|

市場調查報告書

商品編碼

1686561

高性能隔熱材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)High-Performance Insulation Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

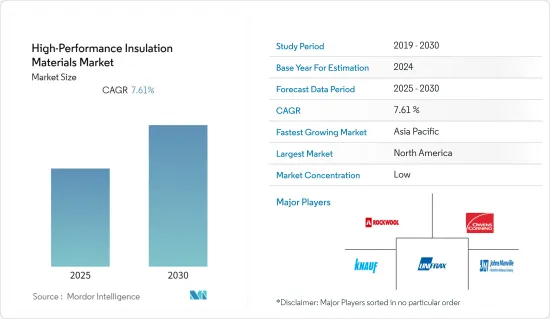

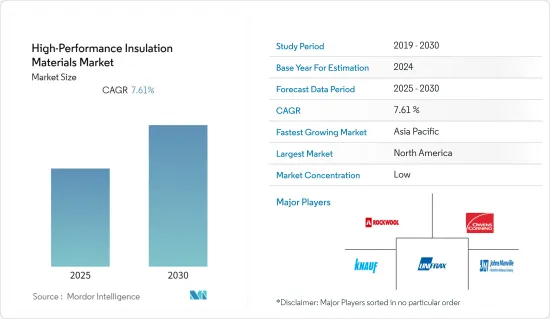

預計高性能隔熱材料市場在預測期內的複合年成長率將達到 7.61%。

主要亮點

- 石油和天然氣行業的使用量不斷增加以及人們對溫室氣體排放和節能意識的不斷增強預計將推動高性能隔熱材料市場的成長。

- 然而,高安裝和維護成本、相對較短的使用壽命以及含 CFC 的隔熱材料和泡沫產品的高可燃性預計將阻礙市場成長。

- 預計亞太地區基礎設施活動投資的增加將為所研究的市場帶來新的機會。

高性能隔熱材料的市場趨勢

石油和天然氣產業的需求不斷成長

- 熱的油氣混合物在井口上升,透過XMT、歧管、各種關鍵設備、短管和出油管線輸送,然後由立管將油輸送到地面。

- 高性能隔熱材料在石油和天然氣領域的需求龐大,這主要是由於海底管線應用需求的不斷增加。

- 此外,這些材料還具有石油和天然氣行業所需的特性,例如防火防水、優異的耐熱性、增強的隔音性、重量輕和外形薄。

- 根據經濟產業省統計,2021年日本原油產量約49萬千公升,較上年的約51.2千萬公升有所下降。

- 加拿大統計局稱,2021 年 10 月美國原油及等效產品產量增加 10.8%,達到 2,440 萬立方米,為 2019 年 12 月以來的最高原油產量。

- 預計上述因素將在預測期內推動高性能隔熱材料的使用。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導高性能隔熱材料市場。

- 該地區石油天然氣和建築業的成長極大地推動了對這些隔熱板的需求。

- 由於對能源和石化產品的需求不斷增加,亞太地區的石油和天然氣產業正在成長。印度、馬來西亞、印尼、中國、韓國和日本等國家正在增加海上鑽井活動。

- 2022年1-2月中國原油產量為3,347萬噸,年增約4.6%。根據中國國家統計局統計,原油日產量接近57.6萬噸。

- 根據OICA統計,2021年汽車產量為7,846,955輛,較2020年的8,067,557輛下降3%。不過,預計預測期內日本對電動車的需求將會成長。

- 在航太領域,根據印度品牌股權基金會 (IBEF) 的數據,預計未來四年印度航空業將吸引 3,500 億印度盧比(49.9 億美元)的投資。

- 上述因素可能會在預測期內增加對高性能隔熱材料的需求。

高性能隔熱材料產業概況

全球高性能隔熱材料市場高度分散,前十大公司在研究市場中佔有相當大的佔有率。市場的主要企業包括歐文斯科寧、可耐福 Gips KG、Rockwool、Johns Manville、Unifrax 等(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 在石油和天然氣產業的應用日益廣泛

- 提高溫室氣體排放與節能意識

- 限制因素

- 安裝維護成本高,使用壽命相對較短

- 含氯氟烴的隔熱材料及泡沫產品易燃性高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依材料類型

- 氣凝膠

- 真空絕熱板(VIP)

- 玻璃纖維

- 陶瓷纖維

- 高性能泡沫

- 其他

- 按最終用戶產業

- 石油和天然氣

- 產業

- 建築與施工

- 運輸

- 發電

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Aerogel Technologies LLC

- Armacell

- Aspen Aerogels Inc.

- BASF SE

- Cabot Corporation

- IBIDEN

- Isolite Insulating Products Co. Ltd

- Johns Manville

- Knauf Gips KG

- Luyang Energy-Saving Materials Co. Ltd

- Morgan Advanced Materials

- Owens Corning

- Panasonic Corporation

- PAR Group

- Rath Group

- ROCKWOOL Group

- Saint-Gobain

- Unifrax

第7章 市場機會與未來趨勢

- 增加亞太地區基礎建設投資

簡介目錄

Product Code: 52653

The High-Performance Insulation Materials Market is expected to register a CAGR of 7.61% during the forecast period.

Key Highlights

- The growing usage in the oil and gas industry and rising awareness regarding greenhouse emissions and energy savings are likely to drive the growth of the high-performance insulation materials market.

- On the flip side, high set-up and maintenance costs, relatively low service life, and high flammability with insulated materials and foam products that contain CFC are expected to hinder the market's growth.

- Increasing investments in infrastructural activities in Asia-Pacific are expected to unveil new opportunities for the market studied.

High Performance Insulation Materials Market Trends

Increasing Demand from the Oil and Gas Industry

- The hot oil and gas composition flows up at the wellhead and is transported through XMTs, manifolds, various critical instruments, spools, and flow lines before the riser brings the oil to the surface.

- High-performance insulation materials are witnessing a huge demand from the oil and gas sector, primarily owing to the increasing demand for subsea pipeline applications.

- Additionally, these materials offer properties, such as fire and water resistance, excellent thermal resistance, enhanced acoustic insulation, lightweight, and reduced thickness, that are required in the oil and gas sector.

- According to the Ministry of Economy, Trade, and Industry (METI), in 2021, approximately 490 thousand kiloliters of crude oil were produced in Japan, down from about 512 thousand kiloliters in the previous year.

- According to StatCan, the production of crude oil and equivalent products in the United States rose 10.8% in October 2021 to 24.4 million cubic meters, the highest crude production level since December 2019.

- The aforementioned factors are likely to result in an increase in the usage of high-performance insulation materials during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the market for high-performance insulation materials during the forecast period.

- The growth in the oil and gas and the construction sector in the region has significantly boosted the demand for such insulation panels.

- The oil and gas industry in the Asia-Pacific region is growing due to the increasing demand for energy and petrochemicals. Countries such as India, Malaysia, Indonesia, China, South Korea, and Japan are experiencing increased offshore drilling activities.

- The crude oil output of China has registered at 33.47 million tons in the first two months of 2022, which is about 4.6% up from the same period of the previous year. According to the National Bureau of Statistics China, the daily output of crude oil is nearly 576,000 tons.

- According to OICA, the production of vehicles in 2021 accounted for 78,46,955 units, a fall of 3% compared to 80,67,557 units produced in 2020. However, the demand for electric vehicles in Japan is projected to grow over the forecast period.

- In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (USD 4.99 billion) investment in the next four years.

- The aforementioned factors will likely increase the demand for high-performance insulation materials during the forecast period.

High Performance Insulation Materials Industry Overview

The global High-Performance Insulation Materials Market is highly fragmented, with the top 10 players capturing a noticeable share in the market studied. Some of the major players in the market include (not in any particular order) Owens Corning, Knauf Gips KG, Rockwool, Johns Manville, and Unifrax, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in the Oil and Gas Industry

- 4.1.2 Rising Awareness Regarding Greenhouse Emissions and Energy Savings

- 4.2 Restraints

- 4.2.1 High Set-up and Maintenance Costs and Relatively Low Service Life

- 4.2.2 High Flammability with Insulated Materials and Foam Products that Contain CFC

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Aerogel

- 5.1.2 Vacuum Insulation Panel (VIP)

- 5.1.3 Fiberglass

- 5.1.4 Ceramic Fiber

- 5.1.5 High-performance Foam

- 5.1.6 Other Material Types

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Industrial

- 5.2.3 Building and Construction

- 5.2.4 Transportation

- 5.2.5 Power Generation

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aerogel Technologies LLC

- 6.4.3 Armacell

- 6.4.4 Aspen Aerogels Inc.

- 6.4.5 BASF SE

- 6.4.6 Cabot Corporation

- 6.4.7 IBIDEN

- 6.4.8 Isolite Insulating Products Co. Ltd

- 6.4.9 Johns Manville

- 6.4.10 Knauf Gips KG

- 6.4.11 Luyang Energy-Saving Materials Co. Ltd

- 6.4.12 Morgan Advanced Materials

- 6.4.13 Owens Corning

- 6.4.14 Panasonic Corporation

- 6.4.15 PAR Group

- 6.4.16 Rath Group

- 6.4.17 ROCKWOOL Group

- 6.4.18 Saint-Gobain

- 6.4.19 Unifrax

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments in Infrastructural Activities in Asia-Pacific

02-2729-4219

+886-2-2729-4219