|

市場調查報告書

商品編碼

1685881

雙酚A(BPA) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Bisphenol A (BPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

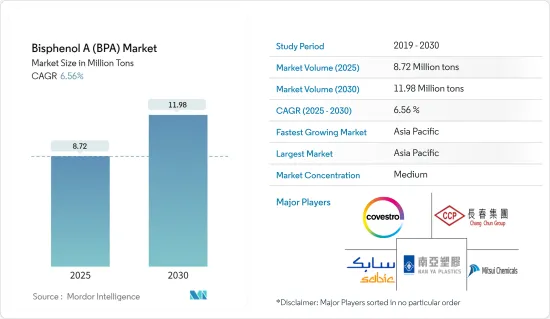

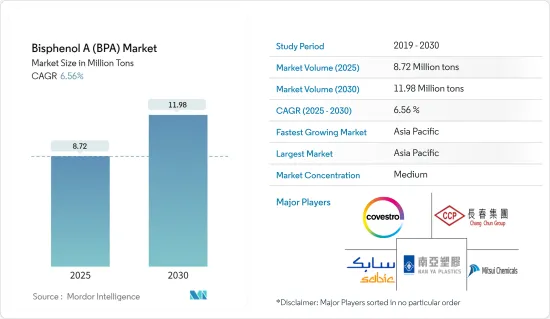

預計 2025 年雙酚 A 市場規模為 872 萬噸,2030 年將達到 1,198 萬噸,預測期間(2025-2030 年)的複合年成長率為 6.56%。

主要亮點

- 從中期來看,聚碳酸酯產業需求的成長和環氧樹脂生產需求的增加預計將推動雙酚 A 的需求。

- 然而,食品和飲料行業對雙酚 A 使用的監管日益嚴格,對受調查市場的成長構成了重大限制。

- 另一方面,生物基雙酚 A 的潛在市場需求可能會在未來幾年創造有利可圖的市場機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的複合年成長率。

雙酚A市場趨勢

聚碳酸酯樹脂需求不斷成長

- 聚碳酸酯主要由雙酚A與光氣的界面反應生成。在所有其他應用領域中,聚碳酸酯樹脂的使用對雙酚 A (BPA) 產生了巨大的市場需求。

- 雙酚A在增強聚碳酸酯樹脂的性能方面起著重要作用。 BPA 有助於提高聚碳酸酯塑膠的強度和耐用性。含有 BPA 的聚碳酸酯因其抗衝擊性而聞名,適用於安全玻璃、防彈窗和醫療設備等應用。

- 含有BPA的聚碳酸酯具有較高的玻璃化轉變溫度,可以承受高溫而不會翹曲或熔化。這種特性使其成為食品容器和可重複使用的水瓶的理想選擇。

- 聚碳酸酯天然透明,BPA 有助於維持這種透明度。這使得可以生產透明的容器和鏡片。

- 聚碳酸酯是一種高性能熱塑性塑膠,廣泛用於建築應用。使用聚碳酸酯製造的板材被廣泛用作各種窗戶和天窗應用中的玻璃替代品。此外,它們還可用作筒形拱頂、不透明覆層層板、座艙罩、建築幕牆、標誌、半透明牆壁、體育場屋頂、百葉窗和屋頂圓頂。

- 近年來,溫室對聚碳酸酯材料的使用增加。德國、法國、荷蘭、西班牙等歐洲國家都有大面積的溫室種植。

- 聚碳酸酯市場的主要企業包括三菱工程塑膠株式會社、科思創股份公司、沙烏地阿拉伯基礎工業公司、樂天化學株式會社和帝人株式會社。這些公司正在大力投資併購和業務擴張,預計將推動聚碳酸酯對 BPA 的需求。例如,2024年3月,全球領先的高品質聚合物材料製造商之一科思創股份公司在比利時安特衛普運作了其第一家工業規模生產聚碳酸酯共聚物的工廠。

- 2023年9月,沙烏地阿拉伯化工巨頭沙烏地基礎工業公司(SABIC)和中國石油燃氣公司中石化宣布,由其合資企業中石化沙烏地基礎天津石油化工有限公司(SSTPC)建設一座新的聚碳酸酯(PC)工廠。新聚碳酸酯工廠年產能為26萬噸,是SABIC中國聚碳酸酯成長策略的核心部分,並將為SABIC與全球和本地客戶提供進一步的合作機會。

- 2023年3月,科思創擴大了在泰國的聚碳酸酯薄膜產能。聚碳酸酯薄膜主要用於身分證、汽車顯示器以及電氣和電子應用。這些發展使該公司每年的生產能力增加了10多萬噸。

- 因此,預計上述因素將在預測期內影響聚碳酸酯應用中對 BPA 的需求。

亞太地區可望主導市場

- 亞太地區是雙酚 A (BPA) 的最大生產地和消費地,涉及各個終端用戶產業。因此,預計它將佔據市場主導地位。

- 近年來,受多種經濟和產業因素推動,中國各地對雙酚A(BPA)新生產裝置的投資呈現明顯增加趨勢。例如,2024年1月,台塑集團子公司南亞塑膠位於中國寧波的BPA生產工廠重啟營運。該工廠每年生產約 17 萬噸 BPA。該公司生產的 BPA 主要用於聚碳酸酯塑膠。

- 雙酚A主要用於聚碳酸酯樹脂和塑膠製品中,由於其在汽車、電子和建築等行業的應用不斷擴大,中國對雙酚A的需求也不斷成長。 2023 年 9 月,沙烏地阿拉伯化學公司 SABIC 和中國石油燃氣公司中石化宣布透過其合資企業中石化沙烏地阿拉伯基礎天津石油化工有限公司 (SSTPC)推出新的聚碳酸酯 (PC) 工廠。 SABIC 在 SSTPC 生產的 PC 材料組合將以 Lexan 樹脂品牌出售。

- 印度長期進口BPA,價格波動和區域貿易問題為印度BPA市場帶來了問題。印度政府和一些公司正在積極在印度生產 BPA。例如,Deepak Chem Tech Limited 於 2024 年 2 月與古吉拉突邦政府簽署了一份合作備忘錄,旨在在古吉拉突邦赫傑建立計劃。該公司計劃建造一座世界級的先進聚合物樹脂生產設施,包括聚碳酸酯樹脂。

- 近年來,由於競爭激烈、收益低等原因,日本的BPA生產工廠出現倒閉潮,對產業帶來了較大衝擊。例如,日本三菱化學公司於2024年2月宣布,計劃在2024年3月底前永久停止其位於日本南部福岡縣黑崎工廠生產BPA,主要原因是來自中國的供應過剩。該工廠每年生產約 12 萬噸 BPA。

- 因此,預計上述因素將影響亞太地區對 BPA 的需求。

雙酚A行業概況

雙酚A(BPA)市場本質上是部分整合的。市場的主要企業(不分先後順序)包括科思創股份公司、沙烏地阿拉伯基礎工業公司、長春集團、三井化學公司和南亞塑膠株式會社。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 聚碳酸酯的需求正在快速成長

- 環氧樹脂需求不斷成長

- 限制因素

- 食品飲料業監管趨嚴

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 技術簡介

- 貿易概況

- 價格概覽

- 監理政策分析

第5章市場區隔

- 按應用

- 聚碳酸酯樹脂

- 環氧樹脂

- 不飽和聚酯樹脂

- 阻燃劑

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Altivia Petrochemicals

- Chang Chun Group

- China National Bluestar(Group)Co. Ltd

- China Petroleum & Chemical Corporation(SINOPEC)

- Covestro AG

- Dow

- Hexion

- Idemitsu Kosan Co. Ltd

- Kumho P&B Chemicals Inc.

- LG Chem

- Lihua Yiweiyuan Chemical Co. Ltd

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Nan Ya Plastics Industry Co. Ltd

- Nippon Steel Chemical & Material Co. Ltd

- PTT Phenol Company Limited

- SABIC

- Samyang Holdings Corporation

- Teijin Limited

- Zhejiang Petroleum & Chemical Co. Ltd

第7章 市場機會與未來趨勢

- 生物基 BPA 的潛在市場需求

簡介目錄

Product Code: 48890

The Bisphenol A Market size is estimated at 8.72 million tons in 2025, and is expected to reach 11.98 million tons by 2030, at a CAGR of 6.56% during the forecast period (2025-2030).

Key Highlights

- In the medium term, soaring demand from the polycarbonate sector and increasing demand for epoxy resin production are likely to drive the demand for Bisphenol-A.

- However, increasing regulations in the food and beverage industry on the use of Bisphenol-A pose major restraints to the growth of the market studied.

- On the other hand, potential market demand for bio-based Bisphenol-A is likely to create lucrative market opportunities in the coming years.

- Asia-Pacific is expected to dominate the market and is anticipated to witness the highest CAGR during the forecast period.

Bisphenol-A Market Trends

Increasing Demand for Polycarbonate Resins

- Polycarbonate is mainly formed after the reaction of Bisphenol-A with carbonyl chloride in an interfacial process. Among all other application areas, polycarbonate resin application provides a significant market demand for Bisphenol-A (BPA).

- Bisphenol-A plays a critical role in enhancing the properties of polycarbonate resins. BPA contributes to the strength and durability of polycarbonate plastics. Polycarbonates made with BPA are known for their impact resistance, which makes them suitable for applications such as safety glasses, bulletproof windows, and medical devices.

- Polycarbonates containing BPA have a high glass transition temperature, meaning they can withstand high temperatures without warping or melting. This property makes them ideal for food containers and reusable water bottles.

- Polycarbonates are naturally transparent, and BPA helps to maintain this clarity. This allows the production of clear containers and lenses.

- Polycarbonates are high-performing thermoplastics that are widely used in construction applications. Sheets manufactured using Polycarbonates are widely used as a substitute for glass in a variety of window and skylight applications. Additionally, they are used as barrel vaults, opaque cladding panels, canopies, facades and signage, translucent walls, sports stadium roofs, louvers, and roof domes.

- The application of polycarbonate materials in greenhouses has increased in recent years. European countries, such as Germany, France, the Netherlands, and Spain, have larger areas for greenhouse cultivation.

- Some of the key companies in the polycarbonate market include Mitsubishi Engineering-Plastics Corporation, Covestro AG, SABIC, Lotte Chemical Corporation, and Teijin Limited. These companies are investing heavily in mergers, acquisitions, and expansion, which are projected to boost the demand for BPA in polycarbonates. For instance, in March 2024, Covestro AG, one of the world's leading manufacturers of high-quality polymer materials, inaugurated its first plant to produce polycarbonate copolymers on an industrial scale at its Antwerp, Belgium site.

- In September 2023, Saudi Arabian chemical giant SABIC and Chinese oil and gas corporation Sinopec announced the launch of a new polycarbonate (PC) plant through their joint venture named Sinopec SABIC Tianjin Petrochemical (SSTPC). With an annual designed capacity of 260 kilotons, the new PC plant is intended as a central piece of SABIC's PC growth strategy in China, providing opportunities for further collaborations with global and local customers.

- In March 2023, Covestro expanded its production capacity for polycarbonate films in Thailand, primarily used in identity documents, automotive displays, and electrical and electronic applications. With these developments, the company's additional capacity now exceeds 100,000 metric tons annually.

- Therefore, the factors mentioned above are expected to impact the demand for BPA in polycarbonate applications during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the largest manufacturer and consumer of Bisphenol-A (BPA) in different end-user industries. Hence, it is expected to dominate the market.

- In recent years, there has been a noticeable trend of increasing investments in new Bisphenol-A (BPA) production facilities across China, driven by various economic and industrial factors. For instance, in January 2024, Nan Ya Plastics, a subsidiary of Formosa Group, restarted operations of the BPA production plant in Ningbo, China. This plant produces about 170,000 tons of BPA per annum. The BPA produced by the company is majorly used in the polycarbonate resins that the company produces.

- The demand for BPA in polycarbonate resins and plastic products in China is growing due to its expanding use in industries like automotive, electronics, and construction. In September 2023, Saudi Arabian chemical company SABIC and Chinese oil and gas corporation Sinopec announced the launch of a new polycarbonate (PC) plant through their joint venture, Sinopec SABIC Tianjin Petrochemical (SSTPC). SABIC's portfolio of PC materials produced at SSTPC is marketed under its Lexan resin brand.

- India has been importing BPA for a long time, and the fluctuations in prices and trade issues among the regions are creating a problem for the Indian BPA market. The government and a few companies have taken initiatives to manufacture BPA in India. For instance, in February 2024, Deepak Chem Tech Limited signed an MoU with the government of Gujarat with an intent to invest around INR 90,000 million to establish projects at Dahej, Gujarat. The company plans to build world-scale production facilities for advanced polymer resins, such as polycarbonate resins.

- In recent years, Japan has seen a trend of BPA manufacturing plants closing down due to intense competition and low profitability, significantly impacting the industry. For instance, in February 2024, Japan's Mitsubishi Chemical planned to permanently halt the production of BPA by the end of March 2024 at its Kurosaki plant in south Japan's Fukuoka prefecture, citing oversupply, mainly from China. This plant produces about 120,000 tons of BPA per annum.

- Hence, the above-mentioned factors are expected to impact the demand for BPA in Asia-Pacific.

Bisphenol A Industry Overview

The Bisphenol-A (BPA) market is partially consolidated in nature. Some of the key players (not in any particular order) in the market include Covestro AG, SABIC, Chang Chun Group, Mitsui Chemical Inc., and Nan Ya Plastics Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Soaring Demand from Polycarbonate Sector

- 4.1.2 Increasing Demand from Epoxy Resin Production

- 4.2 Restraints

- 4.2.1 Increasing Regulations in the Food and Beverage Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Overview

- 4.8 Price Overview

- 4.9 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Polycarbonate Resins

- 5.1.2 Epoxy Resins

- 5.1.3 Unsaturated Polyester Resins

- 5.1.4 Flame Retardants

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Altivia Petrochemicals

- 6.4.2 Chang Chun Group

- 6.4.3 China National Bluestar (Group) Co. Ltd

- 6.4.4 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.5 Covestro AG

- 6.4.6 Dow

- 6.4.7 Hexion

- 6.4.8 Idemitsu Kosan Co. Ltd

- 6.4.9 Kumho P&B Chemicals Inc.

- 6.4.10 LG Chem

- 6.4.11 Lihua Yiweiyuan Chemical Co. Ltd

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Mitsui Chemicals Inc.

- 6.4.14 Nan Ya Plastics Industry Co. Ltd

- 6.4.15 Nippon Steel Chemical & Material Co. Ltd

- 6.4.16 PTT Phenol Company Limited

- 6.4.17 SABIC

- 6.4.18 Samyang Holdings Corporation

- 6.4.19 Teijin Limited

- 6.4.20 Zhejiang Petroleum & Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential Market Demand for Bio-Based BPA

02-2729-4219

+886-2-2729-4219