|

市場調查報告書

商品編碼

1685772

檸檬酸:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Citric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

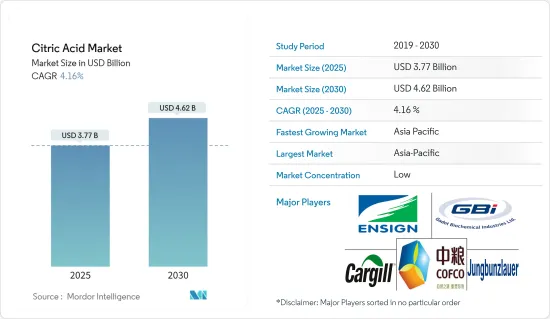

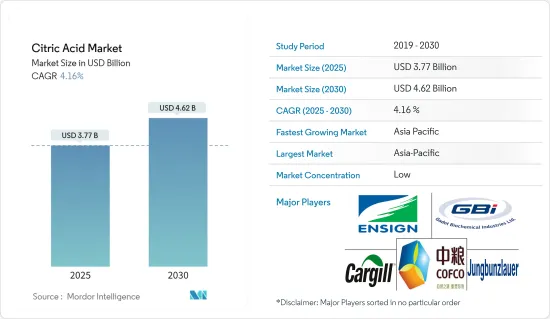

預計 2025 年檸檬酸市場規模為 37.7 億美元,預計到 2030 年將達到 46.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.16%。

主要亮點

- 檸檬酸的多功能性使其成為食品和非食品等各種行業的寶貴成分。它可用作酸味劑、防腐劑、抗氧化劑、緩衝劑和粘合劑。檸檬酸的應用涵蓋各個領域,包括食品和飲料、藥物和個人護理,包括液體和無水形式。在食品中,添加檸檬酸作為添加劑,以增強酸味、澀味和風味。而檸檬酸的存在能抑制微生物的生長,進而延長食品的保存期限,進而推動對檸檬酸的需求。

- 檸檬酸在世界各地作為藥品和膳食補充劑的用途越來越廣泛。使用檸檬酸有助於保存和穩定活性藥物成分,還可以改善咀嚼片和糖漿型藥物的口感。眾所周知,檸檬酸還可以增加鎂和鈣等礦物質補充劑的吸收。

- 此外,越來越多的消費者開始轉向素食,因此尋求天然檸檬酸萃取物。由於這一趨勢,市場相關人員專注於不斷推出具有改進的應用能力和品質標準的新產品。因此,預計未來幾年檸檬酸市場將大幅成長。

檸檬酸市場趨勢

對潔淨標示和天然/有機成分的需求不斷增加

- 由於政府訂定禁令和限制措施以及各種研究計劃,消費者對合成食品添加劑對健康的不利影響的認知正在不斷提高。這些添加劑會導致運動過度、腫瘤、皮疹、腎損傷、偏頭痛、睡眠障礙、氣喘和腸道健康不良等健康問題。這導致了人們轉向天然添加劑,並越來越喜歡清潔標籤和天然成分。

- 世界衛生組織(WHO)、食品藥物管理局(FDA)、歐洲食品安全局以及印度食品安全和標準局(FSSAI)等政府機構已經認知到合成成分的有害影響,並製定了其在食品中的使用指南,食品和飲料製造商必須遵守。此外,為了解決食品安全問題,各組織已經推出了宣傳計劃和研究計劃,以推廣在食品和飲料產品中使用有機植物衍生成分。

- 例如,Organic India 將於 2022 年在印度發起一項名為「#TowardsHealthyEating」的新宣傳活動,旨在促進兒童的健康飲食習慣。因此,全球食品產業在食品開發過程中更加重視這些方面,以滿足不斷成長的消費者需求。

2022 年亞太地區將佔據最大佔有率

- 中國是亞洲最大的食品添加劑生產國和出口國之一,佔全球食品飲料行業大部分配料類別的近四分之三市場。中國是檸檬酸的重要出口國,因為中國大規模生產檸檬酸原料,且供應成本低於其他地區。

- 此外,中國是全球主要原料消費國之一,其不斷擴張的製藥業為中國檸檬酸市場創造了成長機會。例如,2021年中國醫藥業務實現營業收益3.3兆元(5,156億美元),較上年成長近20%。此外,對檸檬酸基清潔劑、洗碗清潔劑和除鏽劑等家用清潔劑產品的需求不斷成長,進一步推動了中國市場的成長。

- 同樣,在日本,酸味柑橘類水果是繼鹽之後最重要的調味品之一,經常用於調味日本料理。由於日本對健康產品的需求很高,製造商將天然檸檬酸加入食品中,將其作為安全、不含防腐劑的全食品出售,以滿足日本市場對健康食品日益成長的需求。

- 日本是亞洲最富裕和文化最多元化的消費市場之一,他們青睞描述性標籤,以便消費者更了解其產品配方中使用的成分,這使得天然檸檬酸成為日本食品製造商的理想選擇。

檸檬酸產業概況

全球檸檬酸市場競爭激烈且較為分散,主要企業包括:阿徹丹尼爾斯米德蘭公司(ADM)、嘉吉公司、榮格本茨勞爾公司、中糧生化、加多特生化工業有限公司等。上述公司憑藉著不斷推出高品質、多功能的新產品等因素佔據了市場主導地位。為了獲得競爭優勢,品牌著重在口味和高溶解度方面實現產品的差異化。

此外,為了維持市場地位,公司在擴大分銷管道的同時,也正在投資研發和行銷。此外,透過投資開發新一代檸檬酸原料生產技術,該公司採取了競爭策略,從而降低成本並提高產品永續性。整體而言,市場參與者的定位取決於他們以創新的方式提供優質產品、滿足客戶多樣化需求的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 形式

- 液體

- 無水

- 應用

- 飲食

- 麵包店

- 糖果零食

- 乳製品

- 飲料

- 其他食品和飲料

- 藥品

- 個人護理

- 其他用途

- 飲食

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Jungbunzlauer Suisse AG

- Cargill Incorporated

- Merck KGaA

- Gadot Biochemical Industries

- Archer Daniels Midland Company

- Foodchem International Corporation

- Cofco Biochemical

- Posy Pharmachem Pvt Ltd

- Hawkins Pharmaceutical Group

- Saudi Bio-Acids Company

第7章 市場機會與未來趨勢

The Citric Acid Market size is estimated at USD 3.77 billion in 2025, and is expected to reach USD 4.62 billion by 2030, at a CAGR of 4.16% during the forecast period (2025-2030).

Key Highlights

- The versatile nature of citric acid makes it a valuable component in various industries, including food and non-food sectors. It is utilized as an acidulant, preservative, antioxidant, buffering, and binding agent. The applications of citric acid, in both liquid and anhydrous forms, span across different domains, such as food and beverages, pharmaceuticals, personal care, and more. In food products, citric acid is added as an additive to intensify sourness, tartness, and flavor. Moreover, its inclusion suppresses microbial growth, thereby increasing the shelf life of food products and driving the demand for citric acid.

- The popularity of citric acid in medicines and dietary supplements is on the rise globally. Its use helps preserve and stabilize the active ingredients in medicines and can also enhance the taste of chewable and syrup-based medications. Citric acid is also known to boost the absorption of mineral supplements like magnesium and calcium.

- Moreover, consumers are increasingly demanding citric acid extraction from natural sources as they prefer vegan sources for their products. This trend has led market players to focus on continuously launching new products with improved application capabilities and high-quality standards. As a result, the market for citric acid is expected to grow significantly in the coming years.

Citric Acid Market Trends

Increasing Demand for Clean-Label and Natural/Organic Ingredients

- With the introduction of bans and limits by governments and various research projects, consumers are increasingly becoming aware of the adverse health effects of synthetic food additives. These additives can lead to health issues such as hyperkinesia, tumors, skin rashes, kidney damage, migraine, sleep disturbance, asthma, and ill-gut health. As a result, there has been a shift towards natural additives and a preference for clean labels and natural ingredients among consumers.

- Government authorities such as the World Health Organization (WHO), Food and Drug Administration (FDA), European Food Safety Authority, and Food Safety and Standards Authority of India (FSSAI) have recognized the hazardous effects of synthetic ingredients and have laid down guidelines for their use in food products, which food and beverage manufacturers must comply with. Furthermore, various organizations have launched awareness programs and research projects promoting the use of organic ingredients extracted from plant sources in food and beverage products to address concerns regarding food safety.

- For instance, Organic India launched a new campaign in India in 2022 called '#TowardsHealthyEating,' with the aim of promoting healthy eating practices among children. As a result, the global food industry is responding to the high consumer demand by placing additional emphasis on these aspects during the food product development process.

Asia-Pacific Holds the Largest Share For the Year 2022

- China is one of the largest producers and exporters of food additives among Asian countries, accounting for nearly three-quarters of the global ingredients market in most ingredient categories used in the food and beverage industry. China produces ingredients on a large scale and supplies them at a lower cost than other regions, making it a significant exporter of citric acid.

- Moreover, China is also one of the major consumers of ingredients globally, and the expanding pharmaceutical industry is creating growth opportunities for the citric acid market in China. For instance, in 2021, the Chinese pharmaceutical business generated operating revenue of CNY 3.3 trillion (USD 515.6 billion), representing a growth of nearly 20% from the previous year. Additionally, the growing demand for household cleaners, including detergents, dish soaps, and rust remover products, that use citric acid as an ingredient is further driving the market growth in China.

- Similarly, in Japan, the native tart citrus is one of the country's most essential seasonings after salt and is commonly used as a flavoring agent in Japanese cuisine. With the high demand for healthy products in the country, manufacturers are incorporating naturally sourced citric acid in food items to sell their products as safe, preservative-free, and natural, meeting the increasing demand for healthy foods in the Japanese market.

- Japan is one of the most affluent and cultured consumer markets in Asia, with a preference for descriptive labeling that provides a better understanding of the ingredients used in the product formulation, making naturally sourced citric acid an ideal choice for food manufacturers in Japan.

Citric Acid Industry Overview

The global citric acid market is highly competitive and fragmented, with key players such as Archer Daniels Midland (ADM), Cargill Incorporated, Jungbunzlauer Company, Cofco Biochemical, and Gadot Biochemical Industries Ltd. These players dominate the market owing to factors such as the continuous launch of new products with high-quality and versatile applications. To gain a competitive advantage, brands are focusing on differentiating their products in terms of taste and high solubility.

Companies are also investing in research and development (R&D) and marketing while expanding their distribution channels to maintain their position in the market. Furthermore, they are adopting competitive strategies by investing in developing new-generation technologies to produce citric acid ingredients, which can help reduce costs and improve the product's sustainability. Overall, the market players' positioning is determined by their ability to innovate and provide high-quality products that cater to the varying demands of the customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Liquid

- 5.1.2 Anhydrous

- 5.2 Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery

- 5.2.1.2 Confectionery

- 5.2.1.3 Dairy

- 5.2.1.4 Beverages

- 5.2.1.5 Other Foods and Beverages

- 5.2.2 Pharmaceutical

- 5.2.3 Personal Care

- 5.2.4 Other Applications

- 5.2.1 Food and Beverage

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jungbunzlauer Suisse AG

- 6.3.2 Cargill Incorporated

- 6.3.3 Merck KGaA

- 6.3.4 Gadot Biochemical Industries

- 6.3.5 Archer Daniels Midland Company

- 6.3.6 Foodchem International Corporation

- 6.3.7 Cofco Biochemical

- 6.3.8 Posy Pharmachem Pvt Ltd

- 6.3.9 Hawkins Pharmaceutical Group

- 6.3.10 Saudi Bio-Acids Company