|

市場調查報告書

商品編碼

1687242

建築自動化系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Building Automation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

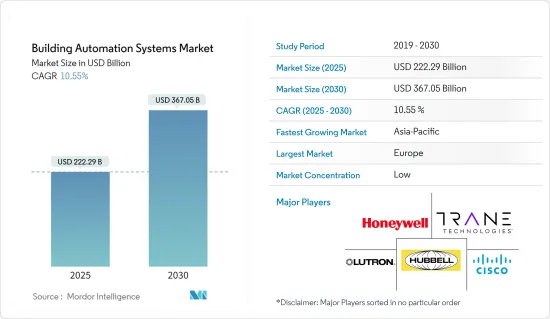

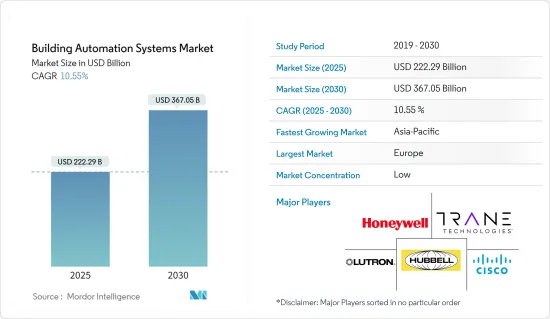

建築自動化系統市場規模預計在 2025 年為 2,222.9 億美元,預計到 2030 年將達到 3,670.5 億美元,預測期內(2025-2030 年)的複合年成長率為 10.55%。

建築自動化系統 (BAS),也稱為建築控制系統或建築管理系統,是一種控制整個建築物中的多個電氣、電子和機械系統的系統。本市場報告追蹤了全球各公司透過銷售建築自動化解決方案所獲得的收益。研究範圍包括建築管理系統、照明控制、火災偵測、暖通空調控制和安全系統等組件,涵蓋住宅和商業終端用戶。

關鍵亮點

- 物聯網的廣泛應用和日益成長的安全問題推動著全球建築自動化系統市場的發展。根據思科年度網際網路報告,明年將有約 300 億台連網設備和連接,高於 2018 年的 184 億台。預計到 2023 年,物聯網設備將佔所有連網裝置的 50%(147 億台),而 2018 年這一比例為 33%(61 億台)。

- 根據美國能源局,建築是美國經濟中最大的能源消耗部門。它約佔全國電力使用量的75%和總能源需求的40%。國際能源總署 (IEA) 表示,為了實現全球淨零目標,到 2030 年所有新建建築和 20% 的現有建築都需要實現零碳排放。

- 根據《美國科學院院刊》發表的報告,未來50年,氣候變遷導致的氣溫快速升高和人口成長預計將導致全球約30%的人口居住在平均氣溫高於29°C的地區。目前,這種氣候存在於地球表面不到 1% 的面積,主要分佈在撒哈拉沙漠最熱的地區。但到 2070 年,預計地球表面約五分之一的面積將達到這種溫度。

- 隨著科技的發展,智慧建築變得越來越複雜,需要透過性能再檢驗進行快速跟進。此外,維護營運完整性也會帶來更大的風險。因此,對綜合建築自動化系統的需求預計將會猛增。為了了解建築物的功能,在系統提供者/設計者和建築物業主之間建立必要的溝通非常重要。

- 受新冠疫情影響,大部分商業和工業建築計劃開工緩慢,部分項目甚至被取消。一些暖通空調製造商不得不關閉生產線數週,安裝人員也發現衛生準則限制了新的安裝計劃。然而,在義大利等歐洲國家,AHU 的銷售受益於 COVID-19 導致的通風需求增加。

建築自動化系統市場趨勢

人口快速成長導致住宅暖通空調需求激增

- 根據聯合國的數據,1950年世界人口為25億人。截至2022年,人口將達到約80億。它還預測,到本世紀末,地球上的人口將達到104億。此外,國際能源總署預測,到2050年,炎熱國家的擁有空調人口將達到25億。這可能會讓 19 億人失去電力,儘管他們也需要空調。根據這項預測,到2050年,炎熱國家的75%的人口可能會使用空調。

- 根據國際貨幣基金組織的數據,2021年美國總人口約3.3218億人。預計人口的成長將增加對新住宅的需求,從而推動暖通空調產業的發展。 HVAC 公司正在製造新產品以增加市場佔有率,並尋求拓展新市場。

- 例如,2022 年 5 月,江森自控-日立推出了一款壁掛式室內迷你分離式機組,作為其 PRIMARY P300 系列高效單區商用迷你分離式系統的最新成員。這種無管道加熱和冷卻系統的開發是為了滿足零售、餐廳和教育設施等中小型空間的獨特需求。新型壁掛式裝置結構緊湊、重量輕,日立整個 PRIMARY 系列迷你分離式系統具有多種安裝選項,使承包商更容易安裝。此外,長管道提供了更大的佈局靈活性,並且廣泛的容量範圍使我們能夠為任何應用提供完美尺寸的系統。

- 夏季氣溫升高、大城市人口減少以及人們日程繁忙導致家用空調的需求增加。隨著空調系統在亞太地區變得越來越普及、越來越便宜、越來越重要,這個問題越來越受到關注。過去可靠的空調很少,但現在的需求很大。這意味著消費者住宅市場必須在盛夏提供可接受的居住條件。

- 根據聯合國預測,2021年7月1日,亞洲人口將達到46.8億左右。亞洲是人口最多的大洲,其人口約為第二大洲非洲的3.5倍。預計亞洲人口將再增加6.2億,到2055年將達到53億的高峰。全球近三分之一的人口生活在亞洲。

歐洲佔了很大的市場佔有率,其中德國引領成長

- 在當前的市場情況下,由於盜竊和搶劫案件的增加,安全系統在德國的市場上獲得了顯著的吸引力。根據德國聯邦刑事警察局統計,2021年共通報了超過1483,000起竊盜案。這表明該地區是一個尚未開發的安全系統市場。

- 對安全的日益關注也促使公司透過產品創新和收購為建築物提供新的安全產品。例如,2022 年 10 月,亞薩合萊 (ASSA ABLOY) 收購了 Bird Home Automation GmbH,這是一家德國製造商,專門為獨棟住宅和多用戶住宅生產高品質 IP 門對講機。此次收購將加速該公司在住宅領域的成長。

- 歐洲住宅終端用戶對智慧門鎖的需求也出現了前所未有的成長。現有的市場參與企業正在透過提供具有多種附加功能的先進智慧門鎖來利用這一需求。

- 例如,2022 年 9 月,Ring 推出了一款針對公寓居住者的新型無線對講設備。這對講機旨在連接到多用戶住宅中使用的大多數建築物範圍的對講系統,以篩選訪客並發出蜂鳴聲讓他們進入。對講機可自動對亞馬遜送貨人員和核准的客人進行身份驗證,使他們無需門禁密碼或額外的遙控器即可發出蜂鳴聲進入。

- 政府對能源效率的監管和舉措不斷增加、盜竊事件增多導致對安全系統的需求以及火災事故造成的損失不斷增加,預計將推動該地區建築自動化系統的成長。各個供應商都在開發新產品以滿足客戶的需求。

建築自動化系統產業概況

建築自動化系統市場較分散,主要參與者包括霍尼韋爾國際公司、思科系統公司、Tran Technologies、路創電子和 Hubbell 公司。此外,每家公司都在透過推出新產品、業務擴張和策略併購來擴大其市場佔有率。

- 2022 年 5 月:三菱電機特靈 HVAC 美國公司是無管道和管道迷你分離式和變冷媒流量 (VRF) 熱泵和空調系統的領先供應商,該公司宣布發布 Building Connect+,這是雲端基礎的控制和監控平台的擴展版本。 Building Connect+ 是一個雲端基礎的安全控制和監控平台,適用於預製建築,用於控制和管理 CITY MULTI 系統和支援 BACnet 的第三方設備。

- 2022年3月,日立與Siam Motors集團(泰國電梯及手扶梯獨家銷售及服務公司)的合資公司日立電梯宣布,在泰國及東南亞地區首個全面智慧建築解決方案業務正式啟動。目的是利用 Lumada IoT 平台為具有實體安全系統和滿足新常態的數位服務的建築物提供價值。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 受政府措施推動,能源和業務效率需求不斷增加

- 市場問題

- 缺乏技術一致性,採購實施成本高

第6章市場區隔

- 按組成部分(市場規模和預測、趨勢、動態)

- 硬體(控制器和現場設備)

- 軟體

- 服務

- 依最終用戶(市場規模、預測、趨勢、動態)

- 住宅

- 商業

- 工業的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Honeywell International Inc.

- Cisco Systems Inc.

- Trane Technologies

- Lutron Electronics Co. Ltd

- Hubbell Inc

- United Technologies Corporation

- Hitachi Ltd

- Huawei Technologies Corporation

- Emerson Electric Co.

- Mitsubishi Electric Corporation

第8章投資分析

第9章:市場的未來

The Building Automation Systems Market size is estimated at USD 222.29 billion in 2025, and is expected to reach USD 367.05 billion by 2030, at a CAGR of 10.55% during the forecast period (2025-2030).

A building automation system (BAS), also referred to as a building control system or a building management system, is a system that controls several electric, electronic, and mechanical systems throughout a building. The market report tracks the revenue accrued by the companies through the sale of building automation solutions worldwide. Components like building management systems, lighting controls, fire detection, HVAC controls, and security systems are included in the scope of the study and span across end users like residential and commercial.

Key Highlights

- The global market for building automation systems has been driven by the increased popularity of the Internet of Things and rising security concerns. According to Cisco's Annual Internet Report, by the next year, nearly 30 billion network-connected devices and connections are expected to exist, increasing from 18.4 billion in 2018. IoT devices are expected to account for 50% (14.7 billion) of all networked devices by 2023, compared to 33% (6.1 billion) in 2018.

- According to the US Department of Energy, buildings are the single largest energy-consuming sector of the US economy. They account for approximately 75% of the nation's electricity use and 40% of its total energy demand. The International Energy Agency states that to hit global net-zero targets, all new buildings and 20% of existing buildings must be zero-carbon as soon as 2030.

- According to a report published in Proceedings of the National Academy of Sciences, in the next 50 years, 30% of the world's estimated population is expected to reside in regions where the average temperature is above 29°C due to climate change-related rapid temperature rise and population expansion. Currently, this climate only exists on less than 1% of the Earth's land surface, mainly in the hottest regions of the Sahara desert. But by 2070, these temperatures are expected to be present across about a fifth of the planet's terrestrial surface.

- With the growth of technology, smart buildings are growing more and more complex, requiring quicker follow-up looks via retro-commissioning. Adding to that, the risks associated with sustained operational integrity are also mounting. Hence, the demand for comprehensive building automation systems is expected to spike. It is very important to establish the necessary communication between the system providers/designers and owners of the buildings to understand the functioning of the building.

- With the COVID-19 outbreak, most commercial and industrial construction projects started at a slower pace, while some were canceled. Production lines at some HVAC manufacturers had to be put on hold for several weeks, and installers saw their new installation projects being limited by sanitary guidelines. However, in European countries such as Italy, AHU sales benefitted from the increased ventilation demand due to COVID-19.

Building Automation Systems Market Trends

Surge in Demand for HVAC Housing, Owing to Rapid Population Growth

- According to the United Nations, there were 2.5 billion people in the world in 1950. There are about 8 billion as of 2022. It also projects that there are expected to be 10.4 billion people living on earth by the end of the century. Moreover, the IEA estimates that, by 2050, up to 2.5 billion individuals in hot countries are expected to own an air conditioner. Even though they would also need air conditioning, 1.9 billion individuals may be left out of the equation. According to this prediction, air conditioners may be used by 75% of people in hot nations by 2050.

- According to the International Monetary Fund, in 2021, the total population of the United States was approximately 332.18 million inhabitants. Such a rise in the population is expected to increase the demand for the construction of new homes, which is expected to drive the HVAC segment. HVAC firms are manufacturing new products to increase their market shares and are looking to expand into new markets.

- For instance, in May 2022, Johnson Controls-Hitachi introduced a new Wall Mount indoor mini-split unit as the latest addition to its PRIMARY P300 line of high-efficiency, single-zone commercial mini-split systems. This ductless heating and cooling system was developed to address the particular requirements of small to medium-sized spaces, such as retail establishments, dining establishments, and educational facilities. The new wall mount unit is small and lightweight, and the entire series of Hitachi PRIMARY mini-split systems have several mounting possibilities, making installation for contractors easier. Its long pipe adds to the layout freedom, and an extensive capacity range ensures a system is precisely the right size for any application.

- There is a greater need for consumer air conditioning due to the rising temperatures during summer, the overpopulation of large cities, and people's busy schedules. There are mounting concerns in the Asia-Pacific region, where air-conditioning systems are becoming more prevalent, affordable, and essential than ever before. There used to be little reliable air conditioning, but there is now a great need. This implies that the consumer housing market must offer acceptable living circumstances during the height of summer.

- According to the United Nations, Asia's population will likely be around 4.68 billion on July 1, 2021. Asia is the most populated continent, with approximately 3.5 times as many people as Africa, which is second. Before reaching a high in 2055 with 5.3 billion inhabitants, Asia is expected to gain another 620 million people. Nearly a third of the world's population is found in Asia.

Europe to Hold Significant Market Share with Germany Leading the Region's Growth

- In the current market scenario, security systems are gaining significant market traction in Germany due to increasing cases of theft and burglary. According to the Federal Criminal Police Office of Germany, over 1,483,000 thefts were reported in 2021. This further indicates the region's substantial untapped market potential for security systems.

- The rise in security concerns is also driving firms to provide new security products for buildings through product innovations and acquisitions. For instance, in October 2022, ASSA ABLOY acquired Bird Home Automation GmbH, a German manufacturer of high-quality IP door intercoms for single and multi-family buildings. This acquisition accelerates the company's growth in the residential segment.

- Europe is also witnessing unprecedented demand spikes in smart door locks from residential end users. Established market players capitalize on this demand by offering advanced smart door locks with several additional features.

- For instance, in September 2022, Ring announced a new wireless intercom device aimed at apartment dwellers. This intercom is designed to connect to most building-wide intercom systems used by apartment complexes to vet visitors and buzz them in. This intercom enables auto-verification for Amazon deliveries and approved guests, which would let them buzz themselves in without needing a door code or an extra fob.

- The rise in government policies and regulations toward energy efficiency, the requirement for security systems due to the increase in theft activities, and the increases in losses due to fire accidents are expected to drive the growth of building automation systems in the region. Various vendors are developing new products to satisfy customer needs.

Building Automation Systems Industry Overview

The Building Automation Systems Market is fragmented, with major players like Honeywell International Inc., Cisco Systems Inc., Trane Technologies, Lutron Electronics Co. Ltd, and Hubbell Inc. Companies are also increasing their market presence by introducing new products, expanding their operations, or by entering into strategic mergers and acquisitions.

- May 2022: Mitsubishi Electric Trane HVAC US, a leading provider of ductless and ducted mini-split and variable refrigerant flow (VRF) heat-pump and air-conditioning systems, announced the release of Building Connect+, an expanded version of the cloud-based controls and monitoring platform. Building Connect+ is a pre-engineered cloud-based secure control and monitoring platform for controlling and managing CITY MULTI systems and BACnet-enabled third-party devices.

- March 2022 - Hitachi Elevator Co. Ltd, a joint venture company of Hitachi Ltd and Siam Motors Group (the exclusive sales and service company of elevators and escalators in Thailand), announced that it had launched a full-scale Smart Building Solution business for the first time in Thailand and Southeast Asia. This aims to provide value to buildings with physical security system and digital service for the new normal by utilizing teh Lumada IoT platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy and Operational Efficiency, Supported by Government Initiatives

- 5.2 Market Challenges

- 5.2.1 Absence of Technology Alignment and High Acquisition and Implementation Costs

6 MARKET SEGMENTATION

- 6.1 By Component (Market Sizing and Forecast, Trends, and Dynamics)

- 6.1.1 Hardware (Controllers and Field Devices)

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End User (Market Sizing and Forecast, Trends, and Dynamics)

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Trane Technologies

- 7.1.4 Lutron Electronics Co. Ltd

- 7.1.5 Hubbell Inc

- 7.1.6 United Technologies Corporation

- 7.1.7 Hitachi Ltd

- 7.1.8 Huawei Technologies Corporation

- 7.1.9 Emerson Electric Co.

- 7.1.10 Mitsubishi Electric Corporation