|

市場調查報告書

商品編碼

1685678

異丙苯:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cumene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

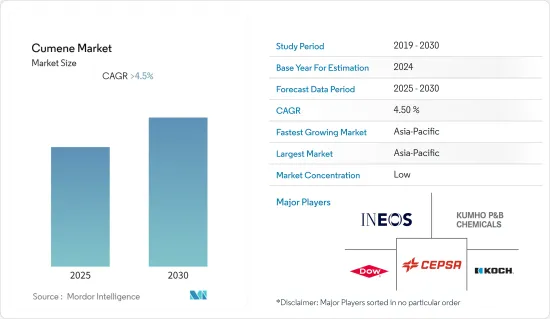

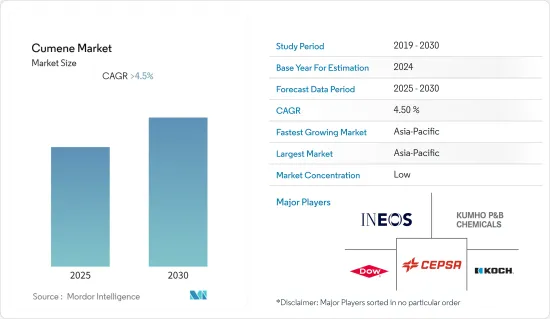

預測期內,異丙苯市場預計將以超過 4.5% 的複合年成長率成長。

2020年突然爆發的新冠疫情導致全球市場對異丙苯的需求下降,進而導致對異丙苯的苯酚和丙酮衍生物的需求下降。由於工業活動停止,苯酚市場部門從 2020 年初到 2021 年中期成長率放緩。 COVID-19對產業、地區以及後續供應鏈營運的影響導致苯酚產量下降。此外,疫情也影響了異丙苯的主要終端用戶產業,如化妝品和個人護理、油漆和搪瓷、高辛烷值航空燃料以及聚合物產業,由於銷量減少,導致異丙苯的需求長期疲軟。然而,由於建設業等消耗異丙苯及其衍生產品的各種終端用戶行業的活動迅速增加,預計市場將在疫情後實現強勁成長。

主要亮點

- 從中期來看,塑膠產業對苯酚的需求增加以及作為溶劑的丙酮的高消耗力是市場成長的主要驅動力。

- 另一方面,長期接觸異丙苯及其衍生物的有害影響預計會嚴重阻礙市場成長。

- 然而,雙酚 A (BPA) 的投資和應用不斷增加可能很快為全球市場創造有利的成長機會。

- 預計預測期內亞太地區將主導全球市場。預計在預測期內,其複合年成長率也將達到最高。

異丙苯市場趨勢

苯酚領域需求不斷成長

- 異丙苯的主要用途之一是生產苯酚。異丙苯與分子氧進行液相氧化,生成氫異丙苯過氧化氫,再在催化劑的作用下進一步分解為苯酚和丙酮。

- 苯酚在許多工業中發揮關鍵作用。酚醛樹脂的常見用途包括膠合板、窗玻璃、DVD 和 CD、電腦、體育用品、玻璃纖維船、汽車零件和配件、電路基板和平面電視。

- 汽車工業的成長對於苯酚市場的成長至關重要,這反過來又增加了對異丙苯的需求。過去幾年,汽車產業取得了長足的成長。根據OICA的數據,2021年汽車產量為80,145,988輛,較2020年成長3%。

- 苯酚也是膠合板、定向塑合板等木製品中使用的酚醛膠黏劑的主要成分。它也是生產清潔劑、殺蟲劑、藥物、塑化劑和染料的寶貴中間體。

- 苯酚最大的單一市場是生產由苯酚和丙酮製成的雙酚A (BPA)。 BPA 用於生產聚碳酸酯和環氧樹脂,並有多種用途。

- 根據經濟產業省統計,2021年日本苯酚產量達61.77萬噸,2020年為55.169萬噸,成長率為11.9%。苯酚產量的增加可能在未來推動異丙苯消費量的增加。

中國主導亞太市場

- 在亞太地區,中國佔據區域主導地位。由於在各種化學製程中需求量很大,異丙苯是一種領先的大宗化學品。異丙苯的主要用途是作為苯酚和丙酮生產的中間體。亞太國家化學製造業的擴張和不斷成長的終端用戶需求為異丙苯的市場提供了積極的動力。

- 少量的異丙苯也可用作油漆、亮漆和搪瓷的稀釋劑,以及油漆和其他被覆劑的溶劑。目前,中國佔據全球塗料市場的四分之一以上。日本塗料公司 (Nippon Paint) 已開始透過升級其位於中國的新工廠的塗料生產流程來進軍這一市場。 2021年中國企業收益價值為3791億元(545.5億美元)。

- 2021年5月,PPG宣布完成對中國嘉定油漆塗料工廠1,300萬美元的投資。其中包括八條新的粉末塗料生產線和粉末塗料技術中心的擴建,預計將增強 PPG 的研發能力。預計此次擴建將使該工廠的年生產能力增加8,000噸以上。

- 異丙苯也可用作汽油混合物,為噴射機和民航機提供高辛烷值航空燃料。此外,根據中國民航局的數據,中國是國內航空客運最大的市場之一。過去五年來,中國民航機持有穩定成長。

- 根據中國航空運輸協會統計,截至2021年6月,中國共有通用航空飛機3066架,其中渦輪螺旋槳、活塞飛機1583架,直升機1049架,噴射機360總合,其他通用航空飛機74架。

異丙苯產業概覽

全球異丙苯市場較為分散。主要市場參與者(不分先後順序)包括 Cepsa、INEOS、Kumho P&B Chemicals Inc.、Dow 和 Koch Industries Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 塑膠產業對苯酚的需求不斷增加

- 增加使用丙酮作為溶劑

- 限制因素

- 長期接觸的有害影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 技術簡介

- 貿易分析

- 價格趨勢

- 監理政策分析

第5章 市場區隔

- 催化劑類型

- 氯化鋁催化劑

- 固體磷酸(SPA)催化劑

- 沸石催化劑

- 其他催化劑類型

- 應用

- 苯酚

- 丙酮

- 其他用途(油漆、搪瓷、航空燃料等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Braskem

- Cepsa

- Chang Chun Group

- CITGO Petroleum Corporation

- Domo Chemicals

- Dow

- INEOS

- Koch Industries Inc.

- Kumho P&B Chemicals Inc.

- Prasol Chemicals Pvt. Ltd

- Shell PLC

- SABIC

- Versalis SpA

第7章 市場機會與未來趨勢

- 增加對雙酚A(BPA)的投資和使用

The Cumene Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The sudden onset of the COVID-19 pandemic in 2020 caused demand for cumene to decline in the global market, leading to low demand for phenol and acetone derivatives of cumene. The phenol market segment witnessed a lower growth rate from early 2020 to mid-2021 owing to the suspension of industrial activities. The production of phenol decreased due to the impact of COVID-19 on the industry, the region, and subsequent supply chain operations. Moreover, the pandemic affected the major end-user industries of cumene, such as cosmetics and personal care, paints and enamels, high-octane aviation fuels, and polymer industries, where declined sales weakened the demand for cumene for a long period. However, the market is projected to grow steadily, owing to a rapid headstart in activities of various end-user industries such as construction and others, which consume cumene and its derivative-based products, post the pandemic retraction.

Key Highlights

- Over the medium term, the increasing demand for phenol from the plastic industry and the large consumption of acetone as a solvent are major factors driving the growth of the market studied.

- On the flip side, harmful effects ehibited by cumene and its derivatives due to extended exposure is anticipated to significantly hinder the market's growth.

- Nevertheless, the rising investments and applications of bisphenol A (BPA) is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is expected to dominate the global market during the forecast period. Also, it is expected to register the highest CAGR during the forecast period.

Cumene Market Trends

Increasing Demand from Phenol Segment

- One of the major applications of cumene is in the production of phenol. The liquid-phase oxidation of cumene with molecular oxygen forms cumene hydroperoxide, further decomposed with a catalyst into phenol and acetone.

- Phenol plays a major role in many industries. Some common applications of phenol include plywood, window glazing, DVDs and CDs, computers, sports equipment, fiberglass boats, automotive parts and accessories, circuit boards, and flat-panel televisions.

- The growth in the automotive sector is imperative to the growth of the phenol market, which in turn increases the demand for cumene. The automotive industry registered massive growth in the past few years. According to OICA, the total number of vehicles produced in 2021 was 80,145,988, a growth of 3% compared to 2020.

- Phenol is also a major component in phenolic adhesives used in wood products such as plywood and oriented strand board. Also, it is a valuable intermediate in producing detergents, agricultural chemicals, medicines, plasticizers, and dyes.

- The largest single market for phenol is in the production of Bisphenol A (BPA), which is manufactured from phenol and acetone. BPA, in turn, is used in the manufacturing of polycarbonate and epoxy resins which are used in many different sectors, making phenol a major component in end-user sectors thus triggering its production in different regions.

- According to the Ministry of Economy Trade and Industry (METI), the total production volume of phenol in Japan amounted to 617.7 thousand tons in 2021 and registered a growth rate of 11.9% compared to 551.69 thousand tons in 2020. Higher production rates of phenol are likely to drive up the consumption rate of cumene in the future.

China to Dominate the Asia-Pacific Market

- In the Asia-Pacific, China dominates the regional market share. Cumene is a top commodity chemical due to its high demand in various chemical processes. The primary use of cumene is as an intermediate in producing phenol and acetone. The expanding chemical manufacturing sector and growing end-user demand in Asia-Pacific countries support the positive market dynamics of cumene.

- Small amounts of cumene are also used as thinners for paints, lacquers, and enamels and as solvents in paints and other coatings. China accounts for more than one-fourth of the global coatings market presently. Nippon has been tapping into this market by upgrading its coatings production process across its new plants in China. The company's revenue in China was valued at CNY 379.1 billion (USD 54.55 billion) in 2021.

- In May 2021, PPG announced the completion of its USD 13 million investment in its Jiading, China, paint and coatings facility, including eight new powder coating production lines and an expanded powder coatings technology center that is expected to enhance PPG's research and development capabilities. The expansion is likely to increase the plant's capacity by more than 8,000 tons per year.

- Cumene is also used as a gasoline blend for providing high octane aviation fuel, which is being used in the jet and commercial aircrafts. Additionally, according to the Civil Aviation Administration of China (CAAC), China is one of the largest markets for domestic air passengers. The civil aircraft fleet in the country has been increasing steadily for the last five years.

- According to the China Aviation Transportation Association, China had a total of 3,066 general aviation aircraft, including 1,583 turboprops and piston airplanes and 1,049 helicopters as well as 360 business jets and 74 other general aviation aircrafts as of June 2021.

Cumene Industry Overview

The global cumene market is fragmented in nature. The major market players (in no particular order) include Cepsa, INEOS, Kumho P&B Chemicals Inc., Dow, and Koch Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Phenol from the Plastic Industry

- 4.1.2 Increasing Use of Acetone as a Solvent

- 4.2 Restraints

- 4.2.1 Harmful Effects Due to Extended Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Price Trends

- 4.9 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Catalyst Type

- 5.1.1 Aluminum Chloride Catalyst

- 5.1.2 Solid Phosphoric Acid (SPA) Catalyst

- 5.1.3 Zeolite Catalyst

- 5.1.4 Other Catalyst Types

- 5.2 Application

- 5.2.1 Phenol

- 5.2.2 Acetone

- 5.2.3 Other Applications (Including Paints, Enamels, Aviation Fuels, and Others)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 US

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 UK

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Braskem

- 6.4.2 Cepsa

- 6.4.3 Chang Chun Group

- 6.4.4 CITGO Petroleum Corporation

- 6.4.5 Domo Chemicals

- 6.4.6 Dow

- 6.4.7 INEOS

- 6.4.8 Koch Industries Inc.

- 6.4.9 Kumho P&B Chemicals Inc.

- 6.4.10 Prasol Chemicals Pvt. Ltd

- 6.4.11 Shell PLC

- 6.4.12 SABIC

- 6.4.13 Versalis S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Investments and Applications of Bisphenol A (BPA)