|

市場調查報告書

商品編碼

1686281

耐火材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Refractories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

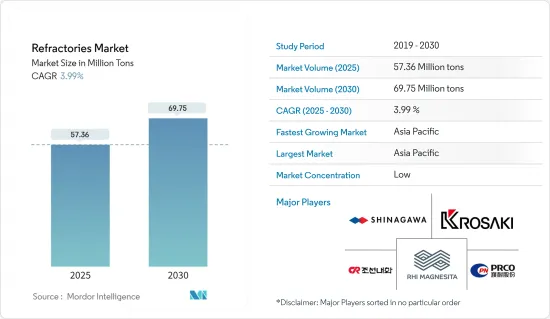

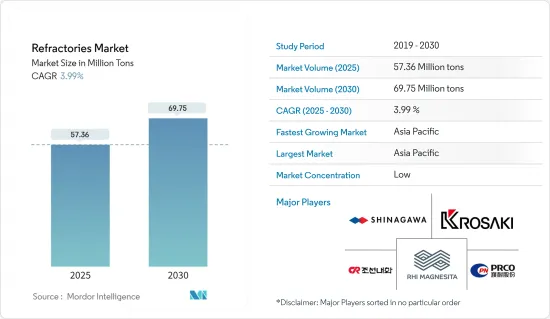

預計 2025 年耐火材料市場規模為 5,736 萬噸,到 2030 年將達到 6,975 萬噸,預測期內(2025-2030 年)的複合年成長率為 3.99%。

新冠肺炎疫情對全球經濟產生了重大影響,許多國家進入封鎖狀態,經濟和工業活動暫時停止。耐火材料市場也受到鋼鐵、水泥、能源、化學品和陶瓷等終端用戶產業的生產和需求的影響。然而,在疫情後時期,由於經濟開放後對產品的需求,終端用戶產業正在成長。

主要亮點

- 鋼鐵業對耐火材料的需求大幅成長以及水泥和能源行業的需求增加正在推動耐火材料市場的成長。

- 環境和健康問題以及相關的準則和法規正在影響市場動態,並部分限制耐火材料市場的工業運作。

- 增加耐火材料回收的投資和研究為耐火材料市場的成長提供了重大機會。

- 預計亞太地區將引領市場,其中中國、印度和日本在預測期內佔據大部分市場佔有率。

耐火材料市場趨勢

鋼鐵業需求增加

- 耐火材料在鋼鐵業中至關重要,可以保護高溫設備和製程。耐火材料可保護高爐零件(如爐床和爐腹)免受極端高溫和腐蝕性爐渣的侵害。鹼性氧氣轉爐 (BOF) 和電弧爐 (EAF) 依靠這些內襯來抵禦煉鋼的挑戰。

- 根據美國地質調查局預測,2023年全球可用鐵礦石產量將達25億噸。澳洲鐵礦石出口量為9.6億噸,佔全球鐵礦石出口總額910億美元的56.4%。

- 據印度品牌股權基金會稱,到 2023 年,印度的鐵礦石產量將增至創紀錄的 2.82 億噸,與前一年同期比較成長 14%。奧裡薩邦的礦石產量佔印度總礦石量的 56%,成長 18%,達到 1.59 億噸。印度八大公司礦業產量總合超過2,000萬噸。

- 根據世界鋼鐵協會的初步資料,2023年1-11月全球粗鋼產量達17.1512億噸,年增0.5%。 11月份,全國糧食產量達1.455億噸,與前一年同期比較增加3.3%。

- 總之,鋼鐵業的產量和需求都呈現顯著成長,凸顯了耐火材料的重要作用以及鐵礦石供應在支持此擴張的重要性。

亞太地區佔市場主導地位

- 在亞太地區,中國是最大的經濟體,在全球製造和生產中發揮主要企業。中國擁有豐富的原料供應,在耐火材料消費和生產方面均佔主導地位。

- 中國是世界最大的鋼鐵生產國,佔全球產量的一半以上,根據世界鋼鐵協會的報告,預計2023年中國鋼鐵產量將維持穩定在10.191億噸左右,與2022年的數字持平。

- 此外,根據中國石油天然氣集團公司研究院報告預測,2023年中國精製能力將增加至9.36億噸/年,精製油消費量將年增與前一年同期比較%至3.99億噸。

- 世界鋼鐵協會預計,印度2023年粗鋼產量將從2022年的1.244億噸增加11.80%至1.402億噸。值得注意的是,光是2024年10月份的鋼鐵產量就達到1,250萬噸,與前一年同期比較增1.7%。

- 2024 年 2 月,JSW 集團宣布計劃在奧裡薩邦 Jagatsinghpur 投資一座大型鋼鐵廠,年產量目標為 1,320 萬噸。同時,AMNS印度公司正在投資74億美元擴大產能並增加其上下游領域的價值,顯示市場前景樂觀。

- 第三大粗鋼生產國日本預計 2023 年其鋼鐵產量將從 2022 年的 8,920 萬噸下降 2.5% 至 8,700 萬噸。 2024 年 10 月鋼鐵產量為 690 萬噸,與前一年同期比較減 7.8%。

- 積極的一面是,JFE鋼鐵公司已獲得資金,將在其位於倉敷的西日本工廠建造一座大型電弧爐(EAF),以取代現有的2號高爐,該高爐計劃於2027/2028會計年度開始試運行,並於2027年4月1日開始營運。

- 總之,儘管面臨日本的挑戰,亞太地區,特別是中國和印度,鋼鐵和耐火材料市場仍經歷動態成長,凸顯了該地區在全球工業格局中的關鍵作用。

耐火材料產業概況

耐火材料市場高度分散。主要企業(不分先後順序)包括RHI Magnesita NV、Krosaki Harima Corporation、濮陽耐火材料集團、朝鮮耐火材料、Shinagawa Refractories等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 鋼鐵業更多使用耐火材料

- 水泥和能源產業對耐火材料的需求不斷增加

- 限制因素

- 與耐火材料相關的環境和健康風險

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 產品類型

- 非黏土耐火材料

- 菱鎂磚

- 鋯磚

- 矽磚

- 鉻磚

- 其他產品類型(碳化物、矽酸鹽)

- 黏土耐火材料

- 高鋁土

- 耐火粘土

- 隔熱材料

- 非黏土耐火材料

- 最終用戶產業

- 鋼

- 能源與化工

- 非鐵金屬

- 水泥

- 陶瓷製品

- 玻璃

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Chosun Refractories

- HWI(Platinum Equity Advisors, LLC)

- Imerys

- Krosaki Harima Corporation

- Puyang Refractories Group Co., Ltd

- Refratechnik

- RHI Magnesita NV

- Saint-Gobain

- Shinagawa Refractories Co. Ltd

- Vesuvius

- List of Other Prominent Companies

第7章 市場機會與未來趨勢

- 擴大耐火材料回收的投資與研究

The Refractories Market size is estimated at 57.36 million tons in 2025, and is expected to reach 69.75 million tons by 2030, at a CAGR of 3.99% during the forecast period (2025-2030).

Due to COVID-19, numerous countries were in lockdown, significantly affecting the global economy and economic and industrial activities were temporarily halted. The refractories market also witnessed repercussions in production and demand from the end-user industries, such as iron and steel, cement, energy and chemicals, ceramics, etc. However, in the post-pandemic period, the end-user industries are growing because of the demand for products after economies open up.

Key Highlights

- The significant demand for refractories in the iron and steel industry, along with increasing requirements from the cement and energy sectors, is driving the growth of the refractories market.

- Environmental and health concerns, along with the resulting guidelines and regulations, impact market dynamics and partially constrain industry operations in the refractories market.

- Increasing investments and research focused on the recycling of refractories present significant opportunities for growth in the refractories market.

- The Asia-Pacific region is projected to lead the market, with China, India, and Japan accounting for the majority of its share during the forecast period.

Refractories Market Trends

Increasing Demand from the Iron and Steel Industry

- Refractories are essential in the iron and steel industry, protecting high-temperature equipment and processes. They shield blast furnace components, such as the hearth and bosh, from extreme heat and corrosive slag. Basic Oxygen Furnaces (BOFs) and Electric Arc Furnaces (EAFs) rely on these linings to withstand the challenges of steelmaking.

- In 2023, global production of usable iron ore reached an estimated 2.5 billion metric tons, according to the United States Geological Survey. Australia led with 960 million metric tons, accounting for 56.4% of the world's iron ore exports, valued at USD 91 billion.

- According to the India Brand Equity Foundation, India set a record by increasing its iron ore production to 282 million tons in 2023, a nearly 14% rise from the previous year. Odisha, contributing 56% of India's ore, boosted its output by 18% to 159 million tons. The top eight mining firms in India collectively exceeded 20 million tons in production.

- According to provisional data from the World Steel Association, global crude steel production reached 1,715.12 million tons (mt) from January to November 2023, marking a year-on-year growth of 0.5%. Production hit 145.5 million tons in November alone, reflecting a 3.3% increase from the previous year.

- In conclusion, the iron and steel industry is witnessing significant growth in both production and demand, underscoring the vital role of refractories and the importance of iron ore supply in supporting this expansion.

Asia-Pacific region to Dominate the Market

- In the Asia-Pacific region, China stands out as the largest economy and a major player in global manufacturing and production. Its abundant supply of raw materials enables China to dominate the refractories market in both consumption and production.

- As the world's leading steel producer, China accounted for over half of global output, with the World Steel Association reporting steel production remained stable at approximately 1,019.1 million tons in 2023, consistent with 2022 figures.

- Additionally, a report from a research institute under the China National Petroleum Corporation revealed that China's annual oil refining capacity increased to 936 million tons in 2023, while refined oil consumption rose by 9.5% year-on-year to 399 million tons.

- In India, the World Steel Association noted a remarkable 11.80% increase in crude steel production for 2023, reaching 140.2 million tons, up from 124.4 million tons in 2022. Notably, October 2024 alone recorded steel production of 12.5 million tons, reflecting a 1.7% increase from the previous year.

- In February 2024, the JSW Group announced plans for a steel plant in Jagatsinghpur, Odisha, with a significant investment of USD 7.8 billion (Rs. 65,000 crore), targeting an annual production of 13.2 million tons. Concurrently, AMNS India is investing USD 7.4 billion in capacity expansion and value-added initiatives across upstream and downstream sectors, indicating a positive market outlook.

- Japan, the third-largest producer of crude steel, experienced a 2.5% decline in steel output in 2023, with production dropping to 87.0 million tons from 89.2 million tons in 2022. In October 2024, steel production was recorded at 6.9 million tons, marking a 7.8% decrease from the previous year.

- On a positive note, JFE Steel is securing funding to construct a significant electric arc furnace (EAF) at its West Japan Works in Kurashiki, set to replace the existing blast furnace No. 2, with commissioning anticipated in the fiscal year 2027/2028, starting April 1, 2027.

- In conclusion, the Asia-Pacific region, particularly China and India, is experiencing dynamic growth in the steel and refractories markets, despite challenges in Japan, highlighting the region's critical role in the global industrial landscape.

Refractories Industry Overview

The refractories market is highly fragmented in nature. The major players (not in any particular order) include RHI Magnesita N.V., Krosaki Harima Corporation, Puyang Refractories Group Co., Ltd, Chosun Refractories, and Shinagawa Refractories Co., Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Substantial Usage of Refractories in the Iron and Steel Industry

- 4.1.2 Growing Demand for Refractories from Cement and Energy Sectors

- 4.2 Restraints

- 4.2.1 Environmental and Health Risks Associated with Refractories

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Non-clay Refractory

- 5.1.1.1 Magnesite Brick

- 5.1.1.2 Zirconia Brick

- 5.1.1.3 Silica Brick

- 5.1.1.4 Chromite Brick

- 5.1.1.5 Other Product Types (Carbides, Silicates)

- 5.1.2 Clay Refractory

- 5.1.2.1 High Alumina

- 5.1.2.2 Fireclay

- 5.1.2.3 Insulating

- 5.1.1 Non-clay Refractory

- 5.2 End-user Industry

- 5.2.1 Iron and Steel

- 5.2.2 Energy and Chemicals

- 5.2.3 Non-ferrous Metals

- 5.2.4 Cement

- 5.2.5 Ceramic

- 5.2.6 Glass

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-east and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chosun Refractories

- 6.4.2 HWI (Platinum Equity Advisors, LLC)

- 6.4.3 Imerys

- 6.4.4 Krosaki Harima Corporation

- 6.4.5 Puyang Refractories Group Co., Ltd

- 6.4.6 Refratechnik

- 6.4.7 RHI Magnesita N.V.

- 6.4.8 Saint-Gobain

- 6.4.9 Shinagawa Refractories Co. Ltd

- 6.4.10 Vesuvius

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investments and Research on the Recycling of Refractories