|

市場調查報告書

商品編碼

1686199

拉丁美洲網路安全:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Latin America Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

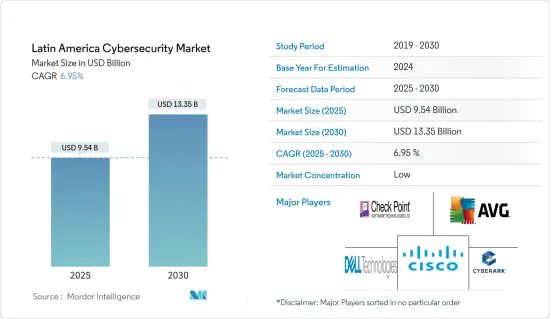

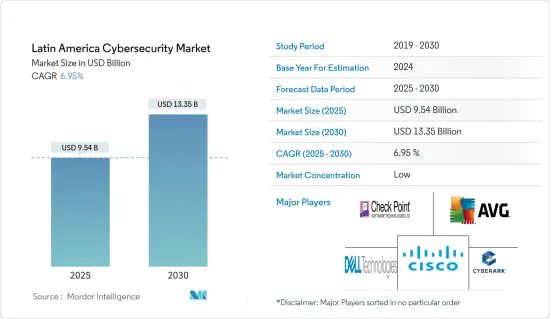

拉丁美洲網路安全市場規模預計在 2025 年為 95.4 億美元,預計到 2030 年將達到 133.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.95%。

由於網際網路的使用和移動的發展,該地區的數位化正在擴大,增加了對網路安全的需求,但如果不優先考慮網路安全,就無法實現數位轉型。快速數位化和數位技術的廣泛使用正在推動拉丁美洲的網路安全應用。

主要亮點

- 拉丁美洲新興市場面臨網路安全挑戰,因此最容易受到駭客和漏洞的攻擊。從目前情況來看,拉丁美洲需要更強大的網路安全基礎來保障其企業的未來。拉丁美洲的網路犯罪主要表現為惡意軟體、網路釣魚和拒絕服務(DoS)攻擊等電腦駭客手段。

- 此外,該地區消費者對行動付款的偏好正在上升,隨著基於應用程式的付款變得越來越普遍以及創建付款應用程式的投資增加,推動了對應用程式安全的需求。

- 拉丁美洲的網路安全產業正受到物聯網、巨量資料和認知智慧等新技術的使用以及雲端託管服務的推動。雲端供應商將對其資料中心擁有更多控制權,企業在疫情期間可能會更依賴公有雲,以利用其靈活性和擴充性。

- 該地區需要更多在網路安全領域擁有寶貴技能的專業人士。根據美洲銀行和美洲組織的評估,拉丁美洲和加勒比地區(LAC)需要更好地應對網路攻擊。

- 隨著企業準備實施為期數月的業務永續營運計畫 (BCP),包括資訊安全監控和回應,同時在隔離條件下加強網路安全,COVID-19 加劇了對網路安全的需求。

拉丁美洲網路安全市場趨勢

擴大 M2M/IoT 連線需要企業加強網路安全

- 隨著拉丁美洲國家的網路普及率提高,網路安全解決方案的使用可能會增加。此外,行動裝置無線網路的擴張使資料更容易受到攻擊,因此網路安全成為拉丁美洲組織的關鍵因素。

- 在拉丁美洲,越來越多的企業將物聯網作為其更大業務轉型計畫的一部分。此外,巴西等某些地區正面臨採用物聯網解決方案作為其數位轉型計畫一部分的壓力。

- 物聯網是一股新的技術變革浪潮,它將顛覆拉丁美洲的各行各業。據 GSMA Intelligence 稱,到 2025 年該地區的物聯網連接數量預計將達到 12 億。

- 在全部區域,企業都熱衷於投資物聯網和工業 4.0 技術。例如,糖廠Agroindustrial Laredo 是 M2M 技術的早期採用者。該公司與物聯網供應商 AZLogica 合作開發了最佳化收穫物流的物聯網解決方案。透過使用物聯網,投資回報率提高了10倍,燃料使用量減少了16%,並確保了產品按時交付。由於這些進步,該地區的組織正在尋求採用物聯網,從而推動對安全解決方案的需求。

巴西:成長機遇

- 網路安全市場。它由巴西、阿根廷和墨西哥組成。預計在整個預測期內,對網路緊急應變小組和電腦安全事件回應小組打擊網路攻擊的需求將推動需求。

- 巴西企業積極投資網路安全解決方案和服務,以保護疫情期間面臨風險的企業系統並遵守新的資料保護法規。這一趨勢也鼓勵了該國對網路安全業務的新投資。

- 由於數位化革命的不斷發展,巴西是拉丁美洲最大的網路安全收益來源。新的一般資料保護規範(GDPR)和5G等最近的監管變化可能會刺激商業投資。

- 此外,政府也為提供創新網路安全解決方案的外國公司提供了多種機會。巴西的網路安全投資主要由私營部門推動,包括銀行和金融服務、電子商務和通訊。政府部門約佔巴西網路安全市場的20%。

拉丁美洲網路安全產業概況

預計拉丁美洲網路安全市場競爭將會非常激烈,因為該市場由大型全球供應商以及迎合市場各個細分領域的小型區域供應商主導。

- 2023 年 5 月-Check Point Software Technologies (CPC) 宣布擴展其 Check Point Harmony 端點保護解決方案,納入漏洞和自動修補程式管理功能。此項增強是為了應對利用未修補系統中的漏洞來獲取未授權存取存取的網路攻擊日益增多的情況。為了提供這項進階功能,Check Point 與 Ivanti 合作,將 Ivanti Patch Management 整合到 Check Point 的 Harmony 端點保護解決方案中,可評估和修復從雲端到邊緣的軟體漏洞。

- 2023 年 5 月—CyberArk 軟體和身分安全宣布了 CyberArk 身分安全平台的新產品和功能。我們對雲端安全、自動化和人工智慧 (AI) 的投資使您能夠比以往更輕鬆地從單一供應商對整個平台上的所有人類和非人類身分應用智慧權限控制。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 網路安全事件和報告法規迅速增加

- 日益增加的 M2M/IoT 連線要求企業加強網路安全措施

- 市場限制

- 網路安全專家短缺

第6章 市場細分

- 安全類型

- 網路安全

- 雲端安全

- 應用程式安全

- 端點安全

- 無線網路安全

- 其他安全

- 成分

- 硬體

- 解決方案

- 威脅情報與回應

- 身分和存取管理

- 預防資料外泄

- 安全和漏洞管理

- 入侵防禦系統

- 其他解決方案

- 服務

- 專業服務

- 託管服務

- 配置

- 雲

- 本地

- 最終用戶產業

- 銀行、金融服務和保險

- 衛生保健

- 製造業

- 零售

- 政府

- 資訊科技/通訊

- 其他最終用戶產業

- 國家名稱

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲國家

第7章 競爭格局

- 公司簡介

- AVG Technologies

- Check Point Software Technologies Ltd

- Cisco Systems Inc.

- Cyber Ark Software Ltd

- Dell Technologies Inc.

- FireEye Inc.

- Fortinet Inc.

- IBM Corporation

- Imperva Inc.

- Trend Micro Inc.

- Intel Corporation

- Symantec Corporation(Broadcom Inc.)

第8章投資分析

第9章 市場機會與未來趨勢

The Latin America Cybersecurity Market size is estimated at USD 9.54 billion in 2025, and is expected to reach USD 13.35 billion by 2030, at a CAGR of 6.95% during the forecast period (2025-2030).

The region's expanding digital penetration, reinforced by internet usage and mobile development, drives demand for cybersecurity, but digital transformation is unattainable unless cybersecurity is prioritized. Rapid digitalization and extensive use of digital technology drive Latin American cybersecurity adoption.

Key Highlights

- Latin American emerging markets are the most exposed to hackers and breaches because they are still confronting cybersecurity. As things stand, Latin America requires a more strong cybersecurity basis in order to defend the future of its firms. In Latin America, cybercrime has manifested mostly through computer hacking strategies such as malware, phishing, and denial of service (DoS) attacks.

- Furthermore, the region's rising consumer bias towards mobile payments is driving up the need for application security as application-based payments become more widespread and investment in creating payment apps increases.

- The key drivers of the Latin American cybersecurity industry have been the use of new technologies such as the IoT, Big Data, and cognitive intelligence, as well as the acceptance of cloud-managed services. Cloud providers will exert more control over data centers, and companies will rely more on the public cloud during the epidemic to take advantage of its flexibility and scalability.

- The area needs more professionals with skill sets that benefit the cybersecurity sector. According to an Inter-American Bank and Organisation of American States assessment, the Latin American and Caribbean (LAC) area needs to be better equipped to deal with cyberattacks.

- COVID-19 has heightened the need for cybersecurity as businesses prepare to implement months-long business continuity plans (BCP), including information security monitoring and response while working under quarantine circumstances to boost cybersecurity.

Latin America Cyber Security Market Trends

Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- The usage of cybersecurity solutions is likely to increase as internet access increases across Latin American countries. Furthermore, the expanding wireless network for mobile devices has increased data susceptibility, making cybersecurity a critical component of any Latin American organisation.

- IoT is increasingly being employed as part of a bigger corporate transformation plan in Latin America. Furthermore, in certain areas, like Brazil, the pressure to implement IoT solutions as part of digital transformation programmes is developing quickly.

- The IoT is a new wave of technological transformation that is upending Latin American industry. Companies and governments alike are investing in IoT solutions; the number of IoT connections in the area is estimated to reach 1,200 million by 2025, according to GSMA Intelligence.

- Across the area, industries are eager to invest in IoT and Industry 4.0 technologies. Agroindustrial Laredo, a sugar mill, for example, was an early adopter of M2M technologies. The firm collaborated with IoT supplier AZLogica to create an IoT solution for optimising harvesting logistics. The use of IoT resulted in a tenfold return on investment, a 16% reduction in fuel usage, and timely product delivery. As a result of such advancements, organisations in the area are aiming to implement IoT, driving up demand for security solutions.

Brazil to Witness the Growth

- The cybersecurity market. Brazil, Argentina, and Mexico have formed. To counteract cyber-attacks Cyber Emergency Response Teams and Computer Security Incident, Response Teams will be required, with demand expected to grow throughout the projected period.

- Brazilian businesses aggressively invest in cybersecurity solutions and services to secure corporate systems in danger during the epidemic and comply with new data protection rules. This tendency has also prompted fresh investments in the country's cybersecurity business.

- Brazil is the most significant revenue-generating country in the Latin American cybersecurity industry, thanks to the country's expanding digital revolution. Recent regulatory changes like the new General Data Protection Regulation (GDPR) and 5G will likely drive business investment.

- Furthermore, the government provides several commercial opportunities for foreign enterprises providing innovative cybersecurity solutions. Brazil's cybersecurity investment is mainly driven by the private sector, including banking and financial services, e-commerce, telecommunications, etc. The government sector accounts for approximately 20% of the Brazilian cybersecurity market.

Latin America Cyber Security Industry Overview

The Latin American cybersecurity market is riddled with major global vendors and smaller regional vendors that cater to various segments of the market, owing to which the competitive space of the market is expected to be high.

- May 2023 - Check Point Software Technologies Ltd has announced the expansion of its check point harmony endpoint protection solution by incorporating vulnerability and automated patch management capabilities. This enhancement addresses the mounting number of cyberattacks that exploit unpatched system vulnerabilities for unauthorized access. To deliver this advanced feature, Check Point has joined forces with Ivanti, integrating Ivanti Patch Management to assess and remediate software vulnerabilities from cloud to edge, into Check Point's Harmony Endpoint protection solution.

- May 2023 - Cyber ark software ltd and Identity Security has announced new products and features across the CyberArk Identity Security Platform, making It is one of the most powerful platforms available. Investments in cloud security and automation and artificial intelligence (AI) breakthroughs throughout the platform make it simpler than ever to apply intelligent privilege controls to all human and non-human identities from a single vendo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapidly Increasing Cybersecurity Incidents and Regulations Requiring their Reporting

- 5.1.2 Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

6 MARKET SEGMENTATION

- 6.1 Security Type

- 6.1.1 Network Security

- 6.1.2 Cloud Security

- 6.1.3 Application Security

- 6.1.4 End-point Security

- 6.1.5 Wireless Network Security

- 6.1.6 Other Types of Security

- 6.2 Component

- 6.2.1 Hardware

- 6.2.2 Solution

- 6.2.2.1 Threat Intelligence and Response

- 6.2.2.2 Identity and Access Management

- 6.2.2.3 Data Loss Prevention

- 6.2.2.4 Security and Vulnerability Management

- 6.2.2.5 Intrusion Prevention System

- 6.2.2.6 Other Solutions

- 6.2.3 Services

- 6.2.3.1 Professional Services

- 6.2.3.2 Managed Services

- 6.3 Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.4 End-user Industry

- 6.4.1 Banking, Financial Services, and Insurance

- 6.4.2 Healthcare

- 6.4.3 Manufacturing

- 6.4.4 Retail

- 6.4.5 Government

- 6.4.6 IT and Telecommunication

- 6.4.7 Other End-user Industries

- 6.5 Country

- 6.5.1 Brazil

- 6.5.2 Argentina

- 6.5.3 Mexico

- 6.5.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AVG Technologies

- 7.1.2 Check Point Software Technologies Ltd

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Cyber Ark Software Ltd

- 7.1.5 Dell Technologies Inc.

- 7.1.6 FireEye Inc.

- 7.1.7 Fortinet Inc.

- 7.1.8 IBM Corporation

- 7.1.9 Imperva Inc.

- 7.1.10 Trend Micro Inc.

- 7.1.11 Intel Corporation

- 7.1.12 Symantec Corporation (Broadcom Inc.)