|

市場調查報告書

商品編碼

1687294

智慧塗料-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Smart Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

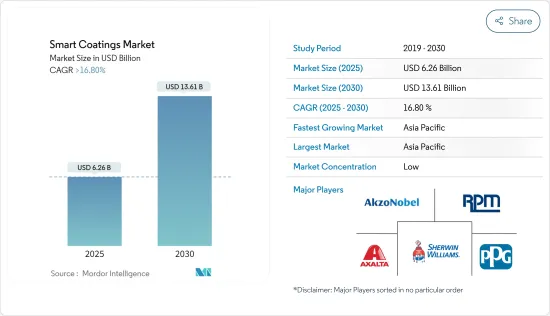

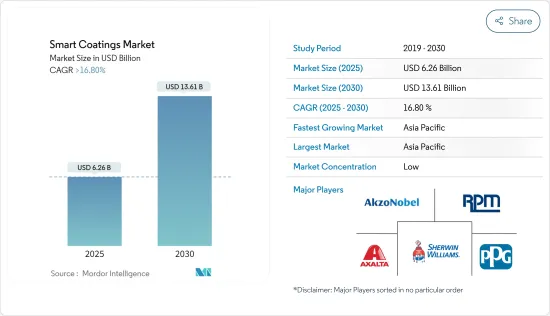

智慧塗料市場規模預計在 2025 年為 62.6 億美元,預計到 2030 年將達到 136.1 億美元,預測期內(2025-2030 年)的複合年成長率將超過 16.8%。

儘管 COVID-19 疫情對市場產生了負面影響,但疫情過後,由於全球建築、汽車、航太和國防等各種終端用戶產業的成長,預計市場在預測期內將穩定成長。

關鍵亮點

- 短期內,優於傳統塗料的優異性能和建築業不斷成長的需求預計將推動市場發展。

- 另一方面,智慧塗料的高成本預計將抑制市場並阻礙其成長。

- 預計未來幾年,奈米粒子在改善功能方面的應用日益增多,以及各種終端用戶行業擴大使用智慧塗料代替傳統塗料,將為機會創造機會。

- 預計亞太地區將主導市場,並在預測期內呈現最高的成長率。

智慧塗料市場趨勢

建築和施工行業的需求正在成長

- 自清潔等智慧塗層正被用於建築物的玻璃牆,以便於維護,特別是在高層商業和辦公大樓中。抗菌塗料廣泛應用於醫院、廚房、公共浴室等。防腐塗料也用於基礎設施和工業建築。

- 亞太地區的建築業是世界上最大的。由於人口成長、中等收入階層的擴大和都市化,中國經濟正在健康成長。

- 根據中國國家統計局的數據,預計2023年全國建築業總產值將達到31.59兆元人民幣(4.43兆美元),而2022年為31.2兆元(4.37兆美元),將刺激市場需求。

- 除住宅建築外,亞太地區近年來辦公空間市場蓬勃發展,是商業建築業最大的市場之一。

- 根據美國人口普查局的數據,建築業是美國經濟的重要組成部分,涉及超過 745,000 家企業。預計2023年整體建築支出將達1.98兆美元,與前一年同期比較成長7.4%。

- 根據歐盟委員會發布的資料,2023年12月歐元區建築業產量年增1.9%,歐盟建築業產量較去年同期成長2.4%。 2023年與2022年相比,歐元區建築產量平均成長率為0.2%,歐盟建築產量平均成長率為0.1%,這推動了該國各種建築應用中智慧塗料的消費。

- 因此,建設活動的強勁成長正在推動市場需求。

中國可望主宰亞太地區

- 就市場佔有率而言,亞太地區在全球智慧塗料市場佔據主導地位。建設活動增加和汽車行業成長等因素正在推動市場發展。

- 智慧塗料在中國建築業的應用越來越廣泛。中國擁有全世界最大的建築業。此外,隨著多個大型建設計劃的實施,預計中國在可預見的未來仍將保持其最大建築業的地位。

- 中國經濟的蓬勃發展很大程度上得益於其豐富的住宅和商業建築開發,這主要得益於經濟成長。在中國,香港住宅委員會已推出多項舉措,推動經濟適用住宅建設。當局的目標是到 2030 年的 10 年內提供 301,000 套公共住宅。

- 預計到 2025 年,印度建築業規模將成長至 1.4 兆美元。到 2030 年,預計將有 6 億人居住在城市中心,因此需要額外建造 2,500 萬套中高階住宅。根據國家投資計畫(NIP),印度的基礎設施投資預算為1.4兆美元,其中24%分配給可再生能源、道路、高速公路和城市基礎設施,12%分配給鐵路。

- 在印度,汽車產業對整體GDP的貢獻率為7.1%。製造業貢獻了該國GDP的49%,年銷售額達7.5兆印度盧比,出口額達3.5兆印度盧比。

- 此外,汽車產量將從2022年的5,457萬輛增加到2023年的5,851萬輛。

- 根據聯合國貿易和發展會議(UNCTAD)的數據,2022年初日本商業船隊載重噸位為40,263,340噸,而2021年初為39,312,530噸,成長率為2.42%,從而增加了國內對智慧塗料的需求。

- 預計所有上述因素都將在預測期內推動市場成長。

智慧塗料產業概況

全球智慧塗料市場正朝半固體方向發展。市場的主要企業包括(不分先後順序):Akzo Nobel NV、PPG Industries Inc.、The Sherwin-Williams Company、RPM International Inc. 和 Axalta Coating Systems, LLC。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 性能優於傳統塗料

- 建築業需求不斷成長

- 限制因素

- 智慧塗料成本高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 功能

- 防污

- 抗菌

- 防鏽

- 防冰

- 自清潔

- 顏色偏移

- 其他

- 最終用戶產業

- 建築與施工

- 車

- 海洋

- 航太與國防

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 其他

- 南美洲

- 中東和非洲

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Axalta Coating Systems LLC

- Dupont

- Hempel AS

- Jotun

- NEI Corporation

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

第7章 市場機會與未來趨勢

- 增加奈米粒子的使用以改善功能

- 智慧塗料在各個終端使用者產業中取代傳統塗料的機會越來越多

The Smart Coatings Market size is estimated at USD 6.26 billion in 2025, and is expected to reach USD 13.61 billion by 2030, at a CAGR of greater than 16.8% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market; however, post-pandemic, the market is projected to grow steadily during the forecast period owing to growth in various end-user industries like construction, automotive, aerospace, and defense worldwide.

Key Highlights

- In the short term, superior properties over traditional coatings and rising demand from the construction industry are expected to drive the market.

- On the other hand, the high cost of smart coatings is expected to restrain the market and hinder its growth.

- The increasing use of nanoparticles to improve functionality and opportunities for smart coatings to replace conventional coatings in various end-user industries are projected to create an opportunity for the market in the coming years.

- Asia-Pacific is expected to dominate the market and witness the highest growth rate during the forecast period.

Smart Coatings Market Trends

The Building and Construction Industry is Experiencing a Growing Demand

- Smart coatings like self-cleaning are used on glass walls in buildings for easier maintenance, especially for high-rise commercial and office buildings. Anti-microbial coatings have extensive applications in hospitals, kitchens, and public bathrooms. Anti-corrosion coatings are also used in infrastructure and industrial buildings.

- The construction sector in Asia-Pacific is the largest in the world. It is increasing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization.

- According to the National Bureau of Statistics of China, the output value of construction works in the country was CNY 31.59 trillion (USD 4.43 trillion) in 2023 compared to CNY 31.2 trillion (USD 4.37 trillion) in 2022, thereby enhancing the demand in the market.

- Apart from residential construction, Asia-Pacific has been a thriving market for office spaces in recent years and is one of the largest markets in the commercial construction industry.

- According to the United States Census Bureau, the buildings and construction industry is a key component of the United States economy, with more than 745,000 businesses involved. In 2023, the overall expenditure on construction climbed to USD 1.98 trillion, signifying a 7.4% rise compared to the year before.

- As per the data released by the European Commission, growth in construction production in December 2023 compared to December 2022 was 1.9% across the euro area and 2.4% across the European Union. The Y-o-Y average increase in construction production in 2023 compared to 2022 was 0.2% for the euro area and 0.1% for the European Union, thereby enhancing the consumption of smart coatings from various construction applications in the country.

- Hence, such robust growth in construction activities is fuelling the demand in the market.

China is Expected to Dominate the Asia-Pacific Region

- Asia-Pacific dominated the global smart coatings market in terms of market share. Factors such as increasing construction activities and the growth of the automotive industry are favoring the market.

- Smart coatings are increasingly used in China's building and construction industry. China has the world's largest construction industry. Moreover, with several major construction projects in progress, China is expected to maintain its status as the largest construction industry in the foreseeable future.

- China has been majorly driven by ample residential and commercial construction developments supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years by 2030.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% earmarked for renewable energy, roads and highways, urban infrastructure, and 12% for railways.

- In India, the automobile industry's contribution to the overall GDP stands at 7.1%. It is 49% of the manufacturing GDP, with an annual turnover of INR 7.5 lakh crore (USD 0.010 million) and an export of INR 3.5 lakh crore (USD 0.0047 million).

- In addition, in 2023, 58.51 million vehicles were produced in the country, compared to 54.57 million units in 2022.

- According to the UN Conference on Trade and Development (UNCTAD), Japan's merchant fleet accounted for 40,263.34 thousand dead-weight tons at the start of 2022, registering a growth rate of 2.42%, compared to 39,312.53 thousand dead-weight tons at the beginning of 2021, thereby, increasing the demand for smart coatings in the country.

- All the above-mentioned factors are expected to augment the market during the forecast period.

Smart Coatings Industry Overview

The global market for smart coatings is semi-consolidated. Major players in the market include Akzo Nobel NV, PPG Industries Inc., The Sherwin-Williams Company, RPM International Inc., and Axalta Coating Systems, LLC (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Superior Properties Over Traditional Coatings

- 4.1.2 Growing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 High Cost of Smart Coatings

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Revenue)

- 5.1 Function

- 5.1.1 Anti-fouling

- 5.1.2 Anti-microbial

- 5.1.3 Anti-corrosion

- 5.1.4 Anti-icing

- 5.1.5 Self-cleaning

- 5.1.6 Color-shifting

- 5.1.7 Other Functions

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Marine

- 5.2.4 Aerospace and Defense

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel NV

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 Dupont

- 6.4.5 Hempel AS

- 6.4.6 Jotun

- 6.4.7 NEI Corporation

- 6.4.8 PPG Industries Inc.

- 6.4.9 RPM International Inc.

- 6.4.10 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing use of Nanoparticles to Improve Functionality

- 7.2 Increasing Opportunities for Smart Coatings to Replace Conventional Coatings in Various End-user Industries