|

市場調查報告書

商品編碼

1685817

毫米波技術-市場佔有率分析、產業趨勢與統計、成長預測(2025-2031)Millimeter Wave Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

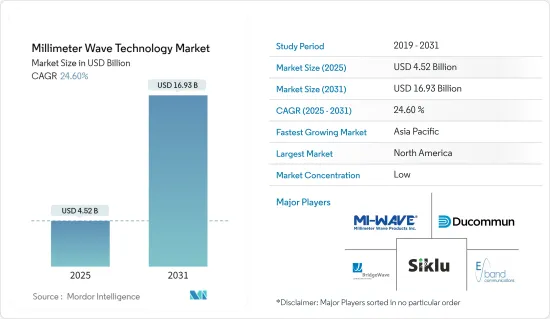

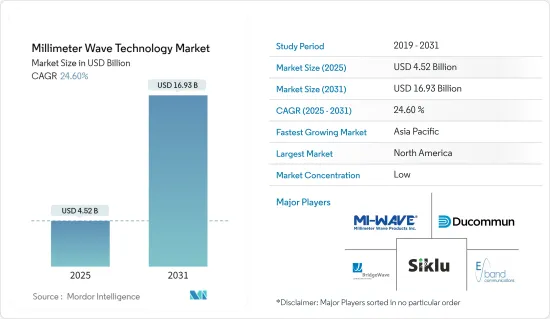

毫米波技術市場規模預計在 2025 年為 45.2 億美元,預計到 2031 年將達到 169.3 億美元,預測期內(2025-2031 年)的複合年成長率為 24.6%。

主要亮點

- 該技術將滿足連網家庭、AR/VR 設備、雲端遊戲系統和其他雲端連接設備的資料需求的大幅成長。此外,50 GHz 以上的毫米波頻寬可以以大而重的區塊形式提供額外的 20 GHz 或更多頻寬,從而實現更高的資料速率。一些傳統無線電頻寬,尤其是 26 GHz 和 28 GHz,對於回程傳輸來說前景不明朗,因為它們目前的目標是 5G 無線存取。 ETSI mWT ISG 已經表示擔心,在為 5G 分配毫米波頻譜時,需要考慮營運商繼續運行其 3G 和 4G 網路回程傳輸的能力。

- 由於頻率再生性和寬通道頻寬等優勢,毫米波頻段的使用正在增加,這使得毫米波和亞毫米波頻段非常適合 5G 增強行動寬頻所需的高容量。因此,在接取網路中使用毫米波頻段來提高用戶設備吞吐量和基地台回程傳輸正在推動對毫米波技術的需求。

- 預計預測期內市場將以溫和的速度成長。政府部署 5G 的舉措以及物聯網和智慧城市等新技術的進步正在鼓勵市場參與者開發新服務/解決方案以佔領市場佔有率。

- 從 4G 到 5G 的過渡推動了對毫米波頻寬的需求,毫米波頻段具有更寬的頻寬和更快的資料速率,從而推高了生產成本。這些大批量零件的零件和勞動成本不斷上漲,迫使製造商重新評估自動化零件測試的經濟性。

- 對相容毫米波組件的需求迫使製造商投入大量資金。 mmWave 5G 設備的製造和銷售成本要高得多。部署足夠多的毫米波小型基地台以覆蓋整個城市的挑戰預計將減緩近年來的市場採用速度。

毫米波技術的市場趨勢

天線和收發器部分佔據了很大的市場佔有率

- 高性能毫米波設備需要高效率、低剖面的天線來確保可靠、無干擾的通訊。由於波長較小,毫米波技術基礎設施需要將大型天線陣列封裝在較小的實體尺寸內,這推動了針對毫米波 (mm) 技術設計的天線和收發器的需求,並推動了市場成長。

- 毫米波技術的高資料傳輸支援各種應用,包括即時遊戲、高清視訊串流和其他頻寬應用,這些應用需要天線和收發器來中繼和轉換訊號,從而對毫米波技術的微帶、片上整合喇叭、透鏡、反射器和其他天線產生了需求。

- 根據 GSMA 最近發布的報告,預計到 2030 年,5G 應用程式將達到約 10 億個連線。該技術將支撐未來的行動創新並推動持續部署,並可能在 2030 年為全球經濟增加約 1 兆美元。根據該報告,到 2023 年,非洲和亞洲將有 30 個新市場推出 5G 服務。隨著 5G 部署的不斷擴大,網路營運商正在加緊努力擴展 5G 固定無線存取 (FWA) 服務。固定寬頻普及率較低且收入不斷成長的市場也將迎來高於平均的 5G 成長。

- 市場供應商正在採取策略性舉措,擴大產品系列,以佔領相當大的市場佔有率。例如,2023 年 10 月,馬來西亞 5G 網路營運商 DNB(Digital Nasional Berhad)與馬來西亞電信™ 和中國供應商中興通訊股份有限公司合作,進行 5G 即時試驗,達到高達 28Gbps 的速度。中興通訊表示,此次夥伴關係預計將利用馬電訊現有的網路基礎設施、數位專業知識和中興通訊的毫米波有源天線單元,為馬來西亞下一代傳輸網路提供首個獨立的 5G 核心。

- 2023年8月,射頻和微波產品供應商Marki Microwave收購了亞太地區赫茲波導技術供應商Precision Millimeter Wave LLC的波導業務。 Marki Microwave 將提供 100 多種標準商用波導產品,包括天線、連接器、開關和隔離器,以及從毫米波到亞太赫茲的多種自訂波導產品。

- 各種終端用戶應用對高速通訊的需求、對相控天線和毫米波通訊高性能收發器的需求正在刺激市場的成長,而毫米波技術市場相關人員的收購、投資和合作則為市場的成長提供了支持。

預計北美將佔據較大的市場佔有率

- 美國在利用毫米波頻譜進行各種應用方面取得了長足的進展。聯邦通訊委員會 (FCC) 等監管機構負責分配和競標毫米波頻寬以供授權和未授權使用。具體來說,FCC已經向5G和其他無線通訊技術開放了28GHz、37GHz、39GHz和47GHz頻段的頻率。

- 美國5G 網路的推出正在推動毫米波技術的採用。此外,總部位於亞利桑那州的網路測試和測量公司 Viavi Solutions 表示,美國是全球採用網路存取的城市最多的國家之一。

- 例如,截至2023年4月,美國約有503個城市已採用5G網路存取。排名第二的是中國,5G涵蓋356個城市。因此,毫米波頻率正在成為 5G 部署的關鍵組成部分,尤其是對於都市區的高速、低延遲 5G 網路而言。通訊公司正在積極推出包括毫米波頻率在內的 5G 基礎設施,以實現超快的網際網路速度並支援擴增實境(AR)、虛擬實境 (VR) 和物聯網等新興用例。

- 根據CTIA(2023年7月)的報導,美國是全球5G部署領先的國家,並且比其他任何國家都擁有更多的5G接入。 5G 響應速度更快的網路和速度將推動企業和消費者的強勁採用。無線產業正在提前推出 5G,利用創紀錄的資本和全球最高額度的資本,以比以往任何一代無線技術更快的速度推出 5G。

- 預計5G最終將為國內經濟增加1.5兆美元,並創造新的就業(至少450萬個)。美國5G網路目前已覆蓋超過3.25億人,是全球覆蓋率最高的5G網路。 Ookla 認為美國是全球無障礙領域的領導者,超過 54% 的 5G 裝置連接已連接到 5G 網路。

- 加拿大在利用毫米波頻譜實現多種用途方面取得了長足進步。加拿大創新、科學和經濟發展部 (ISED) 等監管機構為許可和未許可用途分配毫米波頻率並管理其使用。 26GHz、28GHz、38GHz 和其他頻寬的頻率對於毫米波應用來說是重要的資產。

- 此外,該國對 5G 網路的需求日益成長,5G 網路利用毫米波頻率來提供超快的網路速度和低延遲。例如,愛立信的一份報告發現,截至 2022 年 11 月,400 萬加拿大智慧型手機用戶表示打算在未來 12 到 15 個月內升級到 5G 服務。此外,只有三分之一的加拿大 5G 用戶認為他們超過 50% 的時間都連接到網路,45% 的用戶仍然表示他們擔心覆蓋範圍。這些重大問題預計將導致人們關注在毫米波頻譜中部署更高頻率的無線電波,以滿足日益成長的需求。

毫米波技術市場概況

mmWave 技術市場分散,主要參與者包括 Siklu Communication Ltd(Ceragon Networks Ltd)、Bridgewave Communications Inc(Remec Broadband Wireless International)、E-band Communications LLC(Axxcss Wireless Solutions Inc)、Millimeter Wave Products Inc. 和 Ducommun Incorporated。市場上的公司正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 12 月 - Eravant(SAGE Millimeter Inc.)獲得了一項新型電連接器系列專利,該系列可用於快速成長的毫米波電子領域。該專利設備與現有的同軸介面相容。 Uni-Guide 波導連接器可協助組件製造商以更少的封裝設計提供各種波導尺寸和方向。

- 2023 年 8 月 - Sikul 是一家為數位城市和Gigabit無線接入 (GWA) 提供毫米波 (mmWave) 解決方案的全球供應商,推出了其新的 MultiHaul TG T261 終端單元。 T261 是 Sicuru MultiHaul TG 系列的第四個新成員,該系列主要為點對多點 60GHz 產品,並通過了 Terragraph (TG) 認證。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

- GaN 在毫米波應用的重要性

- 毫米波基板概況(包括 LCP、PI 和 PTFE 等毫米波基板及其對基地台、電話和周邊設備等 5G 基礎設施的影響)

第5章市場動態

- 市場促進因素

- 基地台無線回程傳輸的普及

- 5G演進可望推動市場

- 市場挑戰/限制

- 製造可互換零件的需求和零件成本的上升

- 降低訊號強度的技術漏洞

第6章市場區隔

- 依組件類型

- 天線和收發器

- 通訊和網路

- 介面

- 頻率及相關零件

- 影像學

- 其他組件

- 按許可模式

- 全部/部分許可

- 未經許可

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 中東和非洲

- 拉丁美洲

- 北美洲

第7章競爭格局

- 公司簡介

- Siklu Communication Ltd(Ceragon Networks Ltd)

- Bridgewave Communications Inc.(REMEC Broadband Wireless Networks LLC)

- E-band Communications LLC(Axxcss Wireless Solutions Inc.)

- Millimeter Wave Products Inc.

- Ducommun Incorporated

- Eravant(SAGE Millimeter Inc.)

- Keysight Technologies Inc.

- Farran Technology Ltd

- Smiths Interconnect Group Limited

- NEC Corporation

- L3Harris Technologies Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Millimeter Wave Technology Market size is estimated at USD 4.52 billion in 2025, and is expected to reach USD 16.93 billion by 2031, at a CAGR of 24.6% during the forecast period (2025-2031).

Key Highlights

- The technology accommodates the massive increase in data demands from connected homes, AR/VR devices, cloud gaming systems, and other cloud-connected devices. Furthermore, mmWave bands above 50 GHz can provide over 20 GHz additional bandwidth in large, heavy chunks, allowing higher data rates. Some traditional wireless bands, notably 26 GHz and 28 GHz, have an uncertain future for backhaul since they are now targeted for 5G radio access. ETSI's mWT ISG already expressed concern regarding the need, while allocating mmWave bands for 5G, to consider operators' ability to continue operating the backhaul for their 3G and 4G networks.

- The rising use of millimeter-wave bands, owing to the advantages such as frequency re-usability and large channel bandwidths, make millimeter-wave and sub-millimeter, suitable for the high capacities required by 5G enhanced Mobile Broadband. Thus, the use of millimeter-wave bands for the access networks to increase the throughput of the User Equipment and backhaul of the base stations is adding demand for Millimeter Wave Technology.

- The market is expected to grow moderately during the forecasted period. The government initiatives toward the deployment of 5G and advancement in new technologies like IoT and smart cities are pushing the market players to develop new services/solutions to capture the market share.

- Migration from 4G to 5G has increased the demand for mmWave bands with wider bandwidths and high-speed data rates, increasing manufacturing costs. These higher costs for components and operations in high-volume manufacturing parts have forced manufacturers to rethink the economics of automated component testing.

- Demands for compatible millimeter wave components are adding substantial expense to manufacturers. mmWave 5G devices are substantially expensive to produce and sell. The challenge of deploying enough of the mmWave small cells to cover entire cities is anticipated to slow down market adoption in recent years.

Millimeter Wave Technology Market Trends

Antennas and Transceivers Segment Holds Significant Market Share

- High-performing millimeter-wave devices require efficient low-profile antennas to ensure reliable and interference-free communications, and due to small wavelength, mmWave technology infrastructure requires large antenna arrays to be packed in miniature physical dimensions, which fueling the requirement of antennas and transceivers designed for the millimeter (mm) wave technology, fueling the market growth.

- The higher data transfer rate of the mmWave technology has various uses in real-time gaming, high-quality video streaming, and other bandwidth-intensive applications, which require antennas and transceivers for relaying and transforming the signals, creating a demand for microstrip, on-chip integrated horn, lens, and reflector, and other antennas for mmWave technology.

- According to a recent GSMA report, 5G adoption is anticipated to reach around a billion connections by 2030. The technology will likely underpin future mobile innovation and boost ongoing deployments, adding almost USD 1 trillion to the global economy in 2030. The report states that throughout 2023, 30 new markets across Africa and Asia will launch 5G services. As 5G adoption continues to scale, network operators are increasing their efforts to expand their 5G fixed wireless access (FWA) offerings. Markets with low fixed broadband penetration and rising incomes will also see faster-than-average 5G growth.

- Market vendors are undergoing strategic initiatives to expand antennas and transceivers' product portfolio for mmWave technology applications and hold a major market share. For instance, in October 2023, Malaysia's 5G network operator, Digital Nasional Berhad (DNB), partnered with Telekom Malaysia (TM) and Chinese vendor ZTE Corporation to conduct a 5G live trial which would deliver speeds up to 28 Gbps. ZTE stated that this partnership was expected to help leverage TM's established network infrastructure, digital expertise, and ZTE's mmWave active antenna unit to deliver the first standalone 5G core of Malaysia for the next-generation transport network.

- In August 2023, Marki Microwave, a provider of radio frequency and microwave products, acquired the waveguide business of Precision Millimeter Wave LLC, a supplier of sub-THz waveguide technology. Marki Microwave plans to offer over 100 standard commercial waveguide products and multiple custom waveguide products like mmWave to sub-THz, including antennas, connectors, switches, and isolators.

- The need for high-speed communications in various end-user applications and the need for phase antennas and highly capable transceivers for mmWave communication add growth to the market, which is supported by acquisitions, investments, and collaborations among the millimeter wave technology market stakeholders.

North America is Expected to Hold Significant Market Share

- The United States has made significant strides in utilizing the millimeter wave spectrum for various applications. Regulatory bodies like the Federal Communications Commission (FCC) have allocated and auctioned millimeter wave frequency bands for licensed and unlicensed use. Notably, the FCC opened spectrum in the 28 GHz, 37 GHz, 39 GHz, and 47 GHz bands for 5G and other wireless communication technologies.

- The rollout of 5G networks in the United States has driven the adoption of millimeter wave technology. Moreover, Viavi Solutions, an Arizona-based network test and measurement company, stated that the United States was one of the significant global countries with the most cities adopting network access.

- For instance, as of April 2023, around 503 cities adopted 5G network access in the country. China followed in second, with 5G availability in 356 cities. As a result, millimeter wave frequencies are a key component of 5G, particularly in deploying high-speed, low-latency 5G networks in urban areas. Telecom companies have been actively deploying 5G infrastructure that includes millimeter wave spectrum to deliver ultra-fast internet speeds and support emerging use cases like augmented reality (AR), virtual reality (VR), and IoT.

- According to CTIA (July 2023), the United States was the leading country in the world to deploy 5G, with more 5G accessibility than any other nation. 5G's more responsive networks and faster speeds drive strong enterprise and consumer adoption. The wireless sector is distributing 5G ahead of schedule, capitalizing records and world-leading capital amounts to deploy 5G faster than any preceding generation of wireless.

- It is expected that 5G will eventually add USD 1.5 trillion to the nation's economy and create new jobs (at least 4.5 million). 5G networks across the country already cover over 325 million individuals, giving the world's most accessible 5G networks. Ookla places the United States as the world leader in accessibility, with more than 54% of connections from 5G-capable handsets linking to a 5G network most of the time.

- Canada has made substantial strides in leveraging the millimeter wave spectrum for various applications. Regulatory authorities, such as Innovation, Science, and Economic Development Canada (ISED), allocate and control the use of millimeter wave frequencies for licensed and unlicensed purposes. Frequencies in the 26 GHz, 28 GHz, 38 GHz, and other bands are significant assets for millimeter wave applications.

- Moreover, the country's rising need for 5G networks that leverage millimeter wave frequencies to deliver ultra-fast internet speeds and low latency is increasing. For instance, according to Ericsson reports, as of November 2022, in the upcoming 12 to 15 months, four million Canadian smartphone users intend to upgrade to 5G service. Additionally, only a third of Canadian 5G users believe they are connected to the network more than 50% of the time, while 45% of users still stated they have coverage concerns. Such significant concerns are anticipated to focus on deploying high-frequency radio waves in the millimeter wave spectrum to capture the growing demand.

Millimeter Wave Technology Market Overview

The millimeter wave technology market is fragmented with the presence of major players like Siklu Communication Ltd (Ceragon Networks Ltd), Bridgewave Communications Inc. (Remec Broadband Wireless International), E-band Communications LLC (Axxcss Wireless Solutions Inc.), Millimeter Wave Products Inc., and Ducommun Incorporated. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023 - Eravant (SAGE Millimeter Inc.) received a patent related to a novel series of electrical connectors used in the rapidly growing field of millimeter-wave electronics. The patented devices are compatible with the existing coaxial interfaces. Uni-Guide waveguide connectors help component manufacturers offer a wide range of waveguide sizes and orientations using a reduced number of package designs.

- August 2023 - Siklu, a global provider of millimeter wave (mmWave) solutions for Digital City and Gigabit Wireless Access (GWA), launched its new MultiHaul TG T261 terminal unit. The T261 mainly represents Siklu's fourth addition to the MultiHaul TG family of point-to-multipoint 60 GHz products and is Terragraph (TG) certified.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

- 4.4 Significance of GaN Across mmWave Applications

- 4.5 mmWave Substrate Landscape (to Include Coverage on mmWave Substrates Such as LCP, PI, and PTFE, along With Their Impact on 5G Infrastructure, Including Base Stations, Phones, and Peripherals)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Wireless Backhaul of Base Stations

- 5.1.2 Evolution of 5G is Expected to Drive the Market

- 5.2 Market Challenges/Restraints

- 5.2.1 Need for Manufacturing of Compatible Components and Rising Cost of Components

- 5.2.2 Technological Vulnerabilities Leading to Reduced Wave Strength

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 Antennas and Transceiver

- 6.1.2 Communications and Networking

- 6.1.3 Interface

- 6.1.4 Frequency and Related Components

- 6.1.5 Imaging

- 6.1.6 Other Components

- 6.2 By Licensing Model

- 6.2.1 Fully/Partly Licensed

- 6.2.2 Unlicensed

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siklu Communication Ltd (Ceragon Networks Ltd)

- 7.1.2 Bridgewave Communications Inc. (REMEC Broadband Wireless Networks LLC)

- 7.1.3 E-band Communications LLC (Axxcss Wireless Solutions Inc.)

- 7.1.4 Millimeter Wave Products Inc.

- 7.1.5 Ducommun Incorporated

- 7.1.6 Eravant (SAGE Millimeter Inc.)

- 7.1.7 Keysight Technologies Inc.

- 7.1.8 Farran Technology Ltd

- 7.1.9 Smiths Interconnect Group Limited

- 7.1.10 NEC Corporation

- 7.1.11 L3Harris Technologies Inc.