|

市場調查報告書

商品編碼

1686553

汽車半導體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

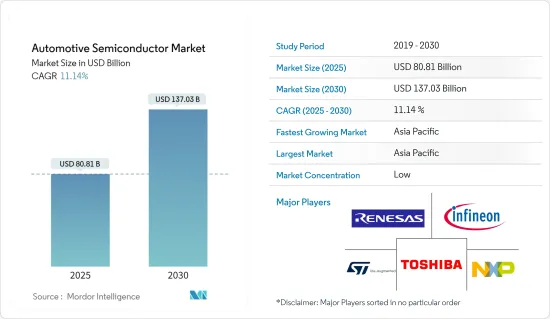

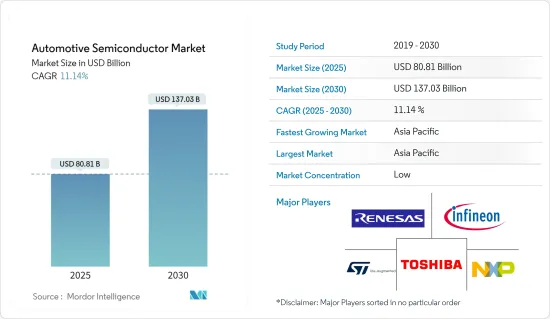

預計 2025 年汽車半導體市場規模為 808.1 億美元,到 2030 年將達到 1,370.3 億美元,預測期內(2025-2030 年)的複合年成長率為 11.14%。

主要亮點

- 近年來,隨著 3D 地圖應用、電動車和車輛自動化等眾多先進技術的出現,汽車產業經歷了快速轉型。這推動了對各種尖端半導體的需求,包括感測器、儲存設備和積體電路。

- 全球汽車半導體銷售趨勢主要受汽車銷售和生產趨勢以及由於車輛整個電子元件的激增而導致每輛汽車的半導體部署增加所驅動。由於全球範圍內嚴格監管和安全要求,汽車半導體市場具有零缺陷品質流程、嚴格的資格認證流程、功能安全的設計架構、廣泛的設計時間範圍、高可靠性和長的產品生命週期等特點,這意味著汽車行業對半導體的需求巨大。

- 根據國際汽車工業組織(OICA)的數據,2023年全球汽車產量將超過9,300萬輛,比2022年成長約10%。新冠疫情帶來了購車行為和消費者態度的許多變化。人們欣然接受能夠幫助他們保持聯繫、安全和可追蹤的數位服務和功能。

- 因此,隨著車載螢幕變得越來越普及,我們可以期待許多其他數位功能將輕鬆整合。由於人們對觸控表面的擔憂日益增加,虛擬助理、語音辨識、個人化和手勢控制的需求也可能增加。汽車市場正在加速標準化,A-PHY(串行器-解串器 (SerDes) 物理層介面)有望成為主要的連接解決方案。汽車生態系統正在圍繞該標準融合,預計A-PHY將在不久的將來成為全球汽車的主導連接解決方案。然而,由於在極冷和極熱條件下運作的缺陷,汽車半導體市場可能會面臨不可避免的挑戰。

- 自 COVID-19 以來,市場上的各種公司正在採取各種策略,例如發布、收購和合併,以獲得競爭優勢。

汽車半導體市場趨勢

乘用車佔主要市場佔有率

- 電動車需求的不斷成長是加速乘用車對汽車半導體需求的主要因素之一。例如,根據彭博經濟論壇報道,2023年印度電動車銷量將在各個領域實現成長,其中乘用車電動車銷量將成長近一倍,達到 96,000 輛,佔乘用車總銷量的 2.3%。

- 從組成部分來看,感測器產業預計將成為市場成長的主要推動力。這是因為對主動式車距維持定速系統和自動緊急煞車等 ADAS 功能的需求不斷增加,從而推動了對更先進、更強大的汽車半導體的需求。這些系統依靠感測器和處理器才能有效運作。

- 安全系統需求的增加可能與 ADAS 和自動緊急煞車系統的引入以及道路安全規則的完善有關,從而推動全球對汽車半導體元件的需求。

- 歐盟 (EU) 計畫從 2024 年中期開始強制使用 ADAS 系統,聯合國計畫於 2025 年 1 月開始實施關於提供額外駕駛輔助系統 (DCAS 和 ADAS) 的新法規,這些計畫預計將透過增加對汽車半導體的需求來進一步推動市場成長。

- 歐洲、北美和亞太地區的多個國家已核准立法,強制消費車輛配備各種類型的 ADAS。

- 自動駕駛和自動駕駛汽車的日益普及是 ADAS 市場的關鍵成長要素,從而推動了汽車半導體市場的成長。例如,據英特爾稱,預計到2030年全球汽車銷量將達到約1.014億輛,而自動駕駛汽車預計將佔2030年汽車註冊量的12%左右。

亞太地區成長迅速

- 汽車製造業的崛起以及汽車原始設備製造商和半導體製造商之間不斷加深的夥伴關係正在推動亞太汽車半導體市場的發展。買家更重視車輛的舒適性和豪華性,而不是成本和燃油經濟性等傳統因素。

- 為了滿足人們對豪華和半豪華汽車日益成長的需求,全球汽車製造商擴大在汽車上配備電子元件。這一趨勢正在推動亞太汽車半導體市場的發展,使該地區成為產業成長的中心。

- 電動車需求的激增將進一步推動亞太地區汽車半導體產業的發展。隨著主要汽車製造國對自動駕駛汽車的興趣日益濃厚,製造商面臨創新和部署此類技術的壓力。完全自動駕駛汽車的未來取決於多種因素,從技術進步和消費者接受度到產業解決定價和安全問題的能力。這些因素可能會影響未來幾年自動駕駛汽車的發展軌跡。

- 汽車和半導體行業正在加強對技術改進和原料談判的關注,以便將更可靠的技術融入車輛中。例如,Nvidia與豐田合作增強自動駕駛能力,凸顯了該產業對先進汽車技術的承諾。

- 豐田採用 NVIDIA 的 DRIVE PX AI 汽車電腦平台,彰顯了其致力於開發尖端自動駕駛系統的決心。這樣的夥伴關係和創新對於推動亞太汽車半導體市場的發展至關重要。

- 中國是亞太地區汽車半導體領域的重要參與者。中國對安全功能的關注、導航等資訊娛樂應用的興起、以及具有停車輔助和車道偏離警告等先進功能的 ADAS(高級駕駛輔助系統)的日益普及,是推動市場成長的主要驅動力。

汽車半導體產業概況

由於整合不斷加強、技術進步和地緣政治情勢的變化,市場出現波動。隨著IDM和代工廠之間的垂直整合不斷加強,考慮到其收益所帶來的投資能力,預計市場競爭將更加激烈。

在透過創新獲得永續競爭優勢相當高的市場中,鑑於各汽車公司的需求預計激增,競爭可能會加劇。

在這種背景下,品牌標識發揮重要作用,因為汽車公司希望半導體製造企業重視品質。此外,由於恩智浦半導體公司、英飛凌科技股份公司、聯發科瑞薩電子株式會社和德州儀器公司等現有參與者的存在,市場滲透率很高。

- 2024年2月:英飛凌科技股份公司宣布,英飛凌與本田汽車工業簽署了合作備忘錄(MoU),建立策略合作關係。本田選擇英飛凌作為其半導體合作夥伴,以協調其未來的產品和技術藍圖。兩家公司同意繼續討論供應安全問題,並鼓勵在加快產品上市時間的技術相關計劃上進行相互知識轉移和合作。

- 2023 年 11 月,恩智浦半導體公司 (NXP Semiconductors NV) 宣布投資和合作 Zendar Inc.,這是一家致力於使用高解析度雷達創新自動駕駛系統的軟體新興企業。此項投資將加速並推進高級駕駛輔助系統(ADAS)和自動駕駛(AD)的高解析度雷達解決方案,補充恩智浦可擴展的雷達產品組合。

- 2023 年 11 月瑞薩電子株式會社宣布了其下一代微控制器 (MCU) 和系統晶片(SoC) 計劃,目標是汽車數位領域的一系列關鍵應用。該公司宣布了兩款 MCU 產品的開發計劃,這些產品將成為下一代 R-Car 系列的特色。首先,我們最近推出了一系列跨界 MCU,可提供下一代 E/E 汽車架構中域和區域電控系統(ECU) 所需的高效能。第二,該公司計劃推出專門針對車輛控制市場的獨立MCU平台。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- 評估新冠疫情和其他宏觀經濟趨勢對市場的影響

- 自動駕駛汽車對射頻設備的需求概述

第5章 市場動態

- 市場促進因素

- 汽車產量增加

- 對先進安全和舒適系統的需求不斷增加

- 市場限制

- 先進車輛成本上升

第6章 市場細分

- 按車型

- 搭乘用車

- 輕型商用車

- 重型商用車

- 按組件

- 處理器

- 感應器

- 儲存裝置

- 積體電路

- 分離式功率元件

- 射頻設備

- 按應用

- 底盤

- 電力電子

- 安全

- 車身電子

- 舒適/娛樂單元

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- NXP Semiconductor NV

- Infineon Technologies AG

- Renesas Electronics Corporaton

- STMicroelectronics NV

- Toshiba Electronic Devices & Storage Corporation(Toshiba Corporation)

- Texas Instrument Inc.

- Robert Bosch GmbH

- Micron Technology

- Onsemi(Semiconductor Components Industries LLC)

- Analog Devices Inc.

- ROHM Co. Ltd

第8章投資分析

第 9 章:未來趨勢

The Automotive Semiconductor Market size is estimated at USD 80.81 billion in 2025, and is expected to reach USD 137.03 billion by 2030, at a CAGR of 11.14% during the forecast period (2025-2030).

Key Highlights

- The automobile industry has transformed rapidly over the past few years with the advent of numerous advanced technologies, such as 3D mapping applications, electric vehicles, and automobile automation. This has increased the demand for several advanced semiconductors, including sensors, memory devices, ICs, and many more.

- Growth in automotive semiconductor sales globally mainly depends on vehicle sales and production trends, along with the increase in semiconductor deployment per vehicle, driven by the proliferation of electronic elements throughout the car. Due to the high degree of regulatory scrutiny and safety requirements worldwide, the automotive semiconductor market is characterized by zero-defect quality processes, stringent qualification processes, functionally safe design architecture, extensive design-in timeframes, high reliability, and long product life cycles, which would lead to significant demand for semiconductors in the automotive sector.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, over 93 million automobiles were manufactured worldwide. This was an increase of around 10% from 2022. The COVID-19 pandemic led to various changes in car buying behavior and customer attitudes. People readily accept digital services and features to stay connected, safe, and trackable.

- Hence, the increasing penetration of in-vehicle screens is expected to lead to the easy integration of many other digital features. Virtual assistants, voice recognition, personalization, and gesture control may also experience increased demand for growing concerns over touching surfaces. The automotive market is racing toward standardization, and A-PHY (serializer-deserializer (SerDes) physical layer interface) is expected to be the leading connectivity solution. The automotive ecosystem is merging around this standard, and it is expected that A-PHY will soon become a dominant connectivity solution in cars worldwide. However, the automotive semiconductor market is likely to face compelling challenges because of operating flaws in climatic conditions like extreme cold and heat.

- Post-COVID-19, various companies in the market are involved in different strategies, such as launches, acquisitions, and mergers, to gain a competitive edge.

Automotive Semiconductor Market Trends

Passenger Vehicles to Hold Major Market Share

- The growing demand for passenger electric vehicles is among the key drivers accelerating the demand for automotive semiconductors in passenger vehicles, as electric vehicles need a greater number of semiconductors compared to traditionally powered vehicles. For instance, according to Bloomberg Economy Forum, electric vehicle sales in India increased across all segments in 2023, with passenger electric vehicles approximately doubling to 96,000 units, 2.3% of all passenger vehicle sales.

- Based on components, the sensors segment is expected to drive market growth significantly. This is due to the increasing demand for ADAS features like adaptive cruise control and automatic emergency braking, driving the need for more sophisticated and powerful automotive semiconductors. These systems rely on sensors and processors to function efficiently.

- The increasing demand for safety systems can be linked to the introduction of ADAS or automated emergency braking systems and improved road safety rules, driving the demand for automotive semiconductor components worldwide.

- The European Union's compulsion of ADAS systems starting mid-2024 and a plan to introduce new regulations by the United Nations for the provision of additional driver assistance systems (DCAS and ADAS) that will come into force in January 2025 are anticipated further to drive market growth with increased demand for automotive semiconductors.

- Some countries in Europe, North America, and Asia-Pacific have approved legislation mandating different types of ADAS in consumer vehicles.

- The rising adoption of self-driving or autonomous vehicles is a crucial growth factor for the ADAS market, driving the growth of the automotive semiconductors market. For instance, according to Intel, global car sales are anticipated to reach around 101.4 million units in 2030, and autonomous vehicles are estimated to account for around 12% of car registrations by 2030.

Asia Pacific to Register Significant Growth

- The increased automotive manufacturing and deepening partnerships between automotive OEMs and semiconductor manufacturers are propelling the Asia-Pacific automotive semiconductor market. Buyers prioritize a vehicle's comfort and luxury over traditional factors like cost and fuel efficiency.

- Global automakers, responding to the rising demand for luxury and semi-luxury vehicles, are increasingly outfitting their cars with electronic components. This trend is boosting the Asia-Pacific automotive semiconductors market, making the region a focal point for industry growth.

- The surge in electric vehicle demand is set to drive the Asia-Pacific automotive semiconductor sector further. As key automotive manufacturing nations witness a growing interest in self-driving cars, manufacturers are pressured to innovate and introduce such technologies. The future of fully autonomous vehicles hinges on various factors, from technological advancements and consumer acceptance to pricing and the industry's ability to address safety concerns. These factors will shape the trajectory of autonomous vehicles in the coming years.

- The automotive and semiconductor sectors are intensifying their focus on technology enhancements and raw material negotiations, integrating reliable technology into vehicles. For instance, NVIDIA's collaboration with Toyota, which enhances autonomous driving capabilities, highlights the industry's push toward advanced automotive technologies.

- Toyota's adoption of NVIDIA's DRIVE PX AI car computer platform underscores the commitment to developing cutting-edge autonomous driving systems. Such partnerships and innovations are pivotal in propelling the Asia-Pacific automotive semiconductor market forward.

- China is a key player in the Asia-Pacific automotive semiconductor landscape. The country's emphasis on safety features, the rise of infotainment applications like navigation, and the growing popularity of ADAS systems, featuring advanced functionalities such as parking assist and lane-departure warnings, are significant drivers of market growth.

Automotive Semiconductor Industry Overview

The market studied fluctuates due to growing consolidation, technological advancement, and geopolitical scenarios. With the rising vertical integration of IDMs and foundries, the intensity of competition in the market is expected to increase, considering their ability to invest, which results from their revenues.

In a market where the sustainable competitive advantage through innovation is considerably high, the competition is likely to increase, considering the anticipated surge in demand from various automotive firms.

In such a situation, brand identity plays a major role, considering the importance of quality that the automotive firms expect from a semiconductor manufacturing player. The market penetration levels are also high with the presence of large market incumbents, such as NXP Semiconductor NV, Infineon Technologies AG, MediaTek Renesas Electronics Corporation, and Texas Instrument Inc..

- February 2024: Infineon Technologies AG announced that Infineon and Honda Motor Co. Ltd signed a memorandum of understanding (MoU) to build a strategic collaboration. Honda selected Infineon as a semiconductor partner to align future product and technology roadmaps. The two companies agreed to continue discussions on supply stability and encourage the transfer of mutual knowledge and collaboration on projects to accelerate the time-to-market technologies.

- November 2023: NXP Semiconductors NV announced the investment in and collaboration with Zendar Inc., a software start-up dedicated to revolutionizing autonomous vehicle systems with high-resolution radar. The investment accelerated and improved high-resolution radar solutions for advanced driver assistance systems (ADAS) and autonomous driving (AD) to complement NXP's leading scalable radar portfolio.

- November 2023: Renesas Electronics Corporation laid out plans for its next-generation microcontrollers (MCUs) and system-on-chips (SoCs), targeting all significant applications across the automotive digital domain. The company shared its plans for two forthcoming MCU product advancements in the next-generation R-Car family. One is a recent crossover MCU series that delivers the high performance required for domain and zone electronic control units (ECU) in next-generation E/E automobile architectures. Secondly, the group plans to introduce a separate MCU platform tailored to the vehicle control market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 and Other Macroeconomic Trends on the Market

- 4.5 Overview of RF Device Demand in Autonomous Vehicles

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Vehicle Production

- 5.1.2 Rising Demand for Advanced Safety and Comfort Systems

- 5.2 Market Restraints

- 5.2.1 Higher Cost of Advanced Featured Vehicles

6 MARKET SEGMENTATION

- 6.1 By Vehicle Type

- 6.1.1 Passenger Vehicle

- 6.1.2 Light Commercial Vehicle

- 6.1.3 Heavy Commercial Vehicle

- 6.2 By Component

- 6.2.1 Processors

- 6.2.2 Sensors

- 6.2.3 Memory Devices

- 6.2.4 Integrated Circuits

- 6.2.5 Discrete Power Devices

- 6.2.6 RF Devices

- 6.3 By Application

- 6.3.1 Chassis

- 6.3.2 Power Electronics

- 6.3.3 Safety

- 6.3.4 Body Electronics

- 6.3.5 Comforts/Entertainment Unit

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductor NV

- 7.1.2 Infineon Technologies AG

- 7.1.3 Renesas Electronics Corporaton

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation)

- 7.1.6 Texas Instrument Inc.

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Micron Technology

- 7.1.9 Onsemi (Semiconductor Components Industries LLC)

- 7.1.10 Analog Devices Inc.

- 7.1.11 ROHM Co. Ltd