|

市場調查報告書

商品編碼

1687069

合成橡膠:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Synthetic Rubber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

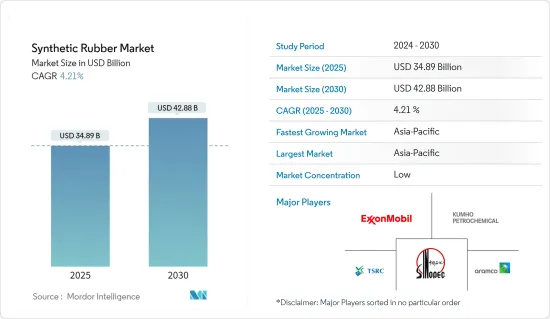

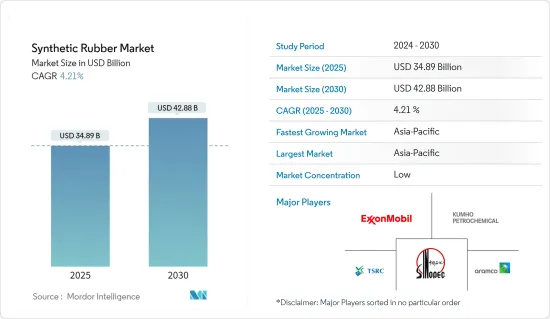

預計 2025 年合成橡膠市場規模為 348.9 億美元,到 2030 年將達到 428.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.21%。

2020年,全球合成橡膠市場受新冠疫情影響遭遇低迷,造成大面積停工、製造及供應鏈中斷、生產停頓。不過,預計 2021-2022 年情況將開始好轉,導致汽車需求增加,預計預測期內市場將與前一年同期比較增。

主要亮點

- 預計電動車產量的增加將為市場成長提供動力。

- 另一方面,在某些應用中使用聚氨酯代替合成橡膠可能會減緩市場成長。

- 未來的市場機會可能來自合成橡膠生物基原料的開發和醫用手套需求的不斷成長。

- 由於中國、印度和日本的需求旺盛,亞太地區佔據了最大的市場佔有率,並且可能在預測期內引領市場。

合成橡膠市場趨勢

輪胎和輪胎零件需求增加

- 在合成橡膠市場中,輪胎和輪胎零件領域佔據最大的市場佔有率。苯乙烯-丁二烯橡膠因其耐用性和耐磨性主要用於輪胎。

- 苯乙烯-丁二烯橡膠是輪胎製造的首選。大約50%的汽車輪胎是由苯乙烯-丁二烯橡膠和天然橡膠混合製成的。

- 在價格分佈輪胎中,SBR與天然橡膠的比例降低,以降低生產成本。這會縮短輪胎的整體壽命,但這是一種經濟有效的選擇。

- 根據國際輪胎和橡膠協會(ITRA)的數據,中國和美國是世界上最大的兩個輪胎生產國。

- 根據中國國家統計局的數據,2022年中國輪胎產業產量約8.5919億條。此外,受需求旺盛、外資企業進入等因素影響,繼2023年之後,中國國內輪胎產業很可能在2024年迎來大幅成長。例如,根據《環球時報》報道,預計2023年中國主要用於乘用車的半鋼輪胎出口量將年增與前一年同期比較%,達到總合億條。

- 由於全球對乘用車的需求不斷增加,預測期內輪胎及其零件的產量也可能增加。例如,根據 EV-Volumes.com 的數據,全球電動車銷量預計將從 2022 年的 1,050 萬輛增加兩倍,達到 2027 年的 3,100 萬輛以上。

- 由於上述因素,預計輪胎和輪胎零件部門將在預測期內顯著推動市場成長。

亞太地區佔市場主導地位

- 由於印度、中國和日本等國家對合成橡膠的需求量很大,亞太地區佔了合成橡膠市場的最大佔有率。

- 中國、印度、日本、韓國、泰國和印尼等國家為世界主要輪胎生產國。

- 印度是亞太地區繼中國之後第二大橡膠生產國和使用國。儘管該國是最大的橡膠生產國之一,但該國仍從其他國家進口大量橡膠以滿足國內需求。

- 據印度橡膠委員會稱,2023會計年度印度合成橡膠消費量量約為75萬噸。此外,其中近四分之三消耗在汽車輪胎和內胎領域,剩餘的則用於一般橡膠製品。

- 日本輪胎產業在該地區也正在大力擴張。工業是日本最大的橡膠公司之一,專門生產汽車輪胎和其他汽車相關產品。

- 工業公司的淨銷售額預計將從上年的約 3,937 億日圓(26 億美元)成長到 2022 年的約 4,972 億日圓(33 億美元),從而大幅推動該地區市場的成長。

- 由於這些因素,預計亞太地區將在預測期內主導整個市場。

合成橡膠產業概況

合成橡膠市場較為分散。市場的主要企業包括埃克森美孚公司、錦湖石化、沙烏地阿拉伯石油公司、台橡和中國石油化學集團公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電動車銷量增加導致需求增加

- 其他促進因素

- 限制因素

- 在某些應用中用聚氨酯代替橡膠

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- 丁苯橡膠(SBR)

- 乙烯丙烯二烯橡膠 (EPDM)

- 聚異戊二烯 (紅外線)

- 聚丁二烯橡膠(BR)

- 異丁烯異戊二烯橡膠(IIR)

- 其他類型

- 應用

- 輪胎和輪胎零件

- 輪胎以外的汽車應用

- 鞋類

- 工業用品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 越南

- 印尼

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐的

- 土耳其

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Apcotex

- China Petrochemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Kumho Petrochemical

- LANXESS

- LG Chem

- Mitsubishi Chemical Corporation

- Reliance Industries Limited

- SABIC

- Saudi Arabian Oil Co.

- SIBUR

- Synthos

- The Goodyear Tire & Rubber Company

- TSRC

- Versalis SpA

- Dow

第7章 市場機會與未來趨勢

- 生物基合成橡膠原料的開發

- 其他機會

The Synthetic Rubber Market size is estimated at USD 34.89 billion in 2025, and is expected to reach USD 42.88 billion by 2030, at a CAGR of 4.21% during the forecast period (2025-2030).

In 2020, due to the COVID-19 pandemic, the global synthetic rubber market experienced a downturn, resulting in widespread lockdowns, disruptions in manufacturing and supply chains, and production stoppages. However, conditions began to improve in 2021-2022, and the market is expected to grow year-on-year during the forecast period as automotive demand is expected to increase.

Key Highlights

- The growth of the market is expected to receive a boost due to the increasing production of electric vehicles.

- On the other hand, using polyurethanes instead of synthetic rubber in some applications is likely to decelerate the growth of the market.

- Future opportunities for the market could come from the development of bio-based feedstock for synthetic rubber and the growing demand for medical gloves.

- Due to high demand from China, India, and Japan, Asia-Pacific has the largest market share and is likely to lead the market during the forecast period.

Synthetic Rubber Market Trends

Increasing Demand From Tire and Tire Components

- The segment for tires and tire parts holds the largest market share in the synthetic rubber market. Tires are predominantly made using styrene-butadiene rubber due to its durability and resistance to wear over time.

- It is the preferred material in the tire manufacturing sector. Around 50% of car tires are made of styrene-butadiene rubber blended with natural rubber.

- For low-end tires, the ratio of SBR to natural rubber is lower to reduce the cost of production. Although this reduces the overall tire life, it is a cost-effective option.

- According to the International Tyre and Rubber Association (ITRA), China and the United States are the two largest tire producer countries in the world.

- According to the National Bureau of Statistics of China, the Chinese tire industry made about 859.19 million tires in 2022. Moreover, due to factors such as high demand and overseas company expansion, the domestic tire industry in China is likely to experience substantial growth in 2024, as it did in 2023. For instance, China's export of semi-steel tires, primarily utilized for passenger vehicles, witnessed a 20% year-on-year surge and reached a total of 287 million units in 2023, according to Global Times.

- The globally increasing demand for passenger cars will also likely increase the production of tires and their components during the forecast period. For instance, according to EV-Volumes.com, the unit volume of global EV sales is projected to triple from 10.5 million in 2022 to over 31 million in 2027.

- Due to the above-mentioned factors, the tire and tire components segment is expected to boost the growth of the market significantly during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounts for the largest share of the synthetic rubber market because of countries such as India, China, and Japan, where the demand is significantly high.

- Countries such as China, India, Japan, South Korea, Thailand, and Indonesia are home to major tire-producing companies in the world.

- India is second only to China in the Asia-Pacific region in terms of how much rubber it makes and uses. Even though the country is one of the biggest producers of rubber, it imports a lot of rubber from other countries to meet local demand.

- According to the Rubber Board, synthetic rubber consumption in India was about 0.75 million metric tons in the financial year 2023. Furthermore, almost three-quarters of this total was consumed by the auto tires and tubes sector, with the remaining quantity used for general rubber goods.

- The Japanese tire industry is also expanding significantly in the region. Toyo Tire Corporation is one of Japan's largest rubber corporations, specializing in automobile tires and other automotive-related products.

- The net sales of Toyo Tire Corporation amounted to approximately JPY 497.2 billion (USD 3.3 billion) in 2022, up from around JPY 393.7 billion (USD 2.6 billion) in the previous year, thus boosting the growth of the market significantly in the region.

- These factors are expected to assist Asia-Pacific dominate the overall market during the forecast period.

Synthetic Rubber Industry Overview

The synthetic rubber market is fragmented in nature. Some of the major players in the market include Exxon Mobil Corporation, Kumho Petrochemical, Saudi Arabian Oil Co., TSRC, and China Petrochemical Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Rising Sales of Electric Vehicles

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Replacement of Rubber by Polyurethanes in Some Applications

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Styrene Butadiene Rubber (SBR)

- 5.1.2 Ethylene Propylenediene Rubber (EPDM)

- 5.1.3 Polyisoprene (IR)

- 5.1.4 Polybutadiene Rubber (BR)

- 5.1.5 Isobutylene Isoprene Rubber (IIR)

- 5.1.6 Other Types

- 5.2 Application

- 5.2.1 Tire and Tire Components

- 5.2.2 Non-tire Automobile Applications

- 5.2.3 Footwear

- 5.2.4 Industrial Goods

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Apcotex

- 6.4.2 China Petrochemical Corporation

- 6.4.3 ENEOS Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Kumho Petrochemical

- 6.4.6 LANXESS

- 6.4.7 LG Chem

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 Reliance Industries Limited

- 6.4.10 SABIC

- 6.4.11 Saudi Arabian Oil Co.

- 6.4.12 SIBUR

- 6.4.13 Synthos

- 6.4.14 The Goodyear Tire & Rubber Company

- 6.4.15 TSRC

- 6.4.16 Versalis S.p.A.

- 6.4.17 Dow

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Feedstock for Synthetic Rubber

- 7.2 Other Opportunities