|

市場調查報告書

商品編碼

1687266

主動地理圍籬 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Active Geofencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

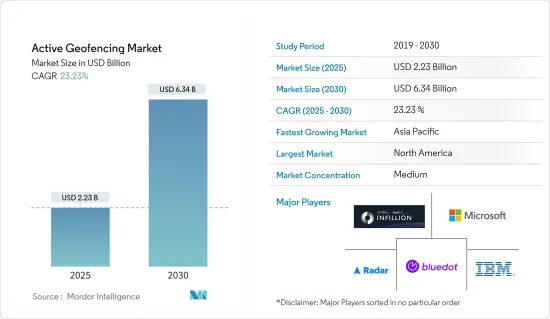

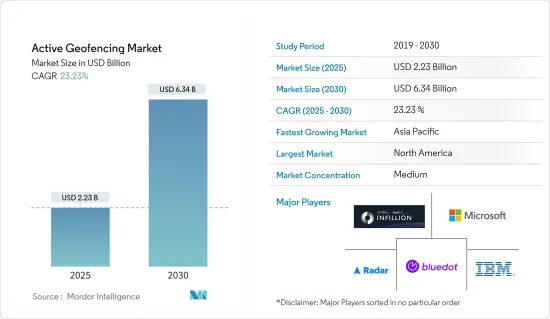

預計 2025 年主動地理圍籬市場規模將達到 22.3 億美元,到 2030 年將達到 63.4 億美元,預測期內(2025-2030 年)的複合年成長率為 23.23%。

由於空間資料的更有效利用、即時定位技術的改進以及全球消費者擴大採用定位應用程式,主動地理圍欄正在不斷發展。

關鍵亮點

- 地理圍欄是一種基於位置的服務,個人最終用戶可以透過應用程式和軟體使用該服務,這些應用程式和軟體利用 GPS、PFID、WiFI 和行動資料等技術,一旦設備離開稱為地理圍欄的地理區域虛擬邊界,就會觸發預先編程的操作。

- 空間資料和即時定位技術的日益普及正在改變人們和企業與世界互動的方式,並帶來巨大的節省。各種設備和系統都連接到網際網路:電話、智慧建築、汽車導航、工業、自動駕駛汽車等等。為了維持系統日常正常運行,需要提供即時位置資訊的技術。

- 由於技術的靈活性和能力,主動地理圍欄的進步正在不斷增加。市場成長受到數位行銷、叢集、自動駕駛汽車以及自帶設備日益普及等趨勢的推動。因此,預計所研究的市場將保持強勁,並見證市場參與企業的顯著成長貢獻。

- 對於位置追蹤日益成長的擔憂和監管可能會威脅主動地理圍欄技術。此外,由於缺乏處理各地區隱私和資料收集的監管機構,主動地理圍欄解決方案受到阻礙。

- COVID-19 病毒增加了醫療保健、工業等多個領域對主動地理圍籬的使用。例如,每家公司都必須提交申請來識別其場所內的員工並立即直接聯繫他們。主動地理圍籬有助於緊急情況下的安全及時通訊。

主動地理圍籬市場趨勢

零售領域顯著成長

- 主動地理圍籬允許零售商識別銷售點規定半徑範圍內的潛在客戶,並向他們發送個人化通知和具體優惠。此外,隨著數位化不斷擴展到所有零售領域,零售業對有效地理圍籬的需求正在迅速成長。

- 利用地理圍欄資料的廣告宣傳往往具有更高的投資收益,因為零售商可以瞄準最有可能使用其服務或產品的消費者。這意味著零售商的利潤更高。

- 展望未來,主動地理圍欄有望與擴增實境(AR)、客戶和先進技術相結合,創造更數位優先、個人化的購物體驗。隨著越來越多的行動裝置變得穿戴式,顧客將期望體驗更數位化、個人化的購物體驗。預計在未來預測期內,零售業中的主動地理圍籬將變得更加普遍。

- 最近一項關於影響未來購物趨勢的研究預測,到 2025 年,大約三分之一的美國消費者將在線上購買商品時使用 AR 技術。 AR技術允許在網路購物時進行虛擬產品瀏覽。根據這項研究,沙烏地阿拉伯和阿拉伯聯合大公國等國家預計 AR 使用率將高達 45%,而在歐洲,這一比例則明顯較低。

預計北美將佔據大部分市場佔有率

- 在北美,投資和創新正在涉及各種終端的主動地理圍欄,包括醫療保健、運輸和物流、金融服務業和安全。空間資訊和即時定位技術的融合正在推動該地區市場的發展。

- 此外,該地區主要由能夠使用主動地理圍欄的 BFSI 行業、零售業以及運輸和物流行業的公司主導。此外,北美是世界上兩個最新興的經濟體的所在地:美國和加拿大。由於該地區擁有強大的通訊網際網路基礎設施,該地區也處於市場領先地位。

- 此外,數位技術的廣泛部署和所有企業對商業智慧工具的需求的成長,導致各種地理圍欄解決方案對自動化工具的採用增加。

- 然而,許多本地零售商現在正在透過數位優惠和促銷活動應用主動地理圍欄來增強客戶忠誠度。零售商還可以更好地了解顧客在訪問特定商店之前和之後來自哪裡。

主動地理圍籬產業概述

由於 Bluedot Innovation Pty Ltd、Infillion Inc. (GIMBLE)、IBM Corporation、Microsoft Corporation、Radar Labs Inc. 等知名供應商的存在,主動地理圍籬市場已半固體。主要企業參與了收購和夥伴關係等各種策略,以提高市場佔有率並增加所研究市場的盈利。

- 2023 年 7 月,Radar 宣布與 Cordial 合作,透過基於位置的體驗(包括內部應用模式、商店地圖和定位器以及地址自動完成)來提高參與度和收益。 JOANN 等品牌正在利用 Radar 的位置基礎設施和 Cordial 的行銷和資料平台的組合,即時為客戶提供高度個人化、與情境相關的體驗。

- 2023 年 6 月,Autodesk 宣布與地理資訊系統 (GIS) 軟體的全球產業領導者 Esri 建立策略聯盟。 ArcGIS GeoBIM 將 Autodesk BIM Collaborate Pro 與 Esri 的 ArcGIS Online 整合,提供設計模型和智慧定位的整體視圖,以降低風險、增加計劃協作並改善相關人員的溝通。

- 2022 年 9 月,M3 宣布對其專有勞動力管理軟體 M3 labor 進行重大改進,該軟體包含地理圍欄和信標技術。此新功能可讓 M3 Labor Service 使用者在一定半徑範圍內設定員工可以打卡上下班的區域。這些新功能旨在使飯店員工能夠在需要的時間和地點打卡上下班,同時防止他們在其他地點打卡上下班,從而避免打卡錯誤的可能性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 空間資料的使用日益增多,即時定位技術的改進

- 基於位置的應用程式的消費者滲透率

- 市場限制

- 提高消費者對位置追蹤安全保障的意識

第6章市場區隔

- 按組織規模

- 中小企業

- 大型企業

- 按最終用戶產業

- 銀行、金融服務和保險

- 零售

- 國防、政府和軍隊

- 醫療保健

- 製造業

- 運輸和物流

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Bluedot Innovation Pty Ltd

- Infillion Inc.(GIMBLE)

- IBM Corporation

- Microsoft Corporation

- Radar Labs Inc.

- Google LLC

- Samsung Electronics Co.

- Verve Inc.

- Apple Inc.

- LocationSmart

- SZ DJI Technology Co.

- ESRI

第8章投資分析

第9章:市場的未來

The Active Geofencing Market size is estimated at USD 2.23 billion in 2025, and is expected to reach USD 6.34 billion by 2030, at a CAGR of 23.23% during the forecast period (2025-2030).

Active geofencing is growing due to more effective use of Spatial Data, improving Real Time Location Technologies, and increased adoption worldwide for location-bassed applications by consumers.

Key Highlights

- Geofencing is a location-based service used by each end user, for which an application or software uses technologies such as GPS, PFID, WiFI, and mobile data to enable them to trigger preprogrammed actions when the device leaves virtual boundaries of geographical zones known as geofences.

- How people and businesses interact with the world and make huge savings has changed due to the increased use of spatial data and real-time location technologies. All kinds of devices and systems are connected to the Internet, such as phones, Smart buildings, car navigation systems, industries, or fleets of autonomous vehicles. Technology that provides real-time location data is required to maintain the system's proper functioning on a daily basis.

- With technological flexibility and capabilities, advancement in Active Geofencing is increasing. The market's growth is driven by trends such as digital marketing and clustering, autonomous cars, increased adoption of Bring Your Own Device, etc. The market studied, therefore, is expected to remain robust and will have a significant growth contribution from players in the market.

- Increasing concerns and regulations regarding location tracking can threaten active geofencing technologies. Moreover, active geofencing solutions are being held back due to the lack of regulatory bodies dealing with privacy and data collection in various regions.

- The COVID-19 virus increased the use of Active Geofences in several sectors, such as healthcare, industry, and many others. For example, an application had to be submitted by individual companies to identify staff at their premises and communicate with them directly and immediately. Active geofencing has facilitated secure, timely communication during an emergency.

Active Geofencing Market Trends

Retail Segment to Witness Significant Growth

- An active geofence enables retailers to determine potential customers within a defined radius of any point of sale, sending them personalised notifications and specific offers that they can use in order to make their purchases. In addition, as digitisation continues to spread across all retail sectors, demand for effective geofencing is growing rapidly in the retail sector.

- In view of the fact that retailers can target consumers who are most likely to take part in their services or products, advertising campaigns using geofenced data tend to deliver higher return on investment. This leads to higher profits for retail organisations.

- Moreover, In the future, active geofencing will be combined with augmented reality (AR), customers and advanced technologies andexpect a more digital-first, personalized shopping experience. As more mobile devices become wearables, customers are expected to experience a more digital first and personalised shopping experience. In the coming forecast period, this will lead to a higher uptake of active geofencing in retail.

- Recent research on trends which are shaping the future of shopping, predicts that by 2025, about one third of consumers in the United States will be using AR technologies when purchasing products online. AR technologies enable virtual product viewing when shopping online. The study showed that while in countries like Saudi Arabia and United Arab Emirates, the expected use of AR was as high as 45 percent, in Europe, this share was much lower.

North America is Expected to Hold the Major Share of the Market

- In North America, active geofencing investments and innovation have been made at various endpoints, such as healthcare, transport, logistics, financial services sector, security, and many others. Market forces push for integrating spatial information and real-time location technologies in this region.

- Further, this region is dominated by companies in the BFSI sector, retail and transport, and logistics sectors capable of using active geofencing. In addition, North America has one of the most developed economies in the world in the form of the United States and Canada. As a result of the strong communication and Internet infrastructure in the region, it is also leading the market.

- In addition, the adoption of automated tools that take different geofence solutions has increased due to the wide deployment of digital technologies and the growing demand for business intelligence tools in all kinds of enterprises.

- However, many regional retailers are increasingly applying active geofencing through digital offers and promotions to strengthen customer loyalty. Retailers can also better understand where their customers are coming from before and after they visit one particular shop.

Active Geofencing Industry Overview

The active geofencing market is semi-consolidated due to prominent vendors like Bluedot Innovation Pty Ltd, Infillion Inc. (GIMBLE), IBM Corporation, Microsoft Corporation, Radar Labs Inc., etc. The key players are involved in various strategies, such as acquisitions and partnerships, to improve their market share and enhance their profitability in the market studied.

- In July 2023, Radar announced our partnership with Cordial, Increasing engagement and revenue through location-based experiences like on-premise app modes, store maps and locators, and address autocomplete. In real time, brands such as JOANN deliver highly personalised, contextually relevant experiences to their customers through the combination of Radar's industry location infrastructure with Cordial's marketing and data platform.

- In June 2023, Autodesk has announced the strategic partnership with Esri, one of the global industry leader in Geographic Information System (GIS) software, Where the Autodesk BIM Collaborate Pro and Esri's ArcGIS Online integrate through ArcGIS GeoBIM for a holistic view of design models and location intelligence to reduce risk, provide better project collaboration, and improve communication with stakeholders.

- In September 2022, M3 announced significant advancements to its proprietary Labour Management software, M3 labor, consisting of geofencing and beacon technologies. With this new functionality, users of the M3 Labour service can create an area radius where staff can punch in and out at work. These new features are intended to ensure that hotel staff clock in and out when and where they should while preventing them from doing so elsewhere, thereby avoiding the possibility of false and erroneous punching.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Use of Spatial Data and Improved Real-time Location Technology

- 5.1.2 Higher Adoption of Location-based Application among Consumers

- 5.2 Market Restraints

- 5.2.1 Rising Awareness Regarding Safety and Security among Consumers of Location Tracking

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small-Scale and Medium-Scale Businesses

- 6.1.2 Large-Scale Businesses

- 6.2 By End-user Industry

- 6.2.1 Banking, Financial Services, and Insurance

- 6.2.2 Retail

- 6.2.3 Defense, Government, and Military

- 6.2.4 Healthcare

- 6.2.5 Industrial Manufacturing

- 6.2.6 Transportation and Logistics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bluedot Innovation Pty Ltd

- 7.1.2 Infillion Inc. (GIMBLE)

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Radar Labs Inc.

- 7.1.6 Google LLC

- 7.1.7 Samsung Electronics Co.

- 7.1.8 Verve Inc.

- 7.1.9 Apple Inc.

- 7.1.10 LocationSmart

- 7.1.11 SZ DJI Technology Co.

- 7.1.12 ESRI