|

市場調查報告書

商品編碼

1686192

印度農業曳引機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Agricultural Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

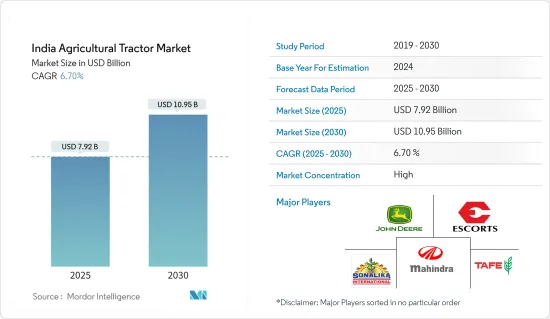

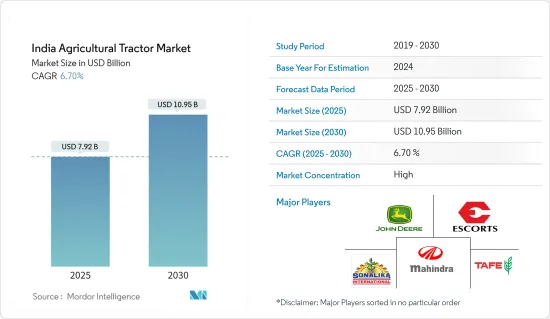

印度農業曳引機市場規模預計在 2025 年為 79.2 億美元,預計到 2030 年將達到 109.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.7%。

農業仍然是印度經濟的主要貢獻者,印度 51.09% 的土地用於農業。根據農業與農民福利部的報告,2021-2022 年,耕作總面積將從 2020-2021 年的 2.0118 億公頃增加到 2.1916 億公頃。這片廣闊的農業用地鼓勵使用曳引機完成各種複雜的農業任務。印度對曳引機的需求主要受到大規模農業、勞動力減少和農業部門機械化程度提高的推動。根據世界銀行的資料,農業就業人數將從2020年的44.7%下降到2022年的42.9%。

印度曳引機市場受到農業工資上漲和政府對農業機械化的支持的進一步推動。根據印度農業和農民福利部的報告,印度全國農業工人的平均日薪從2019-20年的292.05盧比(3.9美元)上漲到2021-22年的328.18盧比(4.2美元)。中央政府根據 Pradhan Mantri Kisan Tractor Yojana 計劃為購買曳引機的人提供 50% 的補貼,補貼金額將直接存入受益人的帳戶。農藝、社會和經濟因素以及人口成長和需求增加等宏觀經濟和內生因素要求採用曳引機等機械化解決方案,以實現永續的長期成長。

印度農業曳引機市場趨勢

30至50馬力的曳引機受到農民的廣泛青睞。

30-50馬力的曳引機非常適合河流流域等軟土壤條件,在印度的需求量很大。這種需求是由於農民可支配所得低、人事費用高、土地面積少所造成的。這些中馬力曳引機具有客製化選項和低油耗等優勢,小農和邊際農戶都可以使用。

土地持有量減少的趨勢進一步推動了對 30-50 馬力曳引機的需求。根據2021-22年全印度農村金融包容性調查(NAFIS),印度農業的平均所擁有土地已降至0.74公頃,自上次調查以來下降了31%。這些曳引機在印度使用最為廣泛,因為它們對於小農戶來說效率很高,對於提高生產力至關重要。預計這一趨勢將在預測期內推動市場成長。

市場上的公司正在透過推出 30-50 馬力領域的新車型來滿足這種日益成長的需求。例如,2023年9月,Swaraj推出了40-50馬力等級的新系列曳引機。同樣,2024 年 5 月,VST Tillers 推出了三款 41-50 匹馬力的新型曳引機:VST ZETOR 4211、4511 和 5011。這些型號由 VST 和 ZETOR 共同開發,將在印度的 VST Zetor 工廠生產。

北方邦是最大的農業曳引機市場

根據統計和計劃實施部 (PRS) 的數據,農業是北方邦經濟的支柱,到 2023 年將為該邦 GDP 貢獻 24%。農業活動是北方邦大部分人口的主要生計來源,推動了對農業機械(尤其是曳引機)的需求。根據印度農業和農民福利部的報告,2021-2022年,北方邦的糧食生產面積將達到1,955萬公頃,佔全國總面積的15%,成為印度最大的糧食生產地區。農民依靠曳引機完成耕作、耕作、播種、收割和收穫等基本農業任務,提高了該州的農業效率和生產力。

在北方邦,土地細碎化加劇導致地塊面積縮小,使傳統的手工耕作方法變得不切實際。這些曳引機為小農戶管理農場經營提供了有效的解決方案,使北方邦成為印度曳引機銷售的領導邦。 2024年,久保田宣布投資450億印度盧比(5.314億美元)在北方邦建立待開發區製造廠。這反映了市場的成長。

印度農業曳引機產業概況

印度農業曳引機市場正在整合,並由大型全球和國內製造商主導。農民對知名品牌有著強烈的偏好,因為它們具有品質保證和可靠的售後服務。 Mahindra &Mahindra Ltd、Tractor and Farm Equipment Ltd (TAFE)、International Tractor Ltd、Escorts Limited 和 John Deere India Private Limited 等主要企業佔據了最大的市場佔有率。這些公司正在大力投資產品開發、擴張計畫和策略性收購。研究和開發是優先領域,特別是以有競爭力的價格分佈推出新產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 農業機械化趨勢

- 客製化曳引機的趨勢

- 加大政府對加強農業機械化的支持

- 市場限制

- 缺乏意識和熟練的人力

- 農民經濟狀況惡化

- 波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 引擎功率

- 小於30馬力

- 31至50馬力

- 51-80馬力

- 超過80馬力

- 驅動系統

- 兩輪驅動

- 四輪驅動

- 應用

- 農用曳引機

- 果園曳引機

- 其他用途

- 地區

- 北方邦

- 中央邦

- 馬哈拉斯特拉邦

- 拉賈斯坦邦

- 古吉拉突邦

- 其他

第6章競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Mahindra & Mahindra Limited

- John Deere India Private Limited

- CNH Industrial(India)Pvt. Ltd

- TAFE Ltd

- International Tractors Limited(Sonalika)

- Preet Tractors(P)Limited

- Escorts Kubota Limited

- Indo Farm Equipment Limited

- VST Tillers Tractors Limited

- Captain Tractors Private Limited

第7章 市場機會與未來趨勢

The India Agricultural Tractor Market size is estimated at USD 7.92 billion in 2025, and is expected to reach USD 10.95 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

Agriculture remains a significant contributor to the Indian economy, with 51.09% of the country's land dedicated to agricultural activities. The Ministry of Agriculture and Farmers Welfare reports an increase in total cropped area from 201.18 million hectares in 2020-2021 to 219.16 million hectares in 2021-2022. This extensive agricultural area promotes using tractors for various complex farming operations. The demand for tractors in India is primarily driven by large-scale farming operations, declining labor availability, and increasing mechanization in the agriculture sector. World Bank data indicates a decrease in agricultural employment, from 44.7% of the population in 2020 to 42.9% in 2022.

The Indian tractor market is further propelled by rising farm wages and government support for farm mechanization. The average daily wage rate for agricultural laborers across India increased from Rs 292.05 (USD 3.9) in 2019-20 to Rs 328.18 (USD 4.2) in 2021-22 as reported by the Ministry of Agriculture and Farmer Welfare. The central government offers a 50% subsidy on tractor purchases under the Pradhan Mantri Kisan Tractor Yojana scheme, with the subsidy amount directly transferred to the beneficiary's account. Beyond agricultural, social, and economic factors, macroeconomic and intrinsic elements such as population growth and increasing demand necessitate the adoption of mechanized solutions like tractors for sustainable long-term growth.

India Agricultural Tractor Market Trends

30-50 HP Tractors Are Widely Preferred by Farmers

Tractors in the 30-50 HP range are well-suited for soft soil conditions, such as river basins, and are in high demand in India. This demand is driven by farmers' low disposable income, high labor costs, and small farmland sizes. These moderate-horsepower tractors offer advantages such as customization options and lower fuel consumption, making them accessible to small and marginal farmers.

The trend towards smaller farm holdings further supports the demand for 30-50 HP tractors. According to the All India Rural Financial Inclusion Survey (NAFIS) 2021-22, the average landholding for farming in India decreased to 0.74 hectares, a 31% reduction from the previous survey. These tractors are efficient for small farm holdings and are crucial for increasing productivity, making them the most commonly used in India. This trend is expected to drive market growth during the forecast period.

Market players are responding to this growing demand by introducing new models in the 30-50 HP segment. For example, in September 2023, Swaraj launched a new range of tractors in the 40-50 horsepower category. Similarly, in May 2024, VST Tillers introduced three new tractors (VST ZETOR 4211, 4511, and 5011) with horsepower ranging from 41-50. These models are the result of joint development efforts between VST and ZETOR, manufactured at the VST Zetor facility in India.

Uttar Pradesh Provides the Biggest Market for Agricultural Tractors

Agriculture forms the backbone of Uttar Pradesh's economy, contributing 24% to the state's GDP in 2023, according to the Ministry of Statistics and Program Implementation (PRS). As the primary source of livelihood for a substantial portion of the state's population, the extensive agricultural activities drive the demand for agricultural machinery, particularly tractors. The Department of Agriculture and Farmers Welfare reports that Uttar Pradesh had the largest area under food grains production in 2021-2022, covering 19.55 million hectares, representing 15% of the country's total. Farmers utilize tractors for essential farming operations including plowing, tilling, sowing, harrowing, and harvesting, which enhances agricultural efficiency and productivity in the state.

The increasing fragmentation of land holdings in Uttar Pradesh has resulted in smaller land parcels, making traditional manual farming methods impractical. Tractors provide an efficient solution for small-scale farmers to manage their agricultural operations, positioning Uttar Pradesh as the leading state in tractor sales across India. In 2024, Escorts Kubota announced an investment of INR 45 billion (USD 531.4 million) to establish a greenfield manufacturing facility in Uttar Pradesh. This reflects the growth of the market.

India Agricultural Tractor Industry Overview

The agricultural tractor market in India is consolidated, with large global and domestic manufacturers holding dominant positions. Farmers show a strong preference for established brands due to quality assurance and reliable after-sales services. The market's largest share is held by key players including Mahindra & Mahindra Ltd, Tractor and Farm Equipment Ltd (TAFE), International Tractor Ltd, Escorts Limited, and John Deere India Private Limited. These companies focus their investments on product development, expansion initiatives, and strategic acquisitions. Research and development remains a priority area, particularly for introducing new products at competitive price points.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Mechanization Trend in Agriculture Sector

- 4.1.2 Trend of Custom Hiring of Tractors

- 4.1.3 Growing Government Support to Enhance Farm Mechanization

- 4.2 Market Restraints

- 4.2.1 Lack of Awareness and Skilled Manpower

- 4.2.2 Poor Economic Condition of Farmers

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Engine Power

- 5.1.1 Less than 30 HP

- 5.1.2 31-50 HP

- 5.1.3 51-80 HP

- 5.1.4 Above 80 HP

- 5.2 Drive Type

- 5.2.1 Two-wheel Drive

- 5.2.2 Four-wheel Drive

- 5.3 Application

- 5.3.1 Row Crop Tractors

- 5.3.2 Orchard Tractors

- 5.3.3 Other Applications

- 5.4 Geography

- 5.4.1 Uttar Pradesh

- 5.4.2 Madhya Pradesh

- 5.4.3 Maharashtra

- 5.4.4 Rajasthan

- 5.4.5 Gujarat

- 5.4.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Mahindra & Mahindra Limited

- 6.3.2 John Deere India Private Limited

- 6.3.3 CNH Industrial (India) Pvt. Ltd

- 6.3.4 TAFE Ltd

- 6.3.5 International Tractors Limited (Sonalika)

- 6.3.6 Preet Tractors (P) Limited

- 6.3.7 Escorts Kubota Limited

- 6.3.8 Indo Farm Equipment Limited

- 6.3.9 VST Tillers Tractors Limited

- 6.3.10 Captain Tractors Private Limited