|

市場調查報告書

商品編碼

1686213

超級電容-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Supercapacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

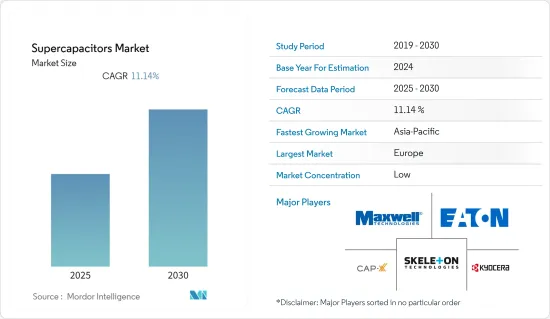

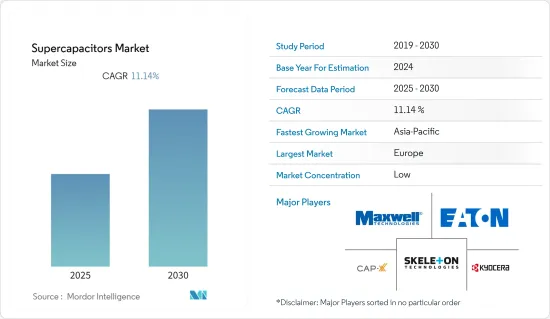

預計預測期內超級電容市場將以 11.14% 的複合年成長率成長。

超級電容因其快速充電和溫度穩定性而迅速取代傳統的電動車電池。此外,超級電容比標準電池更靈活。在研究市場中,GPS、可攜式媒體播放機、筆記型電腦、行動裝置等應用程式對穩定電源的需求很高,這是一個新興趨勢。

主要亮點

- 超級電容的充電和放電也有助於維持尖峰負載和備用電源,這對於持續運作非常重要。這包括電池供電的工業應用,如智慧電錶、煙霧偵測器、可視門鈴和醫療應用。為了支持這一點,各個供應商都在發布新產品。例如,德克薩斯(TI)最近推出了一款新型雙向降壓/升壓轉換器,靜態電流(IQ)為 60nA。此外,與常用的混合層電容器相比,TPS61094 降壓升壓轉換器具有降壓模式,可為超級電容充電,同時提供超低 IQ,使工程師能夠將電池壽命延長多達 20%。 (混合層電容器(HLC))。

- 目前正在進行進一步研究,以基於現有的超級電容技術開發經濟實惠的創新解決方案。這為當前模型提供了更經濟、更環保的替代方案,並強調了降低碳基電極製造成本和對關鍵零件的依賴的必要性。例如,倫敦帝國學院和倫敦大學學院 (UCL) 的研究人員最近為超級電容開發了更永續、能量密度更高的電極材料,為高功率、快速充電電動車技術的更廣泛市場應用鋪平了道路。

- 近年來,電訊和太空通訊系統推動了對超級電容的需求。印度太空研究組織 (ISRO) 維克拉姆·薩拉巴伊太空中心 (VSSC) 開發了一項技術,可以製造各種電容值(如 5F、120F、350F 和 500F)的超級電容(2.5V),以滿足與太空和社會需求相關的特定應用。超級電容正以多種方式有效利用來提高混合動力電動車的效率。

- 例如,Maxwell開發了一種超級電容連接的鉛酸電池,可用於取代傳統的汽車電池。該應用背後的想法是,啟動汽車等高能量需求會降低電池的總能量容量。該公司擁有一系列基於超級電容的模組,溫度可高達華氏 3000 度。用於混合動力啟動停止應用的超級電容已售出超過 60 萬個。

- 此外,各個市場供應商都見證了電動車業務的銷售成長,從而推動了汽車行業超級電容的成長。例如,預計2022年電動車銷量將達到1.06億輛,較2021年成長57%,其中純電動車銷量將達到800萬輛,插電式混合動力車銷量將達到2,600萬輛。預計2022年底,電動車運作將接近2,700萬輛,其中70%為輕型汽車,30%為純電動車,30%為插電式混合動力車。

- 此外,由於新冠疫情爆發,電力產業正受到經濟數位革命的影響。從智慧電錶、數位變電站和智慧電動車充電基礎設施到人工智慧、數位雙胞胎、動態線路評級和區塊鏈技術等軟體解決方案,政府、公用事業和製造商擴大採用數位技術。例如,印度政府在透過國家智慧電網計畫成功籌集3億美元投資後,最近宣布對配電產業計畫進行改革,改革成本超過400億美元,總預算支持超過100億美元。此類投資預計將為超級電容市場帶來新的機會。

超級電容市場趨勢

可再生能源解決方案需求的不斷成長預計將推動市場成長

今年超級電容市場價值為5.491億美元。預計未來五年將達到 11.146 億美元,預測期內複合年成長率為 13.19%。超級電容因其快速充電和溫度穩定性而迅速取代傳統的電動車電池。此外,超級電容比標準電池更靈活。在所研究的市場中,對 GPS、可攜式媒體播放機、筆記型電腦和行動裝置等應用的穩定電源的需求不斷增加,這是一個新興趨勢。

- 超級電容的充電和放電也有助於維持尖峰負載和備用電源,這對於持續運作非常重要。這也包括電池供電的工業應用,如智慧電錶、煙霧偵測器、可視門鈴和醫療應用。為了支持這一點,各個供應商都在發布新產品。例如,德克薩斯(TI)最近推出了一款新型雙向降壓/升壓轉換器,靜態電流(IQ)為 60nA。此外,與常用的混合層電容器相比,TPS61094 降壓升壓轉換器具有降壓模式,可為超級電容充電,同時提供超低 IQ,使工程師能夠將電池壽命延長多達 20%。 (混合層電容器(HLC))。

- 目前正在進行進一步研究,以基於現有的超級電容技術開發經濟實惠的創新解決方案。這為當前模型提供了更經濟、更環保的替代方案,並強調了降低碳基電極製造成本和對關鍵零件的依賴的必要性。例如,倫敦帝國學院和倫敦大學學院 (UCL) 的研究人員最近為超級電容開發了更永續、能量密度更高的電極材料,為高功率、快速充電電動車技術的更廣泛市場應用鋪平了道路。

- 近年來,電訊和太空通訊系統推動了對超級電容的需求。印度太空研究組織 (ISRO) 維克拉姆·薩拉巴伊太空中心 (VSSC) 開發了一項技術,可以製造各種電容值(如 5F、120F、350F 和 500F)的超級電容(2.5V),以滿足與太空和社會需求相關的特定應用。超級電容正以多種方式有效利用來提高混合動力電動車的效率。

- 例如,Maxwell開發了一種超級電容連接的鉛酸電池,可用於取代傳統的汽車電池。該應用背後的想法是,啟動汽車等高能量需求會降低電池的總能量容量。該公司擁有一系列基於超級電容的模組,溫度可高達華氏 3000 度。用於混合動力啟動停止應用的超級電容已售出超過 60 萬個。

- 此外,各個市場供應商都見證了電動車業務的銷售成長,從而推動了汽車行業超級電容的成長。例如,預計2022年電動車銷量將達到1.06億輛,較2021年成長57%,其中純電動車銷量將達到800萬輛,插電式混合動力車銷量將達到2,600萬輛。預計2022年底,電動車運作將接近2,700萬輛,其中70%為輕型汽車,30%為純電動車,30%為插電式混合動力車。

- 此外,由於新冠疫情爆發,電力產業正受到經濟數位革命的影響。從智慧電錶、數位變電站和智慧電動車充電基礎設施到人工智慧、數位雙胞胎、動態線路評級和區塊鏈技術等軟體解決方案,政府、公用事業和製造商擴大採用數位技術。例如,印度政府在透過國家智慧電網計畫成功籌集3億美元投資後,最近宣布對配電產業計畫進行改革,改革成本超過400億美元,總預算支持超過100億美元。這些投資預計將為超級電容市場帶來新的機會。

預計亞太地區成長最快

- 隨著中國努力實現2060年碳中和目標,預計超級電容的需求將以全球最高的長期速度成長。受惠於電動車等下游市場需求的成長,中國超級電容的整體市場佔有率可能會持續上升。在政府政策的支持下,許多新參與企業正在進入市場。

- 知名市場參與者包括國營企業中國鐵路車輛(CRRC)、南通江海、上海奧威和錦州凱美。在超級電容製造方面,出現了北海森斯碳材料科技、江蘇中天科技集團、天津普蘭奈米能源科技等新公司。東華大學、江蘇大學、南中大學、清華大學等科研院所及大學透過專利申請等方式參與超級電容領域的技術創新。

- 中國汽車工業蓬勃發展,在全球汽車市場中發揮越來越重要的作用。政府將汽車工業(包括汽車零件產業)視為國家支柱產業之一。中國中央政府預測,2025年,中國汽車產量將達到3,500萬輛,滿足超級電容的需求。電動車越來越受歡迎,中國被認為是領先的採用者之一。對於中國交通運輸業的發展,「十三五」規劃鼓勵發展混合動力汽車汽車、電動車等綠色交通方式。

- 此外,交通運輸是支撐日本經濟的重要基礎設施之一,伴隨其他產業的發展而發展。此外,日本正在走電動車之路。日本最大的汽車製造商豐田與另一家公司馬自達合作,共同開發包括微型車、轎車、SUV和小型卡車在內的電動車技術。這滿足了對超級電容的需求。

- 日本政府的目標是到2050年,日本銷售的所有新車都是電動或混合動力汽車。日本將提供補貼,加速私人開發電動車電池和馬達。此外,隨著政府推動減少汽車溫室氣體排放,日本公車和卡車製造商正專注於生產電動車。例如,日野汽車推出了首款柴油電動混合動力卡車。

- 日本電力公司正在採用智慧電錶。日本政府已將重點轉向需求面管理,強調透過智慧電網和節能技術實現能源安全和彈性。日本最大的電力公司東京電力公司(TEPCO)計劃在2020年安裝2,900萬台智慧電錶,預計2024年將安裝約8,000萬台,比原計畫提早8年。因此,超級電容在這些領域的應用不斷擴大可望推動市場發展。

- 在日本,一座商業建築中安裝了一套4MW系統,採用大型超級電容來減少電網消耗,並在尖峰時段需求期間減輕負載。在其他應用中,備用發電機在停電期間啟動以提供電力,直到切換穩定為止。

超級電容產業概況

超級電容市場競爭適中,有幾個主要企業。該市場還包括已投入大量老字型大小企業。目前,少數幾家大公司佔據市場主導地位。這些佔據了絕對市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來增加市場佔有率和盈利。主要企業包括伊頓公司、麥克斯韋科技公司(特斯拉公司)等。目前市場參與者包括:

- 2022 年 8 月-京瓷 AXA 推出一系列袋式超級電容,以減少電池的電流突波。這些電容器可以單獨用作系統電源的備用設備,在某些情況下可以替代電池,或與一次電池或二次電池組合使用。

- 2022 年 5 月 - CAP-XX Limited 與 Iconic Industries 成立合資企業,為各市場開發新型石墨烯,並將還原氧化石墨烯 (rGO) 商業化用於超級電容和其他能源儲存設備。 CAP-XX 將代表合資企業以 CAP-XX 品牌生產和銷售基於 rGO 的超級電容和能源儲存設備。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對可再生能源解決方案的需求不斷增加

- 環境問題導致基於超級電容的汽車產量增加

- 市場挑戰

- 產品成本上升

第6章 技術簡介

- 超級電容與傳統電介質的比較分析

- 超級電容的類型-EDLC、偽、混合

第7章市場區隔

- 按最終用戶

- 消費性電子產品

- 能源和公共產業

- 電網應用(包括微電網和UPS)

- 風和其他

- 工業的

- 汽車/運輸

- 巴士和卡車

- 鐵路和路面電車

- 48V輕度混合動力汽車

- 微混合動力汽車和其他車輛

- 大型車輛

- 按地區

- 美國

- 歐洲

- 中國

- 日本

- 韓國等亞洲國家

- 世界其他地區

第8章競爭格局

- 公司簡介

- Eaton Corporation PLC

- Maxwell Technologies Inc.(Tesla Inc.)

- Skeleton Technologies Inc.

- Cap-XX Limited

- Kyocera Corporation

- Supreme Power Solutions

- LS Mtron Ltd

- TOKIN Corporation

- Shanghai Aowei Technology Development Co. Ltd

- Loxus Inc.

- Panasonic Corporation

- Nantong Jianghai Capacitor Co. Ltd

- Beijing HCC Energy

- Jinzhou Kaimei Power Co. Ltd(KAM)

- Shanghai Green Tech Co. Ltd(GTCAP)

- Shenzhen Topmay Electronic Co. Ltd

- Liaoning Brother Electronics Technology Co. Ltd

- SEMG(Seattle Electronics Manufacturing Group(HK)Co. Ltd)

- Chengdu Ztech Polymer Material Co. Ltd

- Shanghai Pluspark Electronics Co. Ltd

- Nippon Chemi-Con Corporation

第9章投資分析

第10章:市場的未來

The Supercapacitors Market is expected to register a CAGR of 11.14% during the forecast period.

Supercapacitors are replacing traditional electric car batteries with quick charging and temperature stability. Additionally, supercapacitors are more flexible than standard batteries. The high demand for a stable power supply for applications such as GPS, portable media players, laptops, and mobile devices, is an emerging trend in the market studied.

Key Highlights

- Supercapacitor charging and discharging also helps sustain peak loads and backup power, which is significant for continuous operation. It includes battery-powered industrial applications such as smart meters, smoke detectors, video doorbells, and medical applications. To support this, various vendors are launching new products. For instance, Texas Instruments (TI) recently announced a new bidirectional buck/boost converter with a quiescent current (IQ) of 60 nA. Additionally, compared to frequently used hybrid-layer capacitors, the TPS61094 buck/boost converter includes a buck mode for supercapacitor charging while delivering ultra-low IQ, allowing engineers to extend battery life by up to 20%. (hybrid-layer capacitors (HLCs)).

- Further research is underway in developing affordable and innovative solutions built on existing supercapacitor technology. It offers a more affordable and ecological alternative to present models and emphasizes the need to reduce the carbon-based electrode production cost and the dependency on crucial components. For instance, researchers from Imperial College London and University College London (UCL) recently developed a more sustainable and energy-dense electrode material for supercapacitors, paving the way for further market use of high-power, quick-charging electric vehicle technology.

- In recent years, communication systems in telecom and space have propelled the supercapacitors demand. The Indian Space Research Organization (ISRO), at its Vikram Sarabhai Space Center (VSSC), developed the technology for processing supercapacitors (2.5 V) of varying capacitance values viz., 5 F, 120 F, 350 F, and 500 F, catering to specific applications related to space and societal needs. Supercapacitors are effectively being used to improve the efficiency of hybrid electric vehicles in various ways.

- For instance, Maxwell developed a supercapacitor-connected lead-acid battery that may be used to replace a traditional vehicle battery. The idea behind this application is that high-energy demands, such as starting an automobile, reduce the battery's total energy capacity. The company has a line of supercapacitor-based modules that can reach temperatures of 3000 degrees Fahrenheit. Over 600,000 supercapacitors have been sold for hybrid start-stop applications.

- Furthermore, various market vendors have witnessed increased sales in the electric vehicle business, pushing the supercapacitor growth in the automotive industry. For instance, according to EV volumes, for the entire year of 2022, sales of 10,6 million were expected, showing a growth of 57 % over 2021, with BEVs reaching 8 million units and PHEVs 2,6 million units. Also, by the end of 2022, it was expected that there would be nearly 27 million EVs in operation, counting light vehicles, 70 % BEVs, and 30 % PHEVs.

- Additionally, with the COVID-19 outbreak, the power sector is impacted by the economy's digital revolution. From smart meters, digital substations, and smart EV charging infrastructure to software solutions, such as artificial intelligence, digital twins, dynamic line rating, and blockchain technology, governments, utilities, and manufacturers, are increasingly embracing digital technologies. For instance, after successfully advancing smart grid deployment and mobilizing investments of USD 300 million through its National Smart Grid Mission, the Indian government recently announced a Revamped Distribution Sector Scheme with a cost of over USD 40 billion and gross budgetary support of over USD 10 billion. Such investments are expected to bring new opportunities to the supercapacitor market.

Supercapacitors Market Trends

Increasing Demand for Renewable Energy Solutions is Expected to Drive the Market Growth

The Supercapacitors Market was valued at USD 549.1 million in the current year. It is expected to reach a value of USD 1,114.60 million by the next five years, registering a CAGR of 13.19% during the forecast period. Supercapacitors are replacing traditional electric car batteries with quick charging and temperature stability. Additionally, supercapacitors are more flexible than standard batteries. The high demand for a stable power supply for applications such as GPS, portable media players, laptops, and mobile devices, is an emerging trend in the market studied.

- Supercapacitor charging and discharging also helps sustain peak loads and backup power, which is significant for continuous operation. It includes battery-powered industrial applications such as smart meters, smoke detectors, video doorbells, and medical applications. To support this, various vendors are launching new products. For instance, Texas Instruments (TI) recently announced a new bidirectional buck/boost converter with a quiescent current (IQ) of 60 nA. Additionally, compared to frequently used hybrid-layer capacitors, the TPS61094 buck/boost converter includes a buck mode for supercapacitor charging while delivering ultra-low IQ, allowing engineers to extend battery life by up to 20%. (hybrid-layer capacitors (HLCs)).

- Further research is underway in developing affordable and innovative solutions built on existing supercapacitor technology. It offers a more affordable and ecological alternative to present models and emphasizes the need to reduce the carbon-based electrode production cost and the dependency on crucial components. For instance, researchers from Imperial College London and University College London (UCL) recently developed a more sustainable and energy-dense electrode material for supercapacitors, paving the way for further market use of high-power, quick-charging electric vehicle technology.

- In recent years, communication systems in telecom and space have propelled the supercapacitors demand. The Indian Space Research Organization (ISRO), at its Vikram Sarabhai Space Center (VSSC), developed the technology for processing supercapacitors (2.5 V) of varying capacitance values viz., 5 F, 120 F, 350 F, and 500 F, catering to specific applications related to space and societal needs. Supercapacitors are effectively being used to improve the efficiency of hybrid electric vehicles in various ways.

- For instance, Maxwell developed a supercapacitor-connected lead-acid battery that may be used to replace a traditional vehicle battery. The idea behind this application is that high-energy demands, such as starting an automobile, reduce the battery's total energy capacity. The company include a line of supercapacitor-based modules that can reach temperatures of 3000 degrees Fahrenheit. Over 600,000 supercapacitors have been sold for hybrid start-stop applications.

- Furthermore, various market vendors have witnessed increased sales in the electric vehicle business, pushing the supercapacitor growth in the automotive industry. For instance, according to EV volumes, for the entire year of 2022, sales of 10,6 million were expected, showing a growth of 57 % over 2021, with BEVs reaching 8 million units and PHEVs 2,6 million units. Also, by the end of 2022, it was expected that there would be nearly 27 million EVs in operation, counting light vehicles, 70 % BEVs, and 30 % PHEVs.

- Additionally, with the COVID-19 outbreak, the power sector is impacted by the economy's digital revolution. From smart meters, digital substations, and smart EV charging infrastructure to software solutions, such as artificial intelligence, digital twins, dynamic line rating, and blockchain technology, governments, utilities, and manufacturers, are increasingly embracing digital technologies. For instance, after successfully advancing smart grid deployment and mobilizing investments of USD 300 million through its National Smart Grid Mission, the Indian government recently announced a Revamped Distribution Sector Scheme with a cost of over USD 40 billion and gross budgetary support of over USD 10 billion. Such investments are expected to bring new opportunities to the supercapacitor market.

Asia Pacific Expected to be the Fastest-growing Region

- In China, the demand for supercapacitors is expected to grow by one of the highest growth rates in the world for a long time to meet the carbon neutrality targets by 2060. Benefiting from the increased demand in downstream markets, such as electric vehicles, the overall market share of supercapacitors in China would continue to rise. With policy support from the government, many new players have positioned themselves in the market.

- Prominent market players include the state-owned CRRC (China Railroad Rolling Stock Corporation), Nantong Jianghai, Shanghai Aowei, and Jinzhou Kaimei. There are new players in supercapacitor manufacturing, such as Beihai Sence Carbon Materials Technology, Jiangsu Zhongtian Technology Group, and Tianjin Plannano Energy Technologies. Research institutions and universities, including Donghua University, Jiangsu University, South Central University, and Tsinghua University, have been involved in innovation in the supercapacitors sector through patent filing, among other things.

- China's automotive industry is overgrowing, and the country plays an increasingly important role in the global automotive market. The government views the automotive industry, including the auto parts sector, as one of its country's pillar industries. The Central Government of China estimates that China's automobile output shall reach 35 million units by 2025, which caters to supercapacitors' demand. Electric vehicles are becoming more popular, and China is considered one of the leading adopters. For developments in China's transportation industry, the 13th Five-Year Plan encourages the development of green mobility alternatives such as hybrid and electric vehicles.

- Additionally, transportation is one of the critical infrastructures that supported the Japanese economy and evolved along with other industries' growth. Additionally, Japan is on the road toward electric vehicles. The biggest motor vehicle company in the country, Toyota, partnered with another player, Mazda, to develop electric vehicle technologies for electric cars, including mini-vehicles, passenger cars, SUVs, and light trucks. It caters to the demand for supercapacitors.

- The Japanese government aimed to have all new cars sold in Japan be electric or hybrid vehicles by 2050. The country plans to offer subsidies to accelerate the private-sector development of batteries and motors for electricity-powered cars. Furthermore, Japanese bus and truck makers are focusing more on electric vehicle production as the government is pushing to reduce greenhouse gas emissions from vehicles. For instance, Hino Motors Ltd launched its first model of a diesel-electric hybrid truck.

- Utility companies in Japan are adopting smart electricity meters. The Japanese government moved its focus to demand-side management, emphasizing energy security and resiliency via smart grid and energy-saving technologies. Tokyo Electric Power (TEPCO), Japan's largest power utility, was expected to have 29 million smart meters installed in 2020. The country estimates to have about 80 million units deployed by 2024, a target brought forward eight years from the original plan. Hence, the growing applications of supercapacitors in such areas are expected to drive the market.

- Japan also employs large supercapacitors as the 4 MW systems are installed in commercial buildings to reduce grid consumption at peak demand times and ease loading. Other applications start backup generators during power outages and provide power until the switchover is stabilized.

Supercapacitors Industry Overview

The Supercapacitors Market is moderately competitive and consists of several major players. The market includes long-standing, established players who have made significant investments. A few major players currently dominate the market in terms of share. With a prominent share in the market, these considerable players focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. Eaton Corporation PLC, Maxwell Technologies Inc. (Tesla Inc.), and others are key players. The current advancement in the market are:

- August 2022 - Kyocera AXA introduced a series of pouch-style supercapacitors for decreasing current surge batteries. These capacitors can be used on their own as system power backup devices, replacing batteries in some cases, or they can be used in conjunction with primary or secondary batteries.

- May 2022 - CAP-XX Limited formed a joint venture with Iconic Industries, which is developing new forms of graphene for various markets and involves the commercialization of reduced graphene oxide (rGO) for supercapacitors and other energy storage devices. CAP-XX will manufacture and sell supercapacitors and energy storage devices using rGO, on behalf of the joint venture, under the CAP-XX brand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Renewable Energy Solutions

- 5.1.2 Increasing Production of Supercapacitor-based Vehicles Owing to Environmental Concerns

- 5.2 Market Challenges

- 5.2.1 Higher Costs Associated with Products

6 TECHNOLOGY SNAPSHOT

- 6.1 Comparative Analysis of Supercapacitors and Conventional Dielectric

- 6.2 Types of Supercapacitors - EDLC, Psuedo, and Hybrid

7 MARKET SEGMENTATION

- 7.1 By End-User

- 7.1.1 Consumer Electronics

- 7.1.2 Energy and Utilities

- 7.1.2.1 Grid Applications (Including Micro Grid and UPS)

- 7.1.2.2 Wind and Others

- 7.1.3 Industrial

- 7.1.4 Automotive/Transportation

- 7.1.4.1 Bus and Truck

- 7.1.4.2 Rail and Tram

- 7.1.4.3 48V Mild Hybrid Car

- 7.1.4.4 Micro Hybrids and Other Cars

- 7.1.4.5 Heavy Vehicles

- 7.2 By Geography

- 7.2.1 United States

- 7.2.2 Europe

- 7.2.3 China

- 7.2.4 Japan

- 7.2.5 Korea and Rest of Asia

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Eaton Corporation PLC

- 8.1.2 Maxwell Technologies Inc. (Tesla Inc.)

- 8.1.3 Skeleton Technologies Inc.

- 8.1.4 Cap-XX Limited

- 8.1.5 Kyocera Corporation

- 8.1.6 Supreme Power Solutions

- 8.1.7 LS Mtron Ltd

- 8.1.8 TOKIN Corporation

- 8.1.9 Shanghai Aowei Technology Development Co. Ltd

- 8.1.10 Loxus Inc.

- 8.1.11 Panasonic Corporation

- 8.1.12 Nantong Jianghai Capacitor Co. Ltd

- 8.1.13 Beijing HCC Energy

- 8.1.14 Jinzhou Kaimei Power Co. Ltd (KAM)

- 8.1.15 Shanghai Green Tech Co. Ltd (GTCAP)

- 8.1.16 Shenzhen Topmay Electronic Co. Ltd

- 8.1.17 Liaoning Brother Electronics Technology Co. Ltd

- 8.1.18 SEMG (Seattle Electronics Manufacturing Group (HK) Co. Ltd)

- 8.1.19 Chengdu Ztech Polymer Material Co. Ltd

- 8.1.20 Shanghai Pluspark Electronics Co. Ltd

- 8.1.21 Nippon Chemi-Con Corporation