|

市場調查報告書

商品編碼

1686275

硬脂酸:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Stearic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

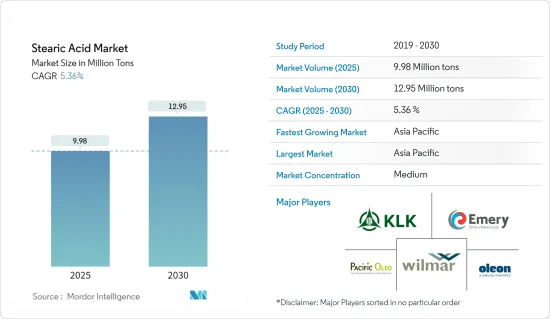

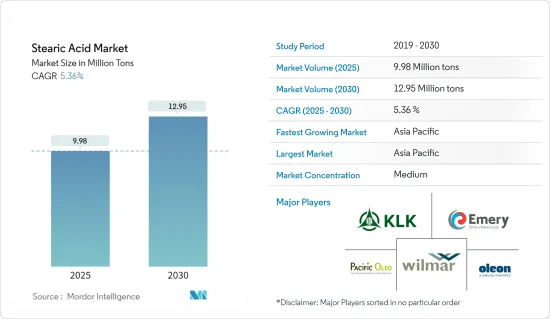

硬脂酸市場規模預計在 2025 年為 998 萬噸,預計在 2030 年達到 1,295 萬噸,預測期內(2025-2030 年)的複合年成長率為 5.36%。

2020 年,COVID-19 對市場產生了負面影響。然而,人們對個人衛生和清潔環境的認知不斷提高,刺激了對基於硬脂酸的個人保健產品和家用清洗產品的需求,從而增加了對硬脂酸的市場需求。

主要亮點

- 推動市場發展的首要因素是個人保健產品需求的不斷成長以及清潔劑和清潔劑行業的快速成長。

- 另一方面,原料價格的波動和高濃度的致癌性正在阻礙市場的成長。

- 金屬清洗和蠟燭製造領域的應用日益增多,可能為預測期內的市場成長提供機會。

- 預計亞太地區將主導市場,並可能在預測期內實現最高的複合年成長率。

硬脂酸市場趨勢

個人護理行業的需求不斷增加

- 硬脂酸用於製造硬脂酸鈉、硬脂酸鎂和硬脂酸鈣等硬脂酸鹽,它們是個人保健產品的成分。硬脂酸用於3,200多種護膚和頭髮護理產品。

- 此外,人們對個人健康和衛生意識的增強以及不斷增強的美容意識預計將推動對硬脂酸的需求。

- 2022 年,全球美容及個人護理市場價值預計超過 5,340 億美元。此外,預計預測期內市場複合年成長率約為 5.86%,為市場研究帶來有利影響。

- 據個人護理協會歐洲化妝品協會 (Cosmetics Europe) 稱,每天有 5 億歐洲消費者使用化妝品和個人護理產品(從止汗劑、香水、彩妝和洗髮精到肥皂、防曬油、牙膏和個人保健產品)來保護他們的健康、增進他們的幸福感並提高他們的自尊。

- 英國天然化妝品市場規模預計在 2022 年達到 2.086 億歐元(約 2.1414 億美元)。根據天然化妝品行業統計數據,預計 2022 年至 2026 年期間,該市場將繼續以每年 7.51% 的速度成長。隨著消費者越來越關注這些物質對環境和健康的影響,這些產品越來越受歡迎。

- 因此,預計未來幾年個人護理行業的需求不斷成長將對市場產生影響。

亞太地區佔市場主導地位

- 由於中國、印度、日本和其他開發中國家的都市化不斷加速和人口年輕化,亞太地區成為化妝品和個人保健產品的主要消費市場。

- 硬脂酸在肥皂和清潔劑中有很多用途。它主要充當增稠劑和硬化劑,幫助固態保持其形狀。硬脂酸可以幫助肥皂顆粒黏附在污垢顆粒上,使其鬆散,以便可以用水沖洗掉。

- 亞太市場由該地區一些全球大型公司公司佔據,包括歐萊雅、寶潔和聯合利華。

- 由於各種研發、業務擴張和化妝品投資,該地區的硬脂酸市場預計在預測期內將大幅成長。

- 根據國際貿易組織的統計,中國是世界第二大化妝品和個人護理市場。 2020年,中國化妝品零售增加至523億美元。此外,預計2022年化妝品整體銷售額將超過701億美元,複合年成長率為9.6%。

- 據 Invest India 稱,印度化妝品和個人保健產品市場目前價值 268 億美元,預計到 2025 年將成長到 372 億美元。

- 根據經濟產業省預測,2021年,日本化妝品及個人保健產品市場規模將超過350億美元,成為繼美國和中國之後的全球第三大化妝品及個人護理產品市場。日本擁有超過 3,000 家美容護理公司,其中包括資生堂、花王、高絲和POLA Orbis 等全球品牌。

- 預計上述因素將在未來幾年對市場產生重大影響。

硬脂酸產業概況

硬脂酸市場因其性質而部分分散。市場的主要企業(不分先後順序)包括 Wilmar International Ltd、Kuala Lumpur Kepong Berhad、Oleon、Pacific Oleochemicals Sdn Bhd 和 Emery Oleochemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 個人保健產品需求不斷成長

- 清洗和清潔劑行業的快速成長

- 限制因素

- 原物料價格波動

- 高濃度致癌性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 飼料原料

- 動物成分

- 植物成分

- 應用

- 肥皂和清潔劑

- 個人護理

- 紡織產品

- 塑膠

- 橡膠加工

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3F Industries Ltd

- BASF SE

- Croda International

- Deeno Group

- Emery Oleochemicals

- Godrej Industries Limited

- Kao Corporation

- Kuala Lumpur Kepong Berhad

- New Japan Chemical Co. Ltd

- Oleon

- Pacific Oleochemicals Sdn Bhd

- Procter & Gamble

- RUGAO Shuangma Chemical Co. Ltd

- Twin River Technologies

- VVF(Global)Limited

- Wilmar International

第7章 市場機會與未來趨勢

- 擴大在金屬清洗和蠟燭製造領域的應用

The Stearic Acid Market size is estimated at 9.98 million tons in 2025, and is expected to reach 12.95 million tons by 2030, at a CAGR of 5.36% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. However, the increasing consciousness regarding personal hygiene and clean surroundings stimulates the demand for stearic acid-based personal care and household cleaning products, thus enhancing the market demand for stearic acid.

Key Highlights

- Major factors driving the market studied are the increasing need for personal care products and the rapid growth of the cleaners and detergents industry.

- On the flip side, fluctuating prices of raw materials and carcinogen effects in high concentrations hinder the growth of the market studied.

- Increasing applications for metal cleaning and candle manufacturing are likely to offer opportunities for the market to rise over the forecast period.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Stearic Acid Market Trends

Increasing Demand from the Personal Care Industry

- Stearic acid is used for the production of stearates, such as sodium stearate, magnesium stearate, or calcium stearate, a component of personal care products. It is used in more than 3,200 skincare and hair care products.

- Furthermore, the growing awareness of personal health and hygiene and increasing beauty consciousness are expected to drive the demand for stearic acid.

- In 2022, the value of the global beauty and personal care market amounted to over USD 534 billion. Moreover, the market is estimated to grow at a CAGR of around 5.86% during the forecast period, which will favor the market studied.

- According to Cosmetic Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being, and boost their self-esteem, ranging from antiperspirants, fragrances, make-up, and shampoos to soaps, sunscreens and toothpaste, and cosmetics.

- The UK natural beauty market is estimated to reach EUR 208.6 million (~ USD 214.14 million) in 2022. Natural cosmetics industry statistics show that the market is expected to keep growing at an annual rate of 7.51% between 2022 and 2026. These goods become more popular as consumers become more concerned about the environmental and health implications of these substances.

- Therefore, the increasing demand from the personal care industry is expected to impact the market in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific was the leading consumer of cosmetics and personal care products due to growing urbanization and the increasing population of the younger generation in countries like China, India, Japan, and other developing nations.

- Stearic acid has a large number of applications in soaps and detergents. It primarily fulfills the role of a thickener and hardener, which helps soap bars retain their shape. Stearic acid helps soap particles attach to dirt particles, loosening them to be washed away with water.

- Leading global giants in the region, such as L'Oreal, Procter & Gamble, and Unilever, supports the Asia-Pacific market.

- With various research and developments, expansions, and investments in cosmetic products, the market for stearic acid is expected to grow significantly in the region during the forecast period.

- According to the International Trade Organization, China is the second-largest market for cosmetic and personal care. The retail sales value of cosmetics in China rose to USD 52.3 billion in 2020. Furthermore, overall cosmetics sales in 2022 is anticipated to surpass USD 70.1 billion and witness an annual growth rate of 9.6%.

- As per invest India, India's market for cosmetics and personal care products is currently worth USD 26.8 billion and is projected to increase to USD 37.2 billion by 2025.

- According to the Ministry of Economy, Trade, and Industry (METI), the size of Japan's cosmetics and personal care products market was over USD 35 billion in 2021, making it the world's third-largest after the United States and China. Japan is home to more than 3,000 beauty care companies, including global brands of Shiseido, Kao, Kose, and Pola Orbis.

- The aforementioned factors are expected to significantly impact the market in the coming years.

Stearic Acid Industry Overview

The stearic acid market is partially fragmented in nature. Major companies in the market (in no particular order) include Wilmar International Ltd, Kuala Lumpur Kepong Berhad, Oleon, Pacific Oleochemicals Sdn Bhd, and Emery Oleochemicals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Need for Personal Care Products

- 4.1.2 Rapid Growth of the Cleaners and Detergents Industry

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Raw Materials

- 4.2.2 Carcinogen Effect in High Concentrations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Feedstock

- 5.1.1 Animal-based Raw Materials

- 5.1.2 Vegetable-based Raw Materials

- 5.2 Application

- 5.2.1 Soaps and Detergents

- 5.2.2 Personal Care

- 5.2.3 Textiles

- 5.2.4 Plastics

- 5.2.5 Rubber Processing

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3F Industries Ltd

- 6.4.2 BASF SE

- 6.4.3 Croda International

- 6.4.4 Deeno Group

- 6.4.5 Emery Oleochemicals

- 6.4.6 Godrej Industries Limited

- 6.4.7 Kao Corporation

- 6.4.8 Kuala Lumpur Kepong Berhad

- 6.4.9 New Japan Chemical Co. Ltd

- 6.4.10 Oleon

- 6.4.11 Pacific Oleochemicals Sdn Bhd

- 6.4.12 Procter & Gamble

- 6.4.13 RUGAO Shuangma Chemical Co. Ltd

- 6.4.14 Twin River Technologies

- 6.4.15 VVF (Global) Limited

- 6.4.16 Wilmar International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application for the Metal Cleaning and Candles Manufacturing