|

市場調查報告書

商品編碼

1683975

美國割草機市場:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)US Lawn Mowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

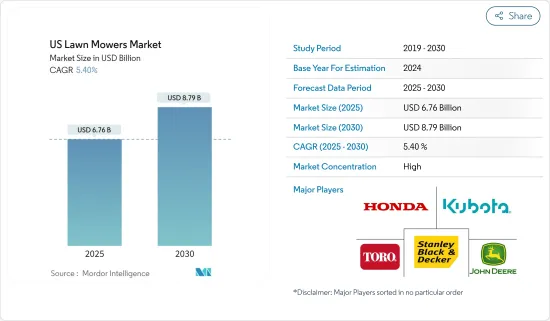

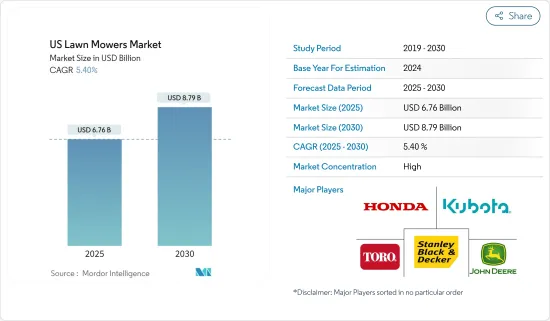

預計 2025 年美國割草機市場規模將達到 67.6 億美元,預計到 2030 年將達到 87.9 億美元,預測期內(2025-2030 年)的複合年成長率為 5.4%。

由於景觀維護的重要性日益增加、人們對綠色屋頂的認知不斷提高以及行業技術創新不斷增加,美國割草機市場預計將加速成長。郊區草坪、高爾夫球場、運動場和公共公園對景觀美化服務的需求不斷增加,推動了美國割草機市場的發展。從長遠來看,綠地和屋頂的不斷增加預計將推動市場成長。作為維護環境的努力的一部分,政府也重視擴大和保護綠地。例如,根據美國人口普查局的數據,政府計劃投資1.7812兆美元用於包括公園在內的商業和住宅建設活動。因此,此類措施可能會在未來幾年支持對割草機的需求。此外,市場參與者正專注於推出技術先進的產品。例如,2022 年 7 月,Toro 公司推出了一款新型機器人割草機(名稱尚未確定),其定位系統使用攝影機而非雷射雷達。這意味著使用者不需要使用周邊電線,割草機可以輕鬆偵測到障礙物。

美國割草機市場的趨勢

汽油割草機需求旺盛

汽油割草機是家庭和商務用的理想選擇。它具有出色的動力和高級的尖端性能,可以在大面積草坪上以推式或自走式使用。此外,該相機採用堅固的專業級組件製造,包括耐腐蝕底盤和鋁,確保低維護和維修成本。此外,預計未來幾年政府措施將推動汽油割草機市場的發展。例如,2022 年 7 月,國家公園管理局透過戶外休閒遺產夥伴關係(ORLP)津貼計畫向當地社區發放了 1.92 億美元。這使得城市社區能夠創造新的戶外休閒空間,振興現有的公園,並讓經濟弱勢群體接觸戶外。

商業/政府部門是最大的最終用戶

隨著高爾夫球場、運動場、學校和公共等商業空間維護需求的不斷成長,美國商務用割草機市場正在擴大。該國擁有大量的高爾夫球場和運動場,這有助於推動商務用割草機市場的成長。例如,根據美國國家高爾夫基金會的研究,到2022年,美國總合16,000個高爾夫球場。 2022年,超過三分之一的5歲及以上美國人口將打高爾夫球(在球場內或場外)、在電視或網上觀看高爾夫球比賽、閱讀高爾夫球書籍或收聽與高爾夫球相關的播客。例如,根據美國高爾夫球基金會的數據,2022年打高爾夫球的總人數為1.19億,比前一年增加12%。全國高爾夫球手數量的增加將促進商務用割草機的使用。此外,政府也致力於透過投資改善公共公園來擴大加州的戶外空間。 2022 年,地方和州領導人撥款約 1,500 萬美元用於擴建戶外設施。預計未來幾年此類戶外設施在該國的擴張將增加商務用割草機的使用。

美國割草機產業概況

美國割草機市場整合且競爭激烈。企業之間的競爭主要體現在產品品質和促銷方面,並專注於採取策略性措施來搶佔更大的市場佔有率。公司正大力投資新產品開發、合作和收購,希望擴大市場佔有率並加強研發活動。市場的主要企業包括 Deere &Co.、Stanley Black & Decker、The Toro Company、Kubota Corporation 和 American Honda Motor Co. Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 維護景觀的需求

- 綠地和屋頂花園的普及

- 市場限制

- 園林綠化勞動力短缺

- 割草機維護成本高

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 手動的

- 電的

- 汽油驅動

- 機器人

- 其他產品類型

- 最終用戶

- 住宅

- 商業/政府

第6章競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Ariensco

- Deere & Company

- American Honda Motor Co. Inc.

- Husqvarna Group

- Kubota Corporation

- Makita Corporation

- Stanley Black & Decker

- Yamabiko Corporation

- The Toro Company

- Stihl Group

第7章 市場機會與未來趨勢

The US Lawn Mowers Market size is estimated at USD 6.76 billion in 2025, and is expected to reach USD 8.79 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

The United States lawn mowers market is anticipated to grow faster, owing to the growing prominence of landscaping maintenance, rising awareness about green roofs, and expanding technological innovations in the industry. Increasing demand for landscaping services in suburban lawns, golf courses, sports fields, and public parks drive the US lawn mower market. Over the long term, increasing adoption of green spaces and roofs is anticipated to drive market growth. Besides, the government emphasizes expanding and preserving green spaces as part of environmental sustainability. For instance, according to the US Census Bureau, the government planned to invest USD 1,781.2 billion for commercial and residential construction activities, including parks. Hence, such initiatives are likely to support the demand for lawnmowers in the coming years. Moreover, market players have been concentrating on introducing technologically advanced products. For instance, in July 2022, the Toro Company launched a new league of robotic lawn mowers (unnamed) that uses cameras instead of LiDAR for their positioning system, which means the user does not need to use a periphery wire, and the mower can detect obstacles easily.

United States Lawn Mowers Market Trends

Petrol Land Mowers are in High Demand

Petrol lawnmowers are ideal for home or professional use. They are push-powered or self-propelled for large lawn areas due to their superior power and high-grade cutting-edge performance. They are built using rigid, professional-grade components, such as corrosion-resistant chassis and aluminum, and require low maintenance and servicing costs. Moreover, initiatives by the government are anticipated to drive the petrol lawnmower market in the coming years. For instance, in July 2022, the National Park Service distributed USD 192 million to local communities through the Outdoor Recreation Legacy Partnership (ORLP) grant program. This enabled urban communities to create new outdoor recreation spaces, reinvigorate existing parks, and form connections between people and the outdoors in economically underserved areas.

Commercial/Government Sector is the Largest End User

The market for commercial lawnmowers in the United States is expanding with the growing demand for the maintenance of commercial spaces such as golf courses, sports fields, schools, and public parks. The large number of golf courses and sports fields in the country are fueling the commercial lawnmower market growth. For instance, according to a survey by the National Golf Foundation, in 2022, there were a total of 16,000 golf courses in the United States. More than one-third of the US population over the age of 5 played golf (on-course or off-course), followed golf on television or online, read about the game, or listened to a golf-related podcast in 2022. For instance, according to the National Golf Foundation, there were a total of 119 million people who played golf in 2022, 12% up from the previous year. This increase in the number of golf players in the country fuels commercial lawnmower use. Furthermore, the government is focusing on expanding outdoor spaces in California by investing in public park improvements. In 2022, local and state leaders granted nearly USD 15 million to expand outdoor facilities. This expansion of outdoor facilities in the country is expected to increase the use of commercial lawnmowers in the coming years.

United States Lawn Mowers Industry Overview

The United States Lawn Mowers market is consolidated and competitive. Companies compete based on product quality and promotion and focus on strategic moves to hold larger market shares. Companies are investing heavily in developing new products and collaborating with and acquiring other companies, which is expected to increase their market shares and strengthen their R&D activities. Some of the key players in the market are Deere & Co., Stanley Black & Decker, The Toro Company, Kubota Corporation, and American Honda Motor Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand For Landscaping Maintenance

- 4.2.2 Adoption of Green Spaces and Green Roofs

- 4.3 Market Restraints

- 4.3.1 Shortage of Labor In Landscaping

- 4.3.2 High Maintenance Cost of Lawn Mowers

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Manual

- 5.1.2 Electric

- 5.1.3 Petrol

- 5.1.4 Robotics

- 5.1.5 Other Product Types

- 5.2 End User

- 5.2.1 Residential

- 5.2.2 Commercial/Government

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Ariensco

- 6.3.2 Deere & Company

- 6.3.3 American Honda Motor Co. Inc.

- 6.3.4 Husqvarna Group

- 6.3.5 Kubota Corporation

- 6.3.6 Makita Corporation

- 6.3.7 Stanley Black & Decker

- 6.3.8 Yamabiko Corporation

- 6.3.9 The Toro Company

- 6.3.10 Stihl Group