|

市場調查報告書

商品編碼

1687281

AI影像識別:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)AI Image Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

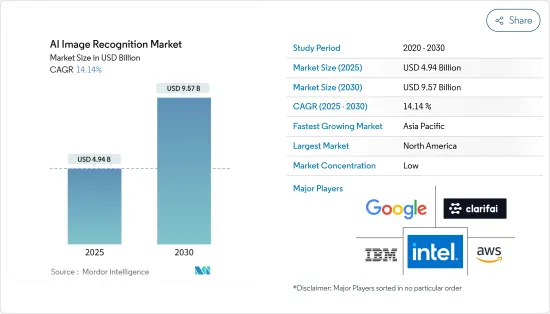

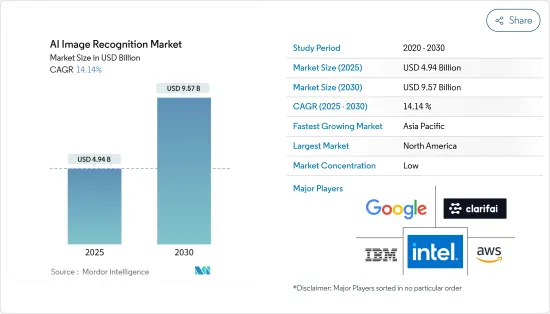

2025年AI影像識別市場規模預估為49.4億美元,預估至2030年將達95.7億美元,預測期間(2025-2030年)複合年成長率為14.14%。

人工智慧 (AI)影像識別可以識別和分類影像中的物件。作為電腦視覺的一個方面,影像識別通常與物件偵測和分類等任務交織在一起。影像識別、照片辨識和影像識別等術語經常互換使用。目前,影像識別是人工智慧(AI)最盈利的應用之一。

主要亮點

- 要訓練影像識別模型,您需要標記的圖像(影片、照片、圖片等)。神經網路利用精選資料集的這些訓練影像來形成對各種類別的識別。一旦整理好,這些影像就會被輸入到神經網路演算法中,體現影像識別模型的深度學習或機器學習性質。這種訓練使卷積類神經網路能夠精確定位特定的類別。訓練完成後,在訓練資料集以外的圖像上對模型進行測試。

- 世界各地擴大採用人工智慧來簡化流程、提高效率和生產標準。由於人工智慧能夠增強和自動化業務並豐富用戶體驗,因此其應用正在加速。這一激增的主要驅動力是人工智慧預期的投資經濟收益(ROI)。企業認知到人工智慧增加收益、降低成本和獲得競爭優勢的潛力。因此,許多國家都在大力投資加速人工智慧的應用,進而擴大市場潛力。

- 巨量資料分析涉及使用流程和技術,特別是人工智慧和機器學習,篩選大量資料集以識別模式並得出可操作的見解。這使組織能夠做出更快、更明智的決策,從而提高效率、收益和利潤。此外,巨量資料和人工智慧領域相互交織,相互推動對方的研究和技術進步。巨量資料技術利用了人工智慧的原理,而人工智慧則依靠大量的巨量資料資料和強大的技術來磨練其決策能力。

- 先進的人工智慧概念,尤其是影像識別,現在對於推動各個領域的創新至關重要。這些領域的專業知識缺乏可能會阻礙新興技術的進步和部署。隨著人工智慧和深度學習在全球範圍內獲得關注並受到從科技巨頭到靈活的中小企業等各類企業的青睞,對熟練的人工智慧工程師的需求正在飆升。然而,儘管需求日益成長,但合格的專業人員卻明顯短缺。

- 人工智慧(AI)影像識別發展因其應用的多樣性而涵蓋整個價值鏈。雖然研發發揮著至關重要的作用,但人工智慧系統需要不斷的訓練和升級才能適應特定的應用。這確保了系統仍然具有相關性並且能夠滿足各個行業的需求。因此,人工智慧產品的開發和部署在不同的領域和用例中有所不同,這取決於最終用戶及其行業的特定要求。

AI影像識別市場趨勢

醫療保健產業成為成長最快的終端用戶產業

- 人工智慧影像識別將徹底改變醫療保健產業,並且已經展示了其潛力。透過實現準確的物體檢測並不斷改進影像分類和分割,人工智慧主導的影像識別正在推動醫療保健服務的創新。

- 醫療診斷是當今市場上電腦視覺最具創新性的應用之一。利用先進的影像識別技術分析醫學影像,檢測多種病症,可以大大提高診斷和早期發現的準確性。這在癌症和腫瘤的檢測中尤其重要,早期檢測對於挽救生命和改善患者預後起著關鍵作用。

- 由於技術進步和對高效、準確診斷工具的需求不斷增加,醫療保健領域對人工智慧影像識別的需求正在迅速成長。人工智慧演算法經過訓練可以分析 X 光、 電腦斷層掃描和 MRI 等醫學影像,並檢測出人眼可能錯過的異常情況。這有助於更早、更準確地診斷疾病。

- 此外,人工智慧可用於自動化影像分割和量化等流程,減輕醫療專業人員的負擔並提高臨床工作流程的效率。人工智慧影像識別的日益普及正在推動醫療保健的轉型,使其能夠提供更快、更準確和個人化的患者照護。

- 多家醫療保健解決方案公司已經展示了戰略舉措,並致力於推動人工智慧影像識別的進步。 2024 年 7 月,GE Healthcare 宣布將收購 Intelligent Ultrasound Group plc 的臨床人工智慧部門。智慧型超音波專門開發旨在增強超音波診斷的人工智慧影像分析工具。 GE 將把這些技術整合到其超音波產品系列中,以簡化工作流程並提高臨床醫生的易用性。

- 此外,GE 計劃引入智慧超音波的研發專家團隊,推動 GE 醫療女性超音波診斷設備和其他解決方案的人工智慧影像識別和創新方面的進步。由於這些發展及其在醫療保健領域的廣泛應用,預計預測期內人工智慧影像識別的採用將會成長。

北美佔有最大市場佔有率

- 美國透過對先進技術、世界一流研究機構以及多元化科學家和企業家隊伍的策略性聯邦投資,維持了強大的創新生態系統,促進了整個北美的人工智慧發展。

- 人工智慧影像識別系統可以即時監控人、人群和物體,識別事故和安全風險,並促進保全服務快速反應。這種能力促使人工智慧公司開發新產品並增強現有解決方案,以滿足多樣化的客戶需求。

- 美國國家人工智慧安全委員會建議國會每年將人工智慧研發經費增加一倍,目標是2026會計年度達到320億美元。拜登政府2023會計年度的聯邦研發預算為2,040億美元,較2021會計年度成長28%。國家人工智慧研究機構正在獲得資助,以促進產學研和政府之間的合作,為影像識別公司整合人工智慧能力創造機會。

- 北美對人工智慧技術的大量投資受到政府支持和行業特定利益的推動。該地區受益於早期技術採用者的身份,並擁有領先的基於人工智慧的影像識別公司。主要服務供應商包括AWS、IBM Watson、Google Cloud和Microsoft Azure,還有許多來自美國和加拿大的AI新興企業。

- 今年 3 月,Google宣布計劃在 2024 年下半年在美國投資數十億美元,以擴展其資料中心基礎設施並支援雲端處理和人工智慧舉措。

- 此外,加拿大 2024 年預算宣佈為人工智慧計畫提供 24 億美元的突破性資金支援。其中包括在五年內撥款 20 億美元用於新推出的加拿大主權人工智慧運算策略。目標是為加拿大研究人員和人工智慧公司提供在全球人工智慧舞台上蓬勃發展所需的工具。

- 此外,2023 年 9 月 27 日,科爾支持加拿大自願行為準則,強調對先進生成人工智慧系統的負責任的開發和管理,以此強調他對人工智慧的奉獻精神。這些積極的政府措施將進一步加速加拿大人工智慧影像識別技術的發展。

AI影像識別產業概況

市場主要企業不斷創新其產品以確保永續的競爭優勢。這種不斷創新的動力正在激發參與者之間的激烈競爭。因此,競爭加劇可能會壓低價格並影響整個行業的盈利。

人工智慧(AI)影像識別工具主要針對大型企業,但對於中小型企業(SME)而言仍有尚未開發的潛力。由於工具都是根據小型企業預算量身定做的,因此競爭非常激烈。

市場的主要參與者包括 Amazon Web Services Inc.(Amazon.Com Inc.)、Google LLC(Alphabet Inc.)、Clarifai Inc.

為了吸引顧客的注意力,你需要花費大量的錢做廣告。擁有強大投資能力的大型公司可以利用這一點來獲得競爭優勢,從而增加小型市場參與者的競爭力。

透明度是這個市場的標誌,有關產品和工具的資訊都可以在網路上輕鬆取得。顧客很精明,他們清楚知道自己想要從某家公司購買什麼產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 人工智慧的採用率不斷提高

- 巨量資料分析的使用日益廣泛

- 擴大科技在醫療保健領域的應用

- 市場限制

- 缺乏技術專業知識

第6章 市場細分

- 按類型

- 硬體

- 軟體

- 服務

- 按行業

- 車

- BFSI

- 衛生保健

- 零售

- 安全功能

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services Inc.(Amazon.Com Inc.)

- Google LLC(Alphabet Inc.)

- Clarifai Inc.

- IBM Corporation

- Intel Corporation

- Micron Technologies Inc.

- Microsoft Corporation

- Nvidia Corporation

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd.

- Xilinx, Inc.(Advanced Micro Devices, Inc.)

第8章投資分析

第9章:市場的未來

The AI Image Recognition Market size is estimated at USD 4.94 billion in 2025, and is expected to reach USD 9.57 billion by 2030, at a CAGR of 14.14% during the forecast period (2025-2030).

Artificial Intelligence (AI) Image Recognition identifies objects within images and categorizes them. As a facet of computer vision, image recognition often intertwines with tasks like object detection and classification. Terms like image recognition, photo recognition, and picture recognition are often used interchangeably. Currently, image recognition stands out as one of the most profitable applications of artificial intelligence (AI).

Key Highlights

- Image recognition models rely on labeled images (be it videos, pictures, or photos) for training. Neural networks utilize these training images from a curated dataset to form perceptions of various classes. Once curated, these images are input into a neural network algorithm, embodying the deep or machine learning essence of the image recognition model. This training empowers convolutional neural networks to pinpoint specific classes. Post-training, the model undergoes testing with images outside its training dataset.

- Organizations worldwide are increasingly adopting AI to streamline processes and elevate efficiency and production standards. AI's capability to enhance, automate operations, and enrich user experiences is fueling its rising adoption. A key driver behind this surge is the anticipated financial return on investment (ROI) from AI. Companies are acknowledging AI's potential to boost revenue, cut costs, and gain a competitive edge. Consequently, numerous countries are making significant investments to accelerate AI adoption, amplifying the market's potential.

- Big data analytics harnesses processes and technologies, notably AI and machine learning, to sift through vast datasets, aiming to pinpoint patterns and derive actionable insights. This empowers organizations to make quicker, more informed decisions, boosting efficiency, revenue, and profits. Furthermore, the realms of big data and artificial intelligence are intertwined, with each driving research and technological advancements in the other. While big data technologies leverage AI principles, AI, in turn, depends on the vast datasets and robust technologies of big data to refine its decision-making prowess.

- Advanced AI concepts, particularly image recognition, are now pivotal in spurring innovation across diverse sectors. Lacking expertise in these domains can hinder the progress and deployment of emerging technologies. As AI and deep learning find their footing worldwide, embraced by everyone from tech behemoths to nimble SMEs, the demand for skilled AI technicians has surged. Yet, this rising need is met with a notable scarcity of qualified professionals.

- Artificial Intelligence (AI) image recognition development spans the entire value chain due to its diverse applications. While research and development (R&D) plays a pivotal role, AI systems require ongoing training and upgrades tailored to their specific applications. This ensures that the systems remain relevant and effective in meeting the demands of various industries. Consequently, both the development and deployment of AI products differ across various segments and uses, depending on the specific requirements of the end-users and the industries they serve.

Artificial Intelligence Image Recognition Market Trends

Healthcare Sector to be the Fastest End-user Vertical

- Artificial intelligence-powered image recognition is poised to revolutionize the healthcare industry and is already demonstrating its potential. By enabling precise object detection and continuously improving image classification and segmentation, AI-driven image recognition is driving innovation in medical services.

- Medical diagnosis represents one of the most transformative applications of computer vision in today's market. By utilizing advanced image recognition to analyze medical imagery and detect various conditions, the accuracy of diagnostics and early detection improves significantly. This is especially critical for cancer and tumor detection, where early identification plays a vital role in saving lives and enhancing patient outcomes.

- The demand for AI image recognition in healthcare is rapidly growing, driven by advancements in technology and the increasing need for efficient and accurate diagnostic tools. AI algorithms are being trained to analyze medical images like X-rays, CT scans, MRIs, and others to detect anomalies that may be missed by the human eye. This leads to earlier and more accurate diagnoses of diseases.

- Furthermore, AI is being leveraged to automate processes such as image segmentation and quantification, reducing the burden on healthcare professionals and enhancing the efficiency of clinical workflows. The increasing adoption of AI-powered image recognition is driving transformation in healthcare by enabling faster, more accurate, and personalized patient care.

- Several healthcare solution-providing companies are witnessing strategic initiatives and working on bringing advancements in AI image recognition. In July 2024, GE HealthCare announced that it would acquire the clinical artificial intelligence division of Intelligent Ultrasound Group plc. Intelligent Ultrasound specializes in developing AI-powered imaging analytics tools designed to enhance ultrasound diagnostics. GE intends to integrate these technologies into its ultrasound product portfolio to streamline workflows and improve usability for clinicians.

- Additionally, GE plans to onboard Intelligent Ultrasound's team of R&D experts to drive advancements in AI-enabled image recognition and innovation for GE HealthCare's Women's Health ultrasound devices and other solutions. With such developments and the wide range of applications in the healthcare sector, the adoption of AI image recognition is expected to grow over the projected period.

North America Holds Largest Market Share

- The United States maintains a robust innovation ecosystem through strategic federal investments in advanced technology, world-class research institutions, and a diverse pool of scientists and entrepreneurs, driving AI development across North America.

- AI image recognition systems enable real-time monitoring of people, crowds, and objects to identify accidents or security risks and facilitate rapid response from security services. This functionality motivates AI companies to develop new products and enhance existing solutions to address diverse customer requirements.

- The National Security Commission on Artificial Intelligence recommended Congress double federal AI R&D funding annually, targeting USD 32 billion by fiscal 2026. The federal R&D budget under the Biden administration's fiscal 2023 plan increased by 28% from FY 2021 to USD 204 billion. The National AI Research Institutes receive funding to facilitate collaboration between industry, academia, and government entities, creating opportunities for image recognition companies to integrate AI capabilities.

- North America's substantial investment in AI technologies stems from government support and industry-specific benefits. The region benefits from early technology adoption and hosts major AI-based image recognition companies. Key service providers include AWS, IBM Watson, Google Cloud, and Microsoft Azure, with numerous AI startups emerging from the United States and Canada.

- In March 2024, Google announced plans to invest billions of dollars through late 2024 in the United States and internationally to expand its data center infrastructure and support cloud computing and AI initiatives.

- Moreover, Canada's 2024 budget unveiled a USD 2.4 billion boost for AI initiatives in a landmark move. This includes a significant allocation of USD 2 billion spread over five years, dedicated to the newly introduced Canadian Sovereign AI Compute Strategy. The aim is to equip Canadian researchers and AI firms with the necessary tools to excel on the global AI stage.

- Additionally, on September 27, 2023, Cohere underscored its dedication to AI by endorsing Canada's Voluntary Code of Conduct, which emphasizes the responsible development and management of advanced generative AI systems. Such proactive government measures are poised to accelerate further the growth of AI-driven image recognition technologies in Canada.

Artificial Intelligence Image Recognition Industry Overview

Key players in the market consistently innovate their products, securing a sustainable competitive edge. This relentless drive for innovation fuels intense competition among players. As a result, heightened competition is likely to push prices down, impacting the industry's overall profitability.

While Artificial Intelligence (AI) image recognition tools predominantly cater to large organizations, there's untapped potential in reaching out to small and medium-sized enterprises (SMEs). By tailoring tools to fit SME budgets, players intensify the competition.

Some of the major players in the market are Amazon Web Services Inc. (Amazon.Com Inc.), Google LLC (Alphabet Inc.), Clarifai Inc., IBM Corporation, and Intel Corporation, among others.

Gaining customer attention demands significant advertising expenditure. Major players, with their capacity for extensive investment, can leverage this to carve out a competitive edge, intensifying the competition for smaller market players.

Transparency is a hallmark of this market; product and tool information is readily available online. Customers are well-informed, knowing precisely what products they seek from specific companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing AI Adoption

- 5.1.2 Increasing Use of Big Data Analytics

- 5.1.3 Growing Applications of the Technology in the Healthcare Sector

- 5.2 Market Restraints

- 5.2.1 Lack of Technical Expertise

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End-user Verticals

- 6.2.1 Automotive

- 6.2.2 BFSI

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Security

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc. (Amazon.Com Inc.)

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Clarifai Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Intel Corporation

- 7.1.6 Micron Technologies Inc.

- 7.1.7 Microsoft Corporation

- 7.1.8 Nvidia Corporation

- 7.1.9 Qualcomm Incorporated

- 7.1.10 Samsung Electronics Co. Ltd.

- 7.1.11 Xilinx, Inc. (Advanced Micro Devices, Inc.)