|

市場調查報告書

商品編碼

1687241

商業衛星圖像:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Commercial Satellite Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

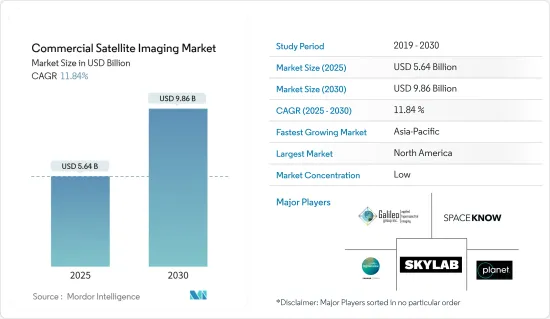

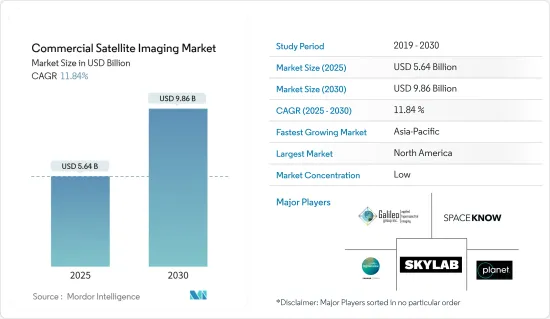

預計 2025 年商業衛星影像市場規模為 56.4 億美元,到 2030 年將達到 98.6 億美元,預測期內(2025-2030 年)的複合年成長率為 11.84%。

由世界各國政府和公司營運的成像衛星拍攝的地球影像稱為衛星影像,有時也稱為地球觀測影像、太空攝影或簡稱為衛星攝影。氣象、海洋學、漁業、農業、生物多樣性保護、林業、景觀、地質學、製圖、區域規劃、教育、資訊和戰爭只是衛星影像應用的幾個領域。

主要亮點

- 此成像方法利用配有光學裝備的衛星產生原始影像資料。由於距離物體較近,航空影像比衛星影像具有更高的影像解析度。地面成像最經濟,並提供最高的影像解析度,但受到地理限制。與其他成像技術相比,衛星更受青睞,因為它們能夠快速提供影像資料,並且覆蓋範圍廣泛。此外,成像服務一旦開始運作就具有經濟效益,能夠長期支持產業成長。

- 大面積高效監控的需求日益成長是商業衛星市場的主要驅動力之一。衛星影像和資料提供有關土地使用、植被和其他特徵的詳細而準確的資訊,可用於廣泛的應用,包括農業、城市規劃、自然資源管理和環境監測。

- 智慧城市計畫的興起也推動了商業衛星市場的發展。智慧城市使用多種技術,包括物聯網 (IoT) 和衛星影像,來收集和分析資料,以改善公民的生活品質並減少都市區對環境的影響。衛星圖像在智慧城市計畫中發揮關鍵作用,它提供有關建築環境的詳細和準確的資訊,包括建築物、道路和其他基礎設施的位置和狀況。這些資訊可以促進城市規劃、交通和公共服務的改善。

- 此外,一些領先的公司正專注於投資衛星成像技術,以保持競爭優勢。例如,Accenture於 2022 年 8 月宣布將對 Pixxel 進行策略性投資,以監測地球的健康狀況。 Pixel 正在建構全球解析度最高的高光譜遙測影像衛星星系,為業界提供人工智慧觀測,以傳統衛星成本的一小部分發現、解決和預測氣候問題。

- 同樣,Pixel 於 2022 年 4 月透過 SpaceX Falcon 9 號共乘任務發射了印度首顆私人商業成像衛星 Shakuntala,這是計畫中的 36 顆衛星星系的一部分。

- 來自不同國家的開放原始碼資料的可用性可能會對商業衛星圖像市場構成挑戰。開放原始碼資料是指衛星圖像和其他免費資料,通常由政府機構或組織提供。

- 在後疫情市場中,隨著限制的解除,企業和政府機構正在為創新轉變做準備,以便快速評估和修改供應鏈。例如,2022年5月,歐洲太空總署(ESA)、美國航太總署(NASA)(負責民用航太計畫和航空航太研究的美國聯邦政府獨立機構)宣佈建立合作夥伴關係,結合地球觀測衛星的科學力量,記錄全球環境和人類社會的變化。

商業衛星圖像市場的趨勢

軍事和國防部門預計將佔據較大的市場佔有率

- 軍事和防禦應用是商業衛星影像最廣泛的終端用戶應用。該部門的成長歸因於安全和監視活動,這是所有國防組織的關鍵職能。衛星軍事通訊的使用對全球防禦努力變得越來越重要。隨著對可靠和安全通訊的需求不斷增加,滿足這項需求的技術也取得了長足的進步。衛星通訊是軍事行動的理想解決方案,因為它能夠即時安全地傳輸關鍵資料和通訊,即使在最惡劣和最偏遠的環境中也是如此。

- 各國持有衛星繞地球運行,提供多種功能。然而,由於其他國家的安全擔憂,進入國際空域通常受到限制。在極端情況下,國家可能會實施百葉窗法,迫使其當地領空的外國衛星關閉其拍攝設備。

- 鑑於這些世界政府的禁令,其他國家經常會取得有關外國的地理資訊。政府可以規範商業性圖像的品質和清晰度等特性,並在某些地方實施禁令。但軍事機構總是傾向有一個備用計畫。

- 因此,有大量的地理資訊是根據不同客戶的需求進行客製化的。隨著衛星影像(例如高光譜遙測影像)的變化,商業部門擴大獲取專門用於軍事目的的資料和為普通公眾修改的資料。

- 商業圖像對於滿足新興的安全和情報需求至關重要。目前,各國的軍事能力正在不斷增強,對應對全球恐怖主義威脅的興趣也不斷增加。商業衛星公司提供對國防和國家安全至關重要的資料。隨著外太空變得越來越容易進入,商業航太提供了巨大的經濟效益,但政府資助的使用衛星影像進行恐怖主義監視的成本過於昂貴。

- 預計大多數國家增加軍事開支和國防預算將有助於所調查市場的成長。例如,2022年7月,歐盟委員會宣布計劃向歐洲防務基金(EDF)首次公開招標中選出的61個聯合國防研究和開發計劃提供總額約12億歐元(13億美元)的資金。

- 此外,利用衛星成像技術的最新進展可以讓軍隊洞察敵人的活動、計畫和位置。它也可用於空中偵察和識別武器系統的潛在目標。

亞太地區可望創下最快成長

- 預計亞太市場在整個預測期內將顯著成長。政府加大對衛星影像的舉措以吸引全球和國內公司是該地區市場成長的另一個重要原因。

- 新興國家商業衛星營運的發展正在影響全球商業衛星成像產業。高通量衛星(HTS)技術的持續擴展為亞太地區各個垂直領域帶來了新的可能性和能力。

- 例如,2022年5月,中國四維太空技術有限公司高維衛星一號01、02顆成像衛星搭載長徵系列火箭成功發射。這些衛星在中國四維空間現有的50公分解析度SuperView-1衛星星系的基礎上進行了改進,為需要額外超高解析度影像通道的客戶提供30公分影像。

- 該地區的終端用戶垂直行業正在以指數級成長的速度採用新技術,從而增強了商業衛星圖像市場的成長。該地區的各國政府也正在投資可望塑造成像衛星未來的先進技術。

- 例如,印度太空研究組織的極地衛星運載火箭C-53(PSLV C-53)從印度斯里哈里科塔航太港發射,搭載三顆新加坡商業衛星。 PSLV 軌道實驗艙(也稱為 POEM DS-EO)包含電光頻譜有效載荷,以滿足人道主義援助和救災要求。此有效載荷為土地分類提供了全彩圖像。

商業衛星圖像產業概況

商業衛星成像市場高度分散,主要參與者包括 DigitalGlobe Inc.、Galileo Group Inc.、Planet Labs Inc.、SpaceKnow Inc. 和 Skylab Analytics。市場參與者正在採取聯盟、合併、創新、投資和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023 年 5 月,歐洲太空成像公司 (EUSI) 和空中巴士宣佈建立戰略夥伴關係,為歐洲海事安全局 (EMSA) 提供極高解析度 (VHR) 光學衛星影像。空中巴士公司將提供其 Pleiades 和 Pleiades Neo 衛星收集的圖像。 SPOT 和 EUSI 將提供目前 Maxar衛星星系的圖像以及其他附加價值服務。

2023 年 3 月,L3Harris Technologies 宣布已獲得 NASA 一份價值 7.65 億美元的契約,用於設計和建造 NOAA 地球靜止擴展觀測衛星系統的下一代高解析度成像儀。 GeoXO 成像儀可能會提供先進的紅外線和可見光影像、更精確的觀測和改進的水蒸氣測量,從而顯著提高西半球天氣預報的準確性和及時性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 大面積高效率監控的需求日益增加

- 智慧城市概念的興起

- 巨量資料與影像分析

- 市場限制

- 其他成像技術提供的高解析度影像

- 市場挑戰

- 各國開放原始碼資料的可用性

第6章 市場細分

- 按應用

- 地理空間資料擷取和映射

- 自然資源管理

- 監控與安全

- 自然保育與研究

- 建設與發展

- 災害管理

- 國防和情報

- 按最終用戶產業

- 政府

- 建造

- 運輸和物流

- 軍事和國防

- 能源

- 林業和農業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- DigitalGlobe Inc.

- Galileo Group Inc.

- Planet Labs Inc.

- SpaceKnow Inc.

- Skylab Analytics

- L3Harris Corporation Inc.

- BlackSky Global LLC

- ImageSat International NV

- European Space Imaging(EUSI)GmbH

- UrtheCast Corp.

第8章投資分析

第9章:市場的未來

The Commercial Satellite Imaging Market size is estimated at USD 5.64 billion in 2025, and is expected to reach USD 9.86 billion by 2030, at a CAGR of 11.84% during the forecast period (2025-2030).

Images of the Earth taken by imaging satellites run by governments and companies worldwide are known as satellite images, sometimes known as Earth observation imagery, spaceborne photography, or simply satellite photos. Meteorology, oceanography, fisheries, agriculture, biodiversity protection, forestry, landscape, geology, cartography, regional planning, education, intelligence, and warfare are just a few fields where satellite photos are used.

Key Highlights

- The imaging method generates raw image data using optically equipped satellites. Since it is closer to the object, aeronautical imaging delivers a higher image resolution than satellite imaging. The most economical and greatest image resolution is provided by terrestrial imaging; however, it has geographical limitations. Because of their quick supply of image data and wide coverage, satellites are favored over other imaging techniques. Additionally, imaging services are economical once they are in orbit, supporting industry growth over time.

- The increasing requirement for efficient monitoring of vast land areas is one of the key drivers for the commercial satellite market. The use of satellite imagery and data can provide detailed and accurate information about land use, vegetation, and other features, which can be used for a wide range of applications such as agriculture, urban planning, natural resource management, and environmental monitoring.

- The rising smart city initiatives are also driving the commercial satellite market. Smart cities utilize various technologies, such as the Internet of Things (IoT) and satellite imagery, to collect and analyze data to improve citizens' quality of life and decrease the environmental impact of urban areas. Satellite imagery plays a key role in smart city initiatives by providing detailed and accurate information about the built environment, such as the location and condition of buildings, roads, and other infrastructure. This information can improve urban planning, transportation, and public services.

- Furthermore, several leading players are focusing on investing in satellite imaging technology to stay ahead of the competition. For instance, in August 2022, Accenture announced to make a strategic investment in Pixxel to monitor Earth's health. Pixxel is building the world's highest-resolution hyperspectral imaging satellite constellation to provide industry AI-powered observations that discover, solve, and predict climate issues at a fraction of the cost of traditional satellites.

- Similarly, in April 2022, Pixxel launched India's first private commercial imaging satellite, "Shakuntala," as a part of its planned 36-satellite constellation aboard a SpaceX Falcon-9 rideshare mission.

- The availability of open-source data for various countries can challenge the commercial satellite imaging market. Open-source data refers to satellite imagery and other freely available data to the public, often provided by government agencies or organizations.

- In the post-COVID-19 market, businesses and government organizations are preparing for an innovation shift since the restrictions are lifted to evaluate and modify their supply chains quickly. For instance, in May 2022, the European Space Agency (ESA), Japan Aerospace Exploration Agency (JAXA), and the National Aeronautics and Space Administration (NASA), an independent agency of the U.S. Federal Government that is in charge of the civilian space program as well as aeronautics and space research, announced that they had teamed up to use the combined scientific power of their earth-observing satellites to document global changes in the environment and human society.

Commercial Satellite Imaging Market Trends

Military and Defense is Expected to Hold Significant Market Share

- Military and defense applications are the most extensive end-user application of commercial satellite imagery. The segment's expansion is attributed to the security and surveillance activities, which are crucial functions of every defense organization. The utilization of satellite-based military communications has grown progressively crucial for defense operations worldwide. As the requirement for reliable and secure communications rises, the technology to fulfill this demand has made considerable progress. Satellite communications present an optimal resolution for military operations, as they offer real-time, secure transmission of vital data and communications, even in the most hostile and remote surroundings.

- Various nations have satellites circling the Earth, providing numerous functions. However, because of the security concerns of other countries, they usually have limited access to international airspace. In extreme circumstances, countries might execute shutter control laws that force satellites of foreign countries in regional airspace to turn off their photographic equipment.

- Considering all these global government prohibitions, other parties often obtain geographical information regarding foreign nations. Governments can regulate the characteristics such as quality and clarity of commercially accessible images and impose a ban on a specific place. However, military agencies always tend to have backup plans.

- Therefore, there is a massive diversity of geographical information that is principally customized to various customers' demands. With changes in satellite imagery (such as hyperspectral imaging), the commercial realm is progressively acquiring data that is only used for military purposes and the data modified for the general public.

- Commercial imaging is vital to meeting the needs of both new security and intelligence concerns. This is due to countries' increased attention to evolving their military capabilities and dealing with terrorism threats worldwide. Commercial satellite firms offer vital data for defense and national security. Commercial aerospace has a substantial economic benefit as space becomes more accessible, but government-funded terrorist monitoring using satellite imagery is too expensive.

- Growing military expenditure and defense budgets in most nations are anticipated to aid the growth of the market under study. For instance, in July 2022, the European Commission announced plans to provide a total of around EUR 1.2 billion (USD 1.3 billion) in funding for 61 collaborative defense research and development projects chosen from the first-ever calls for proposals under the European Defense Fund (EDF).

- Furthermore, by leveraging the latest advancements in satellite imaging technology, military forces can gain insight into enemy activities, plans, and locations. Moreover, it can also be used to identify potential targets for aerial reconnaissance and weapons systems.

Asia-Pacific Expected to Register Fastest Growth

- The Asia-Pacific market is expected to grow considerably throughout the forecast period. Increasing government initiatives for satellite imaging to entice global and domestic firms are other vital reasons for the region's market growth.

- The ASEAN countries' developing commercial satellite business is affecting the worldwide commercial satellite imaging industry. The continuing expansion of High Throughput Satellite (HTS) technology is bringing new possibilities and capabilities in various APAC vertical areas.

- For instance, in May 2022, The SuperView Neo-1 01 and 02 imaging satellites from China Siwei were successfully launched by a Long March rocket. They improved China Siwei's already-existing 50 cm resolution SuperView-1 constellation of satellites and offered 30 cm images to clients needing extra channels of extremely high-resolution imaging.

- The region's end-user verticals are adopting new technologies at an exponentially expanding rate, which is bolstering the growth of the commercial satellite imaging market. Governments across the region are also investing in advanced technologies that are expected to shape the future of imaging satellites.

- For instance, the Polar Satellite Launch Vehicle C-53, or PSLV C-53, of the Indian Space Research Organization, was launched from the Sriharikota, India spaceport carrying three Singaporean commercial satellites. The PSLV Orbital Experimental Module, also known as POEM DS-EO, includes an electro-optic, multi-spectral payload to satisfy the demands of humanitarian aid and disaster relief. This payload will give full-color images for land categorization.

Commercial Satellite Imaging Industry Overview

The commercial satellite imaging market is highly fragmented, with the presence of major players like DigitalGlobe Inc., Galileo Group Inc., Planet Labs Inc., SpaceKnow Inc., and Skylab Analytics. among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, European Space Imaging (EUSI) and Airbus announced a strategic partnership to provide the European Maritime Safety Agency (EMSA) with Very High Resolution (VHR) optical satellite imagery. Airbus will be providing imagery collected by Pleiades and Pleiades Neo satellites. SPOT and EUSI will likely be supplying imagery from the current Maxar satellite constellation and other value-added services.

In March 2023, L3Harris Technologies announced it received a USD 765 million contract from NASA to design and build the next-generation, high-resolution imager for NOAA's Geostationary Extended Observations satellite system. The GeoXO Imager will likely provide advanced infrared and visible imagery, more precise observations, and improved water vapor measurements to significantly improve the accuracy and timeliness of weather forecasting in the Western Hemisphere.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Imapct of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Requirement for Efficient Monitoring of Vast Land Areas

- 5.1.2 Rising Smart City Initiatives

- 5.1.3 Big Data and Imagery Analytics

- 5.2 Market Restraints

- 5.2.1 High-resolution Images Offered by Other Imaging Technologies

- 5.3 Market Challenges

- 5.3.1 Availability of Open-Source Data for Various Countries

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Geospatial Data Acquisition and Mapping

- 6.1.2 Natural Resource Management

- 6.1.3 Surveillance and Security

- 6.1.4 Conservation and Research

- 6.1.5 Construction and Development

- 6.1.6 Disaster Management

- 6.1.7 Defense and Intelligence

- 6.2 By End-user Vertical

- 6.2.1 Government

- 6.2.2 Construction

- 6.2.3 Transportation and Logistics

- 6.2.4 Military and Defense

- 6.2.5 Energy

- 6.2.6 Forestry and Agriculture

- 6.2.7 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DigitalGlobe Inc.

- 7.1.2 Galileo Group Inc.

- 7.1.3 Planet Labs Inc.

- 7.1.4 SpaceKnow Inc.

- 7.1.5 Skylab Analytics

- 7.1.6 L3Harris Corporation Inc.

- 7.1.7 BlackSky Global LLC

- 7.1.8 ImageSat International NV

- 7.1.9 European Space Imaging (EUSI) GmbH

- 7.1.10 UrtheCast Corp.