|

市場調查報告書

商品編碼

1687146

汽車 TPMS:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Automotive TPMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

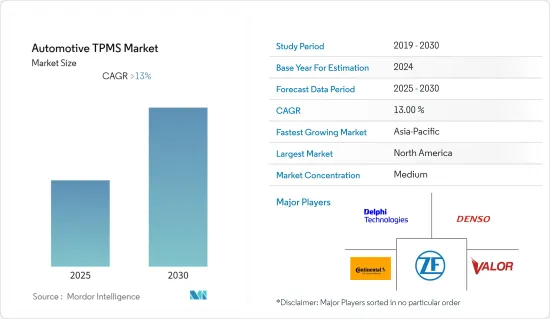

預計預測期內汽車 TPMS 市場將以超過 13% 的複合年成長率成長。

COVID-19 疫情導致全球組裝停擺、社交距離規定實施以及嚴格封鎖。市場回落,需求減少。然而,疫情過後,預測期內汽車銷售的成長預計將支撐市場需求。領先的公司正在形成策略聯盟並專注於開發新產品。例如

關鍵亮點

- 2022 年 10 月:Volvo集團、Qamcom 集團和發明家 Roman Lustin 創立了新興企業Fyrqom AB。本文介紹了重型車輛輪胎壓力監測系統(TPMS)的自動校準系統。

從長遠來看,消費者對 ADAS(高級駕駛輔助系統)的偏好預計將在汽車 TPMS 市場的成長中發揮關鍵作用。此外,配備 TPMS 的高檔汽車銷售激增預計將在預測期內推動汽車 TPMS 的成長。雖然 TPMS 的需求最初是由豪華和高檔汽車領域推動的,但中階單輪胎汽車也滿足了市場需求,因為它們配備了這種監控系統。例如

關鍵亮點

- 2022 年 6 月:大眾推出 2022 年 Virtus,配備單輪胎 TSI Comfortline 車型。轎車部分提供超過 40 種功能和感測器,包括輪胎壓力監測系統。

亞太地區預計將成為汽車 TPMS 的最大市場,其中日本、印度和中國是主要的汽車中心。預計印度汽車 TPMS 市場將受到消費者意識增強、TPMS 售後安裝以及高檔汽車需求成長的推動。例如

關鍵亮點

- 2022年9月,吉利汽車、力帆科技旗下換電汽車品牌重慶力帆汽車科技股份有限公司(力帆汽車)推出兩款新車型。配備8吋LCD主機螢幕、胎壓監測系統(TPMS)、坡道保持控制(HHC)系統。

汽車TPMS市場趨勢

汽車中 TPMS 的普及將推動市場成長

TPMS 最常用於乘用車,其中輪胎壓力管理被視為關鍵的安全系統。汽車產業正持續致力於推出能夠降低事故嚴重程度、減少人員死亡和提高車輛整體安全性的功能。預計這將在預測期內推動汽車 TPMS 市場的成長。

例如,Dill Air Control 目前為豐田、雷克薩斯、寶馬、大眾、現代、克萊斯勒、吉普和勞斯萊斯的高階車型生產 TPMS 系統。目前,各大汽車製造商的運動型、高級型和豪華型乘用車均標配 TPMS,可在儀錶板顯示器上顯示輪胎壓力。隨著消費者對配備先進安全功能的車輛的需求不斷增加,TPMS 預計將成為 C-Class掀背車、轎車和 SUV 的標準配備。

此外,由於該系統具有許多優點,乘用車領域的幾家汽車製造商正在其提案的車輛中安裝 TPMS。例如

- 2022 年 5 月:新款 2022 年奧迪 A6 配備了先進的輪胎壓力監測系統。該功能於 2022 年 A6 上推出,但 2021 年車型上沒有提供。

- 2022 年 5 月:與上一代車型相比,新推出的 2022 年混合動力高檔中型轎車本田思域配備了輪胎壓力監測系統 (TMPS)。

隨著汽車製造商將這些功能添加到其新推出的車輛中,預計整個預測期內該市場對乘用車的需求將保持積極態勢。

預計亞太地區在預測期內將大幅成長

預計亞太汽車 TPMS 市場將在預測期內成長,佔據全球汽車 TPMS 市場的巨大佔有率。

預計中國和印度將成為該地區的市場領導。高檔汽車市場滲透率不斷上升以及每輛車的安全功能數量不斷增加(由於政府/機構採用的安全法規)等因素正在推動對 TPMS 和其他 ADAS 的需求。日本、韓國、南美、新加坡等亞洲已開發國家緊湊型及中型汽車上組裝的TPMS等安全系統較為先進,普遍與北美、歐洲相當。

亞太地區高檔和中階汽車銷售的成長是採用 TMPS 的關鍵成長要素。多家汽車廠商正加快乘用車銷售步伐,推出新產品。例如

- 2022年8月:上汽榮威中型電動MPV iMAX8 EV亮相。該車共推出 5 款車型,補貼後售價區間為 25.98 萬元-35.98 萬元。配備輪胎壓力監測系統。

- 2022 年 5 月:吉利繽瑞 COOL 轎車轎跑車在中國上市,售價 14,000 美元,在中型轎車領域引起轟動。該車配備了主動安全功能、胎壓監測系統和 2 級 ADAS 功能。

此外,現代和日產等主要區域汽車OEM正在策略性地製造先進的汽車 TPMS 技術,並將其與其安全系統相結合,以增加收益。目前,TPMS 的區域市場相當有限,但預計未來五年將會成長。

汽車TPMS產業概況

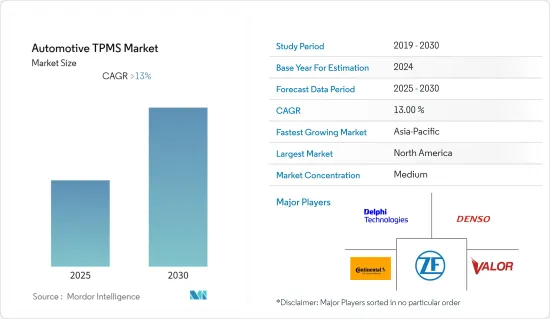

汽車TPMS與多家全球供應商、層級供應商、層級供應商適度整合。然而,在OEM供應方面,Sensata Technologies、Huf Electronics、Continental、Infineon Technology、Lear Corporation 和 ZF TRW 等公司佔據市場主導地位。

- 2022 年 6 月:大陸集團是輪胎壓力監測系統、TPMS 診斷工具和原始設備製造商和售後市場替換零件的領先創新者和供應商,該公司公佈了其下一代 REDI-Sensor 多應用 TPMS 感測器的全新包裝設計。這是大陸集團在該領域進行廣泛研究和開發的成果。

- 2021 年 11 月:KRAIBURG Austria 宣布推出其基於網路的新型輪胎壓力監測系統「TYLOGIC」。 TYLOGIC 能夠可靠地檢測出氣壓的逐漸或突然損失、卡車車軸或煞車的潛在機械損壞、或常規輪胎里程的結束。

此外,汽車製造商青睞大型製造商產品的主要原因之一是對高品質和耐用產品的需求。此外,這些領先的製造商已成倍增加了研發支出,以將汽車 TPMS 與其他安全相關解決方案相結合。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 類型

- 直接式胎壓監測系統

- 間接式胎壓監測系統

- 分銷管道

- OEM

- 售後市場

- 車

- 搭乘用車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Delphi Automotive

- DENSO Corporation

- Continental AG

- ZF TRW

- Valor TPMS

- Pacific Industrial

- Schrader Electronics

- Hella KGaA Hueck & Co.

- Valeo

- ALLIGATOR Ventilfabrik GmbH

- Advantage PressurePro Enterprises Inc.

- Alps Electric Co. Ltd

- Sensata Technologies

- Huf Electronics

第7章 市場機會與未來趨勢

The Automotive TPMS Market is expected to register a CAGR of greater than 13% during the forecast period.

The COVID-19 pandemic resulted in the shutdown of assembly lines, social distancing norms, and stringent lockdowns worldwide. The market took a step back and saw a decline in demand. However, following the pandemic, rising vehicle sales are expected to support market demand over the forecast period. Major players are forming strategic alliances and focusing on developing new products. For instance,

Key Highlights

- October 2022: Volvo Group, Qamcom Group, and the inventor Roman Lustin formed a new start-up company, Fyrqom AB. It will provide an automated system for calibrating heavy-duty vehicles' tire pressure monitoring systems (TPMS).

Over the long term, consumer preference for advanced driver assistance systems is expected to play a significant role in the automotive TPMS market growth. Furthermore, a surge in the sales of luxury vehicles equipped with TPMS will propel the automotive TPMS growth during the forecast period. Though demand for TPMS was initially driven by the luxury and premium car segments, well-equipped with this monitoring system, mid-segment one-tire vehicles meet market demand. For instance,

Key Highlights

- June 2022: Volkswagen debuted the 2022 Virtus with a 1-tire TSI Comfortline variant. More than 40 features and sensors are available in the sedan segment, including a tire pressure monitoring system.

The Asia-Pacific region is expected to be the largest market for automotive TPMS, with Japan, India, and China serving as major automotive hubs. The Indian automotive TPMS market is expected to be driven by rising consumer awareness, aftermarket TPMS installation, and rising demand for luxury vehicles. For instance,

Key Highlights

- September 2022: Chongqing Livan Automotive Technology Co., Ltd. (Livan Auto), a battery-swappable car brand supported by Geely Automobile and Lifan Technology, introduced two new models. It includes a central console screen with an 8-inch LCD, a Tire Pressure Monitoring System (TPMS), and a Hill Hold Control (HHC) system.

Automotive TPMS Market Trends

Increasing Adoption of TPMS in Vehicles to Enhance Growth of Market

TPMS is most commonly used in passenger vehicles, where tire pressure management is regarded as a critical safety system. The automotive industry is stepping up its efforts to introduce features that reduce the collision's impact, reduce fatalities, and improve overall vehicle safety. It will fuel the growth of the automotive TPMS market during the forecast period.

Dill Air Control, for example, is now producing TPMS systems for high-end models from Toyota, Lexus, BMW, Volkswagen, Hyundai, Chrysler, Jeep, and Rolls Royce. Significant automakers' sports, premium, and luxury segment passenger cars now include TPMS as standard equipment, with tire pressure displayed in the instrument panel display. With increasing consumer demand for vehicles with advanced safety features, TPMS is expected to become standard in C-segment hatchbacks, Sedans, and SUVs.

Furthermore, due to this system's numerous benefits, several automakers in the passenger car segment are offering the installed TPMS in their proposed fleet. For instance:

- May 2022: the newly released Audi A6 2022 model includes a sophisticated tire pressure monitoring system. This feature was introduced in the 2022 model A6 but was unavailable in the 2021 models.

- May 2022: Compared to the older model, the newly launched 2022 hybrid premium midsize sedan Honda City includes a tire pressure monitoring system (TMPS).

Due to these additions to automakers' newly launched fleets, demand for passenger vehicles in the market is expected to remain positive throughout the forecast period.

Asia-Pacific Region Anticipated to Grow at Significant Level During the Forecast Period

The Asia-Pacific automotive TPMS market is expected to grow and hold a significant share of the global automotive TPMS market during the forecast period.

China and India are expected to be the region's market leaders. Factors such as rising premium car market penetration and increased safety installations per vehicle (due to the safety regulations adopted by governments/agencies) drive up demand for TPMS and other ADAS. Safety systems, such as automotive TPMS, found in compact and mid-sized vehicles in advanced Asian economies such as Japan, South Korea, and Singapore, are progressive and typically on par with those found in Europe and North America.

Growth in premium and mid-segment car sales in Asia-Pacific is a critical growth factor for TMPS adoption. Several automakers are pushing the pace of passenger vehicle sales even faster and launching new products. For instance:

- August 2022: The iMAX8 EV, a mid-sized electric MPV from SAIC Roewe, was unveiled. It is available in five variants, with prices ranging from CNY 259,800 (USD 37316.32) to CNY 359,800 (USD 51679.80) after subsidies. Tire Pressure Monitoring System is one of the vehicle's features.

- May 2022: Geely Binrui COOL Sedan Coupe was launched in China for USD 14,000 and is considered the racing storm in the mid-sedan segment. The car includes active safety features, a tire pressure monitoring system, and Level 2 ADAS functions.

Furthermore, critical regional automotive OEMs such as Hyundai and Nissan intend to increase revenue by strategically manufacturing and integrating advanced automotive TPMS technology with safety systems. Although the regional market for TPMS is currently quite limited, it is expected to increase over the next five years.

Automotive TPMS Industry Overview

The automotive TPMS is moderately consolidated due to several global, tier-2, and tier-3 suppliers. However, regarding OEM supply, companies like Sensata Technologies, Huf Electronics, Continental, Infineon Technology, Lear Corporation, and ZF TRW dominate the market.

- June 2022: Continental, a leading innovation and supplier of OE and aftermarket for tire pressure monitoring systems, TPMS diagnostic tools, and replacement parts, introduced a new packaging design for its next generation of REDI-Sensor Multi-Application TPMS Sensors. It came from the exhaustive research and development conducted by Continental AG in this segment.

- November 2021: KRAIBURG Austria announced the launch of a new, web-based tire pressure monitoring system called TYLOGIC, which reliably detects gradual or abrupt pressure loss, possible mechanical damage to axles or brakes of the truck, or the imminent end of the regular tire mileage.

Furthermore, one of the primary reasons that automakers prefer products from major manufacturers is the demand for high-quality and durable products. Moreover, these significant players increased R&D spending exponentially to integrate automotive TPMS with other safety-related solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Type

- 5.1.1 Direct TPMS

- 5.1.2 Indirect TPMS

- 5.2 Sales Channel Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Automotive

- 6.2.2 DENSO Corporation

- 6.2.3 Continental AG

- 6.2.4 ZF TRW

- 6.2.5 Valor TPMS

- 6.2.6 Pacific Industrial

- 6.2.7 Schrader Electronics

- 6.2.8 Hella KGaA Hueck & Co.

- 6.2.9 Valeo

- 6.2.10 ALLIGATOR Ventilfabrik GmbH

- 6.2.11 Advantage PressurePro Enterprises Inc.

- 6.2.12 Alps Electric Co. Ltd

- 6.2.13 Sensata Technologies

- 6.2.14 Huf Electronics