|

市場調查報告書

商品編碼

1686665

工業馬達:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Industrial Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

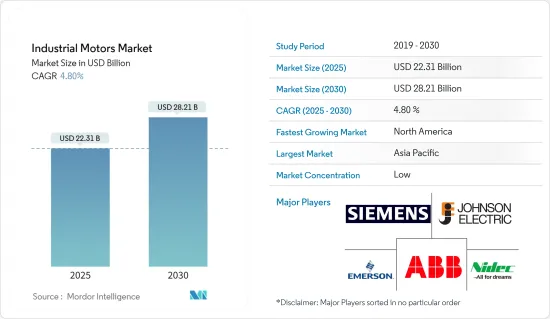

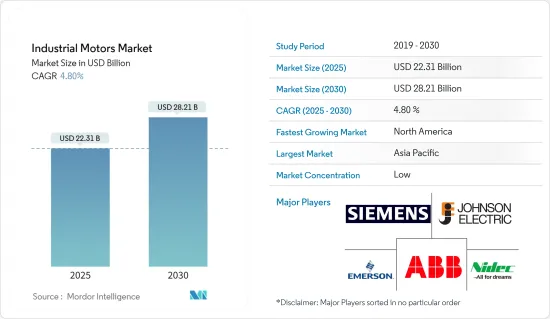

預計 2025 年工業馬達市場規模為 223.1 億美元,到 2030 年將達到 282.1 億美元,預測期內(2025-2030 年)的複合年成長率為 4.8%。

工業馬達是電子機械。工業馬達旨在為製造、石油和天然氣、建築、運輸等領域使用的各種設備和機械提供動力和動力。這些馬達通常比住宅和商業應用中使用的馬達更堅固、更強大,因為它們必須承受高負載並在惡劣的環境中運行。

主要亮點

- 馬達是工業生產的驅動力。監控、調整、測試和連接馬達的創新方法可以節省時間和金錢並提高安全性。同時,節能馬達和智慧驅動器可提高效率和性能並簡化故障排除。

- 隨著世界朝著能源效率和永續性的方向發展,製造商擴大選擇節能馬達。這些選擇旨在降低能源消耗和營業成本,其中 IE4 高效能馬達因比舊型號節省大量能源而脫穎而出。

- 全球工業化正在推動對節能馬達的需求。隨著行業的建立和擴張,對降低能耗和營業成本的馬達的需求變得至關重要。這些節能馬達提高了效率並最大限度地減少了能量損失,從長遠來看可以顯著節省成本。這種不斷成長的需求涉及製造業、農業、建設業和運輸業等多個領域。

- 自動化系統對於製造、工程、建築和發電至關重要,可提高效率和生產力。在人工智慧 (AI)、雲端處理、巨量資料和物聯網 (IoT) 的推動下,工業自動化正在快速發展。

- 儘管有這些優點,但仍存在一些挑戰阻礙節能馬達的廣泛應用。基本限制包括能源、維護和初始購買等相關成本。此外,生產節能馬達需要優質的材料、先進的製造技術以及嚴格的測試和認證。這些要求可能會增加製造商的生產成本,並導致消費者支付更高的價格。

工業馬達市場趨勢

石油和天然氣產業預計將成長

- 由於需要工業馬達為鑽井、採礦、精製和運輸等各種過程提供動力,石油和天然氣產業目前在市場中處於領先地位。隨著人們對氣候變遷和減少二氧化碳排放的需求的認知不斷提高,石油和天然氣產業逐漸意識到節能馬達的重要性。

- 據估計,交流感應馬達將在石油和天然氣行業中普及,因為它們廣泛應用於泵浦、壓縮機、渦輪機以及石油和天然氣的開採、加工和從精製場到煉油廠再銷售給消費者的運輸中。此外,低壓感應馬達也用於煉油廠驅動泵浦、壓縮機和攪拌器,將原油轉化為汽油、柴油和噴射機燃料等多種產品。

- 開發中國家快速都市化伴隨著能源需求的大幅增加。這將導致液體燃料和天然氣的消費量增加。例如,根據英國石油公司預測,2023年天然氣產量將達到4.8兆立方公尺。全球對電力和燃料的需求日益成長,推動了對石油和天然氣的需求。

- 隨著對石油和天然氣的需求增加,探勘與生產機械、設備及零件的市場也在成長。因此,石油和天然氣產業的下游和上游部分對各種容量的AC馬達的需求也在增加。

- 據貝克休斯稱,北美擁有世界上最多的石油和天然氣鑽機。截至 2024 年 8 月,該區共有陸上鑽井鑽機781 個,海上鑽機23 個。至2023年,全球石油鑽機數量平均將超過1,800座。

預計北美將佔據較大的市場佔有率

- 工業馬達市場主要受到美國越來越多專注於工業 4.0 的工業的推動。預計工業自動化將在預測期內實現強勁成長,因為它可以幫助製造商生產更有效率的產品。這種模式引發了開發新型工業馬達的願望。預計工業自動化在各行業的滲透率將會更加均衡。因此,預計美國工業馬達市場將得到發展,以滿足工業自動化的成長。

- 隨著產業和消費者尋求減少能源消耗並盡量減少碳排放,對節能解決方案的需求日益增加。眾所周知,工業馬達比傳統馬達效率更高、能量損失更少。

- 石油和天然氣是一個涉及鑽井作業以使用鑽井機從儲存中提取原油和天然氣的行業。馬達是鑽井設備常見的動力來源。貝克休斯稱,北美在石油和天然氣鑽井平台持有居世界之冠。截至 2024 年 8 月,該地區共有 781 個陸上鑽機,另有 23 個海上鑽機。 2023年底,美國將有500台石油天然氣旋轉鑽機和120台天然氣旋轉鑽機運作,總合622運作旋轉鑽機。

- 加拿大已經實施了能源效率法規,將低效馬達從市場淘汰。加拿大公司可以透過該性能標準獲得 NEMA MG-1 提供的馬達效率指南。這些法規涵蓋功率從 1 到 500 馬力的三相感應馬達。這些性能標準涵蓋了製造和工業應用中使用的大多數馬達。企業主必須遵守這些能源標準。

- 加拿大政府採取了多項舉措來促進加拿大製造業的發展,包括對新投資實施稅收減免、與各國簽訂貿易協定、投資新技術以及開展多項技能培訓計劃。加拿大政府也進行了投資,以確保當地企業和企業家擁有成功所需的工具。

- 例如,2024 年 7 月,日立能源加拿大公司從加拿大政府獲得 3,000 萬加元(2,154 萬美元)的資金。這筆資金將有助於在蒙特婁建立一個新的高壓直流模擬中心,並對瓦雷納的電力變壓器工廠進行現代化改造。這些努力旨在滿足北美對永續能源日益成長的需求。

工業馬達市場概況

競爭程度取決於影響市場的各種因素,例如品牌識別、強大的競爭策略和透明度。

工業馬達市場由各種知名公司代表,例如 ABB、艾默生電氣公司、日本電產工業解決方案、德昌電機控股有限公司和西門子股份公司。在這個市場中,每家公司的品牌形像都具有很大的影響力。由於強大的品牌是良好業務表現的代名詞,因此老字型大小企業有望佔據優勢。

在一個很可能透過創新獲得永續競爭永續的市場中,隨著採礦、石油天然氣和能源等終端用戶產業新客戶需求的預期激增,競爭只會加劇。由於大型現有企業的存在,市場滲透率也很高。

由於市場滲透率和提供先進產品的能力,預計未來競爭對手之間的競爭仍將保持在高水準。市場上有各種各樣的公司,但只有少數公司憑藉高標準和卓越品質脫穎而出。

隨著綜合技術的進步和地緣政治格局的擴大,所研究的市場正經歷波動。除此之外,主要產業參與者也考慮其收入產生的投資能力,並依賴其附屬公司作為原料供應商。

創新水準、上市時間和績效是公司在研究市場中脫穎而出的關鍵標準。

總體而言,研究市場參與者之間的競爭正在加劇,由於行業的成長,預計在預測期內競爭仍將保持高水準。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 政府法規推動能源效率需求

- 向智慧馬達的轉變日益明顯

- 市場挑戰

- 便攜性問題

- 購買新設備和升級現有設備的前期投資較高

第6章市場區隔

- 依馬達類型

- 交流馬達

- 直流馬達

- 其他馬達(伺服馬達和電子換向馬達(EC馬達))

- 按電壓

- 高壓

- 中壓

- 低電壓

- 按最終用戶

- 石油和天然氣

- 發電

- 礦業與金屬

- 用水和污水管理

- 化工和石化

- 離散製造

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- Nidec Industrial Solutions

- Johnson Electric Holdings Limited

- Arc Systems Inc.

- Ametek Inc.

- Toshiba Electronic Devices and Storage Corporation

- Wolong Industrial Motors

- Allen-Bradly Co. LLC(Rockwell Automation Inc.)

- Maxon Motor AG

- Franklin Electric Co. Inc.

- Fuji Electric Co. Ltd

- ATB Austria Antriebstechnik AG

- Menzel Elektromotoren GmbH

第8章投資分析

第9章:市場的未來

The Industrial Motors Market size is estimated at USD 22.31 billion in 2025, and is expected to reach USD 28.21 billion by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

An industrial motor is an electrical machine that converts electrical energy into mechanical energy to perform various tasks in industrial settings. Industrial motors are designed to provide power and motion to different equipment and machinery used in manufacturing, oil and gas, construction, transportation, etc. These motors are typically more robust and powerful than motors used in residential or commercial applications, as they need to withstand heavy loads and operate in demanding environments.

Key Highlights

- Motors drive industrial production. Innovative methods in motor monitoring, alignment, testing, and connections save time and costs and enhance safety. Concurrently, energy-saving motors and intelligent drives elevate efficiency and performance and simplify troubleshooting.

- With a global push towards energy efficiency and sustainability, manufacturers are increasingly opting for energy-efficient motors. These choices aim to reduce energy consumption and operating costs, with IE4 efficiency motors standing out for their significant energy savings over older models.

- Global industrialization has heightened the demand for energy-efficient motors. As industries establish and expand, the need for motors that curtail energy consumption and operating costs becomes paramount. These energy-efficient motors enhance efficiency and minimize energy loss, leading to notable cost savings over time. This growing demand spans multiple sectors, including manufacturing, agriculture, construction, and transportation.

- Automation systems are pivotal for manufacturing, engineering, construction, and power generation, driving enhanced efficiency and productivity. Industrial automation is witnessing rapid advancements fueled by artificial intelligence (AI), cloud computing, Big Data, and the Internet of Things (IoT).

- Despite the advantages, several challenges hinder the widespread adoption of energy-efficient motors. Fundamental limitations include the associated costs: energy, maintenance, and initial purchase. Furthermore, producing energy-efficient motors demands superior materials, advanced manufacturing techniques, and rigorous testing and certification. These requirements can inflate production costs for manufacturers, leading to higher consumer prices.

Industrial Motors Market Trends

The Oil and Gas Segment is Expected to Witness Growth

- The oil and gas sector is currently leading the market due to its need for industrial motors to power a range of processes, including drilling, extraction, refining, and transportation. Due to increasing awareness of climate change and the necessity of decreasing CO2 emissions, the oil and gas industry is progressively acknowledging the significance of energy-efficient motors.

- Due to the significant use of AC induction motors in pumps, compressors, and turbines, as well as their application for extraction, processing, and transport of oil and gas from drilling sites into refineries, which are sold to consumers, it is estimated that these motors will be trendy within the oil and gas industry. In addition, low-voltage induction motors are used in refineries for drive pumps, compressors, and agitators to convert crude oil into multiple products such as gasoline, diesel, and jet fuel.

- Rapid urbanization in developing nations accompanies a considerable increase in energy demand. Consequently, the consumption of liquid fuels and natural gas rises. For instance, according to BP, natural gas production amounted to 4.08 trillion cubic meters in 2023. The escalating global need for electricity and fuel has increased the demand for oil and natural gas.

- With rising oil and gas demand, the market for E&P machines, equipment, and components is growing. As a result, the need for AC motors used in different capacities within the downstream and upstream segments of the oil and gas industry is also increasing.

- According to Baker Hughes, North America hosts oil and gas rigs globally. As of August 2024, the region boasted 781 land rigs and 23 offshore rigs. In 2023, the global count of oil rigs surpassed 1,800 units on average.

North America is Expected to Hold Significant Market Share

- Industrial motor markets are mainly driven by the increasing focus of industries on Industry 4.0 within the United States. Industrial automation encourages manufacturers to produce more effective products, with solid growth expected throughout the projection period. This pattern would result in a desire to develop new industrial motor machines. The spread of industrial automation across all sectors is expected to be evenly distributed. Consequently, to cope with industrial automation's growth, the market for industrial motors is predicted to develop in the United States.

- As industries and consumers seek to reduce energy consumption and minimize their carbon footprint, there is a growing demand for energy-efficient solutions. Industrial electric motors are known for their higher efficiency and lower energy losses than traditional motors.

- Oil and gas is an industry in which drilling operations are carried out to extract crude oil and natural gas from reservoirs using drilling rigs. Electric motors are a common source of power for drilling equipment. According to Baker Hughes, North America leads the world in hosting oil and gas rigs. As of August 2024, the region boasted 781 land rigs and an additional 23 offshore. By the end of 2023, the United States had 500 active rotary oil rigs and 120 gas rigs, contributing to a total rotary rig count of 622.

- Canada has implemented energy efficiency regulations to remove inefficient motors from the market. The guidelines for motor efficiency, provided by NEMA MG-1, are available to Canada's businesses through these performance standards. These regulations cover three-phase induction motors with power between 1 and 500 horsepower. These performance standards cover most motors used in manufacturing and industrial applications. Compliance with these energy standards is mandatory for business owners.

- The Government has taken several initiatives to foster Canada's manufacturing sector, including tax reductions on new investments, various trade agreements with different countries, investment in new technologies, and many skill training programs. The Canadian Government has also invested in local companies and entrepreneurs to ensure they have the tools necessary for success.

- For instance, in July 2024, Hitachi Energy Canada secured CAD 30 million (USD 21.54 million) in funding from the Government of Canada. This funding will help set up a new HVDC simulation center in Montreal and modernize the power transformer factory in Varennes. These initiatives aim to meet North America's surging demand for sustainable energy.

Industrial Motors Market Overview

The degree of competition depends on various factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency.

The industrial motors market comprises various prominent players such as ABB Ltd., Emerson Electric Co., Nidec Industrial Solutions, Johnson Electric Holdings Limited, and Siemens AG, among others. The brand identity associated with the companies has a major influence in this market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand.

In a market where the sustainable competitive advantage through innovation is considerably high, the competition is only going to increase, considering the anticipated surge in demand from new customers from the end-user industries like mining, oil and gas, energy. With the presence of large market incumbents, market penetration levels are also high

Owing to their market penetration and the ability to offer advanced products, the competitive rivalry is expected to continue to be high. Although the market comprises various players, only a handful are prominent in the market for their high standards and excellent quality.

With the growing consolidation technological advancement, and geopolitical scenarios, the studied market has been witnessing fluctuation. In addition to this, the major industry player depends on their affiliates for raw materials vendors, considering their ability to invest, which result from their revenues.

The level of innovation, time-to-market, and performance are the key terms by which the players differentiate themselves in the market studied.

Overall, the intensity of the competitive rivalry in the studied market is growing and expected to be high during the forecast period owing to the growth of the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Energy Efficiency Owing to Government Regulations

- 5.1.2 Growing Shift towards Smart Motors

- 5.2 Market Challenges

- 5.2.1 Portability Issues

- 5.2.2 High Initial Investment for Procuring New Equipment and Upgrading Existing Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Motor

- 6.1.1 Alternating Current (AC) Motors

- 6.1.2 Direct Current (DC) Motor

- 6.1.3 Other Types of Motors (Servo and Electronically Commutated Motors (EC))

- 6.2 By Voltage

- 6.2.1 High Voltage

- 6.2.2 Medium Voltage

- 6.2.3 Low Voltage

- 6.3 By End User

- 6.3.1 Oil & Gas

- 6.3.2 Power Generation

- 6.3.3 Mining & Metals

- 6.3.4 Water & Wastewater Management

- 6.3.5 Chemicals & Petrochemicals

- 6.3.6 Discrete Manufacturing

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Siemens AG

- 7.1.4 Nidec Industrial Solutions

- 7.1.5 Johnson Electric Holdings Limited

- 7.1.6 Arc Systems Inc.

- 7.1.7 Ametek Inc.

- 7.1.8 Toshiba Electronic Devices and Storage Corporation

- 7.1.9 Wolong Industrial Motors

- 7.1.10 Allen - Bradly Co. LLC (Rockwell Automation Inc.)

- 7.1.11 Maxon Motor AG

- 7.1.12 Franklin Electric Co. Inc.

- 7.1.13 Fuji Electric Co. Ltd

- 7.1.14 ATB Austria Antriebstechnik AG

- 7.1.15 Menzel Elektromotoren GmbH