|

市場調查報告書

商品編碼

1685708

電動馬達:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Electric Motors for Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

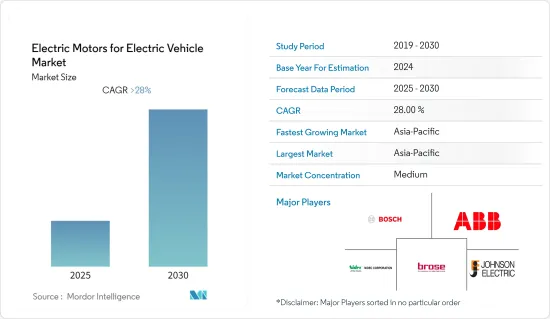

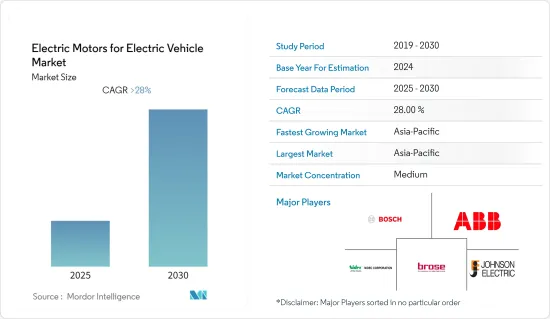

預計預測期內電動馬達電動馬達市場複合年成長率將超過 28%。

新冠疫情導致製造業停擺、封鎖和貿易限制,對 2020 年上半年電動車產業的馬達產生了負面影響。然而,新冠疫情後的復甦、更嚴格的車輛排放氣體標準以及政府為加快電動車普及而提供的慷慨獎勵,導致電動車銷量非常健康地成長。此外,電動汽車馬達的銷量也大幅成長。例如,2020年電動乘用車銷量飆升至310萬輛,較2019年成長39%。

此外,製造商已實施應急計劃,透過多樣化生產和供應鏈來減輕未來的業務不確定性,以確保與汽車行業關鍵領域的客戶的連續性。例如

主要亮點

- 2020 年 2 月,Brose Fahrzeugteile SE & Co. KG 在印度普納附近的 Hinjewadi 開設了新園區。新工廠將僱用 430 名員工。 Brose Fahrzeugteile SE & Co. KG 宣布將在未來幾年向印度投資 6,000 萬歐元(6,240 萬美元)。

從長遠來看,嚴格的排放和燃油經濟性法規的頒布、政府獎勵以及充電基礎設施的改善導致電動車銷量增加,是推動研究市場成長的關鍵因素。豐田、本田、特斯拉、通用汽車和福特等主要汽車公司對電動車的大規模投資預計很快就會推動電動馬達市場的發展。此外,馬達製造商和汽車公司之間日益成長的夥伴關係預計將在全球範圍內擴大所研究的市場。

從地理位置來看,由於中國和印度等新興市場的存在,預計亞太地區將在預測期內成為最大的馬達市場。由於政府採取措施抑制二氧化碳排放,歐洲一直是市場發展的動力。英國、德國和法國正在為該地區的市場擴張做出貢獻。

因此,上述因素可能會進一步推動全球電動汽車馬達市場的成長。

電動汽車馬達市場趨勢

電動車需求成長將推動市場成長

由於中國、美國、日本、韓國和歐洲的電動車銷量快速成長,馬達的需求預計將呈指數級成長。由於各國政府推出的推廣電動車的獎勵、普通購車者環保意識的增強以及燃料價格的上漲,全球電動車銷售量呈指數級成長。造成這種情況的其他因素包括電動車的營業成本低於傳統內燃機汽車,以及中國和歐盟政府宣布將在 2035 年前禁止所有內燃機汽車出行。例如

- 2021年,全球電動車註冊量達690萬輛,與前一年同期比較成長107%。

推動電動車馬達成長的主要因素是對提高電動車行駛里程的需求不斷增加,預計這將對電動車馬達市場的成長產生積極影響。

此外,世界各國政府都在積極實施鼓勵採用電動車的政策。中國、印度、法國和英國已宣布計劃在 2040 年前逐步淘汰汽油和柴油汽車。例如,

- 2022年10月,歐盟宣布將從2035年起禁止在歐盟成員國銷售新的內燃機汽車。

- 歐洲宣布了2050年實現氣候中和的宏偉目標。未來幾年,歐盟委員會預計將提出幾項新的立法提案來實現這一目標。其中許多旨在提高機動性。為了實現這一目標,我們需要一套政策和目標,引導國家、企業和消費者走上正確的道路。歐盟委員會已從其 7,500 億歐元(7,800 億美元)的新冠疫情獎勵策略中撥款 200 億歐元(212 億美元),用於快速廣泛地採用清潔出行方式。歐盟也宣布,到2030年將推動潔淨汽車,包括3,000萬輛電動車和100萬輛氫動力汽車。

- 2022年9月,中國宣布將對新能源電動車(包括純電動車、混合動力車、插電式混合動力車和氫燃料電池車)免徵5%的購置稅政策延長至2023年終。

- 2021年,印度聯邦政府宣布將混合動力汽車和電動車快速採用和製造(FAME)計畫第二階段延長兩年,至2024年3月31日。該計劃旨在促銷。

此外,政府和私人公司打算在全球範圍內建造充電基礎設施,以最大限度地減少排放氣體並保持環保。因此,對電動車不斷成長的需求將進一步推動馬達在汽車中的應用,從而在預測期內增加馬達的製造。

亞太地區可望主導市場

在全球範圍內,亞太地區佔據電動馬達市場的最大佔有率。中國和印度是亞太地區最突出的電動車製造商和消費國。國家銷售目標、有利的立法和當地空氣品質目標支持了這兩個國家的國內需求。例如,

- 印度政府宣布,到 2022 年,將在未來三年內根據 FAME II(混合動力電動車的快速採用和製造)計劃引進 7,000 輛電動公車、5,000 輛電動三輪車、55,000 輛電動四輪車(包括大功率混合動力汽車)和 10,000 輛電動二輪車。已為 FAME II(混合動力電動車的快速採用和製造)撥款 10 億印度盧比(12 億美元)。

- 中國對電動和混合動力汽車製造商設定了超過10%的新車銷量配額。而北市每月僅發放1萬張內燃機汽車登記許可證,以鼓勵居民轉換電動車。

這些國家的電動車銷售每年也在大幅成長,進一步推動了馬達市場的成長。例如

- 2021年中國乘用車銷量為299萬輛,與前一年同期比較去年成長169.1%。 2021年印度共售出17,802輛電動車,與前一年同期比較成長168%。

因此,由於上述因素,預計亞太地區仍將是電動汽車馬達市場最主導的地區。

電動汽車馬達產業概況

由於眾多地區和國際參與者的存在,電動車馬達市場得到了適度整合。主要參與者包括博世行動解決方案、ABB、日本電產公司、Brose Fahrzeugteile GmbH &Co.KG 和德昌電機集團。許多參與者正在透過合資、併購、推出新產品、擴大產能等方式鞏固其市場地位。例如

- 2022 年 12 月,印度汽車零件製造商 Shriram Pistons Ltd. 宣布已收購 EMF Innovations 的多數股權,EMF Innovations 是一家總部位於新加坡的各類電動汽車馬達設計和製造商。 SPR Engineous 是 Shriram Pistons Ltd 的全資子公司,將執行此交易。透過此次交易,我們將進入電動車市場並滿足所有電動車細分市場的需求。

- 2022年10月,博世汽車出行解決方案宣布將投資2.6億美元,擴大其位於美國南卡羅來納州查爾斯頓工廠為Rivian R1T皮卡生產的電動馬達馬達的生產。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 集會

- 輪轂

- 中央動力傳動系統

- 應用

- 搭乘用車

- 商用車

- 馬達類型

- 無刷直流馬達

- 永磁同步馬達

- 非同步馬達

- 同步磁阻馬達

- 其他(無鐵心永磁馬達、開關磁阻馬達等)

- 輸出

- 100kW以下

- 101~250 kW

- 超過250千瓦

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Aisin Seiki Co. Ltd

- Toyota Motor Corporation

- Hitachi Automotive Systems

- DENSO Corporation

- Honda Motor Company Ltd

- Mitsubishi Electric Corp.

- Magna International

- Robert Bosch GmbH

- BMW AG

- Nissan Motor Co. Ltd

- Tesla Inc.

- Toshiba Corporation

- BYD Co. Ltd

第7章 市場機會與未來趨勢

第8章 免責聲明

The Electric Motors for Electric Vehicle Market is expected to register a CAGR of greater than 28% during the forecast period.

COVID-19 led to manufacturing shutdowns, lockdowns, and trade restrictions that negatively impacted the electric motors for the electric vehicle industry in the first half of the year 2020. However, the post-COVID-19 recovery, the stringent automotive emissions norms adoption, and the provision of generous government incentives for the quick adoption of electromobility led to a very healthy rise in the sales of electric vehicles. It further produced significant growth in the sales of electric motors for electric cars. For instance, in 2020, electric passenger vehicle sales jumped to 3.1 million units, an increase of 39% over 2019.

In addition, the manufacturers implemented contingency plans to mitigate future business uncertainties to retain continuity with clients in the critical sectors of the automobile industry by diversifying their manufacturing and supply chains. For instance,

Key Highlights

- In February 2020, Brose Fahrzeugteile SE & Co. KG opened its new campus in India at Hinjewadi near Pune. The new location will employ 430 people. Brose Fahrzeugteile SE & Co. KG announced an investment of EUR 60 million ( USD 62.4 million) in India in the future.

Over the long term, some of the major factors driving the growth of the market studied are the rising sales of electric vehicles due to the enactment of stringent emission and fuel economy norms, government incentives, and improving charging infrastructure. Massive investments in electric vehicles by major automotive companies, such as Toyota, Honda, Tesla, General Motors, and Ford, are expected to drive the electric motor market shortly. Additionally, the evolving partnerships between motor manufacturers and automotive companies are expected to expand the studied market globally.

Geographically Asia-Pacific is expected to be the largest electric motor market during the forecast period due to the presence of emerging markets such as China and India. Europe became a driving force in the market's development for the government's steps to curb carbon emissions. The United Kingdom, Germany, and France are all contributing to the market's expansion in this region.

Thus the factors mentioned above will further drive the growth in the electric motors for electric vehicles market globally.

Electric Vehicle Motor Market Trends

Rising Demand for Electric Vehicles to Augment Growth of Market

The demand for electric motors is expected to increase exponentially, owing to the rapid growth of electric vehicle sales across China, the United States, Japan, South Korea, and Europe. Electric vehicle sales are rising exponentially worldwide due to government incentives offered by various Governments to promote electromobility, increasing environmental consciousness amongst general car buyers, and rising fuel prices. It is also due to lower operating costs provided by electric vehicles than traditional ICE vehicles and announcements by the governments of China and the EU to ban ICE mobility by 2035. For instance,

- In 2021, 6.9 million electric cars were registered worldwide, an increase of 107% from the previous year.

The primary factor driving the electric vehicle motor growth is the increase in demand for improving the electric vehicles driving range, which is, in turn, anticipated to positively impact the electric motors market growth for electric cars.

Moreover, governments worldwide have also been proactive in enacting policies to encourage the adoption of electric vehicles. China, India, France, and the United Kingdom have announced plans to phase out the petrol and diesel vehicles industry entirely before 2040. For instance,

- In October 2022, European Union announced the ban on the sale of new ICE vehicles from 2035 in EU member states.

- Europe announced a lofty target of being climate-neutral by 2050. The European Commission will publish several new legislative proposals to meet this goal over the next few years. Many of them are aimed at improving mobility. To achieve this aim, a set of policies and targets must be in place to guide states, businesses, and consumers on the correct path. European Commission earmarked EUR 20 billion (USD 21.2 billion) in the COVID-19 stimulus package of EUR 750 billion (USD 780 billion) for the faster and widespread adoption of clean mobility. It announced the promotion of sales of clean vehicles, including 30 million electric and 1 million hydrogen vehicles, in the EU by 2030.

- In September 2022, China announced that it had extended the tax exemption from a 5% purchase tax to new energy electric vehicles, including battery electric vehicles, hybrid vehicles, plug-in hybrid vehicles, and hydrogen fuel cell vehicles, till the end of 2023.

- In 2021, The Union government of India announced an extension of the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric vehicle (FAME) scheme by two years to March 31, 2024. The plan aims at promoting sales of electric vehicle adoption and manufacturing of components related to EVs.

In addition, the government and private companies intend to build charging infrastructure worldwide to minimize emissions and keep the environment green. Thus, the rising demand for electric vehicles further aggravates the adoption of electric motors in cars, augmenting the manufacturing of electric motors during the forecast period.

Asia-Pacific Anticipated to Dominate the Market

Globally, Asia-Pacific is capturing the largest share of the electric motors for the electric vehicle market, owing to high EV sales, majorly from China. China and India are the most prominent manufacturers and consumers of electric vehicles in the Asia-Pacific. National sales targets, favorable laws, and municipal air-quality targets are supporting domestic demand in both these countries. For instance,

- The Government of India announced having 7000 e-Buses, five lakh e-3 wheelers, 55000 e-4 wheeler passenger cars (including strong hybrids), and ten lakh e-2 wheelers over the next three years under FAME II (Faster Adoption and Manufacturing of Hybrid Electric Vehicles) by 2022. INR 10000 Cr (USD 1.2 billion) was allocated to FAME II (Faster Adoption and Manufacturing of Hybrid Electric Vehicles).

- China imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, Beijing only issues 10,000 permits for registering combustion engine vehicles per month to encourage its inhabitants to switch to electric cars.

Electric vehicles are also posting huge annual sales gains in these countries, which will further drive the growth in the market for electric motors. For instance,

- 2.99 million passenger electric vehicles were sold in China in 2021, an increase of 169.1% over the last year, while in India, 17802 units of electric cars were sold in 2021, registering a growth of 168% over the previous year.

Thus the factors above are expected to maintain Asia-Pacific as the most dominant region for electric motors for electric vehicles market.

Electric Vehicle Motor Industry Overview

The Electric motors for electric vehicles market is moderately consolidated due to the presence of many regional and international players. Some significant players include Bosch Mobility Solutions, ABB, Nidec Corporation, Brose Fahrzeugteile GmbH & Co. KG, and Johnson Electric Group. Many of these players are engaging in joint ventures, mergers and acquisitions, new product launches, and capacity expansions to cement their market positions. For instance

- In December 2022, Indian automotive component manufacturer Shriram Pistons Ltd. announced an acquisition majority stake in EMF Innovations, a Singapore-based designer and manufacturer of electric motors for all types of electric vehicles. SPR Engineous, a wholly-owned subsidiary of Shriram Pistons Ltd, would make the transaction. They will enter the EV market with this deal and cater to all EV market segments.

- In October 2022, Bosch Mobility Solutions announced to invest USD 260 million to expand the production of electric vehicle motors for the Rivian R1T pickup truck at its Charleston plant in South Carolina, in the US.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Assembly

- 5.1.1 Wheel Hub

- 5.1.2 Central Power Train

- 5.2 Application

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Motor Type

- 5.3.1 Brushless DC Motor

- 5.3.2 Permanent Magnet Synchronous Motor

- 5.3.3 Asynchronous Motor

- 5.3.4 Synchronous Reluctance Motor

- 5.3.5 Others (Axial Flux Ironless Permanent Magnet Motor, Switched Reluctance Motors, etc.

- 5.4 Power

- 5.4.1 Up to 100 kW

- 5.4.2 101-250 kW

- 5.4.3 Above 250 kW

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aisin Seiki Co. Ltd

- 6.2.2 Toyota Motor Corporation

- 6.2.3 Hitachi Automotive Systems

- 6.2.4 DENSO Corporation

- 6.2.5 Honda Motor Company Ltd

- 6.2.6 Mitsubishi Electric Corp.

- 6.2.7 Magna International

- 6.2.8 Robert Bosch GmbH

- 6.2.9 BMW AG

- 6.2.10 Nissan Motor Co. Ltd

- 6.2.11 Tesla Inc.

- 6.2.12 Toshiba Corporation

- 6.2.13 BYD Co. Ltd