|

市場調查報告書

商品編碼

1685685

汽車資訊娛樂系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Infotainment Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

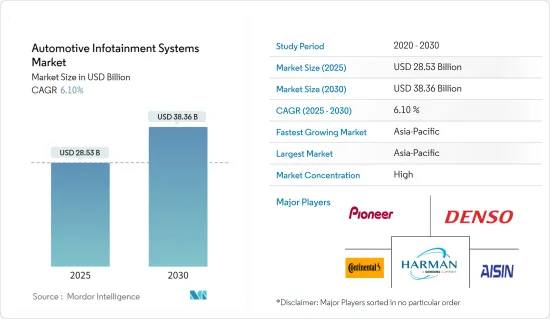

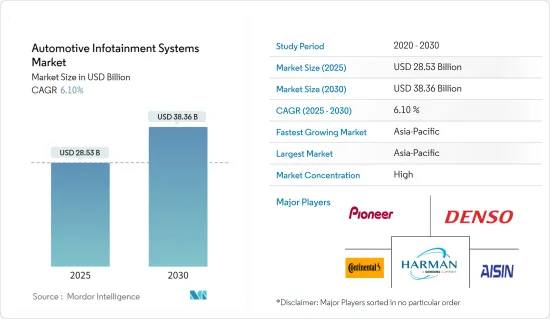

預計2025年汽車資訊娛樂系統市場規模為285.3億美元,2030年將達到383.6億美元,預測期間(2025-2030年)的複合年成長率為6.1%。

汽車資訊娛樂系統市場主要受汽車銷售和產量成長的推動,因此COVID-19疫情對汽車資訊娛樂系統市場的影響是不可避免的。由於製造工廠不斷關閉,2020 年汽車產銷量大幅下滑。然而,在2020年上半年,全球汽車產銷開始回升,並在2021年維持了這股動能。 2021年全球汽車銷售量與2020年相比顯著成長。然而,市場從未恢復到2019年的水平,主要原因是全球半導體短缺。疫情過後,各企業攜手合作,克服疫情影響,開發新的創新產品。例如

主要亮點

- 2022年9月,瑞薩電子株式會社(Renesas)宣布擴大與越南新創汽車製造商VinFast在電動車技術開發上的合作。兩家公司正在資訊娛樂系統方面展開合作,瑞薩電子為 VinFast 的電動 SUV「VF8」和「VF9」提供車載 SoC「R-Car」和類比產品。

汽車製造商正在激烈競爭,爭取在預測期內推出的車型中引入先進的資訊娛樂系統。例如,工業、日產汽車公司和雷諾集團已採用Google的 Android 作業系統作為其下一代資訊娛樂系統。此外,由於消費行為的變化以及對行動電話和系統之間無縫連接的需求,對 IVI(車載資訊娛樂)的需求預計會激增。

豪華車銷售的成長和客戶對車載資訊娛樂系統的偏好是市場的主要驅動力。然而,由於駕駛分心而導致的事故數量增加也可能阻礙市場成長。世界主要汽車製造商在音響單元、顯示器單元、導航系統和整合系統等領域與技術OEM進行了廣泛的合作。例如

主要亮點

- 2022年10月,豐田與Google雲端擴大合作,涵蓋豐田和Lexus的下一代音訊多媒體系統以及Google雲端基於人工智慧的語音服務。客戶將在最新一代豐田音響多媒體和雷克薩斯介面資訊娛樂系統中看到此次合作的首批成果。該系統預計將搭載於 2023 年豐田車型,包括卡羅拉、Tundra、Sequoia、Lexus NX、RX 和電動 RZ。

此外,在商用車中整合導航和車輛控制單元有助於減少緊急回應時間並消除事故風險。此外,一些汽車製造商正在提供低成本的資訊娛樂系統,使產品更實惠。此外,智慧型手機的日益普及和網際網路的高度連接也對全球市場的成長產生了重大影響。

預計預測期內亞太市場將以最高速度成長,其次是北美和歐洲。亞太市場的擴張歸功於中國、日本和印度等世界最大汽車製造國對汽車資訊娛樂系統的廣泛採用。這正在推動整個汽車資訊娛樂系統供應鏈的技術創新。例如

主要亮點

- 2022年8月,羅姆宣布開發用於資訊娛樂系統和ADAS(高級駕駛輔助系統)中的車載攝影機的BD9S402MUF-C DC/DC轉換器IC。

汽車資訊娛樂系統市場趨勢

資訊娛樂系統的進步

汽車資訊娛樂系統擴大配備智慧型手機功能。在北美和歐洲,超過90%的成年人透過行動電話上網,是所有地區中最高的。隨著行動電話使用量的增加,越來越多的汽車配備了智慧型手機以達到相同的目的。

汽車製造商也選擇模組化硬體設計。這有助於降低購買資訊娛樂系統的成本。我們開發的技術能夠將智慧型手機功能以低成本整合到汽車資訊娛樂系統中。製造商正在努力平衡處理能力和系統競爭力。為了幫助汽車製造商提高聯網汽車的效能,數位服務需要產生大量資料。

- 2021年8月,現代汽車選擇全球軟體技術公司QT作為現代、起亞和Genesis的人機介面(HMI)技術合作夥伴。該技術將使現代汽車能夠開發跨車輛資訊娛樂系統的連網汽車作業系統。

- 2021年9月,LG電子在德國慕尼黑舉行的IAA Mobility上發表了其汽車資訊娛樂系統。該車的資訊娛樂系統基於 Google Android Automotive 和 Android 10,以最佳化連接性和便利性。汽車資訊娛樂系統軟體將與雷諾夥伴關係開發,並將搭載於 2022 年 2 月推出的雷諾梅甘娜 E-TECH Electric 車款。

汽車資訊娛樂系統正在經歷重大的技術變革時期。隨著智慧型手機的廣泛使用,ADAS 和自動駕駛技術(自動駕駛汽車)的採用正在興起。車載系統車輛,特別是乘客座椅,對科技越來越熟悉。隨著工程師開發創新的汽車資訊娛樂系統,這些功能很可能成為汽車電子系統不可或缺的一部分。

人工智慧和雲端服務的採用有望推動汽車資訊娛樂系統的技術進步。大多數公司依賴現有的谷歌和蘋果生態系統來建立其資訊娛樂系統。不過,有些公司更願意為資訊娛樂系統開發自己的作業系統。

中國引領亞太市場

中國在亞太汽車產業中佔有最大佔有率,過去十年來汽車銷量最高。隨著汽車製造商更加關注新能源汽車(NEV),預計預測期內汽車銷售將保持正成長。

從簡單的音訊系統到支援導航、Apple CarPlay、Android Auto 和遠端資訊處理等多種功能的觸控螢幕資訊娛樂系統的轉變正在推動該國對資訊娛樂系統的需求。

中國是全球最大的汽車市場之一,2020年乘用車銷量超過2,017萬輛,預計2021年中國汽車總銷量將達到約2,148萬輛。然而,中國汽車製造商正在率先開發智慧座艙,而智慧駕駛座正迅速成為現代駕駛體驗的重要組成部分。智慧駕駛座將智慧技術與一系列駕駛功能相結合,包括車輛指令的語音辨識、娛樂和導航系統。例如

- 2022年9月,NVIDIA公司宣布開發Drive-Soar,這是一款可整合自動駕駛/ADAS(高級駕駛輔助系統)和汽車資訊娛樂系統的集中式車載電腦。

此外,2021年7月的世界人工智慧大會上透露,中國汽車市場引領智慧駕駛座發展,智慧駕駛座相關專利申請數量超過8.23萬件,其次是日本(3.19萬件)和美國(1.93萬件)。智慧駕駛座正在成為現代駕駛體驗的關鍵技術,其中語音辨識和多功能導航系統是整合到智慧汽車駕駛座的一些關鍵技術。

汽車資訊娛樂系統產業概況

主要企業羅伯特博世、阿爾派電子、松下公司、哈曼國際和三菱電機公司主導汽車資訊娛樂系統市場。這些公司在全球範圍內擁有強大的分銷網路,並提供廣泛的產品系列。這些公司採用新產品開發、合作、合約和協議等策略來維持其市場地位。

- 2022 年 9 月,梅賽德斯-奔馳股份公司與高通技術公司宣布合作,利用驍龍數位底盤解決方案為未來的賓士汽車帶來尖端數位功能。賓士利用高通的駕駛座平台實現直覺、智慧的資訊娛樂系統。這些下一代系統將為車載虛擬助理提供高度直覺的人工智慧體驗。

- 2022年6月,梅賽德斯-賓士集團宣布與加州科技公司ZYNC建立合作關係。透過此次合作,ZYNC 將為OEM提供優質的車載數位娛樂平台。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按安裝類型

- 車載資訊娛樂系統

- 後座資訊娛樂系統

- 按車輛類型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Denso Corporation

- Robert Bosch GmbH

- Continental AG

- Harman International Industries Inc.

- Magnetic Marelli SpA

- Kenwood Corporation

- Alpine Electronics Inc.

- Mitsubishi Electric Corporation

- Visteon Corporation

- Pioneer Corporation

- Aptiv PLC

第7章 市場機會與未來趨勢

The Automotive Infotainment Systems Market size is estimated at USD 28.53 billion in 2025, and is expected to reach USD 38.36 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

The impact of the COVID-19 pandemic on the automotive infotainment systems market was inevitable as the market is primarily driven by increasing vehicle sales and production. As there were continuous lockdowns and shutting down of manufacturing units, production and sales of vehicles experienced a slump in 2020. However, in the first half of 2020, global vehicle production and sales started to pick up the pace and continued their growth momentum in 2021. Global vehicle sales witnessed considerable growth in 2021 when compared to 2020. However, the market did not rebound to the levels of the year 2019, primarily due to the global semiconductor shortage. Post-pandemic, players are collaborating and developing new and innovative products to overcome the impact of the pandemic. For instance,

Key Highlights

- In September 2022, Renesas Electronics Corporation (Renesas) announced an expansion of its collaboration with VinFast, a Vietnamese emerging vehicle manufacturer, for the technological development of electric vehicles. Both companies have worked together on infotainment systems, and Renesas provides R-Car, its onboard SoC, and analog products for the VinFast electric SUVs VF8 and VF9.

Automakers are strongly competing to deploy advanced infotainment systems for their upcoming vehicle models during the forecast period. For instance, Mitsubishi Motors Corporation, Nissan Motor Co. Ltd, and Groupe Renault have adopted Google Inc.'s Android OS (operating system) for their next-generation infotainment systems. In addition, demand for IVI (In-Vehicle Infotainment) is expected to witness a steep rise with changing consumer behavior and demand for seamless connectivity of phones with the system.

An increase in luxury vehicle sales and customer preference for in-dash infotainment systems are some of the biggest drivers of the market. However, the rise in the number of accidents due to driver distraction may also hinder the market's growth. The world's leading automobile manufacturers are extensively working with technological OEMs, which work in domains such as audio units, display units, navigation systems, and comprehensive systems. For instance,

Key Highlights

- In October 2022, Toyota and Google Cloud expanded their partnership to include Toyota and Lexus's next-generation audio multimedia systems as well as Google Cloud's AI-based speech services. Customers can see the first fruits of the collaboration in the latest generation Toyota Audio Multimedia and Lexus Interface infotainment systems, which will be available in 2023 models such as the Toyota Corolla, Tundra, and Sequoia, as well as the Lexus NX, RX, and all-electric RZ.

Furthermore, implementing navigation and vehicle control units in commercial vehicles helps reduce the response time during emergencies, thereby eliminating the risk of accidents. Besides this, several automobile manufacturers are also offering low-cost infotainment systems, thereby increasing product affordability. Additionally, the rising adoption of smartphones, along with high internet connectivity, has a significant impact on the market growth on a global level.

The Asia-Pacific market is expected to grow rapidly during the forecast period, followed by North America and Europe. The Asia-Pacific market's expansion can be attributed to the high adoption rate of automotive infotainment systems in countries such as China, Japan, and India, which manufacture the most vehicles globally. This, in turn, is driving technological innovations across the supply chain of the automotive infotainment system. For instance,

Key Highlights

- In August 2022, Rohm Co., Ltd (Rohm) announced the development of the BD9S402MUF-C DC/DC converter IC for infotainment systems and advanced driver assistance system onboard cameras.

Automotive Infotainment Systems Market Trends

Growing Advancements in Infotainment Systems

Smartphone functions are increasingly being integrated into in-vehicle infotainment systems. Over 90% of adults in North America and Europe have access to the internet via their mobile phones, which is one of the highest rates among other regions. As the use of mobile phones has increased, so has the use of smartphones in cars for the same purposes.

Automobile manufacturers are also opting for modular hardware design. This allows them to lower the cost of purchasing infotainment systems. They are developing technologies that allow smartphone functions to be integrated into in-vehicle infotainment systems at a low cost. Manufacturers are working to combine processing power and system competitiveness. For car manufacturers to improve the performance of connected vehicles, digital services generate massive amounts of data.

- In August 2021, Hyundai Motors selected QT, a global software technology company, as its human-machine interface (HMI) technology partner for Hyundai, Kia, and Genesis. This technology would allow Hyundai Motors to develop a connected car operating system across its vehicle infotainment systems.

- In September 2021, LG Electronic unveiled their in-vehicle infotainment system in IAA Mobilityheld in Munich, Germany. The in-vehicle infotainment system was based on Google Android automotive and Android 10 to optimize connectivity and convenience. The in-vehicle infotainment system's software was developed with Renault's partnership, and it is equipped with the Renault Megane E-TECH electric, launched in February 2022.

The automotive infotainment system is undergoing massive technological transformations. With growing smartphone usage, there is an increase in the adoption of ADAS and Autonomous driving technology (self-driving cars). Technologies like Automotive systems vehicles, especially for passenger seating, have become excessively familiar. As engineers develop innovative versions of in-vehicle infotainment systems, these features will become essential contributors to the vehicle's electronic system.

The introduction of AI and cloud services is expected to drive technological advancements in automotive infotainment systems. Most companies rely on the existing Google and Apple ecosystems for their infotainment systems. Although some players prefer to develop their infotainment system OS in-house,

China is Driving the Asia-Pacific Market

China occupied a significant share of the Asia-Pacific automotive industry among Asia-Pacific countries due to its highest vehicle sales over the past decade. The country is anticipated to continue to see positive vehicle sales during the forecast period, owing to the growing focus on new energy vehicles (NEV) among automakers.

The shift from simple audio systems to touchscreen infotainment systems that support multiple features, such as navigation, Apple CarPlay, Android Auto, and telematics, is driving the demand for infotainment systems in the country.

China is one of the world's largest automotive markets, with over 20.17 million passenger cars sold in the country in 2020, and overall car sales in China reached around 21.48 million vehicles in 2021. However, Chinese automakers are pioneering the development of the intelligent cockpit, which is quickly becoming an essential component of the modern driving experience. Intelligent cockpits combine smart technologies with various driving functions, such as voice recognition for vehicle commands and entertainment and navigation systems. For instance,

- In September 2022, NVIDIA Corporation (NVIDIA) announced the development of Drive Soar, a centralized in-vehicle computer capable of integrating autonomous driving/advanced driver assistance systems (ADAS) and in-vehicle infotainment systems.

Further, In July 2021, World artificial intelligence conference, China's automobile market was leading in the development of smart cockpits with more than 82,300 patents application related to intelligent cockpits, followed by Japan and the United States at 31,900 and 19,300, respectively. Intelligent cockpits are becoming a critical technology in the modern driving experience; voice recognition and multiple drive functions navigation systems are some of the prime technologies integrated into intelligent vehicle cockpits.

Automotive Infotainment Systems Industry Overview

Major players such as Robert Bosch, Alpine Electronics, Panasonic Corporation, HARMAN International, and Mitsubishi Electric Corporation dominate the automotive infotainment systems market. These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts and agreements to sustain their market positions.

- In September 2022, Mercedes-Benz AG and Qualcomm Technologies, Inc. announced a collaboration to use Snapdragon Digital Chassis solutions to bring the most advanced digital capabilities to future Mercedes-Benz vehicles. Mercedes-Benz is using Qualcomm Cockpit Platforms to power intuitive and intelligent infotainment systems. These next-generation systems will include highly intuitive AI experiences for in-car virtual assistance.

- In June 2022, Mercedes-Benz Group AG announced a collaboration with ZYNC, a California-based technology company. Under this partnership, the latter company will provide a premium in-car digital entertainment platform for the OEM.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 By Installation Type

- 5.1.1 In-dash Infotainment

- 5.1.2 Rear-seat Infotainment

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Denso Corporation

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental AG

- 6.2.4 Harman International Industries Inc.

- 6.2.5 Magnetic Marelli SpA

- 6.2.6 Kenwood Corporation

- 6.2.7 Alpine Electronics Inc.

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Visteon Corporation

- 6.2.10 Pioneer Corporation

- 6.2.11 Aptiv PLC