|

市場調查報告書

商品編碼

1686263

工業需量反應管理系統-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Industrial Demand Response Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

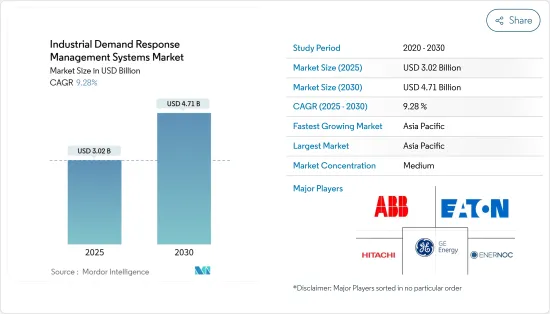

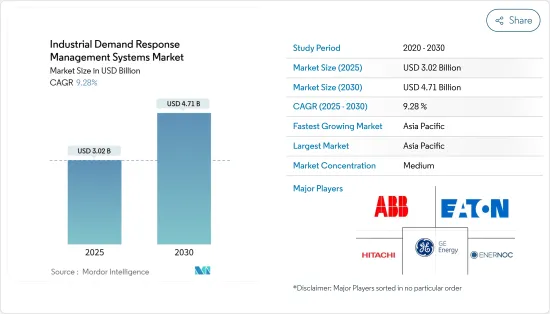

工業需量反應管理系統市場規模預計在 2025 年達到 30.2 億美元,預計到 2030 年將達到 47.1 億美元,預測期內(2025-2030 年)的複合年成長率為 9.28%。

主要亮點

- 從中期來看,對高效能能源管理系統的需求和再生能源來源的不斷普及預計將推動市場的發展。

- 然而,有關工業需量反應管理系統的隱私問題預計會阻礙市場成長。

- 然而,預計在預測期內,智慧電網技術的日益普及將為市場帶來重大機會。

- 由於再生能源來源的日益普及,亞太地區預計將佔據大部分市場佔有率。

工業需量反應管理系統的市場趨勢

自動化需量反應管理系統預計將佔據很大佔有率

- 在關鍵時刻,自動需量反應管理系統 (ADRMS) 市場正在有限範圍內進行 ADRMS 的初步部署,並依靠客戶獎勵和各種通訊系統。這些系統有可能顛覆未來的電力格局。 ADRMS 不僅承諾為公用事業公司和消費者實現成本最佳化,而且還為政策制定者和公用事業公司提供支援。透過 ADRMS,您可以製定電網現代化的智慧策略、設定可實現的目標並設計出強大的解決方案來應對全球暖化的影響。

- 對電網現代化和智慧電網系統的投資正在增加,表明在不久的將來迫切需要部署它們。美國、日本和德國等新興市場以及中國等新興強國正成為大規模採用 ADRMS 的主要場所。這一成長是由可再生能源整合計劃和高效電力系統的協同推動所推動的。

- 值得關注的是,塔塔電力與 AutoGrid 合作在孟買推出以人工智慧為中心的能源管理舉措。該計畫針對塔塔電力的多元化客戶群,旨在解決尖峰需求問題並與印度的清潔能源目標產生共鳴,加強其淨零目標。

- 在另一項重要合作中,Honeywell和 Enel 於 2024 年 5 月宣布,他們將透過自動需求回應系統來增強能源節約。透過兩家公司的合作,Enel North America 的 FlexUp 解決方案現在可以與Honeywell的自動化系統無縫整合。 Enel Flex-Up 不僅為企業的自動化工作提供資金,還鼓勵企業參與需量反應計劃,並獎勵企業減少尖峰時段的用電量。

- 截至 2024 年 3 月,美國擁有全球最多的資料中心,共 5,381 個,其次是德國(521 個)和英國(514 個)。許多政府將能源效率視為需量反應的基石。透過支持和資助能源效率工作,我們獎勵消費者積極參與需量反應計劃。

- 2024年12月,Energy Vault與RackScale 資料 Centers達成策略夥伴關係,為資料中心分配2GW電力。兩家公司的重點都是 B-Nest 基礎設施,其容量為 2GW/20GWh。此次合作不僅將加速投資組合的擴張,還將透過與當地電力公司建立需量反應夥伴關係來開闢收益管道。透過參與這些需量反應活動,尤其是在高峰時段,RackScale資料中心增強了電網穩定性,並協助當地公用事業公司整合可再生能源。

- 由於這些發展,自動化需量反應管理系統部門預計將佔據工業需量反應管理系統市場的很大佔有率。

亞太地區成長強勁

- 預計亞太工業需量反應管理系統市場在預測期內將經歷顯著成長。

- 中國越來越重視實施需求面管理(DSM)計劃,以此作為減少尖峰電力需求和匹配可再生能源需求的手段。這些努力源自於該國致力於應對多重挑戰,此外還包括減少排放、整合再生能源來源、節省尖峰功率、提高負載率和追求淨零能耗。

- 中國也擁有世界上最大的石油和氣體純化能力。 2023年的精製能力將達到約1,848.4萬桶/日,較2022年成長7%。中國也佔全球精製能力的近18%。此外,該國也正在建造新的煉油廠,並升級和提高舊煉油廠的產能。

- 此外,印度經濟成長也增加了對電力的需求,但由於能源資源有限,該國過度開發資源,導致電力需求增加。在印度,重點已轉向重組電力行業,透過使需求與發電要求一致而不是使發電與需求相匹配來減輕電力基礎設施的壓力,從而保持供需平衡。

- 2023 年 2 月,虛擬發電廠和分散式能源管理系統 (DERMS) 供應商 AutoGrid 宣布與印度最大的綜合電力公司之一塔塔電力 (Tata Power) 開展合作舉措。除了支持印度的清潔能源轉型外,這項開創性計畫還將幫助解決住宅、商業和工業領域的尖峰需求。

- 塔塔電力也計劃在2025年夏季之前為印度最大城市孟買的客戶推出一項新的需量反應管理計畫。該計劃將涉及6000家大型商業和工業客戶,並在前六個月實現75兆瓦的峰值容量削減,此後將繼續增加到200兆瓦。

- 考慮到該地區工業部門的發展和需量反應計劃的採用,預計該地區未來對 DRMS 的需求將很大。

工業需量反應管理系統產業概況

工業需量反應管理系統市場減少了一半。市場的主要企業(不分先後順序)包括伊頓公司、日立有限公司、EnerNOC公司、通用電氣公司和ABB有限公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 至2030年市場規模及需求預測(單位:美元)

- 近期趨勢和發展

- 市場動態

- 驅動程式

- 需要高效率的能源管理系統

- 擴大再生能源來源的使用

- 限制因素

- 工業需量反應管理系統的隱私問題

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

- 投資分析

第5章市場區隔

- 類型

- 傳統需量反應

- 自動需量反應

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 埃及

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Schneider Electric SE

- Siemens AG

- Hitachi Ltd

- Mitsubishi Electric Corporation

- ABB Ltd.

- Alstom SA

- General Electric Company

- Eaton Corporation PLC

- Itron Inc

- EnerNOC Inc.

- Uplight, Inc.

- List of Other Prominent Companies(Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 市場排名分析

第7章 市場機會與未來趨勢

- 智慧電網技術的應用日益廣泛

簡介目錄

Product Code: 51306

The Industrial Demand Response Management Systems Market size is estimated at USD 3.02 billion in 2025, and is expected to reach USD 4.71 billion by 2030, at a CAGR of 9.28% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the need for efficient energy management systems and the growing penetration of renewable energy sources are expected to drive the market

- On the other hand, privacy concerns about industrial demand response management systems are expected to hamper the market's growth.

- Nevertheless, the rising adoption of smart grid technologies is expected to be a significant opportunity for the market in the forecast period.

- Asia-Pacific is expected to have a significant share of the market due to the increasing adoption of renewable energy sources.

Industrial Demand Response Management Systems Market Trends

Automated Demand Response Management System is Expected to have Significant Share

- At a pivotal moment, the Automated Demand Response Management System (ADRMS) market is witnessing the initial deployment of ADRMS, albeit on a limited scale and incentivized for customers, all while relying on diverse communication systems. Looking ahead, these systems hold the potential to disrupt the electricity landscape. ADRMS not only promise cost optimization for both utilities and consumers but also empower policymakers and utilities. With ADRMS, they can craft intelligent strategies for grid modernization, set achievable targets, and devise robust solutions to counter global warming's impacts.

- Investment in grid modernization and smart grid systems is on the rise, signaling a pressing need for deployment in the near future. Developed markets, including the U.S., Japan, and Germany, alongside emerging giants like China, are becoming prime arenas for large-scale ADRMS implementation. This surge is driven by renewable integration programs and a concerted push towards efficient electricity systems.

- In a notable move, Tata Power, in partnership with AutoGrid, rolled out an AI-centric energy management initiative in Mumbai. This program, targeting Tata Power's diverse clientele, aims to tackle peak demand issues, resonate with India's clean energy ambitions, and bolster Net Zero objectives.

- In another significant collaboration, Honeywell and Enel, in May 2024, sought to enhance energy savings through automated demand response systems. Their partnership allows Enel North America's FlexUp solutions to seamlessly integrate with Honeywell's automation systems. Enel's FlexUp not only finances businesses' automation endeavors but also boosts their participation in demand response programs, rewarding them for reducing electricity use during peak times.

- As of March 2024, the U.S. led the world with 5,381 data centers, followed by Germany with 521 and the U.K. with 514. Many governments view energy efficiency as pivotal for demand response. By endorsing and financially backing energy efficiency efforts, they incentivize consumers, fostering active engagement in demand response initiatives.

- In December 2024, Energy Vault and RackScale Data Centers forged a strategic alliance, eyeing a 2GW power allocation for data centers. Their focus is on the B-Nest infrastructure, boasting a capacity of 2 GW/20 GWh. This collaboration not only accelerates their portfolio expansion but also opens avenues for revenue through demand response partnerships with local utilities. By engaging in these demand response events, particularly during peak periods, RackScale Data Centers bolster grid stability, aiding local utilities in their renewable energy integration endeavors.

- Given these developments, the Automated Demand Response Management System segment is poised to capture a substantial share of the Industrial Demand Response Management Systems Market.

Asia-Pacific to Witness a Significant Growth

- The market for industrial demand response management systems in the Asia-Pacific region is expected to witness significant growth during the forecast period.

- China is making increasing efforts to implement demand-side management (DSM) programs as a means of reducing peak electricity demand and matching renewable energy with demand. In addition to reducing emissions, integrating renewable energy sources, shaving peak power, improving load factor, and pursuing net zero energy, these efforts are motivated by the country's commitment to address multiple challenges.

- China also has one of the world's largest oil & gas refining capacities. In 2023, it had an oil refining capacity of about 18,484 thousand barrels per day, witnessed a 7% increase from 2022. Besides, China contributes to close to 18% of the global refining capacity. Further, the country has also been constructing new refineries and upgrading and adding capacity to older ones.

- Moreover, Power demand has increased in India owing to the economic growth, but the country's limited energy resources have resulted in overexploitation of these resources, resulting in a rise in power demand. The focus in India is shifting towards restructuring the power sector so that rather than generation adapting to demand, demand can be tailored to meet generation requirements to maintain demand-supply balance, thus reducing strain on power infrastructure.

- In February 2023, AutoGrid, a provider of virtual power plants and distributed energy management systems (DERMS), announced a collaborative initiative with Tata Power, one of India's largest integrated power companies. In addition to supporting India's clean energy transition, this pioneering program will help address peak demand in residential, commercial, and industrial areas.

- Also, by the summer of 2025, Tata Power plans to roll out a new Demand Response Management Program to serve its customers in Mumbai, India's largest city. The program will involve 6,000 large commercial and industrial customers to attain 75 MW of peak capacity decrease within the first six months and then continue to rise to 200 MW.

- Considering the development of the industrial sector in the region and the adoption of demand response programs, the region is expected to witness a massive demand for DRMS in the future.

Industrial Demand Response Management Systems Industry Overview

The industrial demand response system market is semi-fragmented. Some of the major players in the market (in no particular order) include Eaton Corporation PLC, Hitachi Ltd, EnerNOC Inc., General Electric Company, ABB Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, until 2030

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.1.1 Need for Efficient Energy Management Systems

- 4.4.1.2 Growing Penetration of Renewable Energy Sources

- 4.4.2 Restraints

- 4.4.2.1 Privacy Concerns on the Industrial Demand Response Management Systems

- 4.4.1 Drivers

- 4.5 Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional Demand Response

- 5.1.2 Automated Demand Response

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Australia

- 5.2.2.5 Malaysia

- 5.2.2.6 Thailand

- 5.2.2.7 Indonesia

- 5.2.2.8 Vietnam

- 5.2.2.9 Rest of Asia-pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 France

- 5.2.3.3 United Kingdom

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schneider Electric SE

- 6.3.2 Siemens AG

- 6.3.3 Hitachi Ltd

- 6.3.4 Mitsubishi Electric Corporation

- 6.3.5 ABB Ltd.

- 6.3.6 Alstom SA

- 6.3.7 General Electric Company

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Itron Inc

- 6.3.10 EnerNOC Inc.

- 6.3.11 Uplight, Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption of Smart Grid Technologies

02-2729-4219

+886-2-2729-4219