|

市場調查報告書

商品編碼

1687277

動態隨機存取記憶體(DRAM):市場佔有率分析、產業趨勢與成長預測(2025-2030)Dynamic Random Access Memory (DRAM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

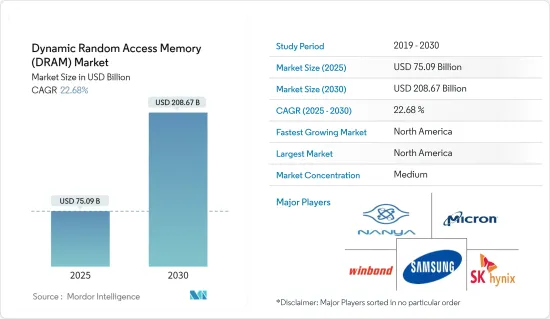

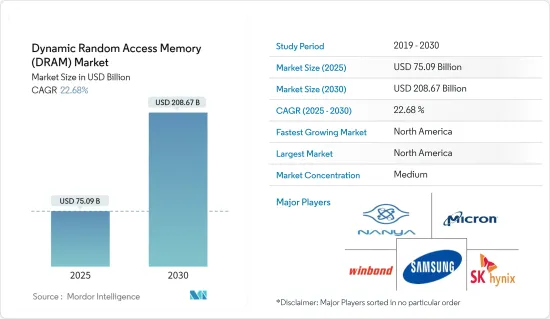

動態隨機存取記憶體市場規模預計在 2025 年為 750.9 億美元,預計到 2030 年將達到 2086.7 億美元,預測期內(2025-2030 年)的複合年成長率為 22.68%。就出貨量而言,預計市場將從 2025 年的 196.2 億台成長到 2030 年的 348.2 億台,預測期間(2025-2030 年)的複合年成長率為 12.16%。

關鍵亮點

- 一種稱為動態隨機存取記憶體 (DRAM) 的半導體記憶體存儲和處理電腦處理器運作所需的資料和程式碼。這種類型的 RAM 常見於個人電腦、智慧型手機、ADAS 系統、智慧型手錶、工作站和伺服器。

- 生成式人工智慧的日益普及正在推動對更快處理速度和更有效率 DRAM 解決方案的需求。例如,美光科技正與高通科技公司合作,加速智慧型手機邊緣產生人工智慧的發展。該公司於 2023 年 10 月向高通交付了其低功耗雙倍資料速率 5X (LPDDR5X) 記憶體的生產樣品。 LPDDR5X 記憶體的運行速度等級為 9.6Gbps,可提供行動生態系統釋放邊緣 AI 力量所需的速度和效能。

- 美光 LPDDR5X 採用其創新的 1B 製程節點技術,為行動用戶帶來先進的省電功能。此外,SK海力士於2023年9月在加州舉辦的2023年AI硬體與邊緣AI高峰會上,發布了基於高速、低功耗、高密度記憶體解決方案GDDR6-AiM的AI加速卡AiMX1的原型。預計AiMX1將為高效能、資料密集型AI系統的開發做出重大貢獻。

- 資料中心對 DRAM 的需求預計將大幅成長,從而推動每年整體 DRAM 需求的成長。人工智慧、串流媒體、遊戲、自動駕駛汽車和其他最尖端科技可能會繼續推動對資料中心的強勁需求。隨著資料中心營運商努力提供支援高效能運算所需的不斷增加的功率密度的能力,我們將看到資料中心架構和技術的進一步創新。人工智慧、物聯網和5G的融合將極大地推動運算和DRAM的需求。

- 由於消費者支出下降、景氣衰退和通貨膨脹上升,預計 23 會計年度全球智慧型手機出貨量將較 22 會計年度大幅下降。三星、蘋果、小米和 Oppo(包括 One Plus)等智慧型手機供應商的智慧型手機銷售量均下滑。繼智慧型手機、平板電腦和個人電腦/筆記型電腦之後,由於消費者支出疲軟、利率下降以及持續的地緣政治緊張局勢導致不確定性增加,2023 會計年度的需求有所下降。這些因素將限制DRAM市場的成長。

- 新冠疫情對DRAM市場的需求與供應都產生了重大影響。世界各地的封鎖和工廠關閉導致供不應求,但預計大部分影響是暫時的。世界各國政府正在採取措施支持半導體產業,這可能會帶來復甦。

動態隨機存取記憶體(DRAM)市場趨勢

資料中心應用領域預計將佔據較大的市場佔有率

- 疫情加速了數位平台和雲端服務的採用,促進了資料中心的發展。資料中心的成長正在推動市場需求,因為 DRAM 是現代企業和資料中心應用正常運作的關鍵元件。據Cloudscene稱,截至2023年9月,全球共有超過9,380個資料中心。

- DRAM供應商一直在調整其產品組合,增加伺服器DRAM產品的晶圓投入,同時盡量減少行動DRAM產品的晶圓投入。造成這種趨勢的原因有二。首先,伺服器DRAM需求前景光明。 AMD 和英特爾的最新伺服器平台最終將於 2022 年向OEM出貨,但認證預計需要六個月時間,這將對近期的伺服器出貨量和相關記憶體需求造成阻力。同時,由於產量持續超過需求,DRAM 供應商一直在大幅增加庫存。

- 第二個原因是,行動DRAM領域在2022年面臨嚴重的供過於求。即使在2023年,對於智慧型手機出貨量的發展以及智慧型手機平均DRAM含量的大幅增加的預測仍然相當保守。因此,DRAM 製造商打算繼續增加伺服器 DRAM 在其產品組合中的佔有率,從而實現資料中心領域的顯著成長。

- 這標誌著企業擴大採用與雲端運算、人工智慧和高效能運算 (HPC) 應用相關的新興技術的一個里程碑。為了處理新興技術工作負載,伺服器的平均 DRAM 容量預計將大幅增加。

- 此外,DDR5 買家庫存在資料中心領域越來越受歡迎。例如,美光科技推出了其 DDR5 晶片,並透露在它們用於客戶端設備之前,其需求主要來自資料中心應用。瑞薩電子以配備 DDR5多工器組合列 (MCR) 雙列直插式記憶體模組的高效能記憶體模組新晶片組引領資料中心領域。另一方面,三星加強減產力度,使得DDR4晶圓的投入量大幅減少,導致伺服器用DDR4庫存吃緊。在這種情況下,伺服器DDR4已經沒有進一步降價的空間。

預計北美將佔很大佔有率

- 由於資料中心、汽車和家用電子電器的應用日益廣泛,北美 DRAM 市場預計將經歷強勁成長。

- 在美國,DRAM 的成長預計將超越個人設備,在雲端運算、伺服器和汽車應用領域的應用也將增加。智慧型手機擴大配備DRAM,由於市場滲透率不斷提高且價格下降,行動電話越來越受到消費者的接受,預計手機將佔據DRAM市場的很大佔有率。隨著使用案例變得更加多樣化以及行動電話變得越來越普及,DRAM 市場的需求預計也將增加。

- 美國行動電話產業是最大的產業之一,對市場的成長有重大影響。該地區投資的增加和生產力的提高是市場的主要驅動力。

- 資料中心營運商需要利用先進的記憶體功能和處理器進步來最佳化平台效能,從而推動對 DDR5 DRAM 市場的需求。美國繼續對資料中心進行大規模投資,預計將刺激DRAM的需求。

- 影響市場的另一個關鍵因素是5G技術的引進。儘管 5G 技術剛剛推出,但預計它將對無線通訊市場產生重大影響。根據埃森哲的分析,預計2021年至2025年間,5G的普及將為美國國內生產總值)貢獻超過1.5兆美元。

動態隨機存取記憶體(DRAM)市場概覽

動態隨機存取記憶體 (DRAM) 市場已呈現半固體狀態,三星電子、SK 海力士和美光等主要參與者佔據了相當大的市場佔有率。地域擴張和產品創新在市場競爭中發揮重要作用。供應商需要提高生產和處理能力,以滿足日益成長的需要提高速度和效能的資料中心、行動和消費者應用的需求。 DRAM 市場的領先供應商正在大力投資 24GB、DDR5、HBM 等下一代晶片,並正在進入為 AI 和 5G 製造 FRAM 的下一階段。這有助於他們在競爭中保持領先,但也意味著他們需要承擔研發成本。

- 2023 年 9 月:三星電子推出其開創性的低功耗壓縮附加記憶體模組 (LPCAMM)外形規格,為個人電腦、筆記型電腦和資料中心的 DRAM 市場帶來重大突破。這項尖端開發成果已通過英特爾平台上的嚴格系統檢驗,實現了驚人的 7.5Gbps 速度。

- 2023 年 6 月:美光科技公司揭露在印度古吉拉突邦建立新的組裝和測試工廠的意圖。該工廠將為國內和國際市場生產 DRAM 和 NAND 產品。新設施將於 2023 年開始建設,並將分階段進行。第一階段將包括 50 萬平方英尺的無塵室空間,預計將於 2024 年底運作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟因素對DRAM產業的影響

第5章市場動態

- 市場促進因素

- 雲端運算、物聯網、5G、人工智慧和行動等大趨勢的持續發展預計將推動未來的需求

- 市場限制

- 行動裝置、平板電腦和筆記型電腦/個人電腦的需求放緩

第6章定價分析

- DRAM現貨價格(每GB)

- 價格趨勢分析

第7章市場區隔

- 按建築

- DDR3

- DDR4

- DDR5

- DDR2/其他架構

- 按應用

- 智慧型手機/平板電腦

- 個人電腦/筆記型電腦

- 資料中心

- 圖形

- 消費品

- 車

- 其他

- 按地區

- 美國

- 歐洲

- 韓國

- 中國

- 台灣

- 其他亞太地區

- 其他

第8章競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- SK Hynix Inc.

- Nanya Technology Corporation

- Winbond Electronics Corporation

- Powerchip Semiconductor Manufacturing Corp.

- Transcend Information Inc.

9.供應商市場佔有率分析

第10章投資分析

第11章:投資分析市場的未來

The Dynamic Random Access Memory Market size is estimated at USD 75.09 billion in 2025, and is expected to reach USD 208.67 billion by 2030, at a CAGR of 22.68% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 19.62 billion units in 2025 to 34.82 billion units by 2030, at a CAGR of 12.16% during the forecast period (2025-2030).

Key Highlights

- Semiconductor memory, called dynamic random access memory (DRAM), stores and processes data or program code necessary for a computer processor's functioning. This type of RAM is commonly found in personal computers, smartphones, ADAS systems, smartwatches, workstations, and servers.

- The growing adoption of generative AI boosts the demand for fast processing and highly efficient DRAM solutions. For instance, Micron Technology partnered with Qualcomm Technologies Inc. to accelerate generative AI at the edge for smartphones. The company shipped production samples of the low-power double data rate 5X (LPDDR5X) memory to Qualcomm in October 2023. The LPDDR5X memory operates at a 9.6 Gbps speed grade, delivering the speed and performance the mobile ecosystem needs to unleash the power of AI at the edge.

- Micron LPDDR5X provides advanced power-saving capabilities for mobile users using its innovative, 1B process node technology. Also, in September 2023, SK Hynix presented a prototype of AI accelerator card, AiMX1, based on the high-speed, low-power, and high-density memory solution GDDR6-AiM at the AI hardware & edge AI Summit 2023 in California. AiMX1 is expected to significantly contribute to developing high-performance, data-intensive, and AI-based systems.

- Datacenter demand for DRAM is projected to grow significantly, which will lift overall DRAM demand annually. Artificial intelligence and other cutting-edge technologies like streaming, gaming, and autonomous vehicles will continue to drive robust demand for data centers. This will drive innovation in data center architecture and technology as operators strive to provide the capacity that supports the increased power density required by high-performance computing. Integrating artificial intelligence, the Internet of Things, and 5G will be a massive tailwind to the demand for computing and DRAM.

- Worldwide smartphone shipments declined significantly in FY 2023 compared to FY 2022 due to decreased consumer spending, economic downturn, and increased inflation. Smartphone vendors such as Samsung, Apple, Xiaomi, and Oppo (including One Plus) witnessed declining smartphone sales. Following smartphones, tablets, and PCs/laptops, demand fell in FY 2023 due to weakened consumer spending, interest rates, and increasing uncertainty due to ongoing geopolitical tensions. These factors will restrict the growth of the DRAM market.

- The COVID-19 pandemic had a significant impact on the DRAM market, both on the demand side and the supply side. Lockdowns and factory shutdowns worldwide contributed to the supply shortage, but many of these impacts are expected to be temporary. Governments worldwide are taking steps to support the semiconductor industries, which could lead to a recovery.

Dynamic Random Access Memory (DRAM) Market Trends

The Data Center Application Segment is Expected to Hold Significant Market Share

- The pandemic accelerated the use of digital platforms and cloud services, boosting data center development. As DRAM is an essential component for the proper functioning of modern enterprise and data center applications, the growth in data centers has significantly fueled the demand in the market. According to Cloudscene, as of September 2023, there were over 9,380 data centers worldwide.

- DRAM suppliers have been working toward adjusting their product mixes to assign more wafer input to server DRAM products while minimizing the wafer input for mobile DRAM products. Two reasons have driven this trend. Firstly, the demand outlook is bright for the server DRAM segment. The latest server platforms from AMD and Intel finally shipped to OEMs in 2022 but are expected to need ~six months for qualifying, facilitating a headwind to near-term server shipments and associated memory demand. Simultaneously, DRAM suppliers are building up significant inventory positions as production surges continue to outpace demand.

- In the second position, the reason lies that the mobile DRAM segment faced a significant oversupply in 2022. In 2023, the projections on the development of smartphone shipments and the surge in the average DRAM content of smartphones remained pretty conservative. As a result, DRAM suppliers intend to keep expanding the share of server DRAM in their product mixes, thus providing significant growth in the data center segment.

- Semiconductor manufacturers are likely to respond to changes in demand by producing more dynamic RAM (DRAM) for servers than for mobile devices this year, a milestone highlighting increasing enterprise use of emerging technology related to cloud computing, AI, and high-performance computing (HPC) applications. To handle the emerging-tech workloads, the average DRAM content of servers is expected to increase significantly.

- Moreover, in the data center segment, the buyer inventory of DDR5 has been gaining popularity. For instance, Micron Technology unveiled its DDR5 chip, which it stated found the most demand from data center applications before popping up in client devices. Renesas has led the data center segment due to new chipsets for high-performance memory modules based on DDR5 multiplexer combined ranks (MCR) dual in-line memory modules. Meanwhile, Samsung's intensified production cutbacks have notably shrunk DDR4 wafer inputs, causing a supply crunch in server DDR4 stocks. This scenario leaves no leeway for further server DDR4 price reductions.

North America is Expected to Hold Significant Market Share

- The market for DRAM is expected to register significant growth in the region owing to its increasing adoption in data centers, automotive, and consumer electronics.

- In the United States, the growth of DRAM is projected to extend beyond personal devices and find increased utilization in cloud computing, servers, and automotive applications. Smartphones are increasingly incorporating DRAM, and mobile phones are anticipated to hold a significant portion of the DRAM market due to their expanding market penetration and declining prices, resulting in greater consumer acceptance. As the range of use cases and mobile phone adoption continues to diversify and expand, the demand for the DRAM market is expected to rise.

- The mobile phone industry in the United States is one of the largest industries, significantly impacting the market's growth positively. Rising investments and growing production rates across the region are significant market drivers.

- Data center operators must optimize platform performance by leveraging advanced memory capabilities and processor advancements, fueling the demand for DDR5 DRAMs in the market. The United States is consistently experiencing substantial investments in data centers, which is anticipated to stimulate the requirement for DRAMs.

- Another significant factor influencing the market is implementing 5G technology. Despite its recent introduction, 5G technology and wireless communication as a whole are projected to have a substantial effect on the market. As per Accenture's analysis, the adoption of 5G is anticipated to contribute more than USD 1.5 trillion to the gross domestic product (GDP) of the United States between 2021 and 2025.

Dynamic Random Access Memory (DRAM) Market Overview

The dynamic random access memory (DRAM) market is semi-consolidated, with the major players in the market, like Samsung Electronics, SK Hynix, and Micron, holding a significant market share. Geographical expansion and product innovation play a vital role in the competitive strategy of market players. Vendors need enhanced fabrication and processing capabilities in line with the increasing data center, mobile, and consumer applications that require improved speed and performance. The prominent vendors in the DRAM market are investing heavily in the next generation of chips, like 24GB, DDR5, and HBM, and have moved into the next phase of making FRAMs for AI and 5G. This is helping them stay ahead of the competition, but it also means they need to be able to pay for their research and development.

- September 2023: Samsung Electronics unveiled the pioneering low-power compression attached memory module (LPCAMM) form factor, marking a significant breakthrough in the DRAM market for personal computers, laptops, and data centers. This cutting-edge development has successfully passed rigorous system verification on Intel's platform, achieving a remarkable speed of 7.5 Gbps.

- June 2023: Micron Technology Inc. revealed its intention to construct a new assembly and test facility in Gujarat, India. The facility will cater to manufacturing DRAM and NAND products in domestic and international markets. The construction of the new facility was to commence in 2023 and will be carried out in phases. The first phase will include 500,000 square feet of cleanroom space and is expected to become operational in late 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the DRAM Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Evolution of Mega Trends Such As Cloud Computing, IoT, 5G, AI, and Mobility are Expected to Create Demand in the Future

- 5.2 Market Restraints

- 5.2.1 Slowdown in the Mobile Device, Tablet, Laptop/PC Demand

6 PRICING ANALYSIS

- 6.1 DRAM Spot Price (Per GB)

- 6.2 Pricing Trends Analysis

7 MARKET SEGMENTATION

- 7.1 By Architecture

- 7.1.1 DDR3

- 7.1.2 DDR4

- 7.1.3 DDR5

- 7.1.4 DDR2/Others Architectures

- 7.2 By Application

- 7.2.1 Smartphones/Tablets

- 7.2.2 PC/Laptop

- 7.2.3 Datacenter

- 7.2.4 Graphics

- 7.2.5 Consumer Products

- 7.2.6 Automotive

- 7.2.7 Other Applications

- 7.3 By Geography

- 7.3.1 United States

- 7.3.2 Europe

- 7.3.3 Korea

- 7.3.4 China

- 7.3.5 Taiwan

- 7.3.6 Rest of Asia-Pacific

- 7.3.7 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Samsung Electronics Co. Ltd

- 8.1.2 Micron Technology Inc.

- 8.1.3 SK Hynix Inc.

- 8.1.4 Nanya Technology Corporation

- 8.1.5 Winbond Electronics Corporation

- 8.1.6 Powerchip Semiconductor Manufacturing Corp.

- 8.1.7 Transcend Information Inc.