|

市場調查報告書

商品編碼

1683805

綠色氫能 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Green Hydrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

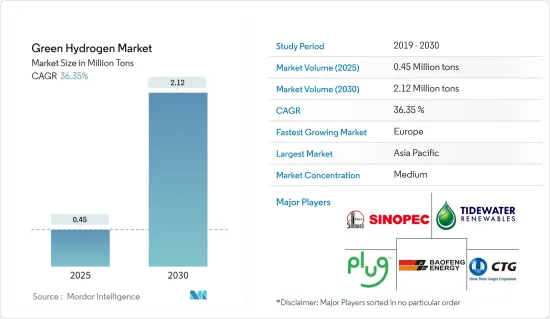

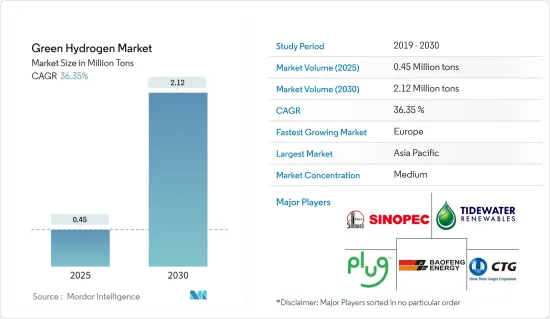

2025年綠氫市場規模預估為45萬噸,預估2030年將達212萬噸,預測期間(2025-2030年)複合年成長率為36.35%。

由於生產停頓和供應鏈中斷,COVID-19 疫情對綠氫產業的整體成長產生了中等影響。然而,疫情過後,交通運輸領域對綠氫的需求增加,推動了該產業的成長。

從中期來看,化學工業對綠氫的需求以及對碳排放日益成長的環境問題預計將推動對綠氫的需求。

另一方面,綠色氫能的高投資成本、有限的技術和基礎設施以及高能源損失可能會阻礙該行業的整體成長。

鼓勵使用綠氫的有利法規和政策預計將為市場提供新的成長機會。

預計亞太地區將主導市場,其中歐洲在預測期內將實現最高的年成長率。

綠氫市場趨勢

電力和其他終端用戶工業領域預計將主導市場

- 氫是一種用途廣泛的能源載體,有可能在能源系統脫碳方面發揮關鍵作用。

- 風能和太陽能發電場產生的可再生能源以壓縮氣體的形式儲存。氫能能源儲存系統由將電能轉化為綠色氫氣的電解槽、將氫氣以壓縮氣體形式儲存的儲存設施和將綠色氫氣轉化為電能的燃料電池組成。

- 世界各主要國家都在加大氫儲存能力建設,主要針對尋求脫碳的發電產業。

- 這種推動作用透過補貼和獎勵等各種措施得到體現。例如,美國政府已在 2023 年向 16 個計劃撥款約 4,800 萬美元,專注於推動清潔氫技術,特別是燃料電池和儲能技術。

- 世界主要經濟體均致力於開發創新解決方案,加速採用氫能綜合綠色發電解決方案,以滿足氣候變遷目標。印度新可再生能源部於2023年9月宣布了一項重大舉措,宣布實施先導計畫,利用綠氫儲存全天候發電100兆瓦電力。

- 此外,2024 年 4 月,Satluj Jal Vidyut Nigam (SJVN) 宣佈在喜馬偕爾邦 Jhakri 啟動印度首個多用途綠色氫先導計畫Nathpa Jhakri 水電站 (NJHPS),這是一個基於 20 Nm3/hr電解槽和電池運作的先導計畫kW 燃料計畫和電池容量。

- 同樣,中國在2023年7月取得了突破,在甘肅省合作市建造了12MW/2MWh綠色氫能能源儲存設施。

- 許多市場公司正在開發創新解決方案,將綠氫融入發電設施。例如,西門子能源和西門子歌美颯計畫在未來五年內共投資約 1.2 億歐元,將離岸風力發電機開發為直接生產綠色氫氣的單一同步系統,並計畫在 2025/2026 年進行全面的海上示範。

- 綠色氫能的日益普及,加上建築和電力行業的積極脫碳努力,為所研究的市場描繪了一幅光明的前景,預計未來幾年將出現強勁成長。

- 此外,綠氫(H2)等低碳燃料將成為 2050 年實現溫室氣體(GHG)淨零排放的全球能源系統的關鍵組成部分。

- 根據國際可再生能源機構(IRNA)報告,全球新建氫發電工程的數量正在逐年變化。例如,2022 年有 5 個計劃,但 2023 年只有 2 個項目。

- 因此,上述因素預計將推動電力和其他終端用戶能源產業對綠氫的消費。

亞太地區可望主導市場

- 預計亞太地區將主導市場。中國是該地區國內生產毛額最高的國家,與印度一道,是世界上成長最快的經濟體之一。

- 2022年3月,中國公佈了首個長期氫能規劃,涵蓋2021年至2035年。此戰略藍圖強調分階段實施,優先透過技術進步和增強製造能力來發展國內氫能產業。值得注意的是,中國的目標是到 2025 年每年利用可再生能源生產 10 萬至 20 萬噸氫氣,更廣泛的目標是到 2035 年將可再生氫能納入經濟的主流,並加強中國的綠色能源轉型。此外,該計畫倡導多樣化的技術路徑,在未來15年內推動再生能源來源的多元化組合。

- 中國鋼鐵製造商處於向綠氫能轉型的前沿,旨在取代高爐操作等過程中的石化燃料。值得注意的是,大型鋼鐵製造商寶武已開始在廣東省湛江市建造一座以綠氫為燃料的電弧爐。

- 鋼鐵、水泥和化肥等行業以其高碳排放而聞名,並面臨越來越大的脫碳壓力。隨著國家綠色氫能計畫的雄心勃勃的目標(到 2030 年減少 1000 億印度盧比的石化燃料進口量並減少每年約 5000 萬噸的二氧化碳排放)以及印度的共同努力,綠色氫能成為這一轉型中的一線希望。

- 同樣,印度國家電力公司 (NTPC) 也邁出了重要一步,將從 2023 年 1 月起在其位於印度古吉拉突邦拉特卡瓦斯鎮的 PNG 網路中混合高達 8% 的綠色氫氣。

- 東京非但沒有落後,反而在公共土地上開發綠色氫能設施方面取得了進展。東京都政府已宣布計劃在 2024 會計年度之前開始建造三台機組,並計劃在當年年終前讓其中一台運作。但仍有待政府提供更多細節。

- 2024 年 1 月,SK Scottplant 與 Bloom Energy 合作推出了一項開創性的綠氫舉措。我們與韓國南方電力公司和地方政府合作,旨在引進大規模氫能發電。 SK Ecoplant 將利用 Bloom 的尖端固體氧化物電解槽(SOEC) 技術在韓國濟州島生產綠色氫氣作為運輸燃料。預計該專案將於 2025 年底投產,將採用 1.8 兆瓦的電解槽技術。

- 因此,上述因素預計將推動亞太地區的綠氫消費。

綠氫產業概況

全球綠氫市場已部分整合。市場的主要企業包括(不分先後順序)中國石油化學集團公司、寧夏寶豐能源集團、普拉格能源公司、中國長江三峽集團公司(CTG)和Tidewater Renewables Ltd.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 發揮化學工業的潛力

- 對碳排放的環境擔憂日益加劇

- 市場限制

- 綠氫投資成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 技術簡介

第5章 市場區隔

- 最終用戶產業

- 精製

- 化學

- 鋼

- 運輸

- 電力和其他終端用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Air Products and Chemicals Inc.

- Air Liquide

- BP PLC

- China Petroleum & Chemical Corporation

- China Three Gorges Corporation

- Engie

- Fortescue Future Industries

- Green Hydrogen International Corp.

- Iberdrola SA

- Intercontinental Energy

- LHYFE

- Linde PLC

- Ningxia Baofeng Energy Group Co. Ltd

- Plug Power Inc.

- Reliance Industries Limited

- Tidewater Renewables Ltd

- Uniper SE

- Yara

第7章 市場機會與未來趨勢

- 有利法規政策推動綠氫應用

The Green Hydrogen Market size is estimated at 0.45 million tons in 2025, and is expected to reach 2.12 million tons by 2030, at a CAGR of 36.35% during the forecast period (2025-2030).

The COVID-19 pandemic moderately impacted the overall growth of the green hydrogen industry, owing to a halt in production and disruption in the supply chain. However, after the pandemic, the demand for green hydrogen increased in the transportation segment, which, in turn, has propelled the industry's growth.

Over the medium term, the demand for green hydrogen in the chemical industry and growing environmental concerns regarding carbon emissions are expected to drive the demand for green hydrogen.

On the flip side, the high investment cost of green hydrogen, limited access to technology and infrastructure, and high energy losses will likely hinder the industry's overall growth.

Favorable policies and regulations promoting the usage of green hydrogen are projected to offer new growth opportunities to the market.

Asia-Pacific is expected to dominate the market, and Europe will likely witness the highest annual growth rate during the forecast period.

Green Hydrogen Market Trends

The Power and Other End-user Industries Segment is Expected to Dominate the Market

- Hydrogen is a very versatile energy carrier that has the potential to play a significant role in decarbonizing the energy system.

- Renewable energy produced via wind or solar farms is stored as compressed gas. The hydrogen energy storage system consists of an electrolyzer to convert electricity to green hydrogen, a storage facility to store hydrogen as a compressed gas, and a fuel cell to convert green hydrogen to electricity.

- Leading economies worldwide are ramping up their hydrogen storage capacities, primarily targeting the power generation sector for decarbonization.

- This push is evident through various initiatives, such as grants and incentives. For example, in 2023, the US government allocated nearly USD 48 million across 16 projects, focusing on advancing clean hydrogen technologies, notably fuel cells and storage.

- Major economies around the globe are foraging into the field of developing innovative solutions to improve the adoption of integrated green hydrogen-based power generation solutions to meet climate goals. In a significant move, in September 2023, India's Ministry of New & Renewable Energy unveiled plans for a pilot project to generate 100 MW of round-the-clock power using green hydrogen storage.

- Moreover, in April 2024, Satluj Jal Vidyut Nigam (SJVN) announced the commissioning of India's first multi-purpose green hydrogen pilot project, a 20 Nm3/hr electrolyzer and 25 kW fuel cell capacity-based green hydrogen pilot project, Nathpa Jhakri Hydro Power Station (NJHPS) in Himachal's Jhakri.

- Similarly, China made strides in July 2023, inaugurating a 12 MW/2 MWh green hydrogen-based energy storage facility in Gannanzhou Cooperation City, Gansu Province.

- Numerous market players are developing innovative solutions to integrate green hydrogen into power generation facilities. For instance, Siemens Energy and Siemens Gamesa target a total investment of around EUR 120 million in the coming five years to develop an offshore wind turbine as a single synchronized system to directly produce green hydrogen, with a full-scale offshore demonstration expected by 2025/2026.

- The rising adoption of green hydrogen, coupled with aggressive decarbonization efforts in the building and power sectors, paints a promising picture for the market under study, projecting robust growth in the coming years.

- Additionally, low-carbon fuels, like green hydrogen (H2), will be a key component of the global energy system, which aims to achieve net zero greenhouse gas (GHG) emissions by 2050.

- According to the report of the International Renewable Energy Agency (IRNA), the number of new power-to-hydrogen projects worldwide has changed yearly. For instance, in 2022, there were five projects, and in 2023, there were only two.

- Therefore, the aforementioned factors are projected to boost the consumption of green hydrogen in the power and other end-user energy industries.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market. China has the largest GDP in the region, and China and India are among the fastest-emerging economies in the world.

- In March 2022, China revealed its first long-term hydrogen plan from 2021 to 2035. This strategic roadmap emphasizes a phased approach, prioritizing the growth of the domestic hydrogen industry through technological advancements and enhanced manufacturing capabilities. Notably, the plan targets producing 100,000 to 200,000 tons of hydrogen annually from renewable sources by 2025, with a broader goal of mainstreaming renewable hydrogen in the economy to bolster China's green energy transition by 2035. Additionally, the plan advocates for a diverse technology pathway, promoting a varied mix of renewable sources over the next 15 years.

- Chinese steelmakers spearhead the shift toward green hydrogen, aiming to replace fossil fuels in processes like Blast Furnace operations. Notably, Baowu, a major player, initiated the construction of a green hydrogen-fueled electric arc furnace in Zhanjiang, Guangdong.

- Industries like steel, cement, and fertilizers, known for their high carbon footprint, face mounting pressure for decarbonization. However, with India's concerted efforts and the ambitious targets set by the National Green Hydrogen Mission, which aims to slash INR 1 lakh crore worth of fossil fuel imports and nearly 50 million metric tons (MMT) of CO2 emissions annually by 2030, green hydrogen emerges as a beacon of hope in their transition.

- Similarly, NTPC Limited took a significant step starting in January 2023, blending up to 8% green hydrogen into the PNG Network at its Kawas Township in Surat, Gujarat, India.

- Tokyo is making strides in developing its green hydrogen facilities on publicly owned land rather than falling behind. The metropolitan government announced intentions to begin constructing three units by the fiscal year 2024, aiming to have one operational by the end of that year. However, further details from the government are eagerly anticipated.

- In January 2024, SK Ecoplant partnered with Bloom Energy for a groundbreaking green hydrogen initiative. Teaming up with Korea Southern Power and local authorities, they aim to introduce hydrogen power on a significant scale. SK Ecoplant will leverage Bloom's cutting-edge solid oxide electrolyzer (SOEC) technology to produce green hydrogen as a transport fuel on Jeju Island, South Korea. The upcoming presentation, scheduled to commence in late 2025, will involve the implementation of 1.8 megawatts of electrolyzer technology.

- Hence, the above-mentioned factors are expected to boost the consumption of green hydrogen in Asia-Pacific.

Green Hydrogen Industry Overview

The global green hydrogen market is partially consolidated. Some of the major players in the market include China Petroleum & Chemical Corporation, Ningxia Baofeng Energy Group Co. LTD, Plug Power Inc., China Three Gorges Corporation (CTG), and Tidewater Renewables Ltd (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Realizing the Potential in the Chemical Industry

- 4.1.2 Growing Environmental Concerns Regarding Carbon Emissions

- 4.2 Market Restraints

- 4.2.1 High Investment Cost of Green Hydrogen

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Refining

- 5.1.2 Chemicals

- 5.1.3 Iron and Steel

- 5.1.4 Transportation

- 5.1.5 Power and Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals Inc.

- 6.4.2 Air Liquide

- 6.4.3 BP PLC

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 China Three Gorges Corporation

- 6.4.6 Engie

- 6.4.7 Fortescue Future Industries

- 6.4.8 Green Hydrogen International Corp.

- 6.4.9 Iberdrola SA

- 6.4.10 Intercontinental Energy

- 6.4.11 LHYFE

- 6.4.12 Linde PLC

- 6.4.13 Ningxia Baofeng Energy Group Co. Ltd

- 6.4.14 Plug Power Inc.

- 6.4.15 Reliance Industries Limited

- 6.4.16 Tidewater Renewables Ltd

- 6.4.17 Uniper SE

- 6.4.18 Yara

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Favorable Policies and Regulations Promoting the Usage of Green Hydrogen