|

市場調查報告書

商品編碼

1687089

肥料添加劑:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Fertilizer Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

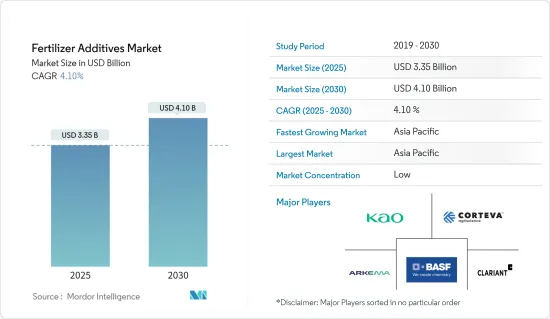

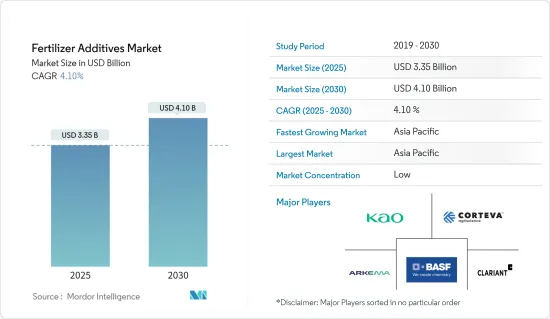

預計 2025 年肥料添加劑市場規模為 33.5 億美元,預計到 2030 年將達到 41 億美元,預測期內(2025-2030 年)的複合年成長率為 4.1%。

肥料添加劑可以增加肥料的營養成分,促進植物對養分的吸收,並減少養分經由淋溶和揮發而流失。這表明肥料添加劑在最佳化肥料效率和確保作物獲得所需營養方面發揮關鍵作用。此外,透過減少養分流失、減少土壤侵蝕和提高養分效率,肥料添加劑在促進永續農業方面發揮著至關重要的作用。對永續實踐的日益重視推動了對肥料添加劑的進一步需求。這些添加劑還能穩定土壤養分,防止其因浸出和揮發而流失。例如,在富氮肥料中添加硝化抑制劑會減緩銨向硝酸鹽的轉化,從而減少氮損失並增加植物對營養物質的利用率。

肥料消費顯著推動了肥料添加劑市場的發展。全球人口不斷成長、飲食結構不斷變化、可支配收入不斷增加以及可耕地面積不斷減少,正在推動對食品和農產品的需求。由於肥料在提高作物生產率和農業產量方面發揮重要作用,全球對肥料的需求正在激增。例如,國際肥料工業協會報告稱,全球氮肥消費量將從 2022 年的 1.082 億噸增加到 2023 年的 1.097 億噸。肥料需求的增加導致全球整體肥料消費量總量的增加。印度農業和加工食品出口發展局指出,2023年印度的穀物產量將達到3.043億噸,其中米、小麥、玉米和小米等主要穀物產量分別為1.367億噸、1.1292億噸、3567兆噸和1066兆噸。隨著未來人口不斷成長,預計肥料的需求量也將增加,從而導致肥料行業對添加劑的需求增加。

肥料消費量高,需要增加蘊藏量以維持持續供應。然而,這可能會導致結塊和凝固等問題,尤其是在雨季。因此,肥料添加劑防止結塊的能力是市場成長的關鍵驅動力。另一方面,這些添加劑雖然有其優點,但也增加了作物的生產成本,給農民帶來經濟負擔,並抑制了市場擴大。此外,添加劑的成本因其類型和品質而異,這使得它們的價格更高。這種價格敏感性導致某些農民的接受度有限,阻礙了這些添加劑的廣泛使用。

肥料添加劑市場趨勢

抑制劑引領市場

抑制劑是添加到氮基肥料中的化合物,以最大限度地減少施用後的損失。這些氮穩定劑添加劑主要分為兩類:尿素酶抑制劑和硝化抑制劑。該類抑制劑可以促進植物生長、維持土壤品質並改善作物品質。農業產業對這些氮肥添加劑的需求激增,推動了市場成長。農民擴大使用尿素酶抑制劑來控制氧化亞氮的排放,以及使用硝化抑制劑來減少水中的硝酸鹽污染。此外,這些添加劑還能改善土壤健康,並增強植物獲得重要水分和養分的能力。隨著農業領域的擴大和肥料添加劑的發展,氮肥添加劑市場可能會出現消費量上升的情況。

在全球範圍內,對尿素基肥料的需求不斷增加是市場成長的主要驅動力。例如,根據國際肥料協會(IFASTAT)的資料,全球尿素消費量將從2021年的53,763,000噸增加到2022年的54,168,900噸。尿素是所有固態肥料中氮含量最高的,是農業主要的氮源。它的高相對濕度使其能夠承受炎熱和潮濕的環境,使其成為比硝酸銨和硝酸鈣(CAN)更優先的選擇。此外,它的多功能性,可以以固體和液體形式使用,也推動了市場需求。但仍存在一些問題,例如尿素氮容易透過揮發、反硝化和淋溶而損失。在巴西等潮濕地區,這些損失非常嚴重,施用的氮肥損失了 20-30%,在某些情況下,在 2022 年達到 60% 的峰值。對肥料添加劑,尤其是尿素酶抑制劑的需求不斷成長,旨在減少這些揮發性損失,從而進一步推動肥料添加劑市場的成長。

此外,技術創新正在促進市場的成長。根據加拿大農業及農業食品部的一項研究,到2022年,在犁地管理的硬紅春小麥生產中,硫代硫酸銨將作為尿素酶抑制劑,與尿素和硝酸銨尿素一起以不同的表面施用方式使用。 TIB Chemicals 的 TIB Thio ATS 是北美最常見的硫代硫酸銨抑制劑之一。

亞太地區佔市場主導地位

亞太地區佔全球肥料添加劑市場的一半以上。中國和印度作為主要消費國,擁有廣大的農業用地。例如,印度肥料協會報告稱,2023 年肥料總消費量為 6,390 萬噸,較 2022 年下降 0.3%。此外,全印度 NPK 使用率已從 2022 年的 7.7:3.1:1 變為 2023 年的 11.8:4.6:1。

此外,印度政府也透過各種補貼和津貼積極推動化肥消費。例如,2024 年 2 月,印度政府批准為磷酸鹽和鉀肥 (P&K) 提供 2.903 億美元的補貼。該計劃涉及引入三種新等級的肥料,旨在支持農民並提高油籽和豆類的生產力。此舉雖然增加了化學肥料使用量,但也凸顯了印度土壤中化學肥料吸收效率低下和揮發損失等問題。這些挑戰凸顯了對肥料添加劑產品日益成長的需求,從而推動了市場成長。因此,該地區化肥消費量的增加正在推動市場擴張。在氮肥中,尿素是印度最常見的氮肥,佔全國氮肥總消費量的80%以上。

中國是世界主要化肥生產國和消費國之一。人們嚴重依賴肥料來滿足作物的營養需求並提高農業生產力。此外,中國蔬菜生產嚴重依賴化肥,降低了土壤氮素的利用效率。該國正在進行多項研究舉措,旨在提高土壤效力和增加肥料的養分吸收。例如,美國國家生物技術資訊中心 (NCBI) 2022 年的一項研究強調了硝化抑制劑的好處。該研究強調了這些添加劑在提高產量、改善氮利用效率和減少氧化亞氮排放所發揮的作用。有關肥料添加劑的這些令人鼓舞的發現將推動該行業在中國的擴張。

肥料添加劑產業概況

肥料添加劑市場高度分散,各種中小型企業和少數大型企業競爭激烈。 Corteva Agriscience、 BASF SE、Arkema、Clariant International Ltd 和 KAO Corporation 是該市場的一些知名參與者。這些大公司正在投資新產品和改進產品、擴張和收購以發展業務。我們也注重研發,以低價推出新產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 肥料消費量增加

- 大型企業策略活動活性化

- 提高肥料性能

- 市場限制

- 作物生產成本上升

- 環境影響大

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 功能

- 抑制劑

- 被覆劑

- 造粒助劑

- 抗結劑

- 其他功能

- 形狀

- 固體的

- 液體

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 西班牙

- 英國

- 法國

- 俄羅斯

- 德國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- BASF SE

- Corteva Agriscience

- Arkema(ARRMAZ)

- Dorf Ketal Company LLC

- Koch Agronomic Services LLC

- Clariant International Ltd

- KAO Corporation

- Michelman Inc.

第7章 市場機會與未來趨勢

The Fertilizer Additives Market size is estimated at USD 3.35 billion in 2025, and is expected to reach USD 4.10 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

Fertilizer additives enhance the nutrient content of fertilizers, boost nutrient absorption by plants, and curb nutrient loss through leaching or volatilization. This underscores their vital role in optimizing fertilizer efficiency and ensuring crops receive the necessary nutrients. Furthermore, by curbing nutrient runoff, minimizing soil erosion, and enhancing nutritional efficiency, fertilizer additives play a pivotal role in promoting sustainable agriculture. The growing emphasis on sustainable practices is further fueling the demand for these additives, as they aim to elevate fertilizer performance. These additives also stabilize soil nutrients, preventing losses from leaching or volatilization. For instance, adding nitrification inhibitors to nitrogen-rich fertilizers decelerates the conversion of ammonium to nitrate, thus mitigating nitrogen loss and boosting nutrient availability for plants.

Fertilizer consumption significantly drives the fertilizer additives market. A growing global population, evolving dietary habits, rising disposable incomes, and shrinking arable land have heightened the demand for food and agricultural products. Given their crucial role in boosting crop productivity and agricultural yields, the global demand for fertilizers has surged. For instance, the International Fertilizer Industry Association reported that global nitrogenous fertilizer consumption rose from 108.2 million metric tons in 2022 to 109.7 million metric tons in 2023. This uptick in fertilizer demand has led to a worldwide increase in overall fertilizer consumption. The Agricultural and Processed Food Products Export Development Authority noted that India produced 304.3 million metric tons of cereals in 2023, with key cereals like rice, wheat, maize, and bajra accounting for 136.7 million, 112.92 million, 35.67 million, and 10.66 million metric tons, respectively. Looking ahead, as the population continues to grow, the demand for enhanced fertilizers is anticipated to rise, subsequently boosting the demand for additives in the fertilizer industry among manufacturers.

High fertilizer consumption necessitates increased storage to maintain a continuous supply. However, this can lead to issues like lump formation and caking, especially during wet seasons. Consequently, the ability of fertilizer additives to prevent such lumping and caking becomes a significant driver for market growth. Conversely, while these additives offer benefits, they also elevate crop production costs, posing a financial burden on farmers and thereby restraining market expansion. Furthermore, the cost of additives varies based on their type and quality, leading to higher prices. This price sensitivity results in limited acceptance among certain farmers, curbing the widespread adoption of these additives.

Fertilizer Additives Market Trends

Inhibitors Leads the Market

Inhibitors are compounds integrated into nitrogen-based fertilizers to minimize losses post-application. These nitrogen stabilizer additives fall into two main categories, urease inhibitors and nitrification inhibitors. Such inhibitors promote plant growth, uphold soil quality, and enhance crop quality. The agriculture industry's surging demand for these nitrogen fertilizer additives propels the market growth. Farmers increasingly turn to urease inhibitors to curb nitrous oxide emissions and nitrification inhibitors to mitigate nitrate pollution in water. Furthermore, these additives bolster soil health and enhance plants' access to vital water and nutrients. With the agriculture sector expanding and fertilizer additives evolving, the market for nitrogen fertilizer additives is set to see heightened consumption.

Globally, the increasing demand for urea-based fertilizers is a key driver of market growth. For instance, data from the International Fertilizers Association (IFASTAT) reveals that global urea consumption rose from 53,760.3 thousand metric tons in 2021 to 54,168.9 thousand metric tons in 2022. Urea, with the highest nitrogen content among solid fertilizers, serves as a primary nitrogen source in agriculture. Its high relative humidity enables it to withstand hot and humid conditions, making it a preferred choice over ammonium nitrate and calcium ammonium nitrate (CAN). Additionally, its versatility in both solid and liquid forms boosts its market demand. However, challenges remain,such as urea nitrogen is prone to losses through volatilization, denitrification, and leaching. In humid regions like Brazil, these losses can be substantial, with 20-30% of the applied nitrogen being lost, and in 2022, some instances even peaked at 60%. As fertilizer additives, particularly urease inhibitors, aim to reduce these volatilization losses, their rising demand further accelerates the growth of the fertilizer additive market.

Additionally, technological innovations are augmenting the growth of the market studied. According to a study by Agriculture and Agri-Food Canada, in 2022, the use of ammonium thiosulphate as a urease inhibitor with the varying surface placement of urea and urea ammonium nitrate in the production of hard red spring wheat under reduced tillage management. TIB Thio ATS, by TIB Chemicals, is one of the popular ammonium thiosulphate inhibitors sold in the North American region.

Asia-Pacific Dominates the Market

Asia-Pacific dominates the global fertilizer additives market, accounting for over half of its share. Major consumers, China and India, leverage their expansive agricultural zones. For example, the Fertilizer Association of India reported a total fertilizer consumption of 63.9 million metric tons in 2023, marking a 0.3% decline from 2022. Additionally, the all-India NPK use ratio shifted from 7.7:3.1:1 in 2022 to 11.8:4.6:1 in 2023.

Moreover, the Indian government is actively promoting fertilizer consumption through various subsidies and grants. For instance, in February 2024, the Indian government sanctioned a subsidy of USD 290.3 million for phosphatic and potassic (P&K) fertilizers. This initiative, which introduced three new grades of fertilizers, aims to assist farmers and boost the productivity of oilseeds and pulses. While this move has led to increased fertilizer usage, it has also highlighted challenges such as inefficient fertilizer uptake and volatilization losses in Indian soils. These challenges underscore the growing demand for fertilizer additive products, bolstering market growth. Consequently, the uptick in fertilizer consumption in the region is propelling the market's expansion. Among nitrogenous fertilizers, urea stands out as the predominant choice in India, constituting over 80% of the nation's total nitrogen fertilizer consumption.

China stands as one of the world's foremost producers and consumers of fertilizers, driven by its expansive agricultural sector. The nation leans heavily on fertilizers to satisfy crop nutritional needs and enhance agricultural productivity. Furthermore, China's vegetable production heavily relies on fertilizers, leading to diminished nitrogen usage efficiency in its soils. Numerous research initiatives within the country aim to bolster soil effectiveness and enhance nutrient uptake from fertilizers. For instance, in 2022 study conducted by the National Center for Biotechnology Information (NCBI), highlighted the benefits of nitrification inhibitors. The study underscored these additives' role in boosting yield, enhancing nitrogen use efficiency, and curbing nitrous oxide emissions. Such promising findings on fertilizer additives bolster the industry's expansion in China.

Fertilizer Additives Industry Overview

The fertilizer additive market is highly fragmented, with various small- and medium-sized companies and a few big players, resulting in stiff competition in the market. Corteva Agriscience, BASF SE, Arkema (Arrmaz), Clariant International Ltd, and KAO Corporation are some of the known players in the market. These major players are investing in new products and improvisation of products, expansions, and acquisitions for business expansions. Another major area of investment is the focus on R&D to launch new products at lower prices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Raising Fertilizer Consumption

- 4.2.2 Increasing Strategic Activities By The Major Players

- 4.2.3 Enhanced Fertilizer Performance

- 4.3 Market Restraints

- 4.3.1 Raising Overall Cost Of Crop Production

- 4.3.2 High Environmental Effects

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Inhibitors

- 5.1.2 Coating Agents

- 5.1.3 Granulation Aids

- 5.1.4 Anti-Caking Agent

- 5.1.5 Other Functions

- 5.2 Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Germany

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Corteva Agriscience

- 6.3.3 Arkema (ARRMAZ)

- 6.3.4 Dorf Ketal Company LLC

- 6.3.5 Koch Agronomic Services LLC

- 6.3.6 Clariant International Ltd

- 6.3.7 KAO Corporation

- 6.3.8 Michelman Inc.