|

市場調查報告書

商品編碼

1687210

汽車煞車系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Brake System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

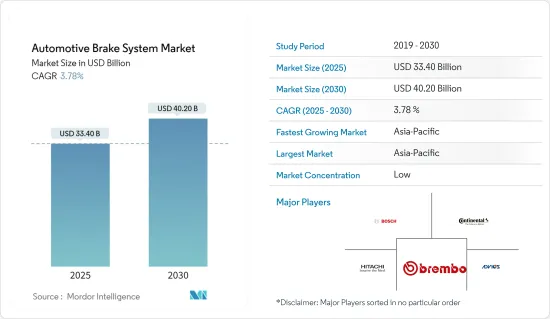

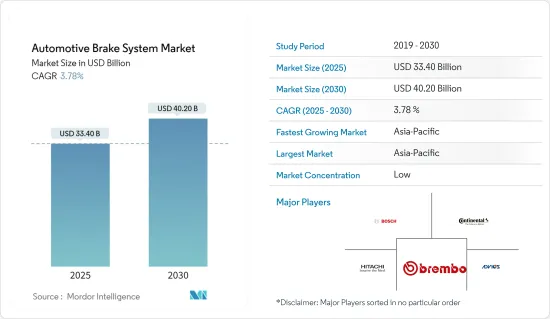

汽車煞車系統市場規模預計在 2025 年為 334 億美元,預計到 2030 年將達到 402 億美元,預測期內(2025-2030 年)的複合年成長率為 3.78%。

由於幾個關鍵因素,汽車煞車系統市場正在經歷強勁成長。其中一個主要因素是全球汽車產量和銷售量的成長。汽車產量的增加直接增加了對汽車煞車系統的需求,因為每輛汽車都需要可靠、高效的煞車系統來確保安全性和性能。

政府法規在加速汽車煞車系統市場的成長方面發揮關鍵作用。在美國,美國國家公路交通安全管理局(NHTSA)和運輸部(DOT)正在提案規則,要求到2029年所有新型乘用車和輕型卡車必須配備自動緊急煞車(AEB)。這些規定旨在提高道路安全性,並減少因煞車反應延遲而導致的事故。

同樣,歐盟的《通用安全法規》(GSR)要求,到2024年7月,新車必須配備包括AEB在內的先進安全功能。這些嚴格的安全標準迫使汽車製造商在其車輛中採用先進的煞車技術,從而推高了對汽車煞車系統的需求。

其他市場推動要素包括由於道路事故增加而導致的對安全和平穩駕駛的意識不斷增強、對減輕車輛重量和摩擦的先進技術的需求以及主要製造商的研發活動。另一方面,電動車的日益普及和對自動駕駛汽車的日益關注預計將很快提升製造公司的商業性成長潛力。

汽車產業的成長也可能推動未來幾年研究市場的發展。

汽車煞車系統市場趨勢

預計預測期內OEM部門將出現顯著成長

汽車公司不斷生產新的和改進的產品,以使駕駛汽車更加舒適和安全。本公司提供整合式電子穩定控制(ESC)的防鎖死煞車系統,以防止打滑並保持車輛控制。因此,汽車安全功能的技術進步是汽車煞車系統市場的潛在成長要素。

根據國際汽車工業組織(OICA)預測,2023年全球汽車產量將達到9511萬輛,較上年的下滑有明顯復甦。隨著汽車產量的增加,對作為製造過程重要組成部分的OEM煞車系統的需求也隨之增加。這種需求進一步受到消費者對先進煞車技術的日益成長的偏好所推動,例如 ABS(防鎖死煞車系統)和 EBD(電子煞車力道分配),這些技術主要由OEM提供。

此外,預計到 2030 年電動車將佔全球汽車銷量的 42% 至 58%,而電動車需要專門的煞車系統來回收能量並提高安全性,這一趨勢也將推動OEM領域發展。

隨著人們對速度的要求不斷提高,煞車已經成為任何汽車確保安全的重要組成部分,因此一些主要企業和汽車製造商都傾向於採用高品質的煞車系統。由於這種趨勢, OEM正在與汽車製造商簽訂煞車系統供應合約。

預計亞太地區在預測期內將大幅成長

亞太地區繼續佔據市場主導地位,該地區的製造商享有低成本的勞動力和原料,從而能夠實現高成本節約。該地區由中國和印度等前景看好的國家組成,汽車產量分別為3,016萬輛和585萬輛,約佔全球汽車產量的38.5%。主動煞車系統日益普及,推動了豪華和高檔汽車的銷售。

公司主要致力於開發環保、可靠且堅固的煞車系統。領先的公司正在大力投資研發,以擴大市場佔有率並確保健康成長。

- 2023年12月,Hella GmbH & Co. KGaA(海拉)宣布有意收購TMD Friction 的合資企業 Hella Pagid 50% 的股份,海拉將成為唯一股東。此舉將於 2024 年 10 月 1 日起生效,符合 TMD Friction 的策略,即將 HELLA 的煞車產品整合到自有品牌下,同時專注於擴大 Pagid 品牌的銷售。

- 2023年11月,採埃孚(ZF)將推出純電子機械煞車系統。這種不使用液壓部件的「乾式」煞車系統可以顯著縮短煞車距離並提高煞車能量回收效果,這對電動車尤其有利。該技術有望透過改善能源回收將電動車的續航里程提高 17%,並在煞車效率方面樹立了新的標準。

此外,全球事故數量的不斷增加也使得車輛,尤其是中階車型的安全性能亟待提升。這一趨勢在印度等國家尤為明顯,為了減少交通事故,印度政府已要求從 2019 年 4 月起所有車輛必須配備防鎖死煞車系統 (ABS)。這項監管舉措對汽車煞車系統市場產生了重大影響,迫使汽車製造商採用先進的煞車技術。

這些發展正在推動市場需求。因此,預計亞太地區在預測期內將出現成長。

汽車煞車系統產業概況

汽車煞車系統市場比較分散,擁有許多不同的參與者。市場的主要企業包括 Advics、Bosch Mobility Solutions、Continental AG、Brembo SpA 和 Hitachi Astemo。

主要企業正在積極投資新的製造設施以擴大生產能力。此次擴張旨在提高生產能力,透過將生產地點設在更靠近主要市場的地方來降低物流成本並提高供應鏈效率。這些新工廠的建立往往伴隨著先進製造技術的採用,以提高生產效率和產品品質。

- 2024年2月,領先的先進煞車系統開發商ASK Automotive宣布計畫在印度卡納塔克邦建立新的製造工廠,投資額為2.19億印度盧比。該工廠預計將於 2025 年第四季度運作,並將提高 ASK Automotive 的煞車板組件、煞車蹄片和其他關鍵煞車零件的生產能力。

- 2024年1月,總部位於中國的Winhair在泰國羅勇府開始建造新工廠,實現了重大擴張。該工廠專門生產煞車盤和煞車皮,旨在加強泰國作為汽車零件行業主要供應商的地位。該計劃預計於 2025 年初完工,將增強 Winhair 在國內和國際市場的生產能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 汽車產量增加

- 市場限制

- 全球貿易動態

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 依產品類型

- 碟式煞車

- 鼓式煞車

- 煞車皮材料類型

- 有機的

- 金屬

- 陶瓷製品

- 按銷售管道

- 目標商標產品製造商(OEM)

- 售後市場

- 按車型

- 商用車

- 搭乘用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Akebono Brake Industry Co. Ltd

- Brembo NV

- Robert Bosch GmbH

- Continental AG

- Disc Brakes Australia(DBA)

- Aptiv PLC

- Federal-Mogul Holding Co.

- Hella Pagid GmbH

- Performance Friction Corporation(PFC)Brakes

- Sundaram Brake Linings(SBL)

- ZF TRW Co.

- Advics Co. Ltd

- Hitachi Automotive Systems

第7章 市場機會與未來趨勢

- 物聯網在汽車煞車系統市場的運用

The Automotive Brake System Market size is estimated at USD 33.40 billion in 2025, and is expected to reach USD 40.20 billion by 2030, at a CAGR of 3.78% during the forecast period (2025-2030).

The automotive brake system market is experiencing robust growth, driven by several key factors. One of the primary drivers is the increasing production and sales of vehicles worldwide. This growth in vehicle production directly boosts the demand for automotive brake systems, as every vehicle requires a reliable and efficient braking system for safety and performance.

Government regulations play a crucial role in accelerating the growth of the automotive brake system market. In the United States, the National Highway Traffic Safety Administration (NHTSA) and the Department of Transportation (DOT) have proposed rules mandating the inclusion of automatic emergency braking (AEB) in all new passenger cars and light trucks by 2029. These regulations are designed to improve road safety and reduce accidents caused by delayed braking responses.

Similarly, the European Union's General Safety Regulation (GSR) mandated advanced safety features, including AEB, in new vehicles in July 2024. These stringent safety standards compel automakers to integrate advanced braking technologies into their vehicles, driving the demand for automotive brake systems.

Some other factors driving the market are growing awareness about safe and smooth driving in the wake of increasing road accidents, the demand for advanced technology to reduce weight and friction generated in vehicles, and R&D activities by major players. On the other hand, the increasing adoption of electric cars and the rising focus on autonomous vehicles are expected to boost the commercial growth potential of manufacturing companies shortly.

The growth in the automotive segment may also drive the studied market in the coming years.

Automotive Brake System Market Trends

The OEM Segment is Expected to Witness Prominent Growth During the Forecast Period

Automobile companies are constantly producing new and enhanced products for the comfortable and safe driving of vehicles. Companies are providing anti-lock braking systems integrated with electronic stability control (ESC) to prevent skidding, thus bringing vehicles under control. Therefore, technological advancements in vehicle safety features are a potential driver for the growth of the automotive brake system market.

According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached 95.11 million units in 2023, marking a significant recovery from the previous year's decline. As vehicle production rises, the demand for OEM brake systems, which are integral to the manufacturing process, also increases. This demand is further amplified by the growing consumer preference for advanced braking technologies such as ABS (anti-lock braking system) and EBD (electronic brakeforce distribution), which are predominantly supplied by OEMs.

Additionally, the rising trend of electric vehicles, which are expected to constitute between 42% and 58% of car sales in the global vehicle market by 2030, also boosts the OEM segment, as EVs require specialized braking systems for energy regeneration and enhanced safety.

As brakes have become a crucial part of any vehicle to ensure safety when the demand for speed is increasing consistently, several key companies and automakers are inclined toward embedding high-quality brake systems. This trend has resulted in OEMs signing contracts with automobile manufacturers to supply braking systems.

Asia-Pacific is Anticipated to Grow Significantly During the Forecast Period

Asia-Pacific continues to dominate the market, and manufacturers in the region offer high-cost reductions due to the availability of low-cost labor and raw materials. The region comprises some high-potential countries, such as China and India, which accounted for 30.16 million and 5.85 million of vehicle production, respectively, i.e., approximately 38.5% of the total global vehicle production. The increasing popularity of active braking systems boosts the sales of luxury and premium vehicles.

The companies are primarily focused on developing eco-friendly, reliable, and robust braking systems. The key players have made heavy investments in research and development to increase their market shares and ensure healthy growth.

- In December 2023, Hella GmbH & Co. KGaA (HELLA) announced its intent to acquire TMD Friction's 50% share in their joint venture, Hella Pagid, making HELLA the sole shareholder. This move, effective from October 1, 2024, aligns with HELLA's strategy to consolidate its brake product offerings under its brand while TMD Friction focuses on expanding its Pagid brand sales.

- In November 2023, ZF Friedrichshafen (ZF) launched a purely electro-mechanical brake system. This "dry" brake system, devoid of hydraulic components, allows for significantly shorter braking distances and enhanced recovery of braking energy, which is particularly beneficial for electric vehicles. This technology promises up to 17% more range for electric vehicles through improved energy recovery, setting a new standard in braking efficiency.

The growing number of accidents globally has also necessitated the enhancement of safety features in vehicles, particularly in mid-segment models. This trend is evident in countries such as India, where the government mandated the installation of anti-lock braking systems (ABS) in all vehicles starting in April 2019 to reduce road accidents. This regulatory push has significantly impacted the automotive brake system market, compelling automakers to adopt advanced braking technologies.

Such developments drive demand in the market. Hence, Asia-Pacific is expected to have enhanced growth during the forecast period.

Automotive Brake System Industry Overview

The automotive brake system market is fragmented, with the presence of various players. Some of the key players in the market include Advics Co. Ltd, Bosch Mobility Solutions, Continental AG, Brembo SpA, and Hitachi Astemo Ltd.

Key players are actively investing in new manufacturing facilities to expand their production capabilities. This expansion is about increasing volume and situating production closer to key markets to reduce logistics costs and improve supply chain efficiency. Establishing these new facilities often comes with adopting advanced manufacturing technologies that increase production efficiency and product quality.

- In February 2024, ASK Automotive, a leading developer of advanced braking systems, announced its plans to set up a new manufacturing facility in Karnataka, India, with an investment of INR 2.19 lakh. Scheduled to be operational by Q4 2025, this facility will bolster ASK Automotive's production capabilities in brake panel assemblies, brake shoes, and other critical braking components.

- In January 2024, China-based Winhere marked a significant expansion by initiating the construction of a new factory in Rayong, Thailand. This facility, focusing on manufacturing brake discs and pads, aims to strengthen Thailand's role as a major supplier in the automotive parts industry. The project is expected to be completed in early 2025, enhancing Winhere's production capacity for both the domestic and international markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Vehicle Production

- 4.2 Market Restraints

- 4.2.1 Global Trade Dynamics

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Product Type

- 5.1.1 Disc Brakes

- 5.1.2 Drum Brakes

- 5.2 By Brake Pad Material Type

- 5.2.1 Organic

- 5.2.2 Metallic

- 5.2.3 Ceramic

- 5.3 By Sales Channel

- 5.3.1 Original Equipment Manufacturers (OEMs)

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Commercial Vehicles

- 5.4.2 Passenger Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 South Africa

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Akebono Brake Industry Co. Ltd

- 6.2.2 Brembo NV

- 6.2.3 Robert Bosch GmbH

- 6.2.4 Continental AG

- 6.2.5 Disc Brakes Australia (DBA)

- 6.2.6 Aptiv PLC

- 6.2.7 Federal-Mogul Holding Co.

- 6.2.8 Hella Pagid GmbH

- 6.2.9 Performance Friction Corporation (PFC) Brakes

- 6.2.10 Sundaram Brake Linings (SBL)

- 6.2.11 ZF TRW Co.

- 6.2.12 Advics Co. Ltd

- 6.2.13 Hitachi Automotive Systems

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of IoT in the Automotive Brake System Market