|

市場調查報告書

商品編碼

1683819

農業軟體-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Agriculture Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

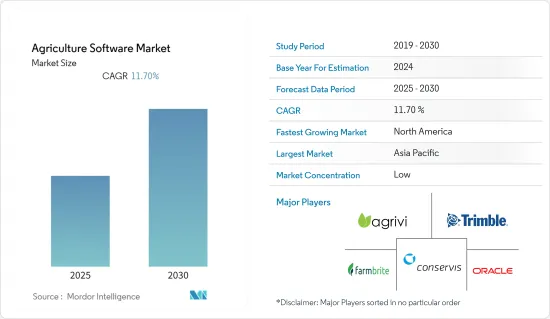

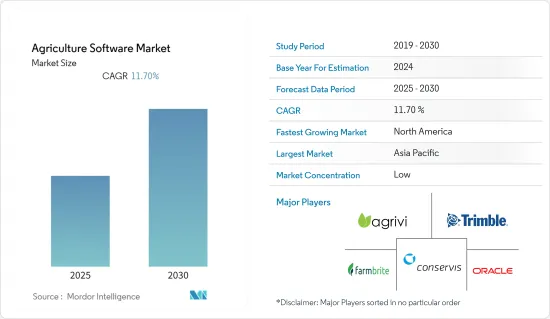

預測期內,農業軟體市場預計將以 11.7% 的複合年成長率成長。

推動農業軟體應用的關鍵促進因素是年輕一代的技術意識不斷增強以及環境意識不斷增強,以最大限度地提高農場的運作能力。

主要亮點

- 預計預測期內,農業領域的成長以及人工智慧、物聯網和雲端等先進技術的整合將推動市場發展。農業軟體涵蓋一系列為農業相關企業提供業務管理和追蹤解決方案的軟體類型。農業軟體可以幫助農民、牧場主和生產者進行各種業務,包括灌溉、庫存、作物規劃、互聯農業、作物管理和農場管理。

- 人口成長產生了巨大的糧食需求,影響了採用農業軟體解決方案等先進技術來最大限度地提高生產力。隨著世界人口大幅成長,2014年至2050年間糧食產量必須增加一倍(資料來源:聯合國糧食及農業組織(FAO))。聯合國預計2050年世界人口將達96億。因此,農民將面臨增加作物產量的巨大壓力,要么通過耕種土地來種植作物,要么通過實施智慧溫室和垂直農業等新技術。

- 快速的都市化、氣候變遷、全球人口成長以及對糧食的需求增加正在推動市場的穩定成長。隨著農民越來越意識到自動監控和控制溫室環境的好處,更智慧的溫室自動化系統和方法的採用近年來有所增加。隨著富裕國家和新興國家可耕地面積都變得越來越稀缺,人們開始採用智慧溫室來提高農業產量並滿足日益成長的糧食需求。

- 隨著對永續農業的需求不斷增加,精密農業因可獲得現場狀況的即時資料而實現高效的監測、控制和決策,預計將以相當快的速度成長,從而極大地推動市場的發展。

- 農業市場的主要宏觀經濟趨勢是人口成長、氣候變遷、俄羅斯-烏克蘭衝突數位化趨勢。精密農業和智慧溫室技術等解決方案可能會促進這些趨勢並在預測期內顯著提高市場成長率。

農業軟體市場趨勢

平台即服務 (PaaS) 市場成長

- 智慧溫室的農業軟體可幫助農民和種植者監測和控制智慧溫室的環境條件和作物生長。智慧溫室是利用各種感測器、致動器和設備為植物創造最佳微氣候並實現栽培過程自動化的溫室。智慧溫室農業軟體可以協助智慧溫室管理的資料收集和分析、資料視覺化和管理、預測建模和規劃、監控和控制等多個方面,從而顯著推動市場成長率。

- 智慧溫室中的農業軟體可以使用各種感測器和設備即時監測環境條件和作物生長。該軟體還可以透過向風扇、加熱器、冷卻器、通風口、簾子、燈、噴灌、泵浦、閥門和機器人等多個致動器和設備發送命令來控制環境條件和作物生長。該軟體還可以針對智慧溫室中檢測到的任何問題或異常提供警報和建議,從而滿足多個地區的需求。

- 基於物聯網的智慧溫室種植,將建立一個系統來使用感測器(光照、濕度、溫度、土壤濕度)監測作物,灌溉系統也將更加自動化。農民可以從任何地方監測田地的狀況。與標準方法相比,使用物聯網的智慧家庭農業生產力更高。

- 例如,2022 年 12 月,微型衛星物聯網網路管理器 Astrocast 和農民控制系統供應商 Aviltec 宣佈建立智慧農業合作夥伴關係,篩檢田間狀況,以降低營運成本並提高產量。 Astrocast 將為 Avirtech 提供衛星物聯網 (SatIoT) 網路解決方案,以支援該公司的 BIOTA Keen Homestead 控制框架。 Avirtec 的 Avirlink 計劃將其技術作為這項工作的一部分。

- 此外,印度和美國等多個政府加大對智慧農業解決方案的投資,預計將在預測期內提高市場成長率。

北美佔據市場的大部分佔有率

- 預計北美將在上年度佔據最高的市場佔有率,為 52.46%。美國對智慧農業的貢獻巨大,預計在預測期內將大幅提高市場成長率。例如,2023 年 5 月,美國農業部承諾向四項合作研究提供 800 萬美元,以促進和增加農業用地土壤碳測量和監測,並評估氣候智慧型實踐如何影響碳封存。美國農業部自然資源保護局 (NRCS) 將與愛荷華州立大學、密西根州立大學、美國氣候夥伴組織和德克薩斯大學埃爾帕索分校合作進行區域土壤有機碳儲量監測計畫。

- 此外,根據美國農業部2023年4月發布的資料,預計2022年美國農產品出口將達到1,964億美元,預示著該國農業生產的發展,為美國農業軟體市場供應商創造了商機。

- 農業軟體在精密農業中的應用正在推動該國的市場成長。它在農民中越來越受歡迎,他們利用透過 GPS、衛星圖像、網路連接設備和其他技術收集的資訊來更有效地耕作。

- 加拿大農業軟體市場主要受到政府為促進精密農業不斷增加的舉措和投資以及該國永續農業日益成長的趨勢的推動。此外,精密農業正在廣泛應用,因為該國的農民能夠借助複雜的分析技術更準確地監控和控制他們的操作。

- 預計未來幾年雲端基礎的農業軟體將會成長。這主要是因為雲端部署提供的雲端基礎的技術解決方案提高了可靠性。此外,易用性、靈活性和可擴展性是推動大型農業企業和中小型農戶增加雲端基礎的農業軟體部署的一些因素。

- 總體而言,由於加拿大政府不斷增加對農業領域永續實踐和技術利用的投入,以及政府為加速該國精密農業而進行的各種當前和過去的投資,加拿大的農業軟體市場預計將大幅成長。此外,易於使用且複雜的農業軟體的推出可能會在預測期內進一步推動加拿大農業軟體的成長。

農業軟體產業概況

農業軟體市場較為分散,各家公司在區域範圍內爭取市場佔有率。預計該市場上的供應商將激烈競爭以贏得大型計劃,而較小的供應商可能會在當地市場湧現。大型綜合供應商因其在價值鏈中的廣泛存在和降低風險的能力,有望獲得很大一部分解決方案的採用。

- 2023 年 1 月-迪爾公司宣布推出基於感測器和機器人的新型施肥系統 ExactShot。農民種植時使用的基肥量可減少60%以上。該系統不再向整行種子連續施肥,而是採用感測器和機器人將基肥精確地分配到土壤中種植的種子上。

- 2022 年 12 月-Raben Industries Inc. 在 CNH Industrial NV 的技術日上推出了其無人駕駛耕作和駕駛員輔助收割解決方案。該系統旨在支持經濟作物生產週期的多個階段,使農民在任何季節都能獲得更大的自主權。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢的影響

- 案例研究

- 生態系分析

第5章 市場區隔

- 依部署類型

- 雲

- 軟體即服務(SAAS)

- 平台即服務(PAAS)

- 本地

- 雲

- 按應用

- 精密農業

- 牲畜追蹤和監控

- 智慧溫室

- 精準林業

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 澳洲和紐西蘭

- 泰國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Trimble Inc.

- AGRIVI Ltd

- Oracle Corporation

- Conservis

- Farmbrite

- Deere & Company

- Ag Leader Technology Incorporated

- AgJunction Inc.

- AGCO Corporation

- Raven Industries Inc.

- Topcon Corporation

第7章投資分析

第 8 章:未來機會

The Agriculture Software Market is expected to register a CAGR of 11.7% during the forecast period.

The key driving factors contributing to the adoption of agriculture software are the increasing awareness of technology among the young generation and environmental awareness to maximize the farm operational capacity, among others.

Key Highlights

- The growth in the agriculture sector, alongside the integration of advanced technologies such as AI, IoT, and cloud, among others, is analyzed to boost the market during the forecast period. Agriculture software covers various software types that provide agribusinesses business management and tracking solutions. Agriculture software can help farmers, ranchers, and growers with different operations, such as irrigation, inventory, crop planning, connected agriculture, crop management, and farm management.

- The growing population is creating significant demand for food, thereby impacting the adoption of advanced technologies such as agriculture software solutions to maximize productivity. As the global population increases significantly, food production must double between 2014 and 2050 (source: Food and Agriculture Organization (FAO)). The United Nations estimates that the world's population will reach 9.6 billion by 2050. As a result, farmers will face intense pressure to increase crop production, either by making land arable for growing crops or by implementing new techniques like smart greenhouses and vertical farming.

- Rapid urbanization, climate change, a growing worldwide population, and increased food demand contribute to steady market revenue growth. The growing understanding of farmers about the benefits of automatic monitoring and control of the greenhouse environment has resulted in a recent increase in the adoption of smarter greenhouse automation systems and approaches. In both wealthy and developing countries, the scarcity of arable land is driving the deployment of smart greenhouses to boost agricultural yields and satisfy rising food demand.

- With the growing demand for sustainable agriculture, precision farming is analyzed to grow at a significant rate owing to the real-time data availability of the field conditions that lead to efficient monitoring, controlling, and decision-making, thereby significantly driving the market.

- The major macroeconomic trends in the agriculture market are the growing population, climate change, Russia-Ukraine conflict, and the trend of digitalization. Solutions such as precision farming and smart greenhouse technologies could aid these trends and significantly boost the market growth rate during the forecast period.

Agriculture Software Market Trends

Platform as a Service (PaaS) to Witness the Market Growth

- Agriculture software in the smart greenhouse helps farmers and growers monitor and control the smart greenhouse's environmental conditions and crop growth. A smart greenhouse is a greenhouse that uses various sensors, actuators, and devices to create an optimal microclimate for plants and to automate the growing process. Agriculture software in smart greenhouses can help with multiple aspects of smart greenhouse management, such as data collection and analysis, data visualization and management, predictive modeling and planning, and monitoring and control, thereby significantly driving the market growth rate.

- Agriculture software in smart greenhouses can monitor the environmental conditions and crop growth in real-time using various sensors and devices. The software can also control the environmental conditions and crop growth by sending commands to multiple actuators and devices, such as fans, heaters, coolers, vents, shades, lights, sprinklers, pumps, valves, or robots. The software can also provide alerts and recommendations for any issues or anomalies detected in the smart greenhouse, thereby contributing to the demand across several regions.

- A system for monitoring the crop field with sensors (light, humidity, temperature, soil moisture) is constructed in IOT-based smart greenhouse farming, making the irrigation system more automated. The farmers can keep an eye on the state of the fields from any location. Compared to the standard method, smart greenhouse farming that is IOT-based is highly productive.

- For instance, in December 2022, Astrocast, a nanosatellite IoT network administrator, and Avirtech, a supplier of farmer control frameworks that screen site conditions to reduce functional expenses and increase yields, reported a smart farming partnership. Astrocast provides Avirtech with Satellite IoT (SatIoT) network answers for its BIOTA keen homestead control framework. Avirtech's Avirlink will incorporate its technology as part of this.

- Further, the growing investments in smart agriculture solutions by several governments, such as India and the United States, are analyzed to bolster the market growth rate during the forecast period.

North America to Hold Major Share in the Market

- North America is analyzed to hold the highest share of 52.46% in the previous year. The United States contributes significantly to the smart agriculture practices analyzed to bolster the market growth rate during the forecast period significantly. For instance, in May 2023, The U.S. Department of Agriculture (USDA) spent USD 8 million in four collaborations to promote and increase soil carbon measurement and monitoring on working agricultural lands and evaluate how climate-smart practices affect carbon sequestration. On regional soil organic carbon stock monitoring programs, the USDA's Natural Resources Conservation Service (NRCS) will collaborate with Iowa State University, Michigan State University, American Climate Partners, and the University of Texas at El Paso.

- Additionally, in April 2023, U.S. agricultural exports reached USD 196.4 billion in 2022, according to the data published by the U.S. Department of Agriculture, which shows the development of agricultural production in the country and creates an opportunity for agricultural software market vendors in the United States.

- The application of agriculture software in precision farming is fueling the country's market growth. It is becoming increasingly popular among farmers, who are employing information gathered by GPS, satellite images, internet-connected devices, and other technology to do farming more effectively.

- The agriculture software market in Canada is primarily driven by increasing government efforts and investments to boost precision farming coupled with the growing trend of transitioning towards sustainable practices in the country. Further, precision farming is witnessing significant adoption as farmers in the country are able to monitor and manage their operations with high precision with the help of sophisticated analytics.

- Cloud-based agriculture software is expected to witness growth in the coming years. This is primarily due to enhanced reliability through cloud-based technology solutions offered in a cloud deployment. In addition, ease of use, flexibility, and scalability are a few of the factors that may help to increase the cloud-based deployment of agriculture software in large agribusiness companies as well as small and medium farmers.

- Overall, the Canadian market for agriculture software is expected to witness substantial growth owing to increasing government initiatives towards sustainable practices and the use of technologies in the agriculture sector coupled with various ongoing and past investments by the government to accelerate precision farming in the country. In addition, easy-to-use and sophisticated agricultural software launches will further proliferate the growth of agriculture software in Canada over the forecast period.

Agriculture Software Industry Overview

The Agriculture Software Market is fragmented, and various companies compete on a regional scale to gain market share. Vendors in the market are expected to compete intensely to gain large-scale projects, but smaller vendors are expected to hold prominence over the market in local space. Major vendors that offer integrated products are expected to command a higher share of the adoption for their solutions due to the spread of their presence over the value chain and the ability to mitigate the risk.

- January 2023 - The Deere & Company announced the launch of ExactShot, a new sensor- and robotics-based system for applying fertilizer. Farmers can minimize the amount of starting fertilizer used during planting by more than 60%. Instead of administering a continuous flow of fertilizer to the whole row of seeds, the system employs sensors and robots to accurately distribute starting fertilizer onto the seeds as they are planted in the soil.

- December 2022 - Raven Industries Inc. launched its driverless tillage and driver assist harvest solutions at CNH Industrial NV's Tech Day. The system is designed to support multiple stages of the cash-crop production cycle and make autonomy more accessible to farmers across seasons.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of Macro Economic Trends

- 4.4 Case Studies

- 4.5 Ecosystem Analysis

5 MARKET SEGMENTATION

- 5.1 By Deployment Type

- 5.1.1 Cloud

- 5.1.1.1 Software-as-a-service (SAAS)

- 5.1.1.2 Platform-as-a-service (PAAS)

- 5.1.2 On-premise

- 5.1.1 Cloud

- 5.2 By Application

- 5.2.1 Precision Farming

- 5.2.2 Livestock Tracking and Monitoring

- 5.2.3 Smart Greenhouse

- 5.2.4 Precision Forestry

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Australia and New Zealand

- 5.3.3.3 Thailand

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trimble Inc.

- 6.1.2 AGRIVI Ltd

- 6.1.3 Oracle Corporation

- 6.1.4 Conservis

- 6.1.5 Farmbrite

- 6.1.6 Deere & Company

- 6.1.7 Ag Leader Technology Incorporated

- 6.1.8 AgJunction Inc.

- 6.1.9 AGCO Corporation

- 6.1.10 Raven Industries Inc.

- 6.1.11 Topcon Corporation