|

市場調查報告書

商品編碼

1686562

硫磺:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Sulfur - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

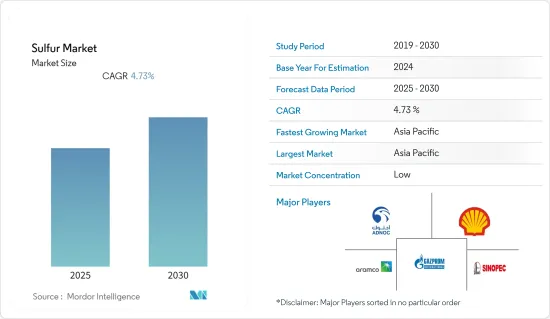

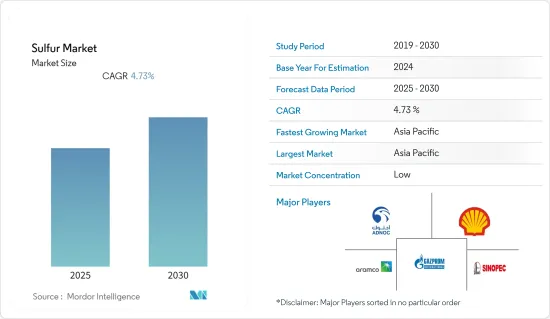

預測期內,硫磺市場預計將以 4.73% 的複合年成長率成長。

COVID-19 的影響擾亂了硫磺供應,並減少了金屬製造和化學加工等多個終端用戶行業的需求。此外,新冠疫情徹底擾亂了化肥的生產和供應鏈,這可能會在短期內阻礙市場發展。不過,預計這種情況將會改善,市場預計將在預測期後半段恢復成長軌跡。

主要亮點

- 短期內,推動硫磺市場成長的關鍵因素是化肥製造業的需求增加和橡膠硫化對硫磺的使用增加。

- 然而,有關排放的嚴格環境法規預計會阻礙市場成長。

- 預計硫在水泥聚合物混凝土中的應用將成為一個未來的機會。

- 亞太地區在全球市場佔據主導地位,在消費量和消費價值方面均佔有最大佔有率。預計預測期內市場將大幅成長。

硫磺市場趨勢

肥料製造業的需求增加

- 由於硫磺經濟實惠,它被廣泛用於製造肥料,如硫酸鈣,硫酸鈣是一種眾所周知的防止養分流失和土壤侵蝕的肥料。硫磺可以殺死昆蟲、真菌、蟎蟲和囓齒動物。這就是為什麼自20世紀20年代以來硫磺就被登記在美國的農藥和肥料中。

- 硫肥是添加到土壤和植物中的有機或合成成分,為植物提供重要的營養,促進生長和生產。硫肥還可用於提高土壤肥力或取代先前作物從土壤中吸收的化學元素,從而提高農業產量,為植物提供額外的營養,促進植物發育。

- 此外,硫肥被認為是農業領域與磷、氮和鉀並列的第四大常量營養素。硫在植物中也發揮多種功能。它的一些重要作用包括蛋白質合成和葉綠素的形成。

- 國際肥料協會稱,在2021年下降2%、2022年下降5%之後,預計2023年全球肥料消費量將恢復3%至1.94億噸(增加590萬噸),略高於2019年的水準。

- 此外,有關化肥使用的環境政策、產能擴張、極端天氣事件和地緣政治緊張局勢都會對全球化肥料價格產生重大影響。然而,到 2035 年,中東地區的化肥產量預計將達到 5,000 萬噸。

- 例如,2022 年 9 月,荷蘭特種化學品公司 Nouryon 收購了 ADOB Fertilizers。此次收購為 ADOB 提供了利用大型全球組織並邁向全球成長下一階段的機會。

- 除此之外,亞太地區政府為增加化肥產量而採取的各種措施也推動了硫磺的需求。

- 例如,據印尼化肥生產商協會(APPI)稱,2023年2月,政府將全面啟動Pusri 3B化肥廠計劃,該項目將取代Pusri 3和4化肥廠。新計劃將於 2030 年完工,化肥產能將由目前的 1,397 萬噸增至 1,687 萬噸。

- 因此,考慮到世界各地的成長趨勢和化肥產量,化肥產業可能會主導市場,從而導致預測期內對硫的需求增加。

亞太地區佔市場主導地位

- 由於中國和印度等國家對肥料和橡膠加工中硫磺的需求不斷成長,亞太地區佔據了市場主導地位。

- 中國是世界各類型硫磺的最大生產國。中國是世界最大的黃鐵礦(原料)生產國,佔各種硫磺的50%以上。中國是全球最大的硫磺進口國之一,佔全球進口量的35%左右,大部分用於製造硫酸。

- 中國使用的硫酸約有三分之二用於化肥生產。在肥料工業中,鈣、鎂和硫被用作二次肥料。雅苒中國有限公司和Nutrien Ltd 是提供二次肥料相關產品的公司之一。

- 根據中國國家統計局的數據,預計2022年硫酸產量將創下9,505萬噸的歷史新高(連續第三年成長),較2021年產量增加1.3%。

- 在產量方面,根據印度化學和化肥部的數據,在 2022-23 會計年度 4 月至 12 月中旬,印度生產了 3.2076 億噸化肥,為化肥供應充足做出了貢獻。由於政府的優惠政策,該國的化肥生產正在受到青睞。例如,2022-23年該國對磷鉀肥的補貼支出將達到5,564.8億印度盧比(67.8億美元)。

- 印度是亞太地區繼中國之後最大的橡膠生產國和消費國之一。儘管該國是最大的橡膠生產國之一,但該國仍從各國進口大量橡膠以滿足國內需求。印度擁有約 6,000 個製造單位,其中包括 30 個大型製造單位、300 家中型製造單位和約 5,600 個小型和微型製造單位。所有這些單位在全國生產超過 35,000 種橡膠產品,因此對硫磺的需求量很大。

- 全球橡膠消費量的約三分之一是泰國、印尼和馬來西亞人工林生產的天然橡膠。泰國是世界上最大的天然橡膠生產國和出口國。

- 上述因素導致亞太地區硫磺消費需求增加。

硫磺行業概況

硫磺市場是一個分散的市場,有多家公司在全球和區域層面開展業務。市場的主要企業(不分先後順序)包括中國石油化學集團公司(中石化)、俄羅斯天然氣工業股份公司、阿布達比國家石油公司、殼牌公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 肥料製造業的需求增加

- 橡膠硫化中硫磺的使用增加

- 精製擴建

- 限制因素

- 有關排放的嚴格環境法規

- 硫磺開採高成本

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 形式

- 固體的

- 液體

- 技術(表面處理工程)

- 顆粒

- 錠劑

- 普林林

- 最終用戶產業

- 肥料

- 化學處理

- 金屬製造

- 橡膠加工

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ADNOC Group

- China Petrochemical Corporation

- Gazprom International Limited

- Marathon Petroleum Company LLC

- Petrovietnam Chemical and Services Corporation(PVCHEM)

- Shell PLC

- Saudi Arabian Oil Co.

- Suncor Energy Inc.

- Tengizchevroil LLP

- Valero Energy Corporation

第7章 市場機會與未來趨勢

- 硫在水泥聚合物混凝土。

- 硫電池的演變

The Sulfur Market is expected to register a CAGR of 4.73% during the forecast period.

Due to COVID-19, there has been a disruption in the supply of sulfur and a decline in the demand from multiple end-user industries, such as metal manufacturing and chemical processing. Moreover, the COVID-19 outbreak has completely disrupted the manufacturing and supply chains of fertilizers, which may hamper the market in the short term. However, the condition is expected to recover, which will restore the growth trajectory of the market studied during the latter half of the forecast period.

Key Highlights

- Over the short term, major factors driving the growth of the sulfur market are the rising demand from the fertilizer manufacturing sector and the increasing usage of sulfur for the vulcanization of rubber.

- On the flip side, stringent environmental regulations regarding emissions are expected to hinder the market's growth.

- Usage of sulfur in cement polymer concrete is expected to act as an opportunity in the future.

- Asia-Pacific dominated the global market, with the largest consumption in terms of volume and value. The market is expected to witness substantial growth during the forecast period.

Sulfur Market Trends

Rising Demand from the Fertilizer Manufacturing Sector

- Sulfur, being economical, is widely consumed in producing fertilizers such as calcium sulfate, which is well-known fertilizer for preventing nutrient runoff and soil erosion. It can kill insects, fungi, mites, and rodents. Therefore, sulfur has been registered for use in pesticides and fertilizers in the United States since the 1920s.

- Sulfur fertilizers are organic or synthetic ingredients put into the soil or plants, boosting growth and production by delivering critical plant nutrients. It is also used for increasing agricultural output, supplying extra nutrients to plants, and boosting plant development by improving soil fertility or replacing chemical components removed from the soil by previous crops.

- Moreover, sulfur fertilizer is considered a fourth macronutrient along with phosphorus, nitrogen, and potassium in the agriculture industry. Also, it has various functions in plants. Some of these significant roles are the synthesis of proteins and chlorophyll formation.

- According to the International Fertilizer Association, after declining by 2% in FY 2021 and 5% in FY 2022, a 3% recovery in global fertilizer consumption in FY 2023 to 194 Mt of nutrients (+5.9 Mt) is forecasted, returning consumption to just above the FY 2019 level.

- Also, the environmental policies related to fertilizer use, capacity expansions, extreme weather conditions, and geopolitical tensions have severely impacted fertilizer prices worldwide. However, fertilizer production in the Middle East is expected to hit 50 million tons by 2035.

- For instance, in September 2022, Nouryon, a Netherlands-based specialty chemicals company, acquired ADOB Fertilizers. This acquisition created an opportunity for ADOB to leverage a large global organization to advance to the next stage of global growth.

- Apart from that, various government initiatives for increasing fertilizer production in Asia-Pacific are driving the demand for sulfur.

- For instance, according to the Indonesian Fertilizer Producers Association (APPI), in February 2023, the government is in the process of fully launching the Pusri 3B fertilizer factory project that will replace the Pusri 3 and 4 fertilizer plants. This new project will be completed by 2030 and will have 16.87 million tons of fertilizer production capacity as compared to the current, which is 13.97 million tons.

- Therefore, considering the growth trends and production of fertilizers in different regions worldwide, the fertilizer industry is likely to dominate the market, which, in turn, is expected to enhance the demand for sulfur during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market due to the growing demand for sulfur in fertilizer and rubber processing from countries such as China and India.

- China is the leading global producer of sulfur in all forms. China is the world's leading producer of pyrites (source), which account for more than 50% of sulfur in all forms. The country is the leading sulfur importer, representing about 35% of the global imports, the bulk of which is used to manufacture sulfuric acid.

- Fertilizer production consumes about two-thirds of the sulfuric acid used in China. In the fertilizer industry, secondary fertilizers include calcium, magnesium, and sulfur. Yara China Limited and Nutrien Ltd are some of the companies that offer products related to secondary fertilizers.

- As per the National Bureau of Statistics of China, the production of sulfuric acid reached record highs in 2022 (consecutively rising for the third year) at 95.05 million metric tons, registering a growth of 1.3% from the output achieved in 2021.

- In terms of production,India produced 320.76 lakh metric tons of fertilizers during April-mid December of FY 2022-23, which contributed to a comfortable availability of fertilizers per the Ministry of Chemicals and Fertilizers. Fertilizer production has been gaining traction in the country due to favorable government policies. For instance, the subsidy outgo on P&K fertilizers in the country during 2022-23 rounded to INR 556.48 billion (USD 6.78 billion).

- India is one of the largest producers and consumers of rubber after China in the Asia-Pacific region. Despite being one of the largest rubber producers, the country imports a noticeable portion of the rubber from various countries to meet the local demand. India has about 6000 manufacturing units comprising 30 large-scale manufacturing units, 300 medium manufacturing scale, and around 5,600 small-scale and tiny sector manufacturing units. All these units manufacture more than 35,000 rubber products in the country, thus generating a substantial demand for sulfur

- About one-third of total global rubber consumption is natural rubber produced in plantations in Thailand, Indonesia, and Malaysia. Thailand is one of the largest producers and exporters of natural rubber globally.

- The aforementioned factors are contributing to the increasing demand for sulfur consumption in the Asia-Pacific region.

Sulfur Industry Overview

The sulfur market is fragmented in nature with several companies operating on both global and regional levels. Some of the major players in the market (Not in any particular order) include China Petrochemical Corporation (Sinopec), Gazprom International Limited, ADNOC Group, and Shell Plc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand From the Fertilizer Manufacturing Sector

- 4.1.2 Increasing Usage of Sulfur for Vulcanization of Rubber

- 4.1.3 Expansion of Petroleum Refining Plants

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding Emissions

- 4.2.2 High Cost of Sulfur Mining Process

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Solid

- 5.1.2 Liquid

- 5.2 Technology (Finishing Process)

- 5.2.1 Granules

- 5.2.2 Pastilles

- 5.2.3 Prilling

- 5.3 End-User Industry

- 5.3.1 Fertilizer

- 5.3.2 Chemical Processing

- 5.3.3 Metal Manufacturing

- 5.3.4 Rubber Processing

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADNOC Group

- 6.4.2 China Petrochemical Corporation

- 6.4.3 Gazprom International Limited

- 6.4.4 Marathon Petroleum Company LLC

- 6.4.5 Petrovietnam Chemical and Services Corporation (PVCHEM)

- 6.4.6 Shell PLC

- 6.4.7 Saudi Arabian Oil Co.

- 6.4.8 Suncor Energy Inc.

- 6.4.9 Tengizchevroil LLP

- 6.4.10 Valero Energy Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Sulfur in Cement Polymer Concrete

- 7.2 Evolution of Sulfur Battery