|

市場調查報告書

商品編碼

1685722

乙酸乙酯-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Ethyl Acetate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

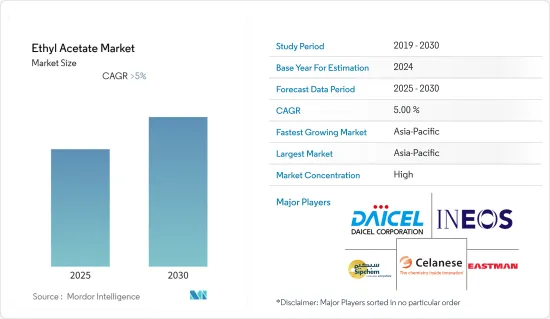

預計預測期內乙酸乙酯市場複合年成長率將超過 5%。

由於建設活動停止,COVID-19 疫情影響了油漆和被覆劑的銷售。然而,由於汽車、食品和飲料等各個終端用戶產業的消費增加,市場在 2021-22 年有所復甦。對乙醯胺酚等消耗乙酸乙酯衍生中間體的藥物的需求不斷增加,刺激了製藥業的市場需求。

主要亮點

- 預計推動市場成長的主要因素是軟包裝和油漆塗料行業的需求不斷成長。此外,對天然皮革生產的嚴格監管規範可能會促進市場成長。

- 另一方面,用水性、高固體含量塗料取代傳統塗料可能會阻礙乙酸乙酯市場的成長。

- 煤/天然氣生產乙醇的技術創新可能會為市場帶來新的成長機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的複合年成長率。

乙酸乙酯市場趨勢

油漆和塗料行業的需求不斷成長

- 油漆和塗料應用領域佔據乙酸乙酯市場的最大佔有率。乙酸乙酯在油漆中用作活化劑和硬化劑。它也用作油漆、黏合劑和人造絲的工業溶劑,主要用於溶解材料。它也是漆、清漆和表面塗層稀釋劑的常見成分。

- 世界各地生產的油漆和被覆劑用於裝飾和保護新建築並維護現有建築:住宅、公寓、公共建築、工廠和工廠。剩餘的油漆用於裝飾和保護工業產品。預計油漆和被覆劑的使用量增加將促進乙酸乙酯市場的發展。

- 此外,預計全球航太和食品飲料產業對環氧塗料的需求不斷增加將對預測期內對乙酸乙酯的需求產生正面影響。

- 根據美國塗料協會的數據,美國油漆和塗料產業價值 260 億美元。 2021年,美國出口了價值25億美元的油漆和塗料產品。

- 此外,美國塗料協會預測,到2023年,亞太地區的塗料需求將達到295億公升,價值1,000億美元。亞太地區將繼續生產和使用比北美和歐洲更多的溶劑型塗料,但這些系統將逐步被更相容、永續和更環保的系統所取代。

- 據 Paintindia 稱,印度塗料產業價值超過 6,200 億印度盧比(80 億美元),是世界上成長最快的主要塗料產業之一。印度擁有超過 3,000 家塗料製造商,其中幾乎包括所有全球大型公司。

- 汽車業是油漆和塗料行業的主要終端用戶。此塗層可保護您的汽車油漆免受道路損壞和太陽紫外線的傷害,並減少氧化。

- 根據OICA的數據,2021年汽車產量為80,145,988輛,較2020年成長3%。亞太地區在全球汽車市場中佔據最高產量佔有率,2021年產量為46,732,785輛。

亞太地區需求占主導地位

- 預計在預測期內亞太地區將佔據市場主導地位。此外,由於中國、印度和馬來西亞等國家的家庭收入增加和都市化提高,預計亞太地區將出現顯著的成長率。

- 中國是世界上最大的乘用車製造國。 2021年中國乘用車銷量較去年與前一年同期比較成長4.4%至2015萬輛。

- 上海工業總公司是中國領先的汽車製造商。公司預計2021年汽車銷售量將超過546萬輛,交車量將超過581萬輛,與前一年同期比較去年同期成長5.5%。因此,汽車銷量的成長可能會促進用於汽車油漆和被覆劑的乙酸乙酯市場的發展。

- 過去幾年,印度對乙酸乙酯的需求一直穩定成長。汽車、食品飲料和包裝是主要的終端用戶產業,佔該國乙酸乙酯消費的大部分佔有率。

- 據印度品牌資產基金會稱,印度已成為全球市場上領先的包裝材料出口國。印度包裝材料出口額以 9.9% 的複合年成長率成長,從 2018-19 年的 8.44 億美元增至 2021-22 年的 11.19 億美元。該國包裝需求的增加正在刺激所調查市場的需求。

- 在印度,由於人造皮革具有透氣性、耐熱性和延展性,汽車產業對人造皮革的需求正在增加。它們被用於汽車、巴士、卡車、摩托車的門飾、遮陽板、車頂內襯、方向盤套、旋鈕套、排擋套等。因此,預計人造皮革需求的增加將導致乙酸乙酯市場的復甦。

- 印度汽車協會稱,2021 年 4 月至 2022 年 3 月,汽車業共生產了 22,933,230 輛汽車,包括乘用車、商用車、三輪車、二輪車和四輪車,總合20,655 輛。

- 根據日本汽車工業協會(JAMA)的報告,2021年乘用車和輕型車的產量為7,846,955輛。

- 由於這些因素,預計該地區的乙酸乙酯市場在預測期內將以穩定的速度成長。

乙酸乙酯產業概況

乙酸乙酯市場正在整合。市場的主要企業包括(不分先後順序)INEOS、Sipchem、塞拉尼斯公司、伊士曼化學公司和大賽璐公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 油漆和塗料應用需求不斷成長

- 軟包裝產業的需求不斷成長

- 天然皮革生產的嚴格監管標準

- 限制因素

- 用水性塗料和高固態被覆劑取代傳統被覆劑

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 應用

- 黏合劑和密封劑

- 油漆和塗料

- 顏料

- 製程溶劑

- 中間體

- 其他用途(增味劑、墨水)

- 最終用戶產業

- 車

- 人造皮革

- 食品和飲料

- 製藥

- 其他終端用戶產業(包裝)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- INEOS

- Jiangsu SOPO(Group)Co. Ltd

- Jubilant Pharmova Limited

- KAI Co. Ltd

- Sasol

- Sipchem

- SHOWA DENKO KK

- Wuxi Baichuan Chemical Industrial Co. Ltd

- Yip's Chemical Holdings Limited

- Linde PLC(Praxair Technology Inc.)

第7章 市場機會與未來趨勢

- 煤炭和天然氣乙醇生產創新

The Ethyl Acetate Market is expected to register a CAGR of greater than 5% during the forecast period.

The COVID-19 pandemic affected the sales of paints and coatings as construction activities were halted. However, the market recovered in the 2021-22 period, owing to rising consumption from various end-user industries such as automotive, food and beverages, and others. The demand for drugs like paracetamol, which consumes ethyl acetate-derived intermediates, has increased, thus stimulating the market demand in the pharmaceutical sector.

Key Highlights

- The major factor driving the market's growth is expected to be increasing demand from flexible packaging industries and applications in the paints and coatings industry. Additionally, stringent regulatory norms for natural leather production are likely to favor the market's growth.

- On the flip side, the replacement of conventional coatings with water-borne and high-solid coatings may hinder the growth of the ethyl acetate market.

- Innovations in the production of ethanol from coal/natural gas will likely provide new growth opportunities for the market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Ethyl Acetate Market Trends

Increasing Demand from the Paints and Coatings Industry

- The paints and coatings application segment accounted for the largest share of the ethyl acetate market. Ethyl acetate is used in paints as an activator or hardener. It is also used as an industrial solvent in coatings, adhesives, and rayon, primarily to dissolve the material. It is a common ingredient in lacquers, varnishes, and thinners that coat surfaces.

- The paints and coatings produced globally decorate and protect new construction and maintain existing structures, including residential homes and apartments, public buildings, and plants and factories. The remaining coatings are used to decorate and protect industrial products. Increased usage of paints and coatings is estimated to fuel the market for ethyl acetate.

- In addition, the increasing demand for epoxy coatings in the global aerospace and food and beverage sectors is expected to positively impact the demand for ethyl acetate over the forecast period.

- According to the American Coatings Association, the United States's paint and coatings industry is USD 26 billion. The United States exported USD 2.5 billion in paint and coatings products in 2021.

- The American Coatings Association also forecasts that paint demand in the Asia-Pacific will be at 29.5 billion liters valued at USD 100 billion by 2023. The Asia-Pacific will continue to produce and use more solvent-borne coatings than North America or Europe, but it will steadily switch these systems to compliant, sustainable, and green systems.

- According to Paintindia, the Indian paint industry is worth over INR 62,000 crores (USD 8 billion) and is one of the fastest-growing major paint economies in the world. The country has over 3,000 paint manufacturers, with nearly all global majors present in the country.

- The automotive industry is a major end-user of the paints and coating industry. Coating protects a vehicle's paint from road damage and the sun's ultraviolet rays, thereby reducing the amount of oxidization.

- According to the OICA, the total number of vehicles produced in 2021 was 80,145,988 and witnessed a growth rate of 3% compared to 2020. The Asia-Pacific region holds the highest production share in the global automotive market with 46,732,785 units in 2021.

Asia-Pacific Region to Dominate the Demand

- Asia-Pacific is expected to dominate the market studied during the forecast period. Moreover, significant growth rates are expected to be witnessed in Asia-Pacific, owing to increases in household incomes and urbanization rates in countries such as China, India, Malaysia, etc.

- China is considered to be the largest passenger car manufacturer in the world. Sales of passenger cars in China rose 4.4% Y-o-Y to 20.15 million units in 2021.

- The Shanghai Automotive Industry Corporation is China's leading vehicle manufacturer. The company sold over 5.46 million vehicles and delivered more than 5.81 million vehicles in 2021, a Y-o-Y increase of 5.5%. Thus, increased automotive vehicle sales are likely to boost the market for ethyl acetate used in automotive paints and coatings.

- The demand for ethyl acetate in India has been growing at a steady rate in the recent past. Automotive, food and beverage, and packaging are the key end-user industries that account for significant shares in the consumption of ethyl acetate in the country.

- According to the India Brand Equity Foundation, India is emerging as a key exporter of packaging materials in the global market. The export of packaging materials from India grew at a CAGR of 9.9% to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. This increase in the demand for packaging within the country is stimulating the demand for the market studied.

- In India, the demand for artificial leather is increasing in the automotive industry due to its breathability, heat-resistant properties, and elasticity. It is being used for door trims, sun visors, roof lining, and other cars, buses, trucks, bikes, steering wheel covers, knob covers, and gear boots. Thus, growth in the demand for artificial leather is estimated to fuel the market for ethyl acetate.

- According to the Society of Indian Automobile Association, the auto industry produced a total of 22,933,230 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles from April 2021 to March 2022, as against 22,655,609 units from April 2020 to March 2021.

- As per reports by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,846,955 units of passenger cars and light vehicles in 2021.

- Due to all such factors, the market for ethyl acetate in the region is expected to have a steady growth during the forecast period.

Ethyl Acetate Industry Overview

The ethyl acetate market is consolidated. Some major players in the market include (not in any particular order) INEOS, Sipchem, Celanese Corporation, Eastman Chemical Company, and Daicel Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Paints and Coatings Applications

- 4.1.2 Increasing Demand from the Flexible Packaging Industry

- 4.1.3 Stringent Regulatory Norms for Natural Leather Production

- 4.2 Restraints

- 4.2.1 Replacement of Conventional Coatings by Water-borne and High Solid Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Adhesives and Sealants

- 5.1.2 Paints and Coatings

- 5.1.3 Pigments

- 5.1.4 Process Solvents

- 5.1.5 Intermediates

- 5.1.6 Other Applications (Flavor Enhancers, Inks)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Artificial Leather

- 5.2.3 Food and Beverage

- 5.2.4 Pharmaceuticals

- 5.2.5 Other End-user Industries (Packaging)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Daicel Corporation

- 6.4.3 Eastman Chemical Company

- 6.4.4 INEOS

- 6.4.5 Jiangsu SOPO (Group) Co. Ltd

- 6.4.6 Jubilant Pharmova Limited

- 6.4.7 KAI Co. Ltd

- 6.4.8 Sasol

- 6.4.9 Sipchem

- 6.4.10 SHOWA DENKO KK

- 6.4.11 Wuxi Baichuan Chemical Industrial Co. Ltd

- 6.4.12 Yip's Chemical Holdings Limited

- 6.4.13 Linde PLC (Praxair Technology Inc.)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Production of Ethanol from Coal/Natural Gas