|

市場調查報告書

商品編碼

1687239

美國電動車 (EV) 充電:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)US Electric Vehicle (EV) Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

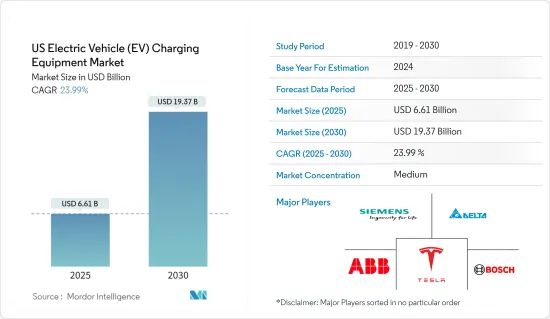

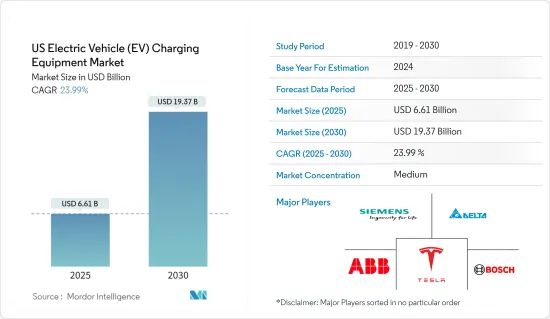

預計 2025 年美國電動車 (EV) 充電器市場規模為 66.1 億美元,到 2030 年將達到 193.7 億美元,預測期內(2025-2030 年)的複合年成長率為 23.99%。

關鍵亮點

- 從中期來看,預計國內電動車普及率不斷提高以及電動車基礎設施發展等因素將在預測期內推動充電器市場的發展。

- 然而,預計在預測期內,建立充電站的高安裝和維護成本將阻礙市場成長。

- 預計在預測期內,對電動車的投資增加和電動車充電設備的技術進步將為美國電動車充電設備市場創造重大機會。

美國電動車充電器市場趨勢

提高電動車在該國的普及率

- 電動車因其環保特性和成本效益而越來越受歡迎。然而,電動車車主最關心的問題之一是充電站的可用性。隨著電動車使用量的增加,需要更多的充電設施和基礎設施來滿足需求。

- 隨著電動車越來越受歡迎,對充電設備和相關基礎設施的需求也日益成長。為了滿足需求,政府和企業正在努力在停車場、購物中心和高速公路等公共區域安裝充電站。此外,許多電動車車主在家中安裝充電站供個人使用。

- 根據國際能源總署 (IEA) 的數據,預計 2022 年美國電動車銷量將比 2021 年成長 55%,其中電池電動車 (BEV) 占主導地位。純電動車銷量成長 70%,達到約 80 萬輛,這是繼 2019-2020 年下滑之後連續第二年實現強勁成長。 PHEV 的銷售也有所成長,但僅成長了 15%。

- 根據美國能源局科學辦公室的數據,2023 年 12 月美國總合售出 141,055 輛插電式汽車(100,928 輛 BEV 和 40,127 輛 PHEV),比 2022 年 12 月的銷量成長 42.4%。此外,2023年12月美國混合動力車銷量為117,690輛(乘用車31,825輛,長續航型汽車85,865輛),較2022年12月成長70.3%。 2022年電動車總保有量將達300萬輛,較2021年成長36%以上,佔全球整體的10%。

- 2023年2月,根據拜登兩黨基礎設施法案,該國宣布計劃投資75億美元用於電動車充電,投資100億美元用於清潔交通,並投資超過70億美元用於電動車電池組件、關鍵礦物和材料。

- 此外,汽車製造商和電池製造商計劃在 37 個專用電動車電池製造工廠投資超過 500 億美元。總設備容量將達到 654 吉瓦時,到 2030 年足以支援每年約 1,000 萬輛輕型汽車,並為電動車的生產和銷售提供支援。所有這些投資將有助於推動電動車在美國的普及。因此,預測期內對電動車充電設備和基礎設施的需求將會上升。

- 因此,預計該國電動車的普及和投資不斷增加將繼續推動對電動車充電設備的需求,在預測期內仍將是一個有前景的市場。

電池電動車佔據市場主導地位。

- 電池電動車(BEV)通常也稱為配備馬達的電動車。該車輛使用大型牽引電池組為馬達提供動力。電動車需要插入牆上插座或稱為電動車供電設備 (EVSE) 的充電設備。

- BEV 是全電動汽車,通常不含內燃機 (ICE)、燃料箱或排氣管。推進力完全依靠電力。車輛的能量來自電池組,由電網充電。 BEV 是零排放汽車,不會產生傳統汽油動力汽車產生的有害廢氣排放或空氣污染風險。

- 電池電動車 (BEV) 在美國的普及正在加速,並正在改變汽車產業。在技術進步、政府支持和日益增強的環保意識的推動下,純電動車已成為應對氣候變遷挑戰和減少對石化燃料依賴的有希望的解決方案。

- 近年來,美國電動車的普及率顯著增加。電池技術的改進、更長的行駛里程以及充電基礎設施的普及有助於克服最初的進入障礙。特斯拉、雪佛蘭、日產和福特等汽車製造商透過提供價格實惠、吸引廣大消費者的車型,在推廣純電動車方面發揮了重要作用。

- 2022年,美國將有99萬輛新電動車註冊,其中約80%將是純電動車。根據國際能源總署 (IEA) 的數據,美國電池電動車 (BEV) 銷量與 2021 年相比成長了 40%。

- 根據美國能源局的數據,公共可用的電動車充電站(1 級、2 級和直流快速)數量將從 2022 年的 143,729 個增加到 2023 年的 175,547 個。在 2023 年可用的 175,547 個充電站中,約 137,795 個為慢速充電站,其餘 37,752 個為快速充電站。近年來,日本公共快速充電站的比例大幅增加。預計預測期內同樣的趨勢仍將持續。

- 隨著科技的不斷發展,美國電動車的未來前景光明。汽車製造商和美國政府正在大力投資研發,以提高電池效率、降低成本並提高整體車輛性能。

- 例如,2022 年第三季度,該國在電動車和電池製造方面投資約 2,100 億美元。特斯拉預計將加大投資,在2022年至2024年期間每年在美國和德國投資60億至80億美元。此外,汽車製造商和電池製造商計劃在全國投資540億美元建設37個電動車電池製造工廠。預計到 2030 年,這些工廠每年將生產 654 吉瓦時 (GWh) 的電動車電池容量。這種情況預計將對純電動車製造業產生正面影響。

- 此外,自動駕駛技術和Vehicle-to-Grid整合的出現進一步增加了純電動車徹底改變交通運輸產業的潛力。這增加了對電動車充電設備的需求。

美國電動車充電產業概況

美國電動車充電器市場減少了一半。市場的主要企業(不分先後順序)包括 ABB 有限公司、羅伯特博世有限公司、台達電子股份有限公司、西門子股份公司和特斯拉公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2029 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 電動車普及及相關投資增加

- 政府支持政策和舉措

- 限制因素

- 安裝電動車充電站的高成本

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 汽車模型

- 純電動車(BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車(HEV)

- 應用

- 家庭充電

- 職場充電

- 公共充電

- 充電類型

- 交流充電(1 級和 2 級)

- 直流充電

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- ABB Ltd.

- Robert Bosch GmbH

- ChargePoint Inc.

- Enphase Energy, Inc.

- Delta Electronics Inc.

- Powercharge

- Siemens AG

- Tesla Inc.

- KOSTAL Automobil Elektrik GmbH & Co. KG.

- Webasto SE

- 市場排名分析

第7章 市場機會與未來趨勢

- 電動車充電技術進步

簡介目錄

Product Code: 56960

The US Electric Vehicle Charging Equipment Market size is estimated at USD 6.61 billion in 2025, and is expected to reach USD 19.37 billion by 2030, at a CAGR of 23.99% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors like the growing adoption of electric vehicles in the country and the development of electric vehicle infrastructure are expected to drive the charging equipment market during the forecast period.

- On the other hand, high installation costs associated with setting up charging stations and maintenance costs are expected to hinder the market's growth during the forecast period.

- Nevertheless, increasing investments in EVs and technological advancements in EV charging Equipment are expected to provide significant opportunities for the US electric vehicle (EV) charging equipment market during the forecast period.

US Electric Vehicle (EV) Charging Equipment Market Trends

Increasing Adoption of Electric Vehicles in the Country

- Electric vehicles (EVs) became increasingly popular due to their eco-friendly nature and cost-effective benefits. However, one of the main concerns for EV owners is the availability of charging stations. As the usage of electric vehicles increases, more charging equipment and infrastructures are required to fulfill the need.

- As the adoption of electric vehicles increases, the need for charging devices and relevant infrastructure is expanding. To meet the demand, the government and companies work on installing more charging stations in public areas such as parking lots, malls, and highways. Many electric vehicle owners also install charging stations in their homes for personal use.

- According to the International Energy Agency (IEA), in the United States, electric car sales increased by 55% in 2022 relative to 2021, led by battery electric vehicles (BEV). Sales of BEVs increased by 70%, reaching nearly 800,000 and confirming a second consecutive year of solid growth after the 2019-2020 dip. Sales of PHEVs also grew, albeit by only 15%.

- According to the United States Department of Energy Office of Science, a total of 141,055 plug-in vehicles (100,928 BEVs and 40,127 PHEVs) were sold during December 2023 in the United States, up 42.4% from the sales in December 2022. Also, In December 2023, 117,690 HEVs (31,825 cars and 85,865 LTs) were sold in the United States, up 70.3% from the sales in December 2022. The total stock of electric cars stood at 3 million in 2022, recording more than a 36% increase compared to 2021, accounting for 10% of the global total.

- In February 2023, Under Biden's Bipartisan Infrastructure Law, the country announced its plan to invest USD 7.5 billion in electric vehicle charging, USD 10 billion in clean transportation, and over USD 7 billion in electric vehicle (EV) battery components, critical minerals, and materials.

- Furthermore, the automakers and battery makers plan to spend over USD 50 billion across 37 dedicated EV battery manufacturing facilities. At total capacity, the facilities could produce 654 GWh in capacity, which is enough to support about 10 million light-duty vehicles annually by 2030 to support their electric vehicle manufacturing and sales. All these investments are likely to boost the adoption of EVs across the United States. It, in turn, is driving the need for EV charging devices and infrastructures over the forecast period.

- Hence, the increasing adoption of electric vehicles (EVs) and investments in the country are expected to continue accelerating the demand for EV charging equipment and hold a promising market over the forecast period.

Battery Electric Vehicles to Dominate the market.

- Battery electric vehicles (BEVs) are also commonly referred to as electric vehicles with an electric motor. The vehicle uses a large traction battery pack to power the electric motor. The EV must be plugged into a wall outlet or charging equipment called electric vehicle supply equipment (EVSE).

- BEVs are fully electric vehicles and typically do not include an internal combustion engine (ICE), fuel tank, or exhaust pipe. They rely only on electricity for propulsion. The vehicle's energy comes from the battery pack, which is recharged from the grid. BEVs are zero-emission vehicles, as they do not generate any harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- The United States is transforming the automotive industry as battery electric vehicles (BEVs) gain momentum and popularity. With technological advancements, government support, and increasing environmental concerns, BEVs emerged as a promising solution to address the challenges of climate change and reduce reliance on fossil fuels.

- In recent years, the adoption of battery-electric vehicles in the United States grew significantly. Improved battery technology, extended driving ranges, and a surge in charging infrastructure helped overcome the initial entry barriers. Automakers like Tesla, Chevrolet, Nissan, and Ford played instrumental roles in popularizing BEVs, offering affordable models that appeal to a broader range of consumers.

- In 2022, the United States registered 990,000 new electric cars, of which about 80% were BEVs, and witnessed a rise of 70% compared to 2021. According to the International Energy Agency (IEA), battery electric vehicle (BEV) sales increased by 40% in the United States relative to 2021.

- According to the United States Department of Energy, the number of publicly available electric vehicle charging points (Level 1, Level 2, and DC Fast) grew from 143,729 in 2022 to 175,547 in 2023. Of the 175,547 charging points in 2023, around 137,795 were slow charging points, and the rest 37,752 were fast charging points. The share of publicly available fast charging points witnessed significant growth in the country in recent years. It is expected to continue the same trend during the forecast period.

- As technology continues to evolve, the future of battery-electric vehicles in the United States looks promising. Automakers, along with the United States government, are investing heavily in research and development to improve battery efficiency, reduce costs, and enhance overall vehicle performance.

- For instance, in Q3 2022, the country invested nearly USD 210 billion in EV and battery manufacturing. The investment is expected to increase, with Tesla including USD 6-8 billion annually in the United States and Germany between 2022 and 2024. Further, automakers and battery makers also planned to spend USD 54 billion across 37 EV battery manufacturing facilities across the country. These facilities are expected to produce 654 gigawatt hours (GWh) of EV battery capacity annually by 2030. Such a scenario is expected with a positive impact on the BEV manufacturing industry.

- Moreover, the emergence of autonomous driving technology and vehicle-to-grid integration further adds to the potential of BEVs to revolutionize the transportation sector. It is thereby driving the demand for charging equipment for battery electric vehicles.

US Electric Vehicle (EV) Charging Equipment Industry Overview

The US electric vehicle (EV) charging equipment market is semi-fragmented. Some of the key players in the market (not in any particular order) include ABB Ltd, Robert Bosch GmbH, Delta Electronics Inc., Siemens AG, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles and Related Investments

- 4.5.1.2 Supportive Government Policies And Initiatives

- 4.5.2 Restraints

- 4.5.2.1 High Cost Of Setting Up Ev Charging Stations

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Battery Electric Vehicle (BEV)

- 5.1.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.1.3 Hybrid Electric Vehicle (HEV)

- 5.2 Application

- 5.2.1 Home Charging

- 5.2.2 Workplace Charging

- 5.2.3 Public Charging

- 5.3 Charging Type

- 5.3.1 AC Charging (Level 1 and Level 2)

- 5.3.2 DC Charging

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Robert Bosch GmbH

- 6.3.3 ChargePoint Inc.

- 6.3.4 Enphase Energy, Inc.

- 6.3.5 Delta Electronics Inc.

- 6.3.6 Powercharge

- 6.3.7 Siemens AG

- 6.3.8 Tesla Inc.

- 6.3.9 KOSTAL Automobil Elektrik GmbH & Co. KG.

- 6.3.10 Webasto SE

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in the EV Charging Equipment

02-2729-4219

+886-2-2729-4219