|

市場調查報告書

商品編碼

1687301

石墨:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

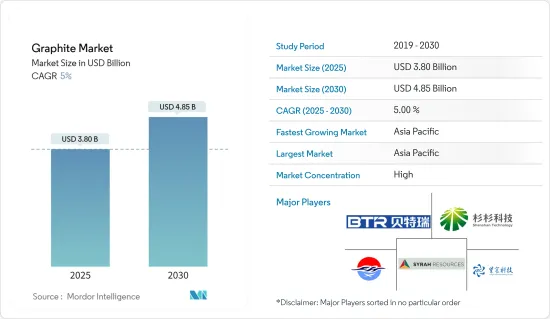

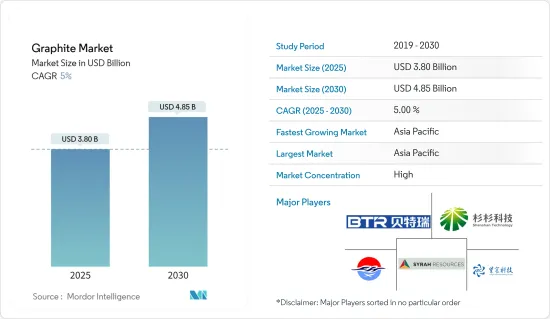

預計 2025 年石墨市場規模為 38 億美元,到 2030 年將達到 48.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5%。

由於疫情封鎖措施減緩了電子、冶金和汽車(包括電動車)等主要終端用戶產業的需求,COVID-19 疫情為石墨市場創造了一個充滿挑戰的工業環境。此外,全球物流放緩和勞動力短缺導致電子元件生產設施停產。然而,自從限制解除、恢復營運以來,該行業已經恢復良好。

主要亮點

- 短期內,蓬勃發展的鋰離子電池產業的需求增加以及亞洲和中東地區鋼鐵產量的上升是推動市場成長的關鍵因素。

- 然而,嚴格的環境法規是預測期內抑制該市場成長的主要因素。

- 然而,石墨在綠色技術中的日益廣泛的應用很可能在不久的將來為全球市場創造豐厚的成長機會。

- 由於印度、中國和日本等國家廣泛使用石墨,預計亞太地區石墨市場在評估期內將出現健康成長。

石墨市場趨勢

冶金業可望主導市場

- 研究的市場冶金部分包括電極、耐火材料、鑄件和鑄造廠。石墨電極用於煉鋼、煉鋁、鐵合金生產和冶煉製程的電弧爐(EAF)和階梯爐(LF)。

- 預計電弧爐煉鋼產量的增加將增加石墨的需求。在耐火材料中,天然石墨用於製造坩堝和鎂碳磚。

- 石墨也用作鋼轉爐和電弧爐的內襯。在鋼成型應用中,各種形式的氧化鋁石墨用於連鑄產品,例如噴嘴和槽。

- 預計全球粗鋼和鋁產量的上升將推動冶金應用對石墨的需求。

- 2023年4月,世界鋼鐵協會發布了2023年和2024年短期展望(SRO)鋼鐵需求預測,預測2023年鋼鐵需求將恢復2.3%至18.223億噸,2024年將增加1.7%至18.54億噸。此外,2022年全球粗鋼產量將為18.785億噸,較2021年下降4.2%。

- 此外,國際鋁業協會稱,預計2022年全球鋁產量僅成長2.0%,低於2021年的2.7%,創2019年以來的最低成長率。

- 歐洲鋼鐵協會(EUROFER)調整了2022年歐盟(EU)鋼鐵產品消費量的預測,與2月預測的2022年區域金屬消費量成長3.2%相比,該協會現預計下降約1.9%。所有這些因素預計都會增加冶金終端用戶產業對石墨的需求。

- 因此,所有上述因素都推動了石墨市場的成長。

亞太地區佔市場主導地位

- 中國是世界上最大的石墨生產國之一,這主要歸功於鋰離子電池生產、電子、鋼鐵生產、太陽能和核能工業等新興領域的巨大需求。根據美國地質調查局的數據,2021 年該國石墨礦產量為 82 萬噸。

- 2022年1-10月,中國透過產能置換新增生鐵產能2,880萬噸/年,新增粗鋼產能2,310萬噸/年。預計2022年生鐵產能將新增830萬噸/年,粗鋼產能將新增600萬噸/年。

- 建築業是推動該國鋼鐵需求成長的動力,佔該國鋼鐵消費量的近三分之二。

- 石墨也用作鋰離子電池的陽極材料。日本是與中國和韓國並列的鋰電池市場領先地區之一,在電池容量出貨量方面佔了96%的市場佔有率。然而,受近期危機影響,日本製造業成長明顯放緩。

- 日本的鋼鐵產量位居世界第三,2022 年產量約 9,600 萬噸,較 2021 年增加 16%。因此,增加鋼鐵產量可能會減少該國的石墨需求。

- 此外,該國計劃在 2030 年將核能在其總能源結構中的佔有率提高到至少 20%。預計該國對核能發電的依賴將在預測期內推動市場發展。

- 到2027年,該國計劃安裝至少14吉瓦的太陽能,預計到預測期結束時將達到100吉瓦以上。政府也透過上網電價(FIT)等補貼計畫大力支持住宅太陽能發電,進一步促進該國太陽能發電的發展。

- 由於這些因素,預計該地區的石墨市場在預測期內將穩定成長。

石墨產業概況

石墨市場本質上呈現整合狀態,前五大公司佔據著很大的市場佔有率。主要企業(排名不分先後)包括百特瑞新材料集團、深圳祥豐華科技、上海杉杉科技、Syrah Resources Limited、江西紫辰科技等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 快速成長的鋰離子電池產業需求不斷成長

- 亞洲和中東鋼鐵產量上升

- 限制因素

- 嚴格的環境法規

- 其他阻礙因素

- 產業價值鏈 – 天然石墨

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- 天然石墨

- 合成石墨

- 應用

- 電極

- 耐火材料, 鑄造, 鑄造

- 電池

- 潤滑劑

- 其他用途

- 最終用戶產業

- 電子產品

- 冶金

- 汽車

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Asbury Carbons

- BTR New Material Group Co.,Ltd.

- Imerys

- Jiangxi Zichen Technology Co. Ltd

- Mason Graphite Inc

- Nippon Kokuen Group

- Northern Graphite Corp.

- SGL Carbon

- Shanghai Shanshan Technology Co. Ltd.

- Shenzhen Xiangfenghua Technology Co., Ltd.

- Showa Denko Kk

- Syrah Resources Limited

- Tokai Carbon Co. Ltd.

- Triton Minerals

第7章 市場機會與未來趨勢

- 擴大石墨在綠色技術的應用

- 石墨烯需求和核能成長

The Graphite Market size is estimated at USD 3.80 billion in 2025, and is expected to reach USD 4.85 billion by 2030, at a CAGR of 5% during the forecast period (2025-2030).

The COVID-19 outbreak presented a challenging industry arena for the graphite market, as it slowed down the demand from the key end-user industries, such as electronics, metallurgy, and automotive (including electric vehicles), owing to the lockdown measures of the pandemic. Furthermore, the production facilities of electronic parts were halted due to the logistics slowdown and unavailability of the workforce across the world. However, the sector has been recovering well since restrictions were lifted and operations were resumed.

Key Highlights

- Over the short term, augmenting demand from the burgeoning lithium-ion battery industry and an increase in steel production in Asia and the Middle East are significant factors driving the growth of the market studied.

- However, stringent environmental regulation is a key factor anticipated to restrain the growth of the target market over the forecast period.

- Nevertheless, the increasing application of graphite in green technologies is likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth over the assessment period in the graphite market due to the wide usage of graphite in countries such as India, China, Japan, and others.

Graphite Market Trends

The Metallurgy Segment is Expected to Dominate the Market

- The metallurgy segment of the market studied includes electrodes and refractories, casting, and foundries. Graphite Electrodes are used in Electric Arc Furnaces (EAF) and ladder furnaces (LF) for steel production, aluminum production, ferroalloy production, and the smelting process.

- The rising steel production using the electric arc furnace process is expected to increase the demand for graphite. In refractories, natural graphite is used to manufacture crucibles and mag-carbon bricks.

- Graphite is also used as a lining in steel converters and electric arc furnaces. In steel molding applications, different forms of alumina-graphite are used in continuous casting ware, such as nozzles and troughs.

- The rising crude steel and aluminum production worldwide is expected to drive the demand for graphite in metallurgical applications.

- In April 2023, the World Steel Association released its Short Range Outlook (SRO) steel demand forecast for 2023 and 2024, which stated that the steel demand would see a 2.3% rebound to reach 1,822.3 Mt in 2023, and it is forecasted to grow by 1.7% in 2024 to reach 1,854.0 Mt. In addition, the total world crude steel production was 1,878.5 Mt in 2022, a 4.2% decrease compared to 2021.

- Furthermore, according to the International Aluminum Institute, global aluminum production rose by a marginal 2.0% in 2022 compared to a growth rate that was down from 2.7% in 2021 and the slowest since 2019.

- European Steel Association (EUROFER) has adjusted its forecast for the consumption of steel products in the European Union in 2022. In comparison to the February 2022 forecast and the expectation of regional metal consumption growth of 3.2%, there is a decline of around 1.9% expected by the association. All these factors are expected to increase the demand for graphite from the metallurgy end-user industry.

- Therefore, all the above-mentioned factors are responsible for driving the growth of the graphite market.

Asia-Pacific Region to Dominate the Market

- China is one of the largest graphite manufacturers globally, mainly due to the immense demand from budding sectors like lithium-ion battery production, electronics, steel production, the solar industry, and the nuclear industry. According to a US Geological Survey, the country accounted for 820 thousand tons of graphite mine production in 2021.

- During January-October 2022, China, through capacity swaps, added 28.8 million mt/year of new pig iron production capacity and 23.1 million mt/year of new crude steel production capacity. This resulted in a net increase of 8.3 million mt/year of pig iron production capacity and 6 million mt/year of new crude steel production capacity for 2022.

- The construction sector is the key factor driving the demand growth for steel in the country, which accounts for almost two-thirds of the country's steel consumption.

- Graphite is also used in lithium-ion batteries to serve as the node material. Japan is one of the prominent regions for the lithium battery market, along with China and Korea, which occupy a 96% market share in battery capacity shipments. However, manufacturing in Japan has significantly slowed down due to the recent crisis.

- The steel production in Japan ranked third largest globally, accounting for around 96 million tons in 2022, up by 16% from 2021. Thus, growth in steel production is likely to reduce the demand for graphite in the country.

- Furthermore, the country plans to increase its nuclear energy share in total energy up to at least 20% by 2030. The country's dependence on nuclear power to generate electricity is expected to drive the market during the forecast period.

- By 2027, the country has planned to install at least 14 GW of solar energy, which is expected to reach more than 100 GW at the end of the forecast period. The government is also hugely pushing household solar power through subsidy systems like feed-in-tariff (FIT), further boosting the country's solar power.

- Due to all such factors, the market for graphite in the region is expected to have a steady growth during the forecast period.

Graphite Industry Overview

The graphite market is consolidated in nature, with the top five players accounting for a significant share. The major players (not in any particular order) include Betterui New Materials Group Co. Ltd., Shenzhen Xiangfenghua Technology Co. Ltd, Shanghai Shanshan Technology Co. Ltd, Syrah Resources Limited, and Jiangxi Zichen Technology Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Augmenting Demand from the Burgeoning Lithium-ion Battery Industry

- 4.1.2 Increase In Steel Production in Asia and the Middle East

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain-Natural Graphite

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Type

- 5.1.1 Natural Graphite

- 5.1.2 Synthetic Graphite

- 5.2 Application

- 5.2.1 Electrodes

- 5.2.2 Refractories, Casting, and Foundries

- 5.2.3 Batteries

- 5.2.4 Lubricants

- 5.2.5 Other Applications

- 5.3 End-user Industry

- 5.3.1 Electronics

- 5.3.2 Metallurgy

- 5.3.3 Automotive (Includes EV/HEV Vehicles)

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asbury Carbons

- 6.4.2 BTR New Material Group Co.,Ltd.

- 6.4.3 Imerys

- 6.4.4 Jiangxi Zichen Technology Co. Ltd

- 6.4.5 Mason Graphite Inc

- 6.4.6 Nippon Kokuen Group

- 6.4.7 Northern Graphite Corp.

- 6.4.8 SGL Carbon

- 6.4.9 Shanghai Shanshan Technology Co. Ltd.

- 6.4.10 Shenzhen Xiangfenghua Technology Co., Ltd.

- 6.4.11 Showa Denko K.k.

- 6.4.12 Syrah Resources Limited

- 6.4.13 Tokai Carbon Co. Ltd.

- 6.4.14 Triton Minerals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications of Graphite in Green Technologies

- 7.2 Increasing Graphene Demand and Nuclear Energy