|

市場調查報告書

商品編碼

1686649

汽車輪胎:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

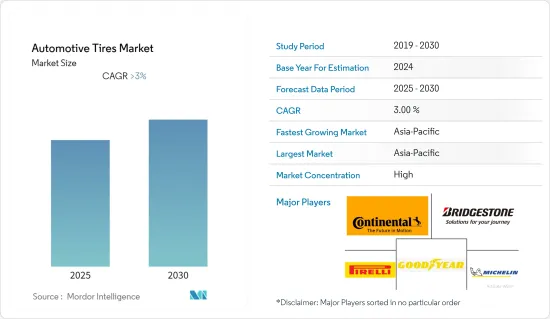

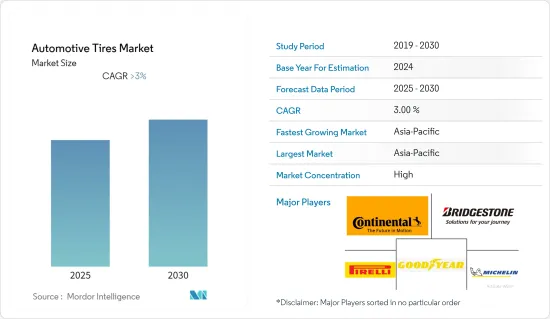

預計預測期內汽車輪胎市場的複合年成長率將超過 3%。

新冠疫情在短期內對汽車輪胎市場產生了直接且重大的影響,導致2020年新車產銷售下降。此外,限制措施導致車主減少駕駛,從而導致維修和換胎時間延遲。然而,由於預測期內汽車銷售量預計將大幅成長,預計市場將經歷經濟復甦。

對燃油效率的日益關注、對便利性的不斷成長的需求以及傳統輪胎的高維護和更換成本正在推動汽車輪胎市場的成長。此外,OEM正在採用尖端的製造技術,並根據永續性、耐用性和可負擔性對其產品進行差異化,這也促進了行業成長。

翻新輪胎的需求正在大幅增加。輪胎翻新有助於顯著降低售後市場的營運成本,因為它無需完全更換輪胎,因此是一種經濟高效的選擇。該外殼有助於提供多個生命週期,從而顯著節省成本,特別是對於商業車隊營運商而言。

該輪胎製造商正在投資零碳技術、能源效率和綠色能源,以便在 2050 年實現碳中和。例如,2021 年 2 月,米其林集團宣布,目標是到 2050 年讓其輪胎 100%永續。為此,米其林與 Axens、IFP Energies Nouvelles、Pyrowave、Carbios、Enviro 和 BlackCycle 等多家組織合作。

汽車輪胎市場趨勢

高性能輪胎的需求不斷增加

預計預測期內汽車高性能輪胎市場將實現高速成長。這種成長是由多種因素推動的,其中包括公眾對賽車、自行車賽和極限地形拉力賽等運動的興趣日益濃厚。 OEM利用這些活動作為銷售產品和提高品牌知名度的平台。新興經濟體消費者的可支配收入不斷提高,推動了對 SUV 和跨界車等大容量車輛的需求。新興經濟體(尤其是印度和中國)的快速基礎設施建設正在推動商用和工程車輛的銷售。替換輪胎和售後輪胎市場為汽車製造商帶來了巨大的收益機會。由於橡膠輪胎容易磨損,因此客戶選擇高性能輪胎而不是傳統橡膠輪胎。

由於BMW、福斯、法拉利、戴姆勒和雷諾等眾多OEM的存在,歐洲對高性能輪胎的需求強勁。這些OEM定期參加整個非洲大陸的馬達活動,展示滿足客戶對更安全、更清潔、更具成本效益的車輛和零件的需求的創新新產品。

市場各主要參與者都在投資高性能輪胎的新產品。例如,2021年3月,埃尼旗下化學公司Versalis與BridgestoneEMIA簽署了共同開發契約,用於研究、生產和供應用於高性能輪胎生產的新型合成橡膠等級,包括合成橡膠和苯乙烯-丁二烯橡膠(SBR)。

亞太地區可望實現最高市場成長

2020年中國汽車銷量下降超過6%,這是全球最大汽車市場連續第三年萎縮。 2020年,中國汽車製造商共銷售乘用車1,929萬輛。同時,2021年4月,中國工業協會(CAAM)宣布,根據主要企業彙總的銷售資料,1月至3月累計銷售量達到634.4萬輛。

印度也是該地區的主要市場,自第三季以來乘用車銷量有所改善,2020年10月達到310,294輛,較去年同期的271,737輛成長14.19%。根據印度汽車經銷商協會聯合會(FADA)的數據,2020年11月乘用車銷量為291,001輛,較2019年11月的279,365輛成長4.17%。

根據日本汽車輪胎製造商協會(JATMA)發布的《2020年日本國內汽車輪胎需求情形》顯示,2020年汽車輪胎新車銷售數量與前一年同期比較減少3,643.9萬條,減少17%。 2020年上半年雖然受到新冠疫情影響,但下半年新車生產強勁,新車輪胎需求開始復甦。

該地區的主要企業正在推出新輪胎,以獲得競爭優勢。 2021 年 3 月,阿波羅輪胎在印度推出了針對小型 SUV 細分市場的 Apterra Cross 輪胎。 Apterra Cross 輪胎是該公司對 CSUV 的具體使用模式進行研究的成果。新系列輪胎將在印度推出,隨後將引入東協和南盟市場。

汽車輪胎產業概況

全球輪胎市場集中度處於中等水平,米其林、Bridgestone、倍耐力等主要製造商分別滿足乘用車和商用車的輪胎需求。然而,在高度區域化和集中化的亞洲汽車市場(如中國、印度和印尼)中,市場主要由當地輪胎製造商主導。

對高品質、安全輪胎的需求是汽車製造商和最終用戶青睞叛逃製造商而非小型區域製造商的產品的主要原因。此外,這些領先的製造商均倍增了研發支出,以整合技術創新和卓越的性能。結果是,生產出了適合越野和公路式使用的高品質輪胎。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按輪胎類型

- 冬季輪胎

- 夏季輪胎

- 其他輪胎類型

- 按應用

- 在路上

- 工程用

- 按車型

- 搭乘用車

- 商用車

- 按最終用戶

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Bridgestone Corp.

- Continental Automotive AG

- Cooper Tire & Rubber Company

- Goodyear Tire & Rubber Company

- Hankook Tires Group

- Michelin Tires

- MRF(Madras Rubber Factory Limited)

- Pirelli & C SpA

- Apollo Tires

- Yokohama Rubber Co. Ltd

- JK Tyre & Industries

第7章 市場機會與未來趨勢

The Automotive Tires Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 pandemic had a significant effect on the automotive tires market directly in the short term as the production and sales of new vehicles witnessed a decline in 2020. Moreover, owing to restrictions, vehicle owners reduced the amount of driving resulting in delayed visits for maintenance or tire replacement. However, with the projected exponential increase in vehicle sales over the forecast period, the market is expected to be revived economically.

The growing focus on fuel economy, rising demand for convenience, and high maintenance or replacement costs of conventional tires are driving the growth of the automotive tires market. Another factor that is responsible for the growth of the industry is the adoption of cutting-edge manufacturing technology by OEMs to offer product differentiation through sustainability, durability, and affordability.

The demand for retreaded tires is increasing at a significant rate. The retreading of tires helps reduce the operating cost significantly in the aftermarket as it prevents the complete replacement of tires and is, thereby, a cost-effective option. The casings can help provide multiple life cycles, resulting in significant cost savings, especially for commercial fleet operators.

Tire makers are turning to green energy in their production as companies are working to achieve carbon neutrality by 2050, with investments in the direction of zero-carbon technology, energy efficiency, and green energy. For instance, in February 2021, Michelin Group announced that it is working toward making its tires 100% sustainable by 2050. For this, Michelin partnered with various organizations like Axens, IFP Energies Nouvelles, Pyrowave, Carbios, Enviro, and BlackCycle.

Automotive Tire Market Trends

Increased Demand for High-performance Tires

The automotive high-performance tires market is expected to witness high growth during the forecast period. The growth is driven by numerous factors, such as the increasing inclination of people toward sports like car and bike racing and extreme terrain rallies. OEMs use these events as a platform to market their products and increase brand visibility. Increasing disposable income of customers living in emerging economies is leading to a growth in demand for higher-capacity vehicles such as SUVs and crossover vehicles. Rapid infrastructure development in developing economies, especially India and China, has caused a growth in sales of commercial vehicles and construction vehicles. The replacement and aftermarket tire market presents a huge opportunity for vehicle manufacturers to generate revenue. Customers are choosing high-performance tires over traditional rubber tires because rubber tires are subjected to wear and tear easily.

Europe has shown a strong demand for high-performance tires due to the presence of a large number of OEMs such as BMW, Volkswagen, Ferrari, Daimler, and Renault. These OEMs regularly participate in motorsports events held in the continent and showcase their new line of innovative products that cater to customers' need for safe, cleaner, and cost-effective vehicles and components.

Various major players in the market are investing in new products for high-performance tires. For instance, in March 2021, Versalis, Eni's chemical company, and Bridgestone EMIA signed a joint development agreement for the research, production, and supply of synthetic rubber and new elastomer grades, including styrene-butadiene rubber (SBR), for the production of high-performance tires.

Asia-Pacific is Expected to Grow at the Fastest Rate in the Market

The world's largest automotive market shrank for a third straight year as Chinese car sales declined by more than 6% in 2020. Automakers in China sold 19.29 million passenger vehicles in 2020. Whereas in April 2021, the China Association of Automobile Manufacturers (CAAM) announced that according to aggregated data of sales figures for major companies, cumulative sales from January to March reached 6.344 million units.

India is another major market in the region, with its passenger vehicle sales improving after the third quarter of the year, reaching 3,10,294 units in October 2020 compared to 2,71,737 units in the same month last year, a 14.19% growth. As per the Federation of Automobile Dealers Associations (FADA), passenger vehicle sales in November 2020 were 2,91,001 units compared to 2,79,365 units in November 2019, with a 4.17% growth.

According to the "2020 Domestic Demand for Automobile Tires" released by the Japan Automobile Tyre Manufacturers Association (JATMA), the sales of new automobile tires for vehicles in 2020 were 36,439,000 down, a 17% decrease year-to-year. The first half of 2020 was affected due to the influence of COVID-19; however, demand for new vehicle tires began to recover in the second half of the year due to strong new vehicle productions.

Major players in the region are introducing new tires to gain an advantage over their competitors. March 2021, Apollo Tires introduced Apterra Cross tires for the compact SUV segment in India. The Apterra Cross tires are an outcome of the company's research to understand the exact usage patterns of CSUV. The new range of tires is being launched in India, with plans to introduce it in the ASEAN and SAARC markets later.

Automotive Tire Industry Overview

The global tires market is mid-level concentrated with major manufacturers like Michelin, Bridgestone, Pirelli, and others catering to the tire needs of both passenger cars and commercial vehicles. However, in the case of regional and highly concentrated Asian automotive markets like China, India, and Indonesia, the market is dominated by local tire manufacturers.

The demand for high-quality and safe tires was the main reason for the automakers and end-users to prefer products from renounced manufacturers over smaller regional players. Furthermore, these big players have increased their R&D spending exponentially to integrate innovation with performance excellence. This, in turn, has resulted in the production of premium quality tires for off-road and on-road applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Tire Type

- 5.1.1 Winter Tires

- 5.1.2 Summer Tires

- 5.1.3 Other Tire Types

- 5.2 By Application

- 5.2.1 On-the-Road

- 5.2.2 Off-the-Road

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By End User

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Bridgestone Corp.

- 6.2.2 Continental Automotive AG

- 6.2.3 Cooper Tire & Rubber Company

- 6.2.4 Goodyear Tire & Rubber Company

- 6.2.5 Hankook Tires Group

- 6.2.6 Michelin Tires

- 6.2.7 MRF (Madras Rubber Factory Limited)

- 6.2.8 Pirelli & C SpA

- 6.2.9 Apollo Tires

- 6.2.10 Yokohama Rubber Co. Ltd

- 6.2.11 JK Tyre & Industries