|

市場調查報告書

商品編碼

1686292

智慧城市 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Cities - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

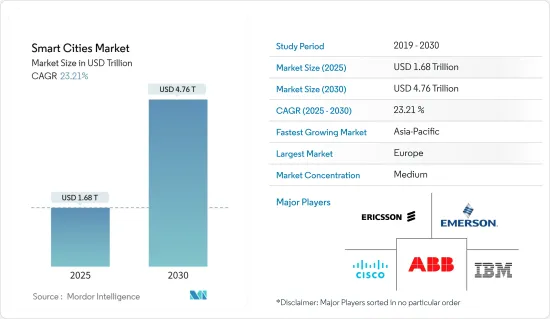

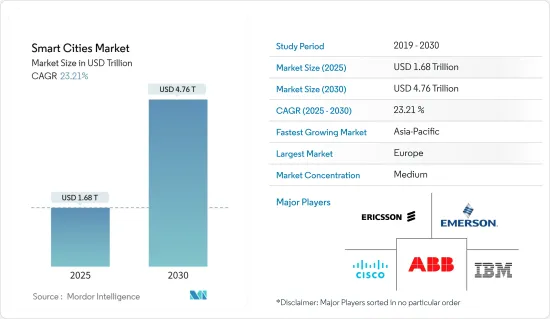

預計2025年智慧城市市場規模為1.68兆美元,2030年將達4.76兆美元,預測期間(2025-2030年)的複合年成長率為23.21%。

本研究中的市場規模代表各種類型的解決方案產生的收益,例如智慧運輸管理、智慧公共、智慧醫療保健、智慧建築、智慧公用事業、智慧安全、智慧教育和其他解決方案。

主要亮點

- 智慧城市是使用人工智慧 (AI)、物都市區(IoT)、雲端儲存、巨量資料和資料分析等最尖端科技來收集和分析使用資料,並利用從中獲得的見解有效管理資源、服務和資產的城市區域。政府為解決都市化和人口過剩問題所採取的舉措,以及永續對資源管理日益成長的需求,正在推動智慧城市產業的發展。

- 網路和物聯網的日益普及也推動著全球智慧城市和平台的成長。未來三年,預計將出現超過 26 個智慧城市,主要在北美和歐洲,這為智慧城市採用人工智慧和物聯網感測器提供重大動力。

- 從第一個電報火警警報器到對講機和行車記錄儀,公共機構一直是最新技術的早期採用者,包括執法、消防、救護車和緊急管理。隨著智慧型設備網路的不斷增加和人工智慧的發展,當今的公共技術正在從必要的套件轉變為可以採取行動保護公民安全的獨立合作夥伴。

- 受訪的市場中的各個組織都專注於策略夥伴關係、投資和擴張,以使各國能夠採用智慧解決方案。例如,2022年10月,諾基亞宣布與杜拜政府安全網路供應商Nedaa建立策略夥伴關係,共同探討用於公共應用和智慧城市的創新5G網路切片。同樣,西門子股份公司於2022年10月宣布,將向印度投資50億歐元(54.1億美元),以支持該國快速的都市化和能源轉型。

- 此外,2023 年 2 月,新加坡和亞太地區的公司(包括 Daily Life Renewable Energy、Mdesigns Solutions、Biodsg 和 Graymatics)將與阿拉伯聯合大公國 (UAE) 的公司合作,在阿布達比開發智慧城市先導計畫。這些公司將與阿布達比國家石油公司等當地企業合作,透過改造街道照明和提高建築物的能源效率,建造一座具有韌性的城市。

- 由於資料的敏感性,資料安全對於 BFSI、零售和醫療保健等行業至關重要,並且已成為任何政府開展智慧城市計劃的首要關注點。由於對物聯網的需求,用於智慧城市的物聯網平台的採用率很高。各行各業對智慧城市平台的使用日益增多,使得這些系統更容易受到資料外洩的攻擊。人們對統一安全平台的需求日益成長,許多提供者提供多種解決方案。

- 新冠疫情加速了智慧城市的發展。智慧城市基礎設施幫助政府機構避開了危險的 COVID-19 病毒。自新冠疫情爆發以來,政府也正在研究部署多種智慧城市技術的可能性,以提高城市在危機時期的韌性。新加坡政府體認到加速各產業數位化的重要性。

智慧城市市場趨勢

人工智慧和物聯網的採用是市場的主要驅動力

- 網際網路和物聯網的廣泛應用正在推動全球智慧城市和平台的發展。預計到 2025 年將出現超過 26 個智慧城市,其中大部分位於北美和歐洲。

- 物聯網的用途正在從工業應用擴展到緊急服務、公共交通、公共、城市照明和智慧城市應用。由於成本較低、效率高且節省資源,市政當局正在轉向物聯網提供的無線通訊。據思科稱,到 2022 年,支援物聯網應用的機器對機器 (M2M) 連接將佔全球 285 億台連網裝置的一半以上。連網家庭領域將佔 M2M 總連線數的大部分,其中智慧音箱、家電、設備和相關設備將擁有 146 億個連線。

- 此外,其他地區的地方政府正在投資智慧和自適應街道照明,以提高能源效率。例如,芝加哥啟動了一項智慧照明計劃,目標是在四年內安裝 270,000 盞 LED 燈。在計劃實施的第一年,該市安裝了 81,000 盞 LED 燈。芝加哥市估計每年可節省約 1,000 萬美元的能源費用。該計劃包括一個監控系統,如果發生停電,該系統將立即向城市發出警報。它還允許工作人員最佳化路燈的性能。

- 作為「數位印度」計畫的一部分,印度政府計劃在該國推廣物聯網。印度政府已撥款 7,000 億盧比(845.2 億美元)用於建設 100 個智慧城市,這些城市將使用物聯網設備控制交通、高效利用水和電,並使用物聯網感測器收集資料以用於醫療保健和其他服務。

- 在智慧城市計畫的推動下,物聯網和連網型設備的成長趨勢預計將在預測期內持續下去。智慧電錶、智慧家庭、智慧照明和智慧交通等使用物聯網的連網型設備的日益普及可能會推動智慧城市平台的發展。

- 截至 2022 年 1 月,印度北方邦是全國安裝智慧電錶最多的邦,超過 115 萬台。其次是比哈爾邦和拉賈斯坦邦。同樣,根據美國能源資訊署的數據,2021 年美國公用事業公司安裝了約 1.11 億個先進(智慧)計量基礎設施 (AMI) 單元,佔所有電錶的 69%。大約 88% 的 AMI 安裝面向住宅客戶,AMI 電錶約佔所有住宅電錶的 69%。

- 此外,市場領導者正專注於採用基於物聯網和人工智慧的解決方案以保持競爭優勢,進一步推動市場成長。例如,日立於2022年3月宣布將在東南亞和泰國全面啟動其智慧建築解決方案業務。透過利用其物聯網平台 Lumada,該公司旨在為具有適應新常態的實體安全系統和數位服務的建築物提供價值。 Lumada 是日立的先進數位服務、解決方案和技術,旨在將資料轉化為有價值的知識並推動數位創新。

亞太地區可望成為成長最快的市場

- 亞太地區是創新城市技術成長最快的地區之一,中國在市場成長中扮演關鍵角色。中國對城市數位轉型投入了大量資金。自上而下的城市發展方式使該國能夠有效地調動產業和資源來支持建立智慧城市的全國目標。透過官民合作關係以及重點技術創新,中國已經建成智慧城市基礎設施,並已應用於許多主要城市和產業。

- 經過幾十年的研究和開發,新技術不斷湧現,許多公司主導了城市的變革。阿里巴巴、百度、滴滴出行、華為、騰訊等已在杭州、蘇州、深圳、上海、北京等城市佈局技術。這些技術將構成「數位大腦」的基礎,利用雲端處理、人工智慧和物聯網來建構智慧城市基礎設施。

- 為了實現永續目標,日本政府支持「社會5.0」計劃,旨在創造一個將網路與實體空間緊密連接的智慧社會,為人們提供更高品質的生活。日本政府的戰略創新推進計劃(SIP)推動了農業、交通基礎設施等各個領域的協作平台的開發,連接這些領域的跨部門資料協作平台的開發,以及作為智慧城市基本設計指南的智慧城市參考架構的製定。

- 政府的城市發展政策和合作預計將推動受調查市場的發展。例如,印度城市資料交換中心是與班加羅爾智慧城市使命和印度科學研究所 (IISc) 合作創建的。 IUDX 提供了一個統一的介面,資料提供者和使用者(包括 ULB)可以透過該介面共用、請求和存取與城市、城市管理和城市服務交付相關的資料。 IUDX是一個開放原始碼軟體平台,支援不同資料平台、第三方認證和授權的應用程式以及其他資訊來源之間進行安全、經過認證和受控的資料交換。隨著越來越多的城市加入 IUDX,它將實現印度都市區資料生產者和消費者之間統一、無摩擦的資料共用。

- 澳洲綠建築委員會(GBCA)公佈了政府的智慧城市計畫。新計劃對現有財政狀況進行了重大調整。這將從協調和推廣更智慧的城市政策開始。這樣做是為了確保地方和國家政府都接受預期的改變。此外,它還將努力在城市範圍內建立清晰的基礎設施、創新和永續性模式。

- 此外,一些公司正在投資和擴張,以支持該地區的智慧城市發展。例如,Honeywell國際公司宣布將於2023年3月啟動其班加羅爾安全城市計劃的第一階段。透過該計劃,該公司旨在透過智慧互聯的安全與安保技術,為女孩和婦女確保一個高效、安全和賦權的環境。該公司計劃在班加羅爾市 3,000 多個戰略位置安裝 7,000 多個攝影機。這些攝影機配備了人工智慧(AI)系統。基於人工智慧的視訊分析平台將能夠分析來自整個城市的視訊來源。

- 同樣,2023 年 1 月,Tech Mahindra 和日本田川市宣佈建立戰略合作夥伴關係,以加速該市的數位轉型。 Tech Mahindra 將幫助田川市成為一個智慧城市。透過此次合作,Tech Mahindra 將加強其在物聯網、5G、虛擬實境和擴增實境等下一代技術方面的專業知識。

智慧城市產業概覽

預計智慧城市市場在預測期內將保持半靜止狀態。市場的主要企業是 ABB 有限公司、思科系統公司、艾默生電氣公司、IBM 公司和愛立信公司。市場上的公司正在採用夥伴關係、創新、投資和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023年6月,ABB宣布收購總部位於慕尼黑、業務遍及美國及歐洲的智慧家庭產品領導廠商Eve Systems,以增強其智慧家庭技術組合。透過此次收購,該公司旨在滿足能源價格和氣候變遷政策加速推動的智慧、安全和永續建築維修的需求。

2023 年 6 月,西門子股份公司將宣布開設埃及首個智慧城市體驗中心,為客戶提供融合數位世界和實體世界的身臨其境型體驗。該中心將展示創建高效、永續的智慧城市基礎設施、建築和工業的最新技術。透過這個概念,參觀者可以了解將現有社區轉變為智慧城市的好處。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場動態

- 市場促進因素

- 人工智慧和物聯網的採用日益增多

- 日益成長的公共和保全需求

- 市場挑戰

- 對物聯網和智慧設備的安全擔憂

- COVID-19對智慧城市市場的影響

第6章市場區隔

- 按解決方案

- 智慧運輸管理

- 智慧公共

- 智慧醫療

- 智慧建築

- 智慧公用事業

- 智慧安全

- 智慧教育

- 其他解決方案

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 瑞典

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第7章競爭格局

- 公司簡介

- ABB Ltd.

- Cisco Systems Inc.

- Emerson Electric Co.

- IBM Corporation

- Ericsson Inc.

- Schneider Electric SE

- General Electric Co.

- Siemens AG

- Huawei Technologies Co. Ltd.

- Honeywell International Inc.

- Hitachi Ltd.

- Nokia Corporation

- Koninklijke Philips NV

第8章投資分析

第9章:市場的未來

The Smart Cities Market size is estimated at USD 1.68 trillion in 2025, and is expected to reach USD 4.76 trillion by 2030, at a CAGR of 23.21% during the forecast period (2025-2030).

The market numbers in the study indicate the revenue generated from various types of solutions such as smart mobility management, smart public safety, smart healthcare, smart building, smart utilities, smart security, smart education, and other solutions.

Key Highlights

- A smart city is an urban area that makes use of cutting-edge technologies such as artificial intelligence (AI), the Internet of Things (IoT), cloud storage, big data, and data analytics to gather and analyze utilization data and use the insights gained from them to manage resources, services, and assets effectively. Growing government measures to address urbanization and overpopulation and the growing need for resource management for sustainable development are driving growth in the smart cities industry.

- The increased adoption of the Internet and the Internet of Things propel the growth of smart cities and platforms worldwide. It is expected that by the next three years, there will be more than 26 smart cities, with the majority existing in North America and Europe, providing a major drive to the AI and IoT sensors for adoption in smart cities.

- From the first telegraphic fire alarms to radios and dash cams, public safety agencies-law enforcement, fire, EMS, and emergency management-have always been early adopters of the newest technologies. Increasing smart device networks and the development of artificial intelligence are turning public safety technology today from a necessary toolkit into an independent partner that can take action to keep the public safe.

- Various organizations in the studied market are focusing on strategic partnerships, investments, and expansion to help countries adopt smart solutions. For instance, in October 2022, Nokia announced a strategic partnership with Nedaa, the security network provider of the Dubai government, to explore innovative 5G network slicing for public safety use and smart cities. Similarly, in October 2022, Siemens AG announced to invest EUR 5 billion ( USD 5.41 billion) in India to support the country's rapid urbanization and energy transformation.

- Moreover, in February 2023, Companies from Singapore and Asia Pacific, such as Daily Life Renewable Energy, Mdesigns Solutions, Biodsg, and Graymatics, among others, will collaborate with United Arab Emirates (UAE) firms to develop smart city pilot projects in Abu Dhabi. These companies will collaborate with local entities such as Adnoc and the rest to develop resilient cities by transforming street lighting and increasing the energy efficiency of Al Dannah City buildings.

- Data security is the prime concern of every government incorporating the smart city plan, as it is vital in industries such as BFSI, retail, healthcare, and others, owing to the sensitive nature of the data. IoT platforms used for smart cities are experiencing high adoption rates due to IoT demand. This increasing use of these platforms for smart cities across various verticals has increased the vulnerabilities of these systems to data breaches. The need for a uniform security platform is increasing, with many providers offering multiple solutions.

- COVID-19 propelled the development of smart cities. Smart city infrastructure helped government agencies avoid the dangerous COVID-19 virus. Post-COVID-19, the government has also been investigating the potential for implementing some smart city technologies to increase urban resilience in times of crisis. The government of Singapore has acknowledged the significance of accelerating the nation's degree of digitization across industries.

Smart Cities Market Trends

Adoption of AI and IoT to be Major Drivers for the Market

- The increased adoption of the Internet and the Internet of Things propel the growth of smart cities and platforms worldwide. It is expected that by 2025, there will be more than 26 smart cities, with the majority existing in North America and Europe, providing a major drive to the AI and IoT sensors for adoption in smart cities.

- The use of IoT has increased, from industrial applications to emergency services, public transportation, public safety, city lighting, and smart city applications. Municipalities are moving to wireless communications offered by IoT due to low cost, greater efficiency, and resource reduction. According to Cisco, machine-to-machine (M2M) connections supporting IoT applications will account for over half of the world's 28.5 billion connected devices by 2022. Connections from smart speakers, fixtures, devices, and associated devices will reach 14.6 billion, and the connected home vertical will account for the bulk of total M2M connections.

- Furthermore, local governments in other parts are investing in smart and adaptive streetlights to improve energy efficiency. For instance, Chicago has launched a smart lighting program that aims to install 270,000 LED lights over four years. During the project's initial year, the city installed 81,000 LED lights. Chicago estimates it will save around USD 10 million yearly in utility costs. The project includes a monitoring and control system that immediately alerts the city of any outages. It also allows workers to optimize the performance of the streetlights.

- As part of the Digital India initiative, the Indian government has planned to push IoT in the country. The government allocated INR 7,000 crore ( USD 84.52 billion) for the development of 100 smart cities powered by IoT devices to control traffic, efficiently use water and power, and collect data using IoT sensors for healthcare and other services.

- With smart city initiatives, the trend of increasing IoT and connected devices is expected to continue over the forecast period. The growing adoption of connected devices that include smart meters, smart homes, smart lighting, and smart transportation, among others that use IoT to connect, is likely to propel the growth of smart city platforms.

- As of January 2022, the state of Uttar Pradesh in India had the smartest meters installed nationwide, with over 1.15 million of them. Bihar and Rajasthan are ranked after this. Similarly, according to the Energy Information Administration, About 111 million advanced (smart) metering infrastructure (AMI) installations, or 69% of all electric meter installations, were made by U.S. electric utilities in 2021. About 88% of all AMI installations were for residential customers, and AMI meters made up about 69% of all residential electric meters.

- Moreover, the leading players in the market are focusing on introducing IoT and AI-based solutions to stay ahead of the competition, further supporting the market growth. For instance, in March 2022, Hitachi announced the launch of a full-scale Smart Building Solution business for Southeast Asia and Thailand. The company aims to provide value to buildings with Physical Security Systems and Digital Services for the New Normal by utilizing Lumada, an IoT Platform. Lumada is Hitachi's advanced digital services, solutions, and technologies for turning data into valuable knowledge to drive digital innovation.

Asia-Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is one of the fastest-growing regions for innovative city technologies, with China playing a significant role in the market growth. China has made significant investments in the digital transformation of its cities. With its top-down approach to urban development, the country has effectively mobilized its industries and resources to support its national aim of constructing smart cities. China has built smart city infrastructure that has already been applied to many of its main metropolises and sectors through public-private partnerships and the promotion of focused technical innovation.

- A few firms have taken the lead in the transformation of cities as new technologies emerge after decades of research and development. Alibaba, Baidu, Didi Chuxing, Huawei, and Tencent are among those that have integrated their technology in cities such as Hangzhou, Suzhou, Shenzhen, Shanghai, and Beijing. These technologies then serve as the foundation for "digital brains," which use cloud computing, AI, and IoT to lay the groundwork for smart city infrastructure.

- The Japanese government has been supporting the Society 5.0 concept to achieve Sustainable Development Goals by realizing a smart society that provides people with a better quality of life by tightly connecting the internet and physical space. The Japanese government's Strategic Innovation Promotion Program (SIP) has been instrumental in the development of collaboration infrastructure in each field, such as agriculture and transportation infrastructure, as well as the development of inter-field data collaboration infrastructure to connect them, and the formulation of the Smart City Reference Architecture as a basic design guideline for smart cities.

- Government policies and collaborations towards the development of cities are expected to drive the studied market. For Instance, The India Urban Data Exchange was created in collaboration with the Smart Cities Mission and the Indian Institute of Science (IISc) in Bengaluru. IUDX provides a unified interface for data suppliers and users, including ULBs, to share, request, and access datasets relating to cities, urban government, and urban service delivery. IUDX is an open-source software platform that enables secure, authenticated, and managed data exchange between different data platforms, third-party certified and authorized apps, and other sources. As the number of cities on IUDX grows, this would lead to uniform and frictionless data sharing between data producers and consumers throughout urban India.

- The Green Building Council of Australia (GBCA) has revealed the government's Smart Cities Plan, which should increase investment performance and seek to improve the country's sustainability factor. This new plan would make significant adjustments to the existing finances. To begin, it would coordinate and drive smarter city policies. This is done to ensure that both local and national governments are on board with the projected changes. Furthermore, it would endeavor to establish clear models for infrastructure, innovation, and sustainability inside city bounds.

- Furthermore, Several companies are making investments and expansions to support the smart city development in the region. For instance, in March 2023, Honeywell International announced the launch of phase one of the Banglore Safe City Project. Through this project, the company aims to secure an efficient, safe, and empowering environment for girls and women through its smart and connected safety and security technology. The company will likely install more than 7,000 video cameras at more than 3,000 strategic locations within Bengaluru. These cameras are equipped with artificial intelligence (AI) enabled systems. The AI-based video analytics platform will allow for the analysis of video feeds from across the city.

- Similarly, in January 2023, Tech Mahindra and Tagawa City in Japan announced a strategic collaboration to accelerate digital transformation in the city. Tech Mahindra will help Tagawa become a smart city. Through this collaboration, Tech Mahindra will enhance its expertise in next-generation technologies such as IoT, 5G, virtual reality, and augmented reality.

Smart Cities Industry Overview

The smart cities market is semi-consolidated during the forecast period. The major players in the market are ABB Ltd, Cisco Systems Inc., Emerson Electric Co., IBM Corporation, and Ericsson Inc. Players in the market are adopting strategies such as partnerships, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In June 2023, ABB announced the acquisition of Eve Systems, a Munich-based leader in smart home products with operations in the United States and Europe, to strengthen its smart home technology portfolio. Through this acquisition, the company aims to meet the accelerating demand for smart, safe, and sustainable retrofitting of buildings driven by energy prices and climate policies.

In June 2023, Siemens AG announced the opening of Egypt's first Smart Cities Experience Centre to offer customers an immersive experience that combines the digital and real worlds. The center will showcase the latest technologies for creating efficient and sustainable smart city infrastructure, buildings, and industries. Through this concept, visitors can understand the benefits of transforming current communities into smart cities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of AI and IoT

- 5.1.2 Growth in the need for public safety and security

- 5.2 Market Challenges

- 5.2.1 Security Concerns Related to IoT and Smart Devices

- 5.3 Impact of COVID-19 on the Smart Cities Market

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Smart Mobility Management

- 6.1.2 Smart Public Safety

- 6.1.3 Smart Healthcare

- 6.1.4 Smart Building

- 6.1.5 Smart Utilities

- 6.1.6 Smart Security

- 6.1.7 Smart Education

- 6.1.8 Other Solutions

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Sweden

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia

- 6.2.3.5 South Korea

- 6.2.3.6 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Mexico

- 6.2.4.2 Brazil

- 6.2.4.3 Argentina

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 United Arab Emirates

- 6.2.5.3 South Africa

- 6.2.5.4 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Emerson Electric Co.

- 7.1.4 IBM Corporation

- 7.1.5 Ericsson Inc.

- 7.1.6 Schneider Electric SE

- 7.1.7 General Electric Co.

- 7.1.8 Siemens AG

- 7.1.9 Huawei Technologies Co. Ltd.

- 7.1.10 Honeywell International Inc.

- 7.1.11 Hitachi Ltd.

- 7.1.12 Nokia Corporation

- 7.1.13 Koninklijke Philips NV