|

市場調查報告書

商品編碼

1687274

隱私過濾器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Privacy Filters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

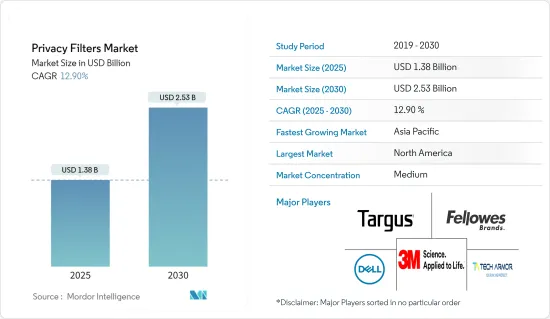

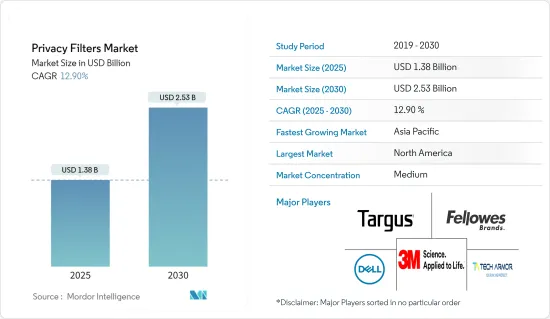

隱私過濾器市場規模預計在 2025 年為 13.8 億美元,預計到 2030 年將達到 25.3 億美元,預測期內(2025-2030 年)的複合年成長率為 12.9%。

主要亮點

- 隨著筆記型電腦、智慧型手機、桌上型電腦和平板電腦等智慧連網型設備在商業和企業內的服務和用途不斷擴大,安全問題也日益凸顯。視覺駭客攻擊是最常見和傳統的駭客方法之一,就是這樣一種威脅。這使得員工無論何時離開辦公室都可以窺探公司的機密資訊。

- 隨著越來越多的企業轉向數位化流程,資料安全變得更加重要。處理或存取敏感業務或客戶資料的業務和 IT負責人可能需要在旅途中或在公共場所存取資料,這增加了敏感資料外洩的風險。

- 未經授權的個人可能能夠查看筆記型電腦、顯示器和平板電腦上顯示的資料。雖然防毒軟體、加密和身分驗證是資料安全的傳統支柱,但實體螢幕隱私可以在全面的資料保護計畫中發揮關鍵作用。

- 複雜的線上付款流程也需要隱私過濾器。顯示密碼或密碼的螢幕上的敏感資訊可能會被旁觀者獲取,並隨後用於惡意活動。訊息、聊天、照片、聯絡人等個人資料必須在暴露的環境中受到保護,從而增加了對隱私過濾器的需求。

- 螢幕過濾器如此受歡迎是因為它們易於安裝和拆卸。顯示器有夾式和磁性式兩種。儘管可移除黏性隱私過濾器(像典型的螢幕保護貼一樣貼在螢幕上)已廣泛用於平板電腦、筆記型電腦和智慧型手機,但缺乏知識仍然是整體市場成長的主要障礙。

- 自從新冠肺炎疫情以來,典型的職場已經發生了變化。由於許多員工選擇在職場以外的地方工作,電腦顯示器上顯示的機密資訊更容易受到人們的窺視。隱私過濾器是一種經濟實惠且簡單的方法,可以保護敏感的螢幕資訊免受視覺駭客和窺探的侵害。預計這將在預測期內增加對隱私過濾器的需求。

電子濾波器市場趨勢

金融機構預計將佔很大佔有率

- 未來幾年,金融機構對電子過濾器的需求將大幅增加。隨著客戶安全問題日益凸顯、資料外洩日益增多以及法律和法規環境日益複雜,消費者資料在儲存、傳輸和存取時必須受到保護。消費者資料保護和內部財務報表對於金融機構來說變得越來越重要,從而推動了對電子過濾器的需求。

- 金融機構不斷尋找新的方法來使用和存取資料,以幫助他們的客戶和企業,更好地服務客戶,資料尋找新的收益來源。在這個新時代,銀行家比以前更容易取得客戶資料。

- 然而,隨著這個資料湖的擴大,嚴重的隱私問題也隨之出現,視覺隱私變得越來越難以控制。電子過濾器在金融機構中有著重要的應用,因為它們可以提供保護資料的視覺隱私。根據 Kroll 的資料,2023 年金融業將遭遇 27% 的資料洩露,而 2022 年這一比例為 19%。因此,企業正在投資資料保護以防止資料被利用。

- 銀行和其他金融機構正受到越來越多的審查,以確定其是否採取了足夠的安全措施,尤其是在過去幾年發生多起備受矚目的資料外洩事件之後。隱私過濾器非常適合為電腦顯示器上的個人或機密資訊增加安全性。

- 此外,為了遵守資料保護條例並保護敏感的財務資料,銀行和金融機構正在確保幾個關鍵領域的視覺隱私。 3M 等多家供應商正在利用這一機會,提供為顯示器、筆記型電腦和行動裝置提供視覺隱私的過濾器,防止敏感的顧客、客戶和金融機構資料暴露給視覺駭客。

亞太地區可望創下最快成長

- 全球化進程的加速使得亞太地區現有的資料隱私法規受到越來越多的關注。過去的一年,亞洲多個國家修改、公佈或審查了資料隱私法規或框架。

- 除了網路駭客攻擊外,駭客使用攝影機捕獲資料的視覺駭客攻擊也正在興起。駭客只需捕捉您的電腦或平板電腦螢幕的影像即可快速取得敏感資訊。這是一個重大問題,尤其是在中國、印度、斯里蘭卡、韓國和其他東南亞國家等新興國家。在醫療保健領域,健康資訊並不是醫生收集的唯一資訊。醫療保健專業人員在處理個人和財務資訊(例如社會安全號碼)時應該小心謹慎。

- 此外,中國、韓國、日本和台灣等國家也是筆記型電腦和智慧型手機的重要製造國。智慧型手機是亞洲數位成長的主要催化劑,它將數百萬人連接在一起,推出了龐大的社交網路,並刺激了電子商務和大規模數位交易。

- 近年來東南亞國家的智慧型手機代工數量一直呈上升趨勢,尤其是泰國、越南等國家,持續的經濟成長帶動了智慧型手機代工銷售的快速發展。

- 對5G擴展的支持也在增加,預計最終將促進該地區的市場成長。韓國、日本、澳洲、中國和台灣的通訊監管機構和政府部門推出了國家5G戰略和行動計劃,共用了建立5G生態系統的願景和指導方針。

- 這些法規正在推動智慧型手機的成長。隨著智慧型手機的興起,對隱私過濾器的需求也隨之增加,因為大多數重要資料和資訊現在都可以在這些裝置上取得。

電子濾波器產業概況

由於消費者對隱私過濾器的需求不斷成長,隱私過濾器市場正變得半固體,從而導致產量增加。此外,參與者也在產品創新和低價方面競爭。市場的主要企業包括 3M Company、Targus Inc.、Tech Armor、DMC 等。

- 2024年8月,雨科技推出Laptop Switchable Privacy(筆記型電腦可切換隱私)。筆記型電腦可切換隱私功能針對蘋果、戴爾、惠普、華為和聯想等頂級製造商,允許用戶在共享和隱私模式之間切換,以控制其他人如何查看他們的螢幕。該產品預計將引起執行 IT 政策的企業和希望在公共場所保護個人資料的消費者的特別關注。

- 2024 年 5 月,戴爾推出了全面的 Copilot+AI PC 產品組合。這有望為消費者和專業人士帶來新的變革性人工智慧體驗並提高他們的工作效率。新的 Windows Studio Effects 提供新的創新濾鏡,幫助您調整燈光並加快通話協作。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 光學舒適度和設備保護

- 對資料隱私和安全的擔憂日益加劇

- 市場限制

- 用戶對隱私過濾器缺乏認知

- 新冠疫情及其他宏觀經濟因素對市場的影響

第6章 市場細分

- 按應用

- 筆記型電腦

- 監視器

- 智慧型手機

- 藥片

- 按功能

- 膠合劑類型

- 磁力型

- 其他功能

- 按最終用戶產業

- 金融機構

- 教育機構

- 律師事務所

- 政府

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- 3M Company

- Targus

- Dell Inc.

- Tech Armor

- Fellowes Brands

- Kensington Computer Products Group(ACCO Brands)

- MoniFilm(Right Group Co. Ltd)

- EPHY Privacy(Advance Services & Solutions Ltd)

- Upscreen(Bedifol GmbH)

- KAPSOLO Europe ApS

- Fujitsu Limited

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 59024

The Privacy Filters Market size is estimated at USD 1.38 billion in 2025, and is expected to reach USD 2.53 billion by 2030, at a CAGR of 12.9% during the forecast period (2025-2030).

Key Highlights

- With the expanding service and application of smart connected devices, such as laptops, smartphones, desktops, and tablets, in companies and enterprises, security problems are also increasing. Visual hacking, one of the most common and traditional hacking techniques, is one such threat. It allows workers to spy on confidential company information anytime they leave the office.

- Data security becomes more critical as more firms transition to digital processes. Business representatives or IT experts who work with or have access to susceptible data belonging to a company or client may occasionally be required to travel or access the data in public locations, expanding the risk of sensitive data exposure.

- Unauthorized eyes may view the data displayed on a laptop, monitor, or tablet. While antivirus software, encryption, and authentication are the mainstays of traditional data security, physical screen privacy could play a noteworthy role in a comprehensive data protection program.

- Advanced online payment processes also necessitate privacy filters. Sensitive information on the screen displaying passwords and PINs can be picked up by onlookers and used later for malicious activities. Personal data, like messages, chats, pictures, and contacts, must be protected in an exposed environment, driving the demand for privacy filters.

- The prevalence of screen filters is simple to apply and remove. They are available as clip-ons or in magnetic form for monitors. Detachable adhesive privacy filters are widely available for tablets, laptops, and smartphones that adhere to the screen, similar to a typical screen protector; however, the lack of knowledge is a significant barrier to the market's overall growth.

- The typical workplace has evolved post-COVID-19. Sensitive information shown on computer displays is more vulnerable to wandering eyes because many employees choose to work from areas outside of the workplace. Privacy filters are an affordable and straightforward way to prevent visual hackers and pry eyes from seeing critical screen information. This is expected to contribute to the demand for privacy filters during the forecast period.

Electronic Filters Market Trends

Financial Institutions Are Expected to Hold a Major Share

- The need for electronic filters will grow significantly in financial institutions over the coming years. With rising customer security sensitivity, growing data breaches, and an increasingly complex legal and regulatory environment, consumer data needs to be protected while stored, transferred, and viewed. Consumer data protection and internal financial statements are becoming essential in financial institutions, driving the need for electronic filters.

- Financial institutions are continuously discovering new ways to use and access data to rescue customers and the company, serve customers better, and find new revenue sources. In this new era, bankers have greater customer data access than ever.

- However, as this data lake widens, critical privacy issues arise, and visual privacy becomes increasingly difficult to control. Electronic filters offer visual privacy to protect data, thus finding significant applications in financial institutions. According to Kroll's data, the finance sector recorded 27% of data breaches in 2023, compared to 19% in 2022. Thus, companies invest in data protection to prevent data exploitations.

- Banks and other financial institutions worldwide are under increasing scrutiny to ensure they have the appropriate security measures in place, especially in the wake of the numerous high-profile data breaches that have occurred over the past few years. Privacy filters are ideal for adding security to personal and confidential information on a computer display.

- Further, to remain compliant with data protection regulations and protect sensitive financial data, banks and financial institutions ensure visual privacy in several key areas. Various market vendors, such as 3M, are capitalizing on this opportunity and offering filters that provide visual privacy on monitors, laptops, and mobile devices, preventing sensitive client, customer, and financial organization data from being exposed to visual hackers.

Asia-Pacific is Expected to Register the Fastest Growth

- The growth in globalization has increased the focus on existing data privacy rules across Asia-Pacific. Over the past year, several Asian nations amended, released, or reviewed their data privacy regulations and frameworks.

- In addition to cyber hacking, visual hacking has increased, where hackers capture data using cameras. Hackers can quickly obtain sensitive information from a computer or tablet screen simply by capturing an image of the screen. It has become a significant concern, especially in developing countries like China, India, Sri Lanka, Korea, and other Southeast Asian nations. Physicians collect more than health information in healthcare. Healthcare professionals should be conscientious when dealing with personal and financial information, such as social security numbers.

- Furthermore, countries like China, Korea, Japan, and Taiwan are critical laptop and smartphone manufacturers. Smartphones are a primary catalyst behind Asia's digital growth, connecting millions, launching social networks at scale, and spurring e-commerce and large-scale digital transactions.

- The sales volume of smartphone manufacturing in Southeast Asian countries has been on an upward trend in recent years, especially in Thailand and Vietnam, where continued economic growth has contributed to the rapid development of smartphone manufacturing sales volume.

- The support for 5G expansion is increasing, which is expected to eventually boost market growth in the region. Telecom regulatory bodies and government authorities in South Korea, Japan, Australia, China, and Taiwan have launched national 5G strategies or action plans, sharing the vision and guidelines to establish 5G ecosystems.

- These regulations are boosting the growth of smartphones. With more smartphones, the demand for privacy filters is also increasing as most of the critical data and information are available nowadays on these devices.

Electronic Filters Industry Overview

The privacy filter market is semi-consolidated due to the constant increase in demand for consumer privacy filters, leading to higher production. Moreover, players are competing among themselves with product innovation and low prices. The key players in the market include 3M Company, Targus Inc., Tech Armor, and DMC Co. Ltd.

- August 2024: Rain Technology launched its Laptop Switchable Privacy. Targeted at tier-one manufacturers like Apple, Dell, HP, Huawei, and Lenovo, Laptop Switchable Privacy allows users to switch between Share Mode and Privacy Mode and control the visibility of their screens to those around them. This product is expected to be of particular interest to enterprises that enforce IT policies and consumers who want to protect personal data in public spaces.

- May 2024: Dell introduced a comprehensive portfolio of Copilot+ AI PCs. This is expected to bring new transformative AI experiences to consumers and professionals, enhancing productivity. The new Windows Studio effects help adjust lighting and offer new creative filters to accelerate call collaboration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Optical Comfort and Device Protection

- 5.1.2 Rising Data Privacy and Security Concerns

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness about the Privacy Filters among the Users

- 5.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Laptops

- 6.1.2 Monitors

- 6.1.3 Smartphones

- 6.1.4 Tablets

- 6.2 By Feature

- 6.2.1 Adhesive

- 6.2.2 Magnetic

- 6.2.3 Other Features

- 6.3 By End-user Industry

- 6.3.1 Financial Institution

- 6.3.2 Educational Institution

- 6.3.3 Legal Firm

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3M Company

- 7.1.2 Targus

- 7.1.3 Dell Inc.

- 7.1.4 Tech Armor

- 7.1.5 Fellowes Brands

- 7.1.6 Kensington Computer Products Group (ACCO Brands)

- 7.1.7 MoniFilm (Right Group Co. Ltd)

- 7.1.8 EPHY Privacy (Advance Services & Solutions Ltd)

- 7.1.9 Upscreen (Bedifol GmbH)

- 7.1.10 KAPSOLO Europe ApS

- 7.1.11 Fujitsu Limited

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219