|

市場調查報告書

商品編碼

1686268

工業閥門:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Industrial Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

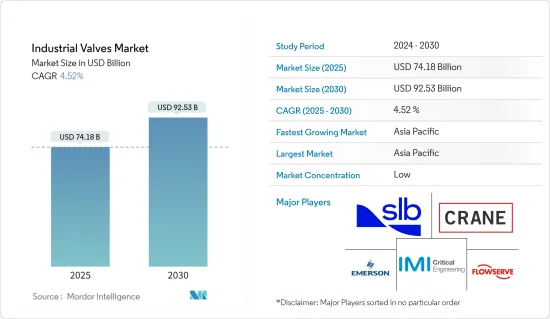

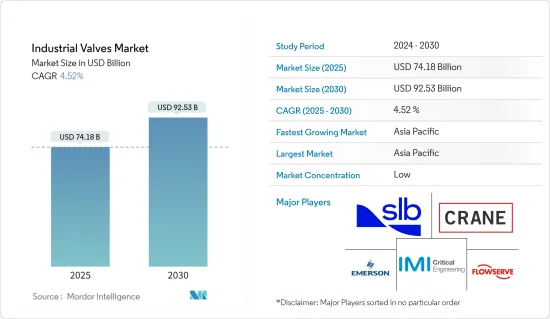

預計 2025 年工業閥門市場價值為 741.8 億美元,到 2030 年將達到 925.3 億美元,市場估計和預測期(2025-2030 年)的複合年成長率為 4.52%。

石油和天然氣工業是使用閥門的主要行業之一。由於 COVID-19 疫情爆發,2020 年封鎖期間該行業受到了不利影響。由於全球疫苗接種的不斷增加以及政府為提振經濟所做的努力,石油和天然氣行業也開始與其他行業一起復甦,從而導致對工業閥門的需求增加。

短期內,電力、化工產業需求增加是推動市場的主要因素。此外,海水淡化活動的需求不斷增加也推動了市場的成長。

然而,已開發國家工業成長緩慢預計將阻礙市場成長。

然而,預計在預測期內,自動閥門的需求不斷增加將增加工業閥門的需求。

預計亞太地區將主導市場,並在預測期內實現最高的複合年成長率。

工業閥市場趨勢

電力產業需求增加

- 在電力產業中,閥門有多種應用,包括鍋爐啟動、給水泵再循環、蒸氣調節和渦輪旁通。

- 例如,冷凝水系統中的閥門控制和調節流體再循環冷凝水泵所需的額外流量。此外,此閥門也控制給水加熱器的除氧等級。

- 在電力工業供水系統中,閥門用於循環鍋爐給水泵。在這種情況下,閥門起著至關重要的作用,因為它們需要進行開關和調節操作。

- 另外,在主流系統中,過熱器、汽輪機旁通、過熱器旁通等處都使用閥門,壓力調節器用來控制壓力。

- 預計到 2030 年,全球電力需求將成長 75%。可再生能源正在迅速擴張,但其生產的電力不足以滿足激增的需求。

- 根據《世界能源展望》-國際能源總署的預測,未來25年全球預計將安裝超過2,457吉瓦(GW)的發電容量。

- 例如,據印度電力、新和可再生能源部長稱,該國很可能在2030年的最後期限前實現500吉瓦的可再生能源目標。截至 2023 年,印度的總發電量為 424 吉瓦,其中約 180 吉瓦來自非石化燃料,另有 88 吉瓦正在規劃中。

- 因此,全球電力需求的增加很可能在預測期內大幅增加電力產業對工業閥門的需求。

亞太地區佔市場主導地位

- 亞太地區佔據全球市場佔有率的主導地位。中國、印度和日本等國家石油和天然氣工業活動的擴大以及水處理需求的增加,推動了該地區工業閥門使用量的成長。

- 亞太地區是全球特種化學品經濟的主要貢獻者,佔了近 36% 的收益佔有率。

- 2021年至2025年間,東南亞六個國家總合54個石油和天然氣計劃投入營運。綜合起來,到 2025 年,全球原油產量將達到每天約 223,000 桶,天然氣產量將達到每天約 81 億立方英尺。

- 在中國、印度和東協地區等國家,大規模工業化正在推動污水處理廠的建設。例如,根據工業和國內貿易促進部的數據,印度22會計年度的工業生產年成長率超過11%。

- 此外,印度德里政府正致力於在2024年建造亞洲最大的污水處理廠,其污水處理能力約為每天5.64億公升(MLD)。

- 上述因素加上政府支持預計將在預測期內促進該地區工業閥門消費需求的增加。

工業閥門產業概況

工業閥門市場高度分散,主要企業市場佔有率%。主要企業(排名不分先後)包括 SLB、艾默生電氣公司、福斯公司、IMI、Crane 公司等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電力和化學產業的需求不斷成長

- 海水淡化需求不斷成長

- 限制因素

- 已開發國家工業成長停滯

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 蝶閥

- 球閥

- 截止閥

- 閘閥

- 塞閥

- 其他類型

- 產品

- 1/4 轉閥

- 多迴轉閥

- 其他產品

- 應用

- 力量

- 用水和污水管理

- 化學

- 石油和天然氣

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 越南

- 馬來西亞

- 泰國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 北歐的

- 土耳其

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 卡達

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ALFA LAVAL

- AVK Holding AS

- CIRCOR International Inc.

- Crane Co.

- Curtiss-Wright Corporation

- Danfoss AS

- Zhejiang Dunan Valve Co. Ltd.

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes

- Georg Fischer Ltd.

- Hitachi Ltd

- Honeywell International Inc.

- IMI

- ITT Inc.

- KITZ Corporation

- KLINGER Group

- Mueller Water Products Inc.

- NIBCO Inc.

- Okano Valve Mfg. Co. Ltd.

- Saint-Gobain

- SLB

- TechnipFMC PLC

- The Weir Group PLC

- Valvitalia SpA

- Xylem

第7章 市場機會與未來趨勢

- 自動閥門需求不斷增加

The Industrial Valves Market size is estimated at USD 74.18 billion in 2025, and is expected to reach USD 92.53 billion by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

The oil and gas industry is one of the key industries that use valves. The industry was negatively impacted during the lockdown because of the outbreak of the COVID-19 pandemic in 2020. Owing to the global rise in vaccinations and government initiatives to boost the economy, the oil and gas industry started to recover with other industries, leading to increased demand for industrial valves.

Over the short term, the major factors driving the market studied are the growing demand from the power and chemical industries. The increase in demand for desalination activity has also driven the market's growth.

However, stagnant industrial growth in developed countries is expected to hinder the growth of the market studied.

Nevertheless, an increase in demand for automatic valves is expected to increase the demand for industrial valves over the forecast period.

The Asia-Pacific region is expected to dominate the market and register the highest CAGR during the forecast period.

Industrial Valves Market Trends

Increasing Demand from the Power Industry

- In the power industry, valves are used for various applications, such as boiler startups, feed pump recirculation, steam conditioning, and turbine bypass.

- For instance, valves in the condensate system control and regulate the additional flow required for a fluid recirculation condensate pump. Furthermore, valves control the deaerator level for the feedwater heater.

- In the power industry's feedwater system, valves are used for boiler feed pump recirculation. The valve plays a key role in this scenario, as it should be operated in on-off and modulating service.

- Additionally, in mainstream systems, the valves are used for superheaters, turbine bypass, superheater bypass, etc. A modulating valve is used for controlling pressure.

- The global electricity demand is estimated to grow by 75% by 2030. Although renewable energy is proliferating, the scale of electricity produced by it is not enough to satiate the rapidly growing demand.

- According to the World Energy Outlook- International Energy Agency forecast, more than 2,457 gigawatts (GW) of power capacity is expected to be installed worldwide over the next 25 years.

- For instance, according to the Union Power and New & Renewable Energy Minister of India, the country will likely achieve its 500GW renewable energy target before the 2030 deadline. As of 2023, India had 424 GW of power generation capacity, which included around 180 GW from non-fossil fuels and another 88 GW in the works.

- Hence, the globally growing demand for power will significantly increase the power industry's demand for industrial valves during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market share. With growing oil and gas industrial activities and the increasing need for water treatment in countries such as China, India, and Japan, the usage of industrial valves is increasing in the region.

- The Asia-Pacific region is the leading contributor to the world's specialty chemicals economy, holding a significant revenue share of nearly 36%.

- Southeast Asia started a total of 54 oil and gas projects across six countries for the timeline 2021 to 2025. Together, they would represent about 223,000 barrels per day of global crude production and about 8.1 billion cubic feet per day of global gas production in 2025.

- Wastewater treatment plants are also being increasingly produced following massive industrialization in countries such as China, India, and the ASEAN region. For instance, according to the Department for Promotion of Industry and Internal Trade of India, the annual growth rate for industrial production in India registered a growth rate of over 11% in the financial year 2022.

- Moreover, in 2024, the government of Delhi, India, worked towards building Asia's largest wastewater treatment plant, with a sewage water treatment capacity of about 564 million liters per day (MLD).

- The factors mentioned above, coupled with government support, are expected to contribute to the increasing demand for industrial valves consumption in the region during the forecast period.

Industrial Valves Industry Overview

The industrial valves market is highly fragmented, with the top ten players accounting for less than 15% of the total market share. The major companies (not in any particular order) include SLB, Emerson Electric Co., Flowserve Corporation, IMI, and Crane Co., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Power and Chemical Industry

- 4.1.2 Increase in Demand for Desalination Activity

- 4.2 Restraints

- 4.2.1 Stagnant Industrial Growth in Developed Countries

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Butterfly Valve

- 5.1.2 Ball Valve

- 5.1.3 Globe Valve

- 5.1.4 Gate Valve

- 5.1.5 Plug Valve

- 5.1.6 Other Types

- 5.2 Product

- 5.2.1 Quarter-turn Valve

- 5.2.2 Multi-turn Valve

- 5.2.3 Other Products

- 5.3 Application

- 5.3.1 Power

- 5.3.2 Water and Wastewater Management

- 5.3.3 Chemicals

- 5.3.4 Oil and Gas

- 5.3.5 Other Applications (Includes Food Processing, Mining, and Marine)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Indonesia

- 5.4.1.6 Vietnam

- 5.4.1.7 Malaysia

- 5.4.1.8 Thailand

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 NORDIC

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 Spain

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Qatar

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALFA LAVAL

- 6.4.2 AVK Holding AS

- 6.4.3 CIRCOR International Inc.

- 6.4.4 Crane Co.

- 6.4.5 Curtiss-Wright Corporation

- 6.4.6 Danfoss AS

- 6.4.7 Zhejiang Dunan Valve Co. Ltd.

- 6.4.8 Emerson Electric Co.

- 6.4.9 Flowserve Corporation

- 6.4.10 Baker Hughes

- 6.4.11 Georg Fischer Ltd.

- 6.4.12 Hitachi Ltd

- 6.4.13 Honeywell International Inc.

- 6.4.14 IMI

- 6.4.15 ITT Inc.

- 6.4.16 KITZ Corporation

- 6.4.17 KLINGER Group

- 6.4.18 Mueller Water Products Inc.

- 6.4.19 NIBCO Inc.

- 6.4.20 Okano Valve Mfg. Co. Ltd.

- 6.4.21 Saint-Gobain

- 6.4.22 SLB

- 6.4.23 TechnipFMC PLC

- 6.4.24 The Weir Group PLC

- 6.4.25 Valvitalia SpA

- 6.4.26 Xylem

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Demand for Automatic Valves