制的電動自行車。例如在德國南部、瑞士、奧地利等山區,功率較大的電動自行車就被歸類為摩托車。這導致對於適合平坦城市地區的模型的需求日益成長。

技術進步正在推動 250W 以下電動自行車領域輪轂馬達的崛起。這些馬達在效率、成本和易於整合之間實現了良好的平衡,使其成為首選。例如,2023 年 3 月,宏碁推出了一款針對都市區通勤者的輕型電動自行車,配備 250W 輪轂驅動,續航里程為 70 英里,最高時速為 20 英里/小時。同樣,Specialized 將於 2022 年 10 月推出其 Globe Haul ST 系列,推出針對實用性和存儲性進行了最佳化的低於 250W 的電動自行車,凸顯了市場向實用、低功率電動自行車的轉變。

順應這一趨勢,塔塔國際旗下的 Stryder 子公司於 2023 年 3 月推出了 Zeeta 電動自行車。該車型配備 36V 250W BLDC 後輪轂馬達,凸顯了都市區對經濟實惠、高效電動自行車的需求,凸顯了 250W 以下電動自行車驅動的勢頭。

這些趨勢凸顯了法律規範、都市化和技術進步對 250W 以下電動自行車驅動器日益成長的需求的影響。隨著城市的擴張和永續交通變得越來越重要,電動自行車驅動裝置市場將迎來成長,其中以 250W 以下的車型為主導。

預計亞太地區在預測期內將實現高成長

亞太地區有望引領電動自行車市場,並預計未來將繼續保持主導地位。中國的電動自行車銷售正在推動該地區的快速成長。過去兩年來,中國已佔據亞太地區電動自行車馬達市場的 50% 以上,這主要得益於中國為緩解交通堵塞和加劇機動車污染所做的努力。

根據中國自行車協會報告顯示,目前我國電動自行車年銷量已超過3,000萬輛,社會保有量接近3億。此外,千元以上自行車產量也增加,2021年產量達3,370萬輛。如果電動自行車價格下降,中國的消費量將進一步增加。

此外,預計印度、韓國和日本也將顯著成長。印度電動自行車馬達市場尚處於起步階段,許多本地公司推出了多樣化的產品。例如,EMotorad 於 2023 年 1 月的 EM Summit 2023 上推出了一系列價格實惠的電動自行車。此車型配備 250W馬達和 120Nm 扭力。

一線城市電動自行車馬達需求旺盛,近年來銷售量持續維持兩位數成長。推動這一成長的因素包括人們對環保交通途徑的認知不斷增強,以及政府對購買電動自行車的激勵措施。鑑於這些動態,電動自行車馬達市場可能會繼續擴大。

電動自行車馬達產業概況

TDCM 股份有限公司、羅伯特博世有限公司、蘇州雄達電機、Yamaha Motor Co, Ltd.等國際和區域企業主導電動自行車馬達市場。其他主要企業包括大普電機、蘇州八方電機科技、松下北美公司、TRANZX、禧瑪諾公司、日本電產株式會社和 SPORTTECH Handels GmbH。領先的電動自行車馬達馬達正在推出創新產品以獲得競爭優勢。例如,

- 2023 年 8 月,博世發布了用於輕型電動自行車的馬達Bosch Performance SX。該馬達專為輕型電動自行車、EMTB、碎石路和城市騎行而設計,可幫助自行車製造商打造更靈活、響應更靈敏的電動自行車。電池和馬達的總重量僅為4公斤,設計優先考慮使用者的便利性。

- 2023 年 4 月,加拿大電動自行車領導者 Dost Bikes 推出了一款時尚的電動貨運自行車。這款貨運電動自行車的載重量高達 200 公斤(440 磅),可運載各種貨物。它配備 120Nm 八方 M600 中置驅動馬達,並配有扭矩感測器和油門功能。

- Trek 於 2023 年 7 月發布了 Fuel Exe Alloy 電動山地自行車,與原始的碳纖維車架不同,它採用的是鋁合金車架。 Fuel Exe Alloy 由 TQ Silent HPR50馬達驅動,提供自然的踏板感覺和 50Nm 的扭矩提升,非常適合山地騎行。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 對環保交通運輸的需求不斷成長將推動市場成長

- 市場限制

- 較高的初始購買成本和電動自行車召回率的增加預計將抑制市場成長

- 其他

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 馬達類型

- 中置驅動

- 輪轂式馬達

- 電動自行車類型

- 城市的

- 電動山地自行車/E-MTB

- 電子貨運

- 容量類型

- 250W 以下

- 250W-500W

- 超過 500W

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- TDCM Corporation Limited

- Robert Bosch GmbH

- Suzhou Xiongda Motor Co. Ltd

- Yamaha Motor Co. Ltd

- Dapu Motors

- Suzhou Bafang Electric Motor Science-Technology Co. Ltd

- Panasonic Corporation of North America

- TRANZX

- Shimano Inc.

- NIDEC CORPORATION

- Ananda Drive Techniques(Shanghai)Co. Ltd

- Mahle GmbH

- Brose Fahrzeugteile Gmbh & Co. KG

- Yadea Technology Group Co. Ltd

- SPORTTECH Handels GmbH

第7章 市場機會與未來趨勢

The E-bike Motor Market size is estimated at USD 4.48 billion in 2025, and is expected to reach USD 9.47 billion by 2030, at a CAGR of 16.16% during the forecast period (2025-2030).

Several factors, including a push for eco-friendly transportation and heightened health consciousness, are fueling the rapid growth of the electric bike motor market. Major cities worldwide grapple with pollution, largely due to rising vehicular gas emissions and noise. This backdrop has spurred a global demand for clean energy and high-powered vehicles, bolstering the e-bike market. Looking ahead, as consumers increasingly gravitate towards adventure and recreational activities, and with e-bikes finding new applications in sectors like rentals and logistics, the demand for e-bike motors is set to surge.

Rising fuel costs over the last decade have nudged many towards adopting electric bicycles for daily commutes. This uptick in fuel prices can be traced back to surges in crude oil costs, predominantly influenced by the Organization of the Petroleum Exporting Countries. As cities worldwide emerge from lockdowns, e-bikes are witnessing a surge in demand, thanks to their operational cost-effectiveness and convenience.

In response to escalating environmental and health concerns tied to rising emissions, governments and global organizations are tightening emission norms to curb carbon footprints. Furthermore, the advent of high-performance e-bikes is poised to significantly bolster the demand for e-bike motors in the coming years.

E-bike Motor Market Trends

Below 250 W Capacity Segment Dominating The Market Growth

Due to their suitability for flat terrain and urban commuting, 250W e-bike drive units are significantly shaping the e-bike drive unit market. These e-bikes enjoy particular popularity in the Asia-Pacific and European regions, where urban infrastructure and short commute distances are the norms. The choice of these lower-power e-bikes is driven by their sufficient performance in city settings and adherence to regional regulations.

European regulations cap e-bike power output at 250 watts, ensuring riders are propelled at speeds not exceeding 25kph. This law reclassifies e-bikes exceeding this power as motorcycles, necessitating extra type approval and homologation. As a result, manufacturers are channeling their efforts into producing e-bikes that stay within the 250W limit. For example, in regions like South Germany, Switzerland, and Austria, where mountainous terrains are common, e-bikes with higher power face motorcycle classification. This has led to a heightened demand for compliant models tailored for flat urban settings.

Technological advancements are propelling the rise of hub-type motors in the sub-250W e-bike segment. These motors strike a balance between efficiency, cost, and ease of integration, making them a preferred choice. For instance, in March 2023, Acer unveiled a lightweight e-bike boasting a 250W hub drive, offering a 70-mile range and a top speed of 20 mph, tailored for urban commuters. In a similar vein, Specialized rolled out the Globe Haul ST series in October 2022, featuring sub-250W e-bikes optimized for utility and storage, underscoring the market's pivot towards practical, low-power e-bikes.

In line with this trend, Tata International's Stryder subsidiary launched the Zeeta Electric Bicycle in March 2023. This model, powered by a 36 V 250W BLDC rear hub motor, underscores the demand for budget-friendly and efficient e-bikes in urban locales, spotlighting the momentum towards below 250W e-bike drives.

These trends underscore the influence of regulatory frameworks, urbanization, and tech advancements on the rising demand for sub-250W e-bike drives. With cities expanding and emphasizing sustainable transport, the e-bike drive unit market is poised for growth, with sub-250W models at the forefront.

Asia-Pacific is Expected to Witness Higher Growth During the Forecast Period -

The Asia-Pacific region is poised to lead the e-bike market, with its dominance expected to continue. China's e-bike sales are driving a surge in the region's growth. Over the past two years, China has accounted for over 50% of the Asia-Pacific e-bike motor market, largely due to its efforts to combat heavy traffic and rising vehicle pollution.

The China Bicycle Association reports that annual e-bike sales in China have topped 30 million units, with social ownership nearing 300 million. Additionally, bike outputs exceeding CNY 1,000 are on the rise, with 2021's production hitting 33.7 million units. As e-bike prices drop, consumption in China is set to climb further.

Moreover, India, South Korea, and Japan are also projected to see significant growth. India's e-bike motor market is nascent, with many local players introducing varied products. For example, EMotorad unveiled an affordable e-bike range at EM Summit 2023 in January 2023. This model boasts a 250 W motor and 120 Nm torque.

Demand for e-bike motors is surging in tier-1 cities, evidenced by double-digit sales growth in recent years. Factors fueling this growth include heightened awareness of eco-friendly transport and government incentives for e-bike purchases. Given these dynamics, the e-bike motor market is set for continued expansion.

E-bike Motor Industry Overview

International and regional players, including TDCM Corporation Limited, Robert Bosch GmbH, Suzhou Xiongda Motor Co. Ltd, and Yamaha Motor Co. Ltd, dominate the e-bike motor market. Other notable players include Dapu Motors, Suzhou Bafang Electric Motor Science-Technology Co. Ltd, Panasonic Corporation of North America, TRANZX, Shimano Inc., NIDEC CORPORATION, and SPORTTECH Handels GmbH. Major e-bike motor manufacturers are launching innovative products to gain a competitive edge. For instance,

- In August 2023, Bosch unveiled its lightweight e-bike motor, the Bosch Performance SX. Designed for lightweight e-bikes, EMTB, gravel, and urban rides, this motor allows bike manufacturers to create more maneuverable and responsive e-bikes. Weighing in at just 4 kg for the combined battery and motor, the design emphasizes user benefits.

- In April 2023, Canadian e-bike leader Dost Bikes rolled out a stylish electric cargo bike. Capable of carrying up to 440 lb. (200 kg), the cargo e-bike offers versatile cargo options. Powering the e-bike is a 120Nm Bafang M600 mid-drive motor, complemented by a torque sensor and throttle functionality.

- In July 2023, Trek introduced the Fuel Exe Alloy electric mountain bike, a more affordable variant of its Fuel e-bike series. Unlike the original's carbon frame, this model boasts an aluminum frame. Equipped with the TQ silent HPR50 motor, the Fuel Exe Alloy offers a natural pedal feel and a 50Nm torque boost, ideal for mountain trails.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Eco-friendly Transportation Is Driving The Market Growth

- 4.2 Market Restraints

- 4.2.1 High Initial Buying Cost And Increasing Recalls of E-Bike Is Anticipated To Restrain The Market Growth

- 4.2.2 Others

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Motor Type

- 5.1.1 Mid-drive

- 5.1.2 Hub Motor

- 5.2 E-Bike Type

- 5.2.1 Urban

- 5.2.2 E-mountain/E-MTB

- 5.2.3 E-cargo

- 5.3 Capacity Type

- 5.3.1 Below 250W

- 5.3.2 250W- 500W

- 5.3.3 500W and Above

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 TDCM Corporation Limited

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Suzhou Xiongda Motor Co. Ltd

- 6.2.4 Yamaha Motor Co. Ltd

- 6.2.5 Dapu Motors

- 6.2.6 Suzhou Bafang Electric Motor Science-Technology Co. Ltd

- 6.2.7 Panasonic Corporation of North America

- 6.2.8 TRANZX

- 6.2.9 Shimano Inc.

- 6.2.10 NIDEC CORPORATION

- 6.2.11 Ananda Drive Techniques (Shanghai) Co. Ltd

- 6.2.12 Mahle GmbH

- 6.2.13 Brose Fahrzeugteile Gmbh & Co. KG

- 6.2.14 Yadea Technology Group Co. Ltd

- 6.2.15 SPORTTECH Handels GmbH