|

市場調查報告書

商品編碼

1685870

氦氣 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Helium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

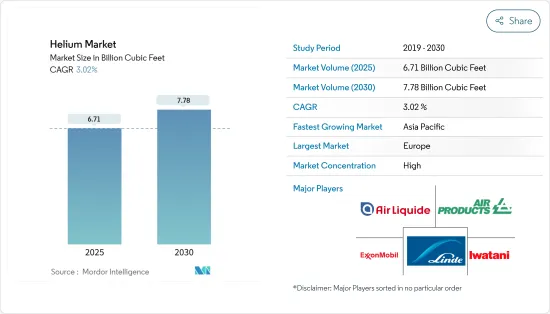

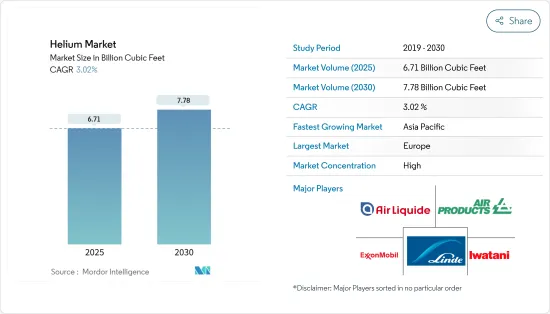

預計 2025 年氦氣市場規模為 67.1 億立方英尺,預計 2030 年將達到 77.8 億立方英尺,預測期內(2025-2030 年)的複合年成長率為 3.02%。

由於新冠疫情,航太業受到嚴重影響,導致近期航太航太業萎縮,對氦氣在航太應用的成長前景產生了負面影響。然而,受醫療保健等各種終端用途消費成長的推動,2021 年消費強勁反彈。

主要亮點

- 半導體產業對氦氣的消耗量增加以及航空業對氦氣的使用量增加是推動市場成長的主要因素。

- 另一方面,氦氣提取製程的高成本和氦氣供應的不穩定可能會阻礙市場成長。

- 然而,解決氦氣短缺問題和增加氦氣在肺部護理中的應用預計將在預測期內為市場提供大量機會。

- 預計歐洲將主導市場,而亞太地區預計將在預測期內實現最高成長率。

氦氣市場趨勢

醫療保健產業需求增加

- 氦氣在醫療保健產業有廣泛的用途。氦的溫度可低至-269°C,因此液態氦是冷卻核磁共振造影系統中磁鐵的理想選擇。氦氣也用於監測呼吸。它是治療肺氣腫和氣喘等影響呼吸的疾病的重要成分。

- 氦氣通常用於治療肺部疾病。氧氣和氦氣聯合使用可治療急性和慢性呼吸系統疾病。對於低溫氦應用,沒有什麼可以取代氦。

- 根據經合組織的報告,美國的醫療衛生支出佔國內生產總值(GDP)的比例最高,為16.6%,其次是德國(12.7%)、法國(11.9%)和日本(11.5%)。

- 由於對 MRI 掃描的需求不斷成長,醫療保健領域對氦氣的需求也在增加。 MRI 在癌症篩檢和神經病學領域的應用也正在不斷擴大。

- 從地理上看,氦氣主要用於北美的醫療保健領域。美國和加拿大將其GDP的很大一部分用於醫療保健。

- 此外,亞太地區預計將成為醫療保健產業成長最快的地區。這一成長是由公共醫療體系改革和醫療旅遊業的快速擴張所推動的。中國的健康醫療產業取得了顯著成長,年成長率超過10%。

- 根據國際醫學磁振造影學會的數據,截至 2024 年 1 月,已有超過 1.5 億名患者接受過 MRI 掃描。每年約有 1000 萬名患者接受 MRI 掃描。

- 此外,根據經濟合作暨發展組織(OECD)的數據,日本的人均核磁共振造影系統擁有量遙遙領先,其次是美國的核磁共振造影系統數量,澳洲的 CT 掃描儀數量則位居第二。奧地利、德國、希臘、冰島、義大利、韓國和瑞士的人均 MRI 和 CT 掃描儀數量也遠高於經合組織的平均值。

- 此外,全球暖化對空氣品質的不利影響以及新冠肺炎疫情的爆發加劇了急性和慢性呼吸系統疾病的發生率,因此需要更多專用於呼吸護理的醫療設備。

- 由於上述因素,預計預測期內醫療保健產業對氦氣的需求將會成長。

歐洲主導市場

- 由於醫療保健、航太和電子等各領域的高需求,預計歐洲將主導市場。

- 德國在生產高品質醫療設備方面有著悠久的歷史,重點是精密儀器、診斷成像和光學技術。日本醫療設備市場規模位居美國、日本之後,居世界第三位,在歐洲是法國的2倍,義大利、英國、西班牙的3倍。

- 德國還擁有強大的半導體產業,這是該國市場成長的主要驅動力之一。據估計,每年約有 155 億歐元(144.7 億美元)用於創新感測器和新時代技術的研發。主要的電子基礎設施公司正在投資擴大其生產能力。例如,2023年2月,全球半導體領先企業英飛凌科技股份公司獲得批准,開始在德勒斯登建造價值50億歐元(53.5億美元)的半導體工廠,以滿足汽車電力電子、5G行動晶片以及工業晶片和感測器的需求。預計生產將於 2026 年開始。

- 航太工業是法國繼汽車工業之後最大的工業部門。近年來,該產業發展迅速,現已成為世界上最大的航太產業之一。法國是世界上最重要的飛機零件和系統生產和出口地之一。此外,印度太空協會(ISpA)與法國航太工業協會(GIFAS)於 2023 年 10 月簽署合作備忘錄(MoU),以加强两國之間的太空合作,這可能會對國內氦氣市場產生積極影響。

- 此外,2022年7月,英國將與雪菲爾大學、劍橋大學和倫敦大學學院(UCL)合作建立一個名為「國家外延設施」的大型研究設施,以幫助英國成為半導體研發領域的世界領導者。該國還推出了一個名為東北先進材料和電子(NEAME)的新叢集,以突出和推廣該國作為先進複合半導體技術設計和製造中心的地位。

- 由於這些因素,預計歐洲氦氣市場在預測期內將穩定成長。

氦氣產業概況

氦氣市場本質上是高度整合的。市場的主要企業包括液化空氣集團、林德集團、Matheson Try Gas、巖谷公司和梅塞爾集團(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 半導體產業氦氣消耗量不斷增加

- 擴大氦氣在航空工業的使用

- 限制因素

- 昂貴的提取過程

- 穩定的氦氣供應

- 產業價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 階段

- 液體

- 氣體

- 應用

- 呼吸混合物

- 低溫

- 洩漏檢測

- 加壓和吹掃

- 焊接

- 受控氣氛

- 其他用途

- 最終用戶產業

- 航太和飛機

- 電子和半導體

- 核能

- 衛生保健

- 焊接和金屬製造

- 其他最終用戶產業

- 地區

- 生產分析

- 美國

- 卡達

- 阿爾及利亞

- 澳洲

- 波蘭

- 俄羅斯

- 其他國家

- 消費分析

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 俄羅斯

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東和非洲

- 生產分析

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Air Liquide

- Air Products Inc.

- Exxon Mobil Corporation

- Gazprom

- Gulf Cryo

- Iwatani Corporation

- Linde PLC

- Matheson Tri-Gas Inc.

- Messer Group GmbH

- NexAir LLC

- Pgnig Sa(Orlen)

- Qatarenergy Lng

- Renergen

- Weil Group

第7章 市場機會與未來趨勢

- 發展4.0解決氦氣短缺問題

- 氦氣在肺部治療的應用日益廣泛

The Helium Market size is estimated at 6.71 Billion Cubic Feet in 2025, and is expected to reach 7.78 Billion Cubic Feet by 2030, at a CAGR of 3.02% during the forecast period (2025-2030).

Due to COVID-19, the aerospace industry was severely affected, resulting in the contraction of the aerospace industry in recent times, negatively affecting the growth prospects of helium in aerospace applications. However, it recovered significantly in 2021, owing to rising consumption from various end-use applications, including healthcare.

Key Highlights

- The increasing consumption of helium across the semiconductor industry and growing utilization of helium across the aviation industry are major factors driving the growth of the market studied.

- On the flip side, the high cost of the extraction process and the inconsistent supply of helium are likely to hinder the growth of the market studied.

- Nevertheless, developments toward ending helium shortage 4.0 and increasing adoption of helium in pulmonary treatment are anticipated to provide numerous opportunities for the market studied during the forecast period.

- Europe is expected to dominate the market, and Asia-Pacific is likely to witness the highest growth rate during the forecast period.

Helium Market Trends

Increasing Demand from the Healthcare Industry

- Helium has a wide range of uses in the healthcare industry. It can reach a temperature of -269 °C, making liquid helium the best option for cooling the magnets of MRI machines. Helium is also being used for breathing observation. It is an essential component in treating emphysema, asthma, and other conditions that affect breathing.

- Helium is usually used to treat lung diseases. Oxygen and helium are used together to treat acute and chronic respiratory ailments, as the combination reaches the lungs faster than all the others. There is no substitute for helium in cryogenic helium applications.

- As per the report of OECD, health expenditure as a percentage of gross domestic product (GDP) is highest in the United States (16.6%), followed by Germany (12.7%), France (11.9%), and Japan (11.5%).

- The demand for helium in the healthcare sector is increasing owing to the rising demand for MRI scans. MRI has also seen growing applications in cancer screening and neurology.

- Geographically, helium is predominantly used in the North American healthcare sector. The United States and Canada spend a major share of their GDP on healthcare.

- Also, Asia-Pacific is expected to be the fastest-growing region in the healthcare industry. This growth is fueled by public healthcare reforms and rapidly expanding medical tourism. The Chinese healthcare industry has been witnessing significant growth, registering a growth rate of more than 10% annually, followed by India.

- As of January 2024, according to the International Society for Magnetic Resonance in Medicine, over 150 million patients underwent MRI examinations. Every year, approximately 10 million patients undergo MRI procedures.

- Furthermore, as per the Organisation for Economic Cooperation and Development (OECD), Japan has by far the highest number of MRI units and CT scanners per capita, followed by the United States for MRI units and Australia for CT scanners. Austria, Germany, Greece, Iceland, Italy, Korea, and Switzerland also have significantly more MRI and CT scanners per capita than the OECD average.

- In addition, global warming's negative effects on air quality and the outbreak of COVID-19 exacerbated the rate of acute and chronic respiratory illnesses, prompting the need to increase the number of healthcare equipment specializing in respiratory care.

- Based on the factors mentioned above, the demand for helium from the healthcare industry is expected to grow over the forecast period.

Europe to Dominate the Market

- Europe is expected to dominate the market studied owing to the high demand from different sectors, such as healthcare, aerospace, electronics, and others.

- Germany has a long history of producing high-quality medical equipment, emphasizing precision instruments, diagnostic imaging, and optical technologies. The nation hosts the third-largest medical devices market in the world, after the United States and Japan, and the largest in Europe, comprising twice the size of the French market and three times as large as those of Italy, the United Kingdom, and Spain.

- Germany also focuses on the semiconductor industry, which is one of the main drivers of the market's growth in the country. It is estimated that around EUR 15.5 billion (USD 14.47 billion) has been invested annually in R&D for the development of innovative sensors and new-age technologies. Major electronic base companies are investing to expand their production capacity. For instance, in February 2023, Infineon Technologies AG, a global semiconductor leader, received the approval to begin work on a EUR 5 billion (USD 5.35 billion) semiconductor plant to meet the demand for power electronics in auto and mobile chips for 5G and industry chips and sensors, in Dresden. It is due to start production in 2026.

- The aerospace industry is the largest industrial sector in France, followed by the automotive industry. It has witnessed rapid growth in recent years and has become one of the largest aerospace industries in the world. France is one of the significant production and export hubs for aircraft components and systems in the global scenario. Furthermore, the signing of a Memorandum of Understanding (MoU) between the Indian Space Association (ISpA) and the French Aerospace Industries Association GIFAS in October 2023 to enhance space cooperation between the two countries was likely to impact the helium market within the country positively.

- Also, in July 2022, a major research facility named the National Epitaxy Facility collaborated with the Universities of Sheffield, Cambridge, and University College London (UCL) to support the United Kingdom in becoming a world leader in semiconductor R&D. The country also launched a new cluster, named the Northeast Advanced Material Electronics (NEAME), to highlight and promote the country as a center of excellence for advanced compound semiconductor technology design and production.

- Due to all such factors, the European helium market is expected to witness steady growth during the forecast period.

Helium Industry Overview

The helium market is highly consolidated in nature. The major players in the market include (not in any particular order) Air Liquide, Linde PLC, Matheson Tri-Gas Inc., Iwatani Corporation, and Messer Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Consumption of Helium Across the Semiconductor Industry

- 4.1.2 Growing Utilization of Helium Across Aviation Industry

- 4.2 Restraints

- 4.2.1 Expensive Extraction Process

- 4.2.2 Inconsistent Supply of Helium

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Phase

- 5.1.1 Liquid

- 5.1.2 Gas

- 5.2 Application

- 5.2.1 Breathing Mixes

- 5.2.2 Cryogenics

- 5.2.3 Leak Detection

- 5.2.4 Pressurizing and Purging

- 5.2.5 Welding

- 5.2.6 Controlled Atmosphere

- 5.2.7 Other Applications

- 5.3 End-user Industry

- 5.3.1 Aerospace and Aircraft

- 5.3.2 Electronics and Semiconductors

- 5.3.3 Nuclear Power

- 5.3.4 Healthcare

- 5.3.5 Welding and Metal Fabrication

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Production Analysis

- 5.4.1.1 United States

- 5.4.1.2 Qatar

- 5.4.1.3 Algeria

- 5.4.1.4 Australia

- 5.4.1.5 Poland

- 5.4.1.6 Russia

- 5.4.1.7 Other Countries

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 India

- 5.4.2.1.3 Japan

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Australia and New Zealand

- 5.4.2.1.6 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Canada

- 5.4.2.2.3 Mexico

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 France

- 5.4.2.3.3 Italy

- 5.4.2.3.4 United Kingdom

- 5.4.2.3.5 Russia

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 Rest of the World

- 5.4.2.4.1 South America

- 5.4.2.4.2 Middle East and Africa

- 5.4.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products Inc.

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 Gazprom

- 6.4.5 Gulf Cryo

- 6.4.6 Iwatani Corporation

- 6.4.7 Linde PLC

- 6.4.8 Matheson Tri-Gas Inc.

- 6.4.9 Messer Group GmbH

- 6.4.10 NexAir LLC

- 6.4.11 Pgnig Sa (Orlen)

- 6.4.12 Qatarenergy Lng

- 6.4.13 Renergen

- 6.4.14 Weil Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developments Toward Ending Helium Shortage 4.0

- 7.2 Increasing Adoption of Helium In Pulmonary Treatment