|

市場調查報告書

商品編碼

1687097

油田服務(OFS) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Oilfield Services (OFS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

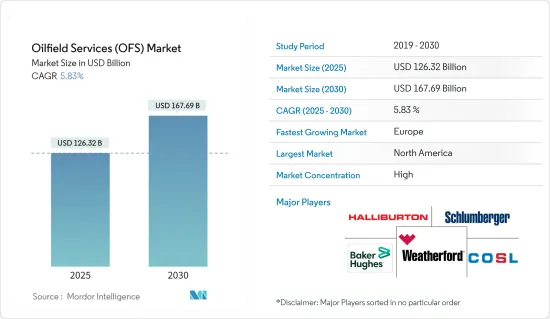

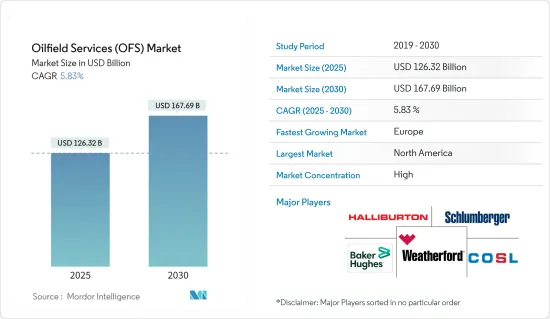

油田服務 (OFS) 市場規模預計在 2025 年為 1,263.2 億美元,預計到 2030 年將達到 1,676.9 億美元,預測期內(2025-2030 年)的複合年成長率為 5.83%。

關鍵亮點

- 從中期來看,預計天然氣蘊藏量開發增加以及先進技術、工具和設備等因素將在預測期內推動油田服務市場的發展。

- 另一方面,近期原油價格受供需缺口、地緣政治等多種因素影響波動,抑制了油田服務市場的需求成長。

- 然而,在預測期內,專注於最佳化碳氫化合物生產成本的新技術和方法預計將為油田服務市場創造一些機會。

- 由於頁岩油田的鑽探和生產活動活躍,預計北美將成為預測期內最大的市場。

油田服務市場趨勢

鑽井服務預計將佔據市場主導地位

- 預計全球經濟將支持石油需求大幅成長。強勁的經濟體預計將消耗更多的石油,並且需求預計在未來多年仍將強勁成長。預計到2024年,印度和中國將佔全球石油需求的50%左右。

- 根據石油輸出國組織(OPEC)的統計,2023年全球原油需求量約為1.0221億桶/日,高於2022年的9,957萬桶/日。原油需求的增加正在增加全球對鑽井服務的需求。

- 2023 年 4 月,海上鑽井公司 Seadrill Limited 宣布成功收購 Aquadrill LLC。此次全股票收購價值 9.58 億美元,打造了一支高規格船隊,包括 12 座浮式鑽井平台、3 座極端環境鑽機、4 座良性自升式鑽井平台和 3 座競標輔助鑽機。

- 2024年2月,中東最大的國有鑽井公司阿布達比國家石油公司鑽井公司獲得在阿曼競標鑽機供應的競標,並正在尋求核准參與沙烏地阿拉伯和科威特的競標。到2024年底,該公司將持有足夠的鑽機部署到阿拉伯聯合大公國以外的地方。

- 因此,大型石油和天然氣公司面臨著增加產量和滿足日益成長的能源需求的壓力。因此,隨著傳統型油田開始顯露出成熟跡象,一些業者正將重點轉向開發傳統型蘊藏量。

- 2023年10月,Transocean宣布已獲得三座陸地鑽井鑽機的新續約合約。其中一座鑽機根據與信實工業公司簽訂的合約部署在印度,日租金為 33 萬美元。合約已續約至2025年10月,每日津貼增加至348,000美元。當現有合約於2023年12月到期時,鑽機將有45天的準備期,然後才能開始新的合約。

- 因此,鑑於上述情況,預計鑽井服務將在預測期內佔據油田服務市場的主導地位。

預計北美將主導市場

- 北美是世界海上石油和天然氣工業最發達的地區之一,主要重點地區是墨西哥灣和阿拉斯加近海的豐富蘊藏量。隨著鑽井深度逐年增加,技術可採蘊藏量大幅增加,吸引了該地區對海上石油和天然氣領域的投資。由於上述因素,該地區也是全球油田服務市場的熱點,其中美國佔據了大部分佔有率。

- 隨著美國大力投資擴大石油和天然氣生產能力,墨西哥灣已成為海上鑽油平臺服務的重點熱點。墨西哥灣為該地區提供了豐富的自然資源,包括石油和天然氣。

- 由於頁岩地層和緻密蘊藏量的鑽井和水力壓裂井數量不斷增加,美國預計將成為最大的油田服務市場之一。這是由於盆地內較低的損益平衡價格所致。頁岩氣、水平鑽井和水力壓裂技術的最新發展大大增加了該地區對油田服務的需求。

- 美國一直處於領先地位,預計在預測期內將繼續主導北美石油和天然氣市場。美國是世界最大的石油和天然氣生產國,預計未來幾年將滿足全球約60%的石油需求。然而,由於俄烏戰爭的影響,美國對俄羅斯的石油、精煉石油產品、天然氣和煤炭實施了進口限制。這導致美國各地天然氣價格上漲,通膨壓力加大,導致2022年資本預算和支出減少,產量受到限制,營運公司的鑽井鑽機數量減少。

- 不過,這種情況在2023年發生了逆轉。例如,根據貝克休斯的油井數量,2024年2月美國共有626座運作中的旋轉鑽機,其中20座為海上鑽機,606座為陸上鑽機。與 2022 年底 15 座運作鑽機相比,海上鑽機數量增加。預計這些趨勢將支持該國鑽井服務的成長,並進一步推動油田服務市場的成長。

- 同樣,加拿大擁有僅次於委內瑞拉和沙烏地阿拉伯的世界第三大原油蘊藏量,其中96%為油砂蘊藏量。該國可開採的原油密度大,含有大量沙粒。這增加了該國對油田服務的需求,因為需要高壓和井下干涉才能將石油從井底輸送到地面。

- 因此,鑑於上述情況,預計北美將在預測期內主導油田服務市場。

油田服務業概況

油田服務市場是細分的。市場的主要企業(不分先後順序)包括斯倫貝謝有限公司、貝克休斯公司、哈里伯頓公司、威德福國際公司和中海油田服務股份有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 2029 年石油和天然氣產量及預測

- 2023年陸上和海上鑽機運作

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 開發天然氣蘊藏量並增加使用先進技術、工具和設備

- 全球油田服務投資增加

- 限制因素

- 近期原油價格波動,供需缺口較大

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 服務類型

- 鑽井服務

- 完井服務

- 生產和干涉服務

- 其他

- 地點

- 陸上

- 海上

- 市場分析:按地區分類的市場規模及至2028年的需求預測(按地區分類)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 俄羅斯

- 西班牙

- 北歐的

- 土耳其

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Schlumberger Limited

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

- Transocean Ltd

- Valaris PLC

- China Oilfield Services Limited

- Nabors Industries Inc.

- Basic Energy Services Inc.

- OiLSERV

- Expro Group

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 更重視最佳化碳氫化合物生產成本的新技術和方法

簡介目錄

Product Code: 55022

The Oilfield Services Market size is estimated at USD 126.32 billion in 2025, and is expected to reach USD 167.69 billion by 2030, at a CAGR of 5.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing development of gas reserves and advanced technology, tools, and equipment are expected to drive the oilfield services market during the forecast period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics, and several other factors, have been restraining the growth in the demand for the oilfield services market.

- However, the focus on new technologies and methods to optimize the production cost of hydrocarbons is expected to create several opportunities for the oilfield services (OFS) market during the forecast period.

- North America is expected to be the largest market during the forecast period, owing to high drilling and production activity in shale fields.

Oilfield Services (OFS) Market Trends

Drilling Services Are Expected to Dominate the Market

- The global economy is expected to underpin a substantial increase in oil demand. Strong economies are anticipated to consume more oil, and the demand is expected to grow significantly over the years. India and China will contribute around 50% of the global oil demand by 2024.

- According to the Organization of the Petroleum Exporting Countries (OPEC) statistics, the worldwide crude oil demand was around 102.21 million barrels per day in 2023, up from 99.57 million barrels in 2022. The rising demand for crude oil increases the demand for drilling services worldwide.

- In April 2023, Seadrill Limited, an offshore drilling company, announced acquiring Aquadrill LLC successfully. The all-stock acquisition, valued at USD 958 million, creates a high-spec fleet comprised of 12 floaters, three harsh environment rigs, four benign jack-ups, and three tender-assisted rigs.

- In February 2024, ADNOC Drilling, the largest national drilling company in the Middle East, was qualified to bid to supply rigs in Oman and is seeking approvals to participate in tenders in Saudi Arabia and Kuwait. By the end of 2024, the company will have enough rigs to deploy outside the United Arab Emirates.

- Hence, the top oil and gas operating companies are under increasing pressure to increase production and meet the increasing energy demand. As a result, several operating companies have shifted their focus toward exploiting unconventional reserves, as the conventional fields have started showing signs of maturity.

- In October 2023, Transocean announced that it secured a new extension contract for three of its onshore drilling rigs. One of those rigs is deployed in India under contract with Reliance Industries Limited at a day rate of USD 330,000. The agreement was renewed until October 2025 with an increased day rate of USD 348,000. Following completion of the current contract in December 2023, the rig will undergo a 45-day preparation period before commencing the new contract.

- Therefore, owing to the above points, drilling services are expected to dominate the oilfield services (OFS) market during the forecast period.

North America is Expected to Dominate the Market

- North America has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and offshore Alaska region. As drilling depths increased over the years, the volume of technically recoverable reserves increased significantly, attracting investments in the region's offshore oil & gas sector. Due to the factors mentioned above, the region is also a global hotspot for the oilfield services market, with most of the share from the United States.

- As the United States invested heavily in expanding its oil & gas production capacity, the Gulf of Mexico has become a key hotspot for offshore drilling rig services. The Gulf of Mexico is responsible for the region's rich natural resources, including oil and gas.

- The United States is expected to be one of the largest markets for oilfield services, mainly due to the increasing number of wells being drilled and fracked in shale and tight reserves. The basins' low breakeven price supports this. The recent development of shale plays, horizontal drilling, and fracking has resulted in a massive increase in demand for oilfield services in the region.

- The United States has always been at the forefront and is expected to continue dominating North America's oil and gas market during the forecast period. The United States is a major crude oil and natural gas producer globally, and it is expected to cover around 60% of the world's oil demand in the coming years. However, owing to the negative impact of the Russia-Ukraine War, the United States imposed restrictions on importing oil, refined petroleum products, natural gas, and coal from Russia. This led to higher gas prices and increased inflation pressure across the United States, leading to a decline in the capital budget and expenditure, curtailed production, and reduced drilling rig count by the operating companies in 2022.

- However, this scenario recovered in 2023. For instance, according to the Baker Hughes Rig Count, in February 2024, the United States had 626 active rotary rigs, of which 20 were offshore rigs and 606 onshore rigs. This recorded a rise in the offshore rig counts compared to the 15 active rigs at the end of 2022. These trends will likely support the growth of the country's drilling services and further promote the growth of the oilfield services market.

- Similarly, Canada has the world's third-largest crude oil reserves, after Venezuela and Saudi Arabia, of which 96% are oil sand reserves. The oil available in the country is high-density and has a high sand particle content. Due to this, oil transport from the bottom hole of the oil well to the surface requires high pressure and wellbore intervention, thus increasing the demand for oilfield services in the country.

- Therefore, owing to the above points, North America is expected to dominate the oilfield services (OFS) market during the forecast period.

Oilfield Services (OFS) Industry Overview

The oilfield services market is fragmented. Some of the major players in the market (in no particular order) include Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International PLC, and China Oilfield Services Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Crude Oil and Natural Gas Production and Forecast, till 2029

- 4.4 Onshore and Offshore Active Rig Count, till 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Development of Gas Reserves and Advanced Technology, Tools, and Equipment

- 4.7.1.2 Increasing Investment in the Oilfield Services across World

- 4.7.2 Restraints

- 4.7.2.1 The Volatile Oil Prices Over the Recent Period, Owing to the Supply-Demand Gap

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production and Intervention Services

- 5.1.4 Other Services

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 NORDIC

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Weatherford International PLC

- 6.3.3 Baker Hughes Company

- 6.3.4 Halliburton Company

- 6.3.5 Transocean Ltd

- 6.3.6 Valaris PLC

- 6.3.7 China Oilfield Services Limited

- 6.3.8 Nabors Industries Inc.

- 6.3.9 Basic Energy Services Inc.

- 6.3.10 OiLSERV

- 6.3.11 Expro Group

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on New Technologies and Methods to Optimize its Production Cost of Hydrocarbons

02-2729-4219

+886-2-2729-4219