|

市場調查報告書

商品編碼

1684049

電力和公共產業用 MLCC -市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Power and Utilities MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

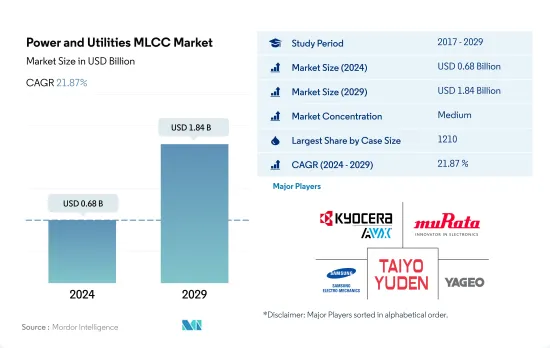

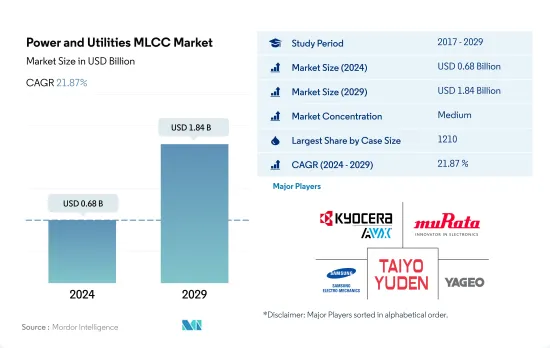

電力和公共產業MLCC 市場規模預計在 2024 年達到 6.8 億美元,預計到 2029 年將達到 18.4 億美元,預測期內(2024-2029 年)的複合年成長率為 21.87%。

電力和公共產業MLCC 市場的變革趨勢以及不同外殼尺寸的動態正在再形成能源模式

- 按外殼尺寸對電力和公共MLCC 市場進行細分,可以全面了解這些關鍵電子元件如何促進能源格局的演變。截至 2023 年,由於發電、配電和公共管理對電子系統的依賴性日益增強,市場正在經歷顯著成長。

- 採用這種特定的外殼尺寸反映了 MLCC 對於解決該領域的獨特挑戰和機會的戰略重要性。 1,210 箱裝市場表現出顯著的韌性,2022 年實現了 1.3206 億美元的可觀收益。 2023 年至 2028 年的複合年成長率為 20.65%,預計 2028 年的銷售額將達到 4.0225 億美元。

- 同時,1,812 外殼尺寸細分市場在電力和公共產業MLCC 市場中處於領先地位,反映了亞洲和大洋洲對清潔能源解決方案日益成長的需求。隨著該地區追求雄心勃勃的可再生能源目標,預計該領域的需求將激增。在歐洲,2,220 箱尺寸部分在支持歐洲大陸向更清潔、更永續的發電轉型方面發揮關鍵作用。清潔能源佔歐洲電力產量的55%左右,該地區正積極減少對煤炭的依賴。

- 最後,3,640 和 4,540 型號的錶殼尺寸部分分別在北美和亞洲經歷了顯著變化。在北美,3640 MLCC 的採用反映了發電動態的變化,其中煤炭發電量大幅下降,而風能和太陽能發電量不斷擴大。

電力及公共事業MLCC市場的區域變化

- 按地區細分電力和公共產業MLCC 市場可以揭示亞太地區、歐洲、北美和亞洲其他地區的明顯趨勢和機會。亞太地區是中國、印度等發展中經濟體的聚集地,該地區的電力消耗和公共工程需求正在穩步成長。

- 印度政府雄心勃勃的目標是到 2026 年安裝 2.5 億個智慧電錶,這將推動對 MLCC 的需求,尤其是在智慧電錶製造業。印度正積極致力於實現能源基礎設施現代化,為 MLCC 製造商創造了巨大的成長機會。

- 美國智慧電錶的安裝取得了長足進步,目前已有超過1億個智慧電錶投入使用。 MLCC 對於確保高效能的能源管理至關重要,並且該市場預計將進一步成長。加拿大正在大力推行更節能的街道照明系統,這也推動了對 MLCC 的需求,從而支持節能工作。

- 沙烏地阿拉伯設定了2030年50%的電力來自可再生能源的開創性目標,為工業MLCC市場創造了巨大的機會。此舉符合沙烏地阿拉伯到2035年將二氧化碳排放減少15%(即4,400萬噸)的目標。 MLCC,尤其是高容量MLCC,預計將在支援可再生能源計劃和自動化系統方面發揮至關重要的作用,從而進一步提升該地區在MLCC市場中的重要性。

全球電力和公共產業MLCC市場趨勢

更嚴格的排放標準預計將增加需求

- 預計逆變器出貨量將從2021年的622.963億台增加至2022年的934.129億台。 MLCC採用電容變化較小的溫度補償陶瓷,非常適合用作逆變器中使用的緩衝電路的元件,這些逆變器在開關過程中會處理大電壓,並且需要小尺寸和耐熱性。

- 隨著世界各地排放法規變得越來越嚴格,汽車製造商正逐漸從傳統引擎汽車的生產轉向混合動力汽車汽車和電動車。不同類型的逆變器,例如牽引逆變器和軟開關逆變器,用於電動車的不同用途。世界各國政府正向電動車計劃投資數十億美元,以鼓勵消費者採用電動車。此外,電動車需求的成長預計將推動電動車所用零件(如電源逆變器)的銷售。 2021年,太陽能光伏發電量創紀錄地成長了179太瓦時,比2020年增加了22%。太陽能光電佔全球發電量的3.6%,仍是繼水力發電和風力發電之後的第三大再生能源技術。隨著全球對工業化污染的擔憂日益加劇,各國政府紛紛推出政策鼓勵太陽能的推廣。例如,2022年8月,美國聯邦政府推出了《通膨削減法案》,該法案將在未來十年透過稅額扣抵等方式大幅擴大對可再生能源的支持。

智慧照明在各種應用中的使用率正在上升

- LED出貨量將從2021年的130萬台增加到2022年的265萬台。 MLCC用於LED中以抑制電磁干擾(EMI)、平滑直流電源並降低聲學雜訊。 LED 中使用的 MLCC 通常必須滿足某些電氣和環境要求,包括高電容值、低等效串聯電阻 (ESR)、高額定電壓和良好的溫度穩定性。

- LED照明可用於各種應用,包括商業照明、住宅照明、汽車照明、裝飾照明和戶外照明。人口成長導致住宅和商業設施建設增加,這是增加對各種基礎設施(尤其是電力)的需求的主要因素之一。新冠肺炎疫情為全球經濟造成了重創。由於建築工地停工和關閉,LED照明的需求下降。然而,由於新計畫和升級計劃的推出,2021年下半年建設量激增,推動LED照明產業穩步復甦。

- 2021年,住宅和旅館業照明電力消耗增加了約5%,推動了排放的增加。雖然一些國家在十多年前就開始逐步淘汰白熾燈,但現在許多國家開始逐步淘汰螢光,使 LED 成為首選照明技術,同時大幅減少二氧化碳排放。

電力和公共產業MLCC產業概況

電力和公共產業MLCC市場適度整合,前五大公司佔據59.90%的市場佔有率。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、太陽誘電和國巨株式會社。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 電力及公共設備銷售

- 逆變器全球銷售

- LED全球銷售

- 全球智慧電錶銷量

- 太陽能逆變器和最佳化器的全球銷售

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 錶殼尺寸

- 1210

- 1812

- 2 220

- 3 640

- 4 540

- 其他

- 電壓

- 600V~1100V

- 小於600V

- 1100V以上

- 電容

- 10μF至100μF

- 小於10μF

- 100μF 以上

- 介電類型

- 1級

- 2級

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001994

The Power and Utilities MLCC Market size is estimated at 0.68 billion USD in 2024, and is expected to reach 1.84 billion USD by 2029, growing at a CAGR of 21.87% during the forecast period (2024-2029).

Transformative trends in the power and utilities MLCC market with different case size dynamics are reshaping the energy landscape

- The power and utilities MLCC market, segmented by case size, offers a comprehensive view of how these critical electronic components contribute to the evolving energy landscape. As of 2023, the market witnessed substantial growth, paralleling the increasing reliance on electronic systems in power generation, distribution, and utility management.

- The adoption of specific case sizes reflects the strategic importance of MLCCs in addressing the unique challenges and opportunities in this sector. The market demonstrated remarkable resilience in the 1210 case size segment, achieving significant revenue of USD 132.06 million in 2022. Projections indicate robust growth potential, with an estimated revenue of USD 402.25 million by 2028, driven by a substantial CAGR of 20.65% from 2023 to 2028.

- Meanwhile, the 1812 case size segment stands at the forefront of the power and utilities MLCC Market, reflecting the growing demand for clean energy solutions in Asia and Oceania. The segment is poised to experience a surge in demand as this region pursues ambitious renewable energy goals. In Europe, the 2 220 case size segment plays a pivotal role in supporting the continent's transition toward cleaner and more sustainable electricity generation. With clean power sources contributing to approximately 55% of Europe's electricity production, the region is actively reducing its reliance on coal.

- Lastly, the 3640 and 4540 case size segments are witnessing notable shifts in North America and Asia, respectively, as these regions grapple with their energy landscapes. In North America, the adoption of 3 640 MLCCs reflects the changing dynamics of power generation, with a significant decline in coal-based electricity and an expansion in wind and solar sources.

The shifting landscape of the power and utilities MLCC market across regions

- The power and utilities MLCC market, segmented by region, exhibits distinct trends and opportunities in Asia-Pacific, Europe, North America, and the Rest of the World. Asia-Pacific, home to thriving economies like China and India, is witnessing robust growth in power consumption and utility demand.

- The Indian government's ambitious goal of installing 250 million smart meters by 2026 is driving significant demand for MLCCs, particularly in smart meter production. With its proactive efforts in modernizing its energy infrastructure, India presents a substantial growth opportunity for MLCC manufacturers.

- The United States has made significant progress in the installation of smart electric meters, with over 100 million units already in use. MLCCs are integral in ensuring efficient energy management and are poised for further growth in this market. Canada's transition to energy-efficient street lighting systems also boosts MLCC demand, supporting energy conservation efforts.

- Saudi Arabia's groundbreaking commitment to renewable energy, aiming to generate 50% of its electricity from renewables by 2030, presents a substantial opportunity for the Industrial MLCC Market. This move aligns with their target to reduce carbon emissions by 15% or 44 million tonnes by 2035. MLCCs, particularly high-capacity ones, are expected to play a pivotal role in supporting renewable energy projects and automation systems, further reinforcing the region's significance in the MLCC market.

Global Power and Utilities MLCC Market Trends

Stringent emission standards are expected to increase demand

- Inverter shipments increased from 62296.3 million units in 2021 to 93412.9 million units in 2022. MLCCs use a temperature-compensating ceramic with minimal capacitance variation, making them ideal for use as components in snubber circuits used in inverters that handle large voltages during switching and where compactness and heat tolerance are required.

- With growing stringent emission standards globally, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. Inverters of various varieties, including traction inverters and soft-switching inverters, are used in electric vehicles for a variety of applications. Governments in various countries are spending heavily on electric mobility projects and encouraging customers to adopt electric vehicles, which will provide an opportunity for electric vehicle power inverter manufacturers. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters. Power generation from solar PV increased by a record 179 TWh in 2021, marking 22% growth in 2020. Solar PV accounted for 3.6% of global electricity generation, and it remains the third largest renewable electricity technology behind hydropower and wind. With the rising concerns over pollution worldwide due to industrialization, governments are introducing policies to drive solar PV deployment. For instance, in August 2022, the federal government of the United States introduced the Inflation Reduction Act, a law significantly expanding support for renewable energy in the next 10 years through tax credits and other measures.

Increasing utilization of smart lighting in various applications

- LED shipments increased from 1.3 million units in 2021 to 2.65 million units in 2022. MLCCs are used in LEDs to suppress electromagnetic interference (EMI) and provide DC supply smoothing and acoustic noise reduction. MLCCs used in LEDs typically need to meet specific electrical and environmental requirements, such as high capacitance values, low equivalent series resistance (ESR), high voltage ratings, and appropriate temperature stability.

- LED lighting can be used in various applications, including commercial and residential, automotive, decorative, and outdoor lighting. The rising population leading to rising residential and commercial construction is one of the major factors that has increased the demand for various basic amenities, especially power. The COVID-19 pandemic harmed the global economy. The demand for LED lighting was lowered due to construction site suspensions and lockdowns. However, the second half of 2021 witnessed a surge in construction due to the launch of new and upgraded projects, contributing to the industry's steady recovery for LED lighting.

- In 2021, electricity consumption by lighting in the residential and services sectors grew by around 5%, which drove the increase in emissions. Although several countries began to phase out incandescent bulbs more than 10 years ago, many are now beginning to phase out fluorescent lighting to make LEDs the leading lighting technology while saving significant CO2 emissions.

Power and Utilities MLCC Industry Overview

The Power and Utilities MLCC Market is moderately consolidated, with the top five companies occupying 59.90%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Power And Utilities Equipment Sales

- 4.1.1 Global Inverters Sales

- 4.1.2 Global LEDs Sales

- 4.1.3 Global Smart Meters Sales

- 4.1.4 Global Solar PV Inverters and Optimizers Sales

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Case Size

- 5.1.1 1210

- 5.1.2 1812

- 5.1.3 2 220

- 5.1.4 3 640

- 5.1.5 4 540

- 5.1.6 Others

- 5.2 Voltage

- 5.2.1 600V to 1100V

- 5.2.2 Less than 600V

- 5.2.3 More than 1100V

- 5.3 Capacitance

- 5.3.1 10 μF to 100 μF

- 5.3.2 Less than 10 μF

- 5.3.3 More than 100 μF

- 5.4 Dielectric Type

- 5.4.1 Class 1

- 5.4.2 Class 2

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219