|

市場調查報告書

商品編碼

1683517

電磁線 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Magnet Wire - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

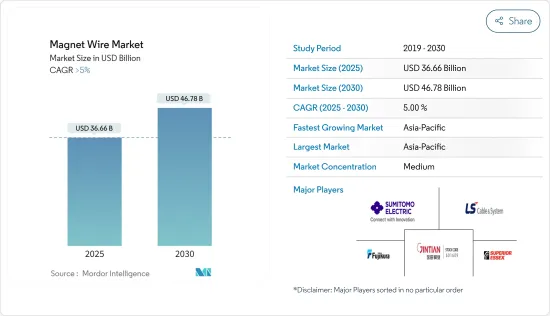

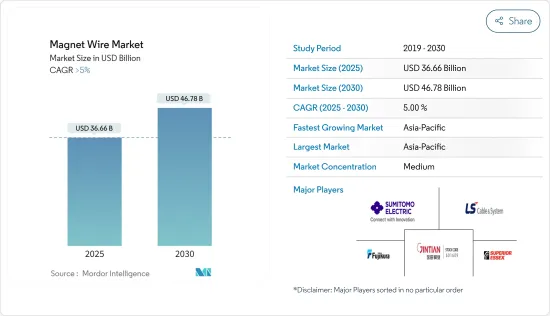

電磁線市場規模預計在 2025 年為 366.6 億美元,預計到 2030 年將達到 467.8 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5%。

2020年市場受到了COVID-19的負面影響。 2020年初爆發的COVID-19對電子和運輸業產生了重大影響。因此,電磁線消費量一直呈下降趨勢。目前,市場已經從疫情中恢復,並呈現出顯著的成長率。

主要亮點

- 電動車需求的不斷成長預計將刺激電磁線市場的成長。此外,電磁線在電子領域的潛在應用以及能源領域的高功率需求(不僅在新興經濟體而且在已開發國家)都是推動市場發展的因素之一。

- 另一方面,原料供應及其成本的持續波動預計將對市場成長產生不利影響。特別是,從大容量馬達到小型馬達的穩定轉變已成為預測期內限制該產業成長的另一個主要因素。

- 然而,在預測期內,具有更高耐熱性、優異耐用性和改進絕緣性能的新型和改進型電磁線的進步和發展可能會為全球市場帶來有利的成長機會。

- 預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。這一成長是由於該地區國家(包括中國、日本和印度)在電子、交通、工業、基礎設施和能源領域對漆包線的消費不斷增加。

電磁線市場趨勢

不斷成長的電動車市場

- 用於纏繞電氣設備的電線稱為磁線。磁線用於將電能與磁能交換。

- 這是一種覆蓋有絕緣層的銅線。由於其具有優良的導電性和耐熱性,常用於電動車馬達。電線絕緣有助於防止短路並確保電動馬達的最佳性能。

- 此外,電動車馬達要求轉速高、高功率、重量輕、結構緊湊、可靠性高。

- 電動車是實現公路運輸脫碳的重要解決方案,而公路運輸佔全球排放的很大一部分。近年來,由於續航里程增加、車型種類繁多以及車輛性能提升,電動車銷量大幅成長。

- 中國政府已設定目標,到2030年,國內電動車銷量將達到40%,這意味著將有更多的汽車需要充電。此外,工業和資訊化部等七部門宣佈在全國範圍內開展試點,旨在對政府部門、城市公車和計程車等車輛進行電動化。此外,還計劃提供用於環衛、郵政、城際貨運和機場服務的車輛。

- 根據加州《先進清潔汽車 II》法規,到 2035 年銷售的所有新乘用車必須實現零排放。 《先進清潔汽車 II》法規從 2026 年車型年開始實施,一直持續到 2035 年,將迅速減少輕型乘用車、皮卡和 SUV 的排放氣體。

- 印度政府推出了多項獎勵來促進電動車的普及,包括電動車購買補貼、免稅和雄心勃勃的電動車銷售目標。這些激勵措施促進了行業成長並吸引了國內外公司的投資。

- 2023年5月,特斯拉宣布計畫在印度建立工廠,生產電動車,供國內和國際銷售。此外,該公司計劃於2022年5月在中國上海超級工廠附近建立一個新的製造地,年產能為45萬輛。

- 墨西哥州長在2023年5月透露,起亞計畫投資約10億美元在墨西哥北部建造新的電動車工廠。

- 因此,考慮到上述因素,預計不久的將來電動汽車產業對電磁線的需求將大幅增加。

亞太地區佔市場主導地位

- 由於中國、印度和日本等主要國家的電氣和電子以及運輸等工業領域的擴張,預計亞太地區將在預測期內佔據最大的電磁線市場。

- 漆包線在電氣和電子領域的應用正在推動亞太地區的市場成長。變頻器、空調、玩具、修剪器和電風扇等消費性產品均使用漆包線線圈元件。

- 由於基礎設施的進步,家庭、工業和其他商業機構對持續供電的需求激增,以及攜帶可攜式能源的電子設備的使用增加,能源產業對電磁線的需求也在增加。

- 預計預測期內電氣和電子行業的使用量增加和應用領域的擴大將推動市場研究的發展。

- 根據日本電子情報技術產業協會(JEITA)預測,2022年全球電子與IT產業產值將達3.4368兆美元,與前一年同期比較成長1%,而2021年為3.4159兆美元。此外,預計2023年將達3.5266兆美元,與前一年同期比較增3%。

- 根據印度品牌股權基金會(IBEF)統計,到2025年,印度電子製造業的產值預計將達到5,200億美元。受政府「印度製造」、「電子國家政策」、「電子設備零淨進口」和「零缺陷效應」等政策推動,印度電氣和電子設備產量預計將快速成長。這些政策旨在促進國內製造業的成長、減少進口依賴、促進出口、致力於製造業並實現國家自力更生,就像「印度製造」計劃一樣。

- 預計預測期內所有上述因素都將推動亞太地區電磁線市場的成長。

電磁線產業概況

電磁線市場部分分散。主要企業(排名不分先後)包括寧波金田銅業(集團)、住友電氣工業株式會社、LS電線株式會社、Superior Essex Inc.、藤倉株式會社。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電動車市場正在成長

- 可再生能源需求不斷成長

- 限制因素

- 轉向小型馬達

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價分析

- 銅電磁線

- 鋁電磁線

第5章 市場區隔

- 材料

- 銅

- 鋁

- 絕緣類型

- 漆包線

- 絕緣導體

- 最終用途產業

- 電動車

- 能源

- 變壓器

- 其他能源類型

- 工業的

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Dahren Group(Liljedahl Group AB)

- Ederfil Becker

- Elektrisola

- Fujikura Ltd.

- Grupo Condumex

- Irce SPA

- Ls Cable & System Ltd

- Ningbo Jintian Copper(Group)Co., Ltd.

- Proterial, Ltd

- Sam Dong

- Stimple & Ward Company

- Sumitomo Electric Industries, Ltd

- Superior Essex Inc.

第7章 市場機會與未來趨勢

- 電磁線的進步

- 醫療產業需求增加

The Magnet Wire Market size is estimated at USD 36.66 billion in 2025, and is expected to reach USD 46.78 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. Due to the COVID-19 outbreak in the first half of 2020, the electronics and transportation industries were significantly impacted. This, in turn, led to a downtrend in the consumption of magnet wire. Currently, the market recovered from the pandemic and is growing at a significant rate.

Key Highlights

- The growing demand for electric vehicles is expected to stimulate the market growth of magnet wire. Furthermore, potential applications of magnet wire in the electronics sector, coupled with high power needs triggering demand surge for magnet wire in the energy sector in developed as well as emerging economies, are some of the driving factors augmenting the growth of the market studied.

- On the other hand, the continuous fluctuations in the raw material availability and their cost are expected to exert a depreciating impact on the market growth. Notably, the steady transition from bulk to compact motors emerged as another key factor responsible for restraining the growth of the target industry over the forecast period.

- Nevertheless, the advancements and development of new and improved magnet wires that offer increased higher temperature resistance, superior durability, or improvement in insulation properties are likely to create lucrative growth opportunities for the global market in the forecast period.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rise in the consumption of magnet wire in the electronics, transportation, industrial, infrastructure, and energy sectors in the countries of this region, including China, Japan, and India.

Magnet Wire Market Trends

Growing Electric Vehicles Market

- The wire used for winding in electrical equipment is known as magnet wire. The magnet wire is used for interchanging electrical energy with magnetic energy.

- It is a type of copper wire coated with a layer of insulation. It is commonly used in electric vehicle motors due to its superior electrical conductivity and thermal resistance properties. The insulation on the wire helps to prevent short circuits and ensures optimal performance of the EV motor.

- Further, electric vehicle motors strive for high speed, high power density, lightweight and miniaturization, and high reliability.

- Electric vehicles are the essential solution for decarbonizing road transport, which accounts for a considerable portion of worldwide emissions. The sales of electric vehicles expanded exponentially in recent years, owing to the enhanced range, wider model availability, and improved vehicle performance.

- The Chinese government set a target of having 40% of electric vehicles sold in the country by 2030, which implies that a lot more vehicles will need to be charged. Furthermore, the nationwide pilot program, announced by China's Ministry of Industry and Information Technology and seven other organizations, intends to electrify vehicles used by government departments, city buses, and taxis. Vehicles for sanitation, postal services, intercity freight, and airport services are also on the agenda.

- According to California's Advanced Clean Cars II Regulations, all new passenger cars sold must include zero emissions by 2035. Beginning with the 2026 model year and continuing until 2035, the Advanced Clean Cars II rules will rapidly reduce light-duty passenger vehicle, pickup truck, and SUV emissions.

- The Indian government introduced a few incentives to promote the adoption of EVs, including subsidies on the purchase of EVs, tax exemptions, and the setting of ambitious EV sales targets. These incentives helped to drive the growth of the industry and attracted investment from domestic and international companies.

- In May 2023, Tesla presented its plans to establish a plant in India to manufacture electric cars for local and international sales, which would significantly boost the country's EV industry. Furthermore, the company planned to establish a new manufacturing site near its Gigafactory in Shanghai, China, in May 2022, with an annual capacity of 450,000 vehicles.

- A Mexican Governor, in May 2023, revealed Kia's plans to invest around USD 1 billion for building a new electric vehicle plant in Northern Mexico.

- Therefore, considering the factors above, the demand for magnet wire is expected to rise in the electric vehicles industry significantly in the near future.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for magnet wire during the forecast period owing to expanding industrial sectors such as electrical and electronics and transportation etc. in major countries such as China, India, Japan, etc.

- The application of magnet wire in the electrical and electronics segment propels the market growth in the Asia-Pacific region. Several consumer products, such as inverters, air conditioners, toys, trimmers, fans, etc., carry magnet wire coil components.

- The demand for magnet wire from the energy sector also increased owing to the growing infrastructural advancements and the surge in the need for continuous power supply in households, industries, and other commercial setups, along with the growing use of portable energy-carrying electronic devices.

- The increasing usage and widening arena of application in the electrical and electronics industry is expected to drive the market studied during the forecast period.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year on year, compared to USD 3,415.9 billion in 2021. Moreover, the industry is expected to reach USD 3,526.6 billion, with a growth rate of 3% year on year, by 2023.

- According to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing, like the "Make in India" program to make the country self-reliant.

- All factors above are likely to fuel the growth of the Asia-Pacific magnet wire market over the forecast time frame.

Magnet Wire Industry Overview

The magnet wire market is partially fragmented in nature. The major players (not in any particular order) include Ningbo Jintian Copper (Group) Co. Ltd, Sumitomo Electric Industries, Ltd., LS Cable & System Ltd., Superior Essex Inc., and Fujikura Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Electric Vehicles Market

- 4.1.2 Increasing Demand For Renewable Energy

- 4.2 Restraints

- 4.2.1 Shift Towards Compact Motors

- 4.2.2 Fluctuating Raw Materials Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.5.1 Copper Magnet Wire

- 4.5.2 Aluminum Magnet Wire

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material

- 5.1.1 Copper

- 5.1.2 Aluminum

- 5.2 Insulation Type

- 5.2.1 Enameled Wire

- 5.2.2 Covered Conductor Wire

- 5.3 End-use Industry

- 5.3.1 Electric Vehicle

- 5.3.2 Energy

- 5.3.2.1 Transformers

- 5.3.2.2 Other Energy Types

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dahren Group (Liljedahl Group AB)

- 6.4.2 Ederfil Becker

- 6.4.3 Elektrisola

- 6.4.4 Fujikura Ltd.

- 6.4.5 Grupo Condumex

- 6.4.6 Irce S.P.A.

- 6.4.7 Ls Cable & System Ltd

- 6.4.8 Ningbo Jintian Copper (Group) Co., Ltd.

- 6.4.9 Proterial, Ltd

- 6.4.10 Sam Dong

- 6.4.11 Stimple & Ward Company

- 6.4.12 Sumitomo Electric Industries, Ltd

- 6.4.13 Superior Essex Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements In Magnet Wire

- 7.2 Increasing Demand From Medical Sector