|

市場調查報告書

商品編碼

1683833

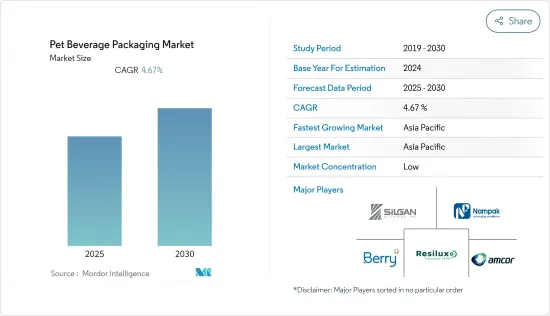

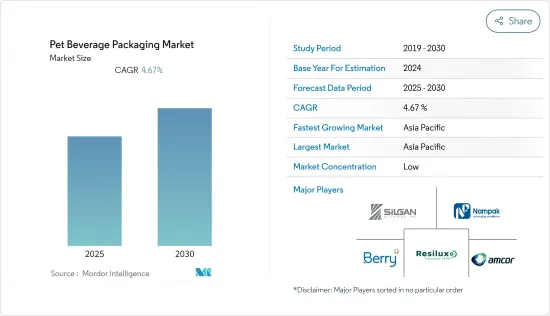

PET 飲料包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pet Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,PET 飲料包裝市場預計將達到 4.67% 的複合年成長率。

聚對苯二甲酸乙二醇酯(PET)正在擴大寶特瓶的用途。寶特瓶、軟水領域對PET包裝的需求日益增加。目前已有許多創意、經濟且環保的包裝選擇,其中PET是廣受認可的材料。

主要亮點

- 聚對苯二甲酸乙二醇酯作為一種材料的優點在於它具有抗碎裂性,與飲料接觸時不會發生反應,並且具有較高的強度重量比。其重量輕也降低了使用 PET 包裝運送產品的成本。 PET塑膠是飲料產品的安全包裝材料。 PET 塑膠已獲得美國FDA 和北美類似監管機構的核准,可安全與食品和飲料接觸。

- 俄羅斯與烏克蘭戰爭導致多國遭受經濟制裁,大宗商品價格上漲,供應鏈中斷。針對這項衝突,一些公司已對俄羅斯實施制裁,暫停其在烏克蘭和其他歐洲國家的營運活動。俄羅斯與烏克蘭的衝突引發抗議活動,為石油和天然氣市場帶來巨大不確定性,進一步加劇了全球大宗商品市場本已較高的通膨壓力。一些製造商也正在努力將需求從塑膠轉向其他原料。

- 生活方式的改變以及由此產生的消費者對包裝飲料的依賴正在推動寶特瓶包裝產品的銷售。這一趨勢推動了具有優異阻隔性、便捷形式、高品質印刷性和謹慎使用材料資源的產品的銷售。世界各地的消費者對飲用水包裝的需求日益增加,這種包裝比其他包裝方式更耐用、更易於使用,能夠更好地保護產品,並避免潛在的腐敗因素。由於其成本低廉,它正在推動寶特瓶包裝市場的發展。

- 由於監管規範的變化(主要是由於環境問題日益嚴重),預計市場將面臨重大挑戰。世界各國政府正在回應公眾對塑膠包裝廢棄物的擔憂,並實施法規以減少環境廢棄物並改善廢棄物管理流程。

- 然而,與其他包裝產品相比,製造商更喜歡 PET,因為與其他塑膠材料相比,它在整個製造過程中產生的原料浪費更少。它是可回收的,並且可以製成多種顏色和設計,因此是一個不錯的選擇。隨著消費者環保意識的不斷增強,可再填充產品也應運而生。這有助於創造對產品的需求。

PET 飲料包裝市場趨勢

瓶裝水佔據主要市場佔有率

- 包裝水和碳酸飲料的需求不斷成長,推動了寶特瓶需求的激增。此外,日益增強的環保意識和對環保包裝解決方案的需求促使消費者更喜歡寶特瓶而不是其他包裝材料。

- 與其他塑膠相比,PET 具有優異的剛性。它還保持了堅固的保護結構並且具有防潮功能。它用於生產飲料和液體的寶特瓶。 PET 之所以廣為人知,是因為它具有出色的油阻隔性,可以抵抗損害塑膠的化學物質。

- 飲料製造商正致力於創新新的解決方案。例如,三得利集團為了實現2030年實現100%再生植物來源寶特瓶的目標,推出了100%植物來源原料夥伴關係生產的寶特瓶。該瓶由三得利與美國公司 Anellotech 合作開發,將用於三得利在歐洲和日本市場銷售的軟性飲料品牌 Orangina 和 Tensen-sui。

- PET 因 100% 可回收且具有很強的永續性,被廣泛用於製作寶特瓶(及其他用途)。 PET可以被收集並多次回收再利用成新產品,減少資源浪費。預計生物基塑膠,尤其是 100% 生物基寶特瓶的市場佔有率將在預測期內增加。

- 據飲料行銷公司和國際瓶裝水協會稱,美國瓶裝水銷售趨勢呈穩步成長。到 2022 年,銷售量將從五年前 2017 年的每瓶 13.20 加侖飆升至每瓶 15.90 加侖。據加拿大農業及農業食品部稱,美國調味瓶裝水的零售也從 2015 年的 36.3 億美元成長到 2022 年的 72.9 億美元。預計這種成長將在預測期內持續,預計將顯著提振寶特瓶水市場的需求。

亞太地區可望實現顯著成長

- 隨著中國經濟的擴張和中階的不斷壯大以及購買力的不斷增強,中國的包裝產業一直在穩步成長。過去幾年,中國飲料市場大幅成長,導致對飲料包裝的需求增加。每種飲料類別都會面臨各自的挑戰和機會。

- 在都市區,非酒精飲料的消費量不斷增加,推動了飲料的成長。受此機會的吸引,可口可樂等外國公司繼續大力投資中國市場。可口可樂中國及其裝瓶合作夥伴最近宣布,計劃運作新的生產線和工廠,總投資預計為 5.2 億元(7,530 萬美元)。此外,2023年公司將投資工廠,提升業績,加強線上線下通路佈局與行銷創新。這些因素預計將推動市場成長並吸引外國公司進入中國市場。

- 近年來,印度的飲料包裝出現了顯著的成長。推動市場成長的主要因素是全國飲料包裝趨勢的快速變化。該包裝因採用創新技術而引人注目。新的飲料包裝趨勢集中在包裝材料的結構改進、開發能夠與產品及其環境相互作用的新型活性系統、提高客戶接受度、安全性和某些飲料的保存期限。

- 玻璃瓶和寶特瓶在日本被廣泛使用。與傳統玻璃瓶相比, 寶特瓶更受青睞,因為技術改進使 PET 瓶除了能盛裝液體外,還能發揮其他功能。由於消費者工作繁忙、久坐不動的生活方式,即飲飲料(RTD)消費量不斷成長,推動了日本飲料包裝市場的發展。這些瓶子有助於延長產品的保存期限和保存時間,並且具有經濟高效的特性。

- 由於消費者越來越擔心合成添加劑和防腐劑對健康的不利影響,飲料包裝市場正在大幅擴張,推動了對有機飲料的需求。此外,都市化水準的提高和消費者生活水準的提高也推動了人均優質有機飲料的支出。

PET 飲料包裝市場概況

PET 飲料包裝市場分散,主要參與者包括 Amcor Ltd、Gerresheimer AG、Berry Global Group、Silgan Holdings Inc. 和 Huhtamaki Oyj。每個參與者都專注於透過在該行業的合作和投資來創新新的解決方案,從而擴大業務。

- 2023 年 7 月 - Amcor Rigid Packaging (ARP) 與 Ron Rubin Winery 合作推出“BLUE BIN”,這是第一款採用 100% 再生聚對苯二甲酸乙二醇酯 (rPET) 塑膠製成的 750 毫升瓶包裝的優質葡萄酒。

- 2023 年 6 月 - ALPLA 將在德班北部沿海城鎮巴利托建造一座高科技回收廠,產能為 35,000 噸回收 PET 原料。該工廠標誌著 ALPLA 進軍非洲回收市場的第一步,建設計劃於 2023 年夏季開始,並於 2024 年秋季完工。 ALPLA 將投資約 6,000 萬歐元(64,531,200 美元)來加強該地區的循環經濟。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 評估烏克蘭-俄羅斯衝突對塑膠包裝市場的影響

- 法律規範

- 進出口分析

第5章 市場動態

- 市場促進因素

- PET 的優異性能使其成為飲料包裝的理想選擇

- 永續包裝需求不斷成長

- 市場挑戰

- 部分地區實施禁塑令

第6章 全球飲料產業概況

第7章全球飲料包裝產業概況

第 8 章市場細分

- 按產品

- 瓶子

- 瓶子

- 蓋子、蓋子與封口裝置

- 其他產品

- 按最終用戶產業

- 碳酸飲料

- 汁

- 水瓶

- 酒精飲料

- 機能飲料

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 德國

- 義大利

- 西班牙

- 英國

- 亞洲

- 中國

- 印度

- 日本

- 拉丁美洲

- 中東和非洲

- 北美洲

第9章 競爭格局

- 公司簡介

- Amcor PLC

- Resilux NV

- Nampak Ltd

- Berry Global Inc.

- Silgan Holdings Inc.

- Graham Packaging

- GTX Hanex Plastic Sp. ZOO

- Altium Packaging

- Comar LLC

- Apex Plastics

- Khs GmbH(Salzgitter Klckner-Werke GmbH)

- Esterform Packaging

- ALPLA Group

- Plastipak Holdings Inc.

- Retal Industries Limited

第10章 PET飲料包裝生產企業

第11章 投資分析

第12章:投資分析市場的未來

The Pet Beverage Packaging Market is expected to register a CAGR of 4.67% during the forecast period.

Polyethylene terephthalate (PET) is broadening the use of plastic bottles. There is a rising demand for PET packaging in the bottled and soft water segments. Many creative, economical, and environmentally friendly packaging options are already available, and PET is a widely recognized material.

Key Highlights

- The benefits of polyethylene terephthalate as a material are that it is shatterproof, non-reactive when in contact with beverages, and delivers a high strength-to-weight ratio. Being lightweight also provides cost savings when transporting products using PET packaging. PET plastic is a secure packaging material for beverage products. PET plastic has been approved as safe for food and beverage contact by the FDA in the United States and similar regulatory bodies across North America.

- The war between Russia and Ukraine has resulted in economic sanctions against several countries, high commodity prices, and supply chain disruptions. Regarding the conflict, some companies have taken steps to sanction Russia by suspending their activities in Ukraine and other European countries. The Russia-Ukraine conflict has triggered a protest in crude oil and gas markets and a big dose of uncertainty, adding to the already high inflationary pressure on global commodity markets. Several manufacturers also fretted over the transformation in demand from plastics to other raw materials.

- The changing lifestyles and accompanying consumer reliance on packaged beverages boost sales of PET bottle packaging products. This trend is driving the sales of products with their superior barrier properties, convenient formats, high-quality printability, and careful use of material resources. Growing demand for packaged drinking water from consumers worldwide provides higher durability, ease of use, and improved product protection from potential spoilage factors than other packaging alternatives. Due to its low cost, it drives the market for PET bottles for packaging.

- The market is anticipated to be significantly challenged due to dynamic regulatory standard changes, mainly due to rising environmental concerns. Governments globally have been responding to public concerns regarding plastic packaging waste and implementing regulations to reduce environmental waste and improve waste management processes.

- However, manufacturers prefer PET over other packaging products, as it has a minimal loss of raw material during the entire manufacturing process compared to other plastic materials. Its recyclability and the feature of adding multiple colors and designs have made it a suitable choice. Refillable products have emerged with rising consumer awareness about the environment. This has helped in creating the demand for the product.

Pet Beverage Packaging Market Trends

Bottles to Hold Major Market Share

- The growing demand for packaged water and carbonated drinks has led to a spike in demand for PET bottles. In addition, increasing environmental awareness and demand for eco-friendly packaging solutions have led consumers to prefer PET bottles over other packaging materials.

- PET offers superior stiffness compared to other plastics. It also maintains a robust protective structure and has moisture resistance. It is used in the production of PET bottles for beverages and liquids. PET is well known because it provides a superior oil barrier that helps resist chemicals that can damage plastics.

- Beverage companies are focused on innovating new solutions. For instance, in line with its goal to transition to 100% recycled and plant-based PET bottles by 2030, the Suntory Group unveiled a prototype PET bottle made from a 100% plant-based materials partnership. The bottle was developed in collaboration with US-based Anellotech for Suntory's Orangina and Tennensui soft drinks brands in the European and Japanese markets.

- PET is widely favored for plastic bottles (and other uses) because it is 100% recyclable and highly sustainable. It can be recovered and recycled many times into new products, reducing the number of wasted resources. Over the projected period, bio-based plastics, particularly 100% bio-based PET bottles, are anticipated to increase market share.

- According to Beverage Marketing Corporation and International Bottled Water Association, the Sales volume of bottled water in the United States has witnessed a steady growth trend. The sale volume shot up to 15.90 gallons in 2022, starting from 13.20 gallons just five years back in 2017. Notably, according to Agriculture and Agri-Food Canada, the retail sales value of flavored bottled water in the United States also increased from USD 3.63 billion in 2015 to USD 7.29 billion in 2022. This growth is expected to be witnessed in the forecast period, also attributing to a substantial push to the market demand for PET water bottles.

Asia Pacific Expected to Witness Significant Growth

- China's packaging industry is growing steadily due to the nation's expanding economy and growing middle class with increased purchasing power. Beverage packaging demand is rising because China's beverage market has grown significantly over the last few years. Each beverage category will face its own set of challenges and opportunities.

- The growing consumption of non-alcoholic drinks in urban regions has propelled the growth of beverages. Such potential has attracted foreign companies like Coca-Cola to continue to invest heavily in the Chinese market. Recently, Coca-Cola China and its bottling partners have announced plans to inaugurate new production lines and a factory, following an estimated total investment of CNY 520 million (USD 75.3 million). Additionally, in 2023, the company invested in its plant to boost its performance and enhance its presence on online and offline channels and marketing innovations. These factors are projected to fuel market growth and attract foreign companies to the Chinese market.

- In India, beverage packaging has witnessed significant growth in recent years. The key factors that drive the market growth include the rapid changes in beverage packaging trends across the country. There has been significant adoption of novel techniques for packaging. New beverage packaging trends focus on the structure modification of packaging materials and the development of new active systems that can interact with the product or its environment, customer acceptability, security, and improving the conservation of several beverages.

- Glass and PET bottles are used extensively in Japan. PET bottles are still chosen over conventional glass bottles because of technical improvements that allow them to perform additional functions besides only retaining liquids. The market for beverage packaging in Japan is driven by the growing consumption of ready-to-drink (RTD) beverages due to busy consumer work schedules and sedentary lifestyles. These bottles help to improve the shelf life and preservation of the products and are available in cost-effective formats.

- The beverage packaging market is expanding significantly due to the growing consumer concerns about the negative health impact of synthetic additives, preservatives, etc., which augment the demand for organic beverages. Additionally, the elevating levels of urbanization and enhanced consumer living standards have propelled the country's per capita expenditures on high-quality, organic drinks.

Pet Beverage Packaging Market Overview

The PET Beverage Packaging market is fragmented with the presence of major players such as Amcor Ltd, Gerresheimer AG, Berry Global Group, Silgan Holdings Inc., and Huhtamaki Oyj. Players are focused on expanding their business by innovating new solutions through collaborations and investments in the industry.

- In July 2023 - Amcor Rigid Packaging (ARP) is to partner with Ron Rubin Winery for the launch of BLUE BIN, the first premium wine packaged in a 750mL bottle made from 100% recycled polyethylene terephthalate (rPET) plastic.

- In June 2023 - In Ballito, a coastal town north of Durban, ALPLA is constructing a high-tech recycling plant with a capacity of 35,000 tons of recycled PET material. The plant is ALPLA's first step in entering the African recycling market and will begin construction in the summer of 2023 with a planned completion date of autumn 2024. ALPLA is investing approximately EUR 60 million (USD 64.5312 million) to strengthen the regional circular economy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of the Ukraine-Russia Standoff on the Plastic Packaging Market

- 4.5 Regulatory Framework

- 4.6 Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Outstanding Properties of Pet Suited to Beverage Packaging

- 5.1.2 Rising Demand for Sustainable Packaging

- 5.2 Market Challenges

- 5.2.1 Regulations Against the use of Plastics in Some Regions

6 GLOBAL BEVERAGE INDUSTRY LANDSCAPE

7 GLOBAL BEVERAGE PACKAGING INDUSTRY LANDSCAPE

8 MARKET SEGMENTATION

- 8.1 By Product

- 8.1.1 Bottles

- 8.1.2 Jars

- 8.1.3 Lids/Caps & Closures

- 8.1.4 Other Products

- 8.2 By End-user Industry

- 8.2.1 Carbonated Drinks

- 8.2.2 Juices

- 8.2.3 Water Bottles

- 8.2.4 Alcoholic Beverages

- 8.2.5 Energy Drinks

- 8.2.6 Other End-user Industries

- 8.3 By Geography

- 8.3.1 North America

- 8.3.1.1 United States

- 8.3.1.2 Canada

- 8.3.2 Europe

- 8.3.2.1 France

- 8.3.2.2 Germany

- 8.3.2.3 Italy

- 8.3.2.4 Spain

- 8.3.2.5 United Kingdom

- 8.3.3 Asia

- 8.3.3.1 China

- 8.3.3.2 India

- 8.3.3.3 Japan

- 8.3.4 Latin America

- 8.3.5 Middle East and Africa

- 8.3.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Amcor PLC

- 9.1.2 Resilux NV

- 9.1.3 Nampak Ltd

- 9.1.4 Berry Global Inc.

- 9.1.5 Silgan Holdings Inc.

- 9.1.6 Graham Packaging

- 9.1.7 GTX Hanex Plastic Sp. Z.O.O

- 9.1.8 Altium Packaging

- 9.1.9 Comar LLC

- 9.1.10 Apex Plastics

- 9.1.11 Khs GmbH (Salzgitter Klckner-Werke GmbH)

- 9.1.12 Esterform Packaging

- 9.1.13 ALPLA Group

- 9.1.14 Plastipak Holdings Inc.

- 9.1.15 Retal Industries Limited