|

市場調查報告書

商品編碼

1686255

1,4 丁二醇 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)1,4 Butanediol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

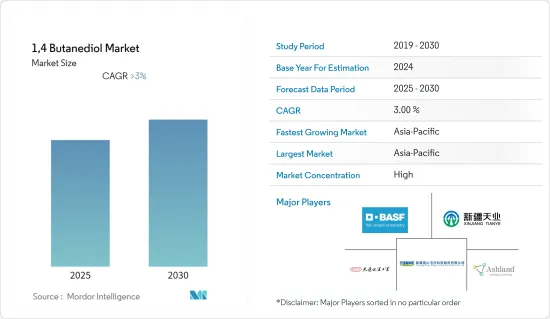

預計預測期內 1,4 丁二醇市場將以超過 3% 的複合年成長率成長。

由於化學品供應鏈中斷以及原料價格在疫情期間飆升,COVID-19 疫情對市場產生了重大負面影響。不過,隨著紡織業活動活性化,預計 2021 年市場將實現穩定成長。

主要亮點

- 短期內,氨綸纖維對四氫呋喃(THF)的需求增加以及各行業對聚丁烯對苯二甲酸酯(PBT)的需求增加是推動研究市場成長的關鍵因素。

- 然而,多年來1,4丁二醇工廠的關閉是預測期內抑制目標產業成長的主要因素。

- 然而,生物基 BDO 的不斷發展和服飾碳排放的減少可能很快就會為全球市場創造有利可圖的成長機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的複合年成長率。

1,4-丁二醇市場趨勢

紡織業需求不斷成長

- 1,4 BDO 用作皮革、塑膠、聚酯層壓板和聚氨酯鞋的黏合劑。 1,4-丁二醇是一種即時化學品,用於生產熱塑性聚氨酯 (TPU) 以及合成皮革鞋底。

- 四氫呋喃 (THF) 用於製造風靡服飾的氨綸纖維。氨綸是一種輕質、柔軟、光滑的合成纖維,具有獨特的拉伸性能。該材料用於製造動態捕捉服、手術軟管和支撐軟管等壓縮服飾。

- 它對於酒店和工業組織來說也是有用的材料。氨綸材質主要用於注重舒適性和合身性的服裝,例如針織品、泳裝、運動服、襪子、內衣、手套、騎行短褲、緊身衣、丹寧布料和運動器材。

- Industrievereinigung Chemiefaser預測,全球紡織纖維產量將從2020年的1.083億噸增加到2021年的1.136億噸。

- 近年來,全球體育用品市場經歷了顯著成長。根據Statista消費者市場展望,全球運動用品市場規模預計到2021年將達到1,265.4億美元,到2026年將達到1,594.1億美元。

- 例如,澳洲政府計劃在未來五年內投資2.3億美元用於體育和體育活動計畫。這些措施可望鼓勵更多人參與各種戶外運動,進而促進氨綸運動服的銷售。

- 因此,由於上述因素,紡織業預計對 1,4 BDO 產品的需求將在預測期內對研究市場產生正面影響。

亞太地區佔市場主導地位

- 亞太地區佔據全球 1,4 丁二醇市場的主導地位。該地區的需求受到汽車、電子、皮革和電子產品等各行業不斷成長的需求的推動。

- 1,4丁二醇廣泛用於生產PBT,而PBT又用於汽車生產。在汽車領域,PBT 可以吸收能量、減輕重量、在保險桿中提供防撞保護、降低燃料箱爆炸的風險、用於安全帶、安全氣囊、車門和座椅組件以及許多其他應用。

- 在中國,汽車產量的成長以及製藥、電氣和電子產業的擴張正在支撐國內對BDO及其衍生物的需求,預計這將成為未來市場成長的正面因素。

- 不過,2021年中國汽車產量達26082220輛,而2020年為25225242輛,成長率為3%。預計這將促進汽車領域各個應用對 1,4 BDO 的需求。

- 此外,印度人口不斷成長,對人員便捷流動的需求很大。根據OICA統計,2021年印度汽車產量為4,399,112輛,較2020年成長30%。

- 日本的電氣電子產業是世界領先的產業之一。該公司在攝影機、光碟、電腦、影印機、傳真機、行動電話以及其他各種關鍵電腦零件的生產領域處於世界領先地位。

- 根據日本電子情報技術產業協會(JEITA)統計,2022年9月家電進口總額達14,371.74億日圓(約105.2732億美元)。

- 因此,預計這種有利趨勢將在預測期內推動對 1,4 丁二醇的需求。

1,4丁二醇產業概況

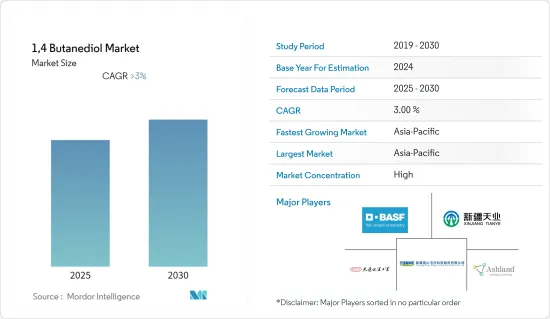

1,4丁二醇市場部分整合。主要市場公司包括(不分先後順序)BASF歐洲公司、DCC、新疆蘭陵屯河化工、新疆天亞(集團)和亞什蘭。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 氨綸纖維對四氫呋喃(THF)的需求不斷增加

- 各行業對聚丁烯對苯二甲酸酯(PBT)的需求不斷增加

- 限制因素

- 關閉長期存在的1,4丁二醇工廠

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 生產能力(主要製造商)

第5章市場區隔

- 衍生性商品

- 四氫呋喃(THF)

- 聚丁烯對苯二甲酸酯(PBT)

- γ-丁內酯(GBL)

- 聚氨酯(PU)

- 其他衍生性商品

- 最終用戶產業

- 車

- 醫療保健和製藥

- 纖維

- 電氣和電子

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- Ashland

- BASF SE

- DCC

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- NAN YA PLASTICS CORPORATION

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- Sipchem

- Shanxi Sanwei Group Co. Ltd

- Xinjiang Guotai

- Xinjiang Tianye(Group)Co. Ltd

- Xinjiang Blueridge Tunhe Chemical Industry Co. Ltd

第7章 市場機會與未來趨勢

- 生物基BDO的不斷發展

- 減少服飾的碳足跡

The 1,4 Butanediol Market is expected to register a CAGR of greater than 3% during the forecast period.

Due to the disruption in the chemical goods supply chain during the pandemic, which raised the price of raw materials, the COVID-19 pandemic had a significant negative impact on the market. However, the market is projected to grow steadily, owing to increased activities of the textile industry in 2021.

Key Highlights

- Over the short term, increasing demand for tetrahydrofuran (THF) for spandex fibers, and increasing demand for polybutylene terephthalate (PBT) from various industries are major factors driving the growth of the market studied.

- However, the shutdown of 1,4 butanediol plants throughout the years is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the rising development of bio-based BDO, and reducing the carbon footprint of clothing are likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is expected to dominate the market and witness the highest CAGR during the forecast period.

1,4 Butanediol Market Trends

Growing Demand in the Textile Industry

- 1,4 BDO is used as an adhesive in leather, plastics, polyester laminates, and polyurethane footwear. 1,4-Butanediol is an immediate chemical used in the production of Thermoplastic polyurethane (TPU) which is further used in the making of Synthetic leather sole material.

- Tetrahydrofuran (THF) is used for the production of spandex fiber which has captured the garment industry. Spandex is a lightweight, soft smooth synthetic fiber that has a unique elasticity. The material is used in making compression garments: motion capture suits, Surgical hoses, and Support hoses.

- This is also a useful fabric for hospitality and industrial organizations. Spandex fabrics are mostly used in garments where comfort and fit are required like hosiery, swimsuits, exercise wear, socks, undergarments, gloves, cycling shorts, specialized clothing like zentai suits, denim, and sports equipment, etc.

- The Industrievereinigung Chemiefaser estimates that the global production of textile fibers increased from 108,300 thousand metric tonnes in 2020 to 113,600 thousand metric tonnes in 2021.

- The global sports equipment market has been witnessing significant growth in the recent past. According to Statista Consumer Market Outlook, the global sports equipment market is projected to reach USD 126.54 billion in 2021 to USD 159.41 billion in 2026.

- For instance, the Government of Australia is planning to invest USD 230 million in sports and physical activity initiatives over the next five years. Such initiatives are expected to encourage more people to indulge in various outdoor sports, which, in turn, will increase the sales of spandex sportswear.

- Therefore, owing to the abovementioned factors, the demand for 1,4 BDO products in the textile industry is expected to positively impact the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global 1,4 butanediol market. The regional demand for the market studied is driven by growing demand from various industries such as automotive, electronics, leather, and electronics.

- 1, 4 butanediol is widely used in the production of PBT, which is further used in the production of automotive. In the automotive sector, PBT allows for energy absorption, weight reduction, shock absorption for bumpers, restriction of explosion risk in fuel tanks, seat belts, airbags, door and seat assemblies, and various other applications.

- In China, the growing production of motor vehicles and the expanding pharmaceutical and electrical & electronics industry is expected to support the domestic demand for BDO and its derivatives, which is a positive factor for the market's growth in the future.

- However, in 2021, the production of vehicles in China reached 26,082,220 units, registering a growth rate of 3%, compared to 25,225,242 units in 2020. This is expected to boost the tho demand for 1,4 BDO from various applications in the automotive sector.

- Moreover, the growing population in India is creating the need for easy mobility of the people, which in turn is increasing the demand for automobiles in the region. According to OICA, in India, the total number of vehicles produced in 2021 was 4,399,112 and witnessed a growth rate of 30% compared to 2020.

- The Japanese electrical and electronics industry is one of the world's leading industries. The country is a world leader in producing video cameras, compact discs, computers, photocopiers, fax machines, cell phones, and various other key computer components.

- According to Japan Electronic and Information Technology Association (JEITA), the total number of imports of consumer electronics amounted to JPY 1,437,174 million (USD 10527.32 million )in September 2022.

- Hence, such favorable trends are expected to drive the demand for 1,4 butanediol during the forecast period.

1,4 Butanediol Industry Overview

The 1,4 butanediol market is partially consolidated in nature. Some of the major market players include BASF SE, DCC, Xinjiang Blue Ridge Tunhe Chemical Co. Ltd, Xinjiang Tianye (Group) Co. Ltd, and Ashland, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Tetrahydrofuran (THF) for Spandex Fibers

- 4.1.2 Increasing Demand for Polybutylene Terephthalate (PBT) from Various Industries

- 4.2 Restraints

- 4.2.1 Shutdown of 1,4 Butanediol Plants Throughout the Years

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Capacity (Major Players)

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Tetrahydrofuran (THF)

- 5.1.2 Polybutylene Terephthalate (PBT)

- 5.1.3 Gamma-Butyrolactone (GBL)

- 5.1.4 Polyurethane (PU)

- 5.1.5 Other Derivatives

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Healthcare and Pharmaceutical

- 5.2.3 Textile

- 5.2.4 Electrical and Electronics

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashland

- 6.4.2 BASF SE

- 6.4.3 DCC

- 6.4.4 LyondellBasell Industries Holdings BV

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 NAN YA PLASTICS CORPORATION

- 6.4.7 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- 6.4.8 Sipchem

- 6.4.9 Shanxi Sanwei Group Co. Ltd

- 6.4.10 Xinjiang Guotai

- 6.4.11 Xinjiang Tianye (Group) Co. Ltd

- 6.4.12 Xinjiang Blueridge Tunhe Chemical Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Development of Bio-based BDO

- 7.2 Reducing Carbon Footprint of Clothing