|

市場調查報告書

商品編碼

1685768

固體氧化物燃料電池-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Solid Oxide Fuel Cells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

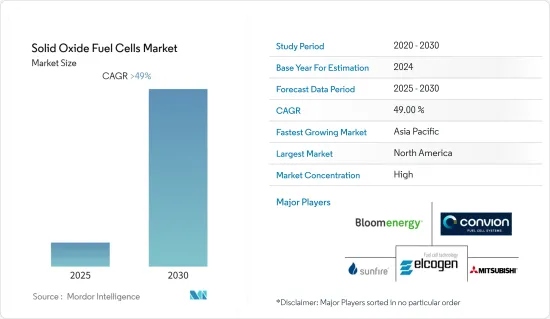

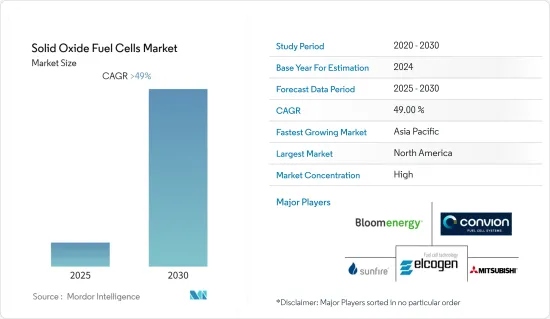

預計預測期內固體氧化物燃料電池市場複合年成長率將超過 49%。

2020 年,新冠疫情對市場產生了負面影響。現在,市場可能會恢復到疫情前的水準。

主要亮點

- 從長遠來看,由於 SOFC 比其他發電源具有更高的能量轉換效率並且長期更穩定,因此 SOFC 市場預計將持續成長。

- 然而,與鹼性燃料電池相比,該技術的成本較高,可能會限制市場。

- 由於對固定式高溫應用的需求,預計非車輛領域將在未來幾年佔據市場主導地位。

- 儘管如此,技術里程碑正在為市場創造充足的機會。例如,飛利浦66公司獲得了美國能源局(DOE)300萬美元的津貼,用於開發高性能可逆固體氧化物燃料電池。該公司將與喬治亞理工學院合作,證明該系統用於氫氣和發電的可行性。

- 由於政府對清潔能源的優惠政策,亞太地區可能在這一發展趨勢中佔據主要佔有率。

固體氧化物燃料電池(SOFC)市場趨勢

非汽車領域預計將主導市場

- 固定電源旨在提供電力,而不是移動。這些主要包括主電源、不斷電系統(UPS) 和熱電聯產 (CHP) 系統。熱電聯產系統中使用的 SOFC 可透過單一燃料源產生電能和熱能。 SOFC 既可用於大型固定式熱電聯產 (CHP) 電廠,也可用於小型固定式微型熱電聯產電廠。

- SOFC 因其具有供熱品質高、電效率高、燃料使用靈活、使用廉價材料和占地面積小等優點,被用於熱電聯產應用。使用 SOFC,CHP 系統可以以 60% 的效率在低功率輸出下發電,並且幾乎沒有污染排放。

- 固體氧化物燃料電池是家庭和企業固定發電系統的理想選擇。然而,它的高溫效率使其有別於其他用於此類目的的燃料電池,使其成為熱電汽電共生和熱電聯產系統的理想選擇。

- 在美國和歐洲,微型熱電聯產系統的安裝不斷加速,導致二氧化碳排放大幅減少。在英國,2010 年的二氧化碳排放量約為 9 噸,但透過合格的熱電聯產系統,此排放量已減少至約 4 噸。

- 該技術在住宅和商業領域正蓬勃發展。 2020年11月,康明斯公司宣布獲得兩項聯邦政府撥款,總額為460萬美元,用於推進美國固體氧化物燃料電池(SOFC)技術的商業化,幫助商業和工業客戶提供能源彈性並降低營運成本,同時透過部署總合燃料電池的熱電聯產系統最大限度地減少碳排放。

- 此外,Bloom Energy Solutions 也推出了基於固體氧化物燃料電池技術的先進分散式發電解決方案。它為客戶提供了可靠、經濟高效且清潔的電網替代方案。

- 同樣,微軟等公司也認為 SOFC 是電網的快速可行替代方案,並且比燃燒更具環境效益。微軟估計,它可以減少高達49%的二氧化碳排放、91%的氮氧化物排放量、68%的一氧化碳排放量以及93%的揮發性有機化合物排放量。據微軟稱,由於發電、輸電和配電損耗,發電廠輸送的能源中只有不到 35% 能夠到達資料中心。考慮到與現場照明、冷卻和能源儲存相關的能源消耗,發電廠提供的能源只有 17.5% 到達伺服器。

- 專為資料中心機架內發電而設計的 SOFC 系統有望產生更多的電力和更少的熱量,並且此類系統預計將透過資料中心現有的過量空氣或通風系統進行冷卻。

- 預計這些發展將在未來增加對固定式 SOFC 系統的需求。

亞太地區佔市場主導地位

- 由於政府支持國內能源結構中的永續能源,預計亞太地區的燃料電池部署將出現最高成長。中國和日本在燃料電池的廣泛應用領域(從資料中心備援服務到家庭熱電聯產系統)處於該地區領先地位。

- 隨著中國政府在低碳經濟轉型過程中越來越重視利用清潔能源技術,中國的固體氧化物燃料電池市場擁有巨大潛力。

- 此外,在國家和地方政府獎勵以及地方當局鼓勵採用氫動力汽車以減少污染的激勵計劃的支持下,中國的氫燃料SOFC市場正在獲得發展動力。

- 中國也正在見證超大規模平台的崛起,因此需要為中國超大規模平台提供資料中心服務。中國每100人就有50名網路用戶,連接生態系統還有很大的發展空間。資料中心很可能成為該國 SOFC 的主要消費者。

- 2022 年,Elcogen 完成了將固體氧化物燃料電池(SOFC) 和電堆技術融入其 Convion C60 動力裝置,以高效能產生熱能和電能。該計劃預計將成為未來類似計劃的模板,規模更大,使企業能夠有效率地生產熱能和電力,同時減少碳排放。

- 預計這些發展將推動該地區固體氧化物燃料電池市場的成長。

固體氧化物燃料電池(SOFC)產業概況

固體氧化物燃料電池市場比較分散。市場的主要企業(不分先後順序)包括三菱日立電力系統、杜邦、Bloom Energy、Sunfire、Convion 和 Elcogen AS。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2028 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 應用

- 對於車輛

- 非車輛使用

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- DuPont de Nemours Inc.

- Mitsubishi Hitachi Power Systems Ltd

- Watt Fuel Cell Corp.

- Sunfire GmbH

- Bloom Energy Corp.

- Elcogen AS

- Convion Ltd

- Hexis SA

- H2E Power Systems Inc.

- Ceres Power Holdings PLC

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 47178

The Solid Oxide Fuel Cells Market is expected to register a CAGR of greater than 49% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, the SOFC market is likely to grow in the future due to the energy conversion efficiency of the cells compared to other power generation sources and long-term stability.

- However, the market can be constrained due to the high cost of the technology compared to alkaline fuel cells.

- Non- Vehicular segment is expected to dominate the market in the coming years due to the demand for stationary high-temperature applications.

- Nevertheless, the technological milestones create ample opportunities for the market. For instance, Phillips 66 Company received a USD 3 million grant from the US Department of Energy (DOE) to develop high-performance reversible solid oxide fuel cells. The company will collaborate with the Georgia Institute of Technology to demonstrate the feasibility of this system for hydrogen and electricity generation.

- The Asia-Pacific region is likely to have the major share in this evolving scenario due to the favorable government policies for cleaner power supply sources.

Solid Oxide Fuel Cells (SOFC) Market Trends

Non-Vehicular segment expected to Dominate the Market

- Stationary power sources are designed to provide power, not to move. It primarily includes main power units, uninterruptible power systems (UPS), and heat and power (CHP) co-generation systems. SOFC's used in CHP systems generate electricity and heat from a single fuel source. SOFC's are used in both large stationary combined heat and power (CHP) and small stationary micro-CHP.

- Due to the advantages such as high-quality heat supply, high electrical efficiency, flexibility of fuel use, use of inexpensive materials, and small installation footprints, SOFC's are used in CHP applications. Using SOFC, the CHP system generates electricity with almost zero pollutant emissions at 60% efficiency even in low power ranges.

- Solid oxide fuel cells are best suited for stationary power generation systems for homes and businesses. However, their high-temperature efficiency distinguishes them from other fuel cells used for such purposes, making them best suited for cogeneration systems or combined heat and power systems.

- The United States and Europe witnessed a constant acceleration in the installed micro-CHP systems, which reduced carbon-dioxide emissions to a great level. In the United Kingdom, the CO2 emissions were recorded at around nine metric ton in 2010, which were reduced to around four metric ton with the qualifying CHP systems.

- The technology is gaining momentum in the residential sector and the Commercial segment. In November 2020, Cummins Inc. announced that it received two federal grants of a total of USD 4.6 million to advance the commercialization of solid oxide fuel cell (SOFC) technology in the United States to help commercial and industrial customers minimize their carbon impact while providing energy resiliency and cutting costs in their businesses by installing fuel cell-based CHP systems.

- Furthermore, Bloom Energy Solutions has introduced an advanced distributed electric power generation solution based on solid oxide fuel cell technology. This offers customers a reliable, and cost-effective clean alternative to the electric grid.

- Similarly, companies such as Microsoft consider SOFCs to be a quick and viable alternative to the electric grid and can still provide some environmental advantages over combustion. Microsoft estimates that carbon dioxide emissions could be reduced by up to 49%, nitrogen oxide by 91%, carbon monoxide by 68%, and volatile organic compounds by 93%. Microsoft says less than 35% of the energy provided by a power plant is delivered to the data center due to generation, transmission and distribution losses. When energy consumption associated with lighting, cooling, and energy storage on the site is considered, only 17.5% of the energy supplied by a power plant reaches the servers.

- It is expected that SOFC systems designed for in-rack power generation in data centers are likely to produce more electricity and less heat and that such will be cooled with excess air and air ventilation systems already present in the data center

- Such developments are expected to boost the demand for Stationary SOFC systems in the future.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to have the highest growth in the deployment of fuel cells due to the government's support for sustainable sources in the domestic energy mix. China and Japan are leading in the region with vast applications of fuel cells, ranging from backup services for data centers and combined heat and power systems for homes.

- China has great potential in the solid oxide fuel cell market as the government is increasingly focusing on ways to utilize clean energy technology in order to switch to a low-carbon economy.

- Moreover, the SOFC market with hydrogen as fuel in the country has been gaining traction on the back of favorable national and provincial government subsidies and incentive programs from local authorities to encourage the uptake of hydrogen vehicles to cut pollution.

- China has also witnessed a rise in its hyper-scale platforms, owing to which providing data center services for Chinese hyper-scale platforms has become necessary. China has 50 internet users per 100 population, indicating scope for a lot of development and the connectivity ecosystem. The data centers can become a major consumer for the SOFCs in the country.

- In 2022, Elcogen completed the incorporation of Solid Oxide Fuel Cell (SOFC) and stack technology into the Convion C60 power unit to generate both heat and electricity at high-efficiency levels. The project provides a template for future projects of this kind, also at scale, which is expected to enable companies to generate both heat and electricity at high-efficiency levels, all whilst reducing carbon emissions.

- Such developments are likely to elevate the growth of the solid oxide fuel cells market in the region.

Solid Oxide Fuel Cells (SOFC) Industry Overview

The solid oxide fuel cells market is fragmented. Some of the key players in the market (in no particular order) include Mitsubishi Hitachi Power Systems Ltd, DuPont de Nemours Inc., Bloom Energy Corp., Sunfire GmbH, Convion Ltd, and Elcogen AS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Vehicular

- 5.1.2 Non-Vehicular

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South-America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 DuPont de Nemours Inc.

- 6.3.2 Mitsubishi Hitachi Power Systems Ltd

- 6.3.3 Watt Fuel Cell Corp.

- 6.3.4 Sunfire GmbH

- 6.3.5 Bloom Energy Corp.

- 6.3.6 Elcogen AS

- 6.3.7 Convion Ltd

- 6.3.8 Hexis SA

- 6.3.9 H2E Power Systems Inc.

- 6.3.10 Ceres Power Holdings PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219